We used the most efficient web developers to implement our PDF editor. Our application will assist you to prepare the oregon form oq oa form simply and won't require a great deal of your time. This convenient procedure can help you get started.

Step 1: Click the orange button "Get Form Here" on this webpage.

Step 2: At this point, you are able to edit your oregon form oq oa. The multifunctional toolbar lets you insert, eliminate, change, highlight, and perform similar commands to the content and fields within the document.

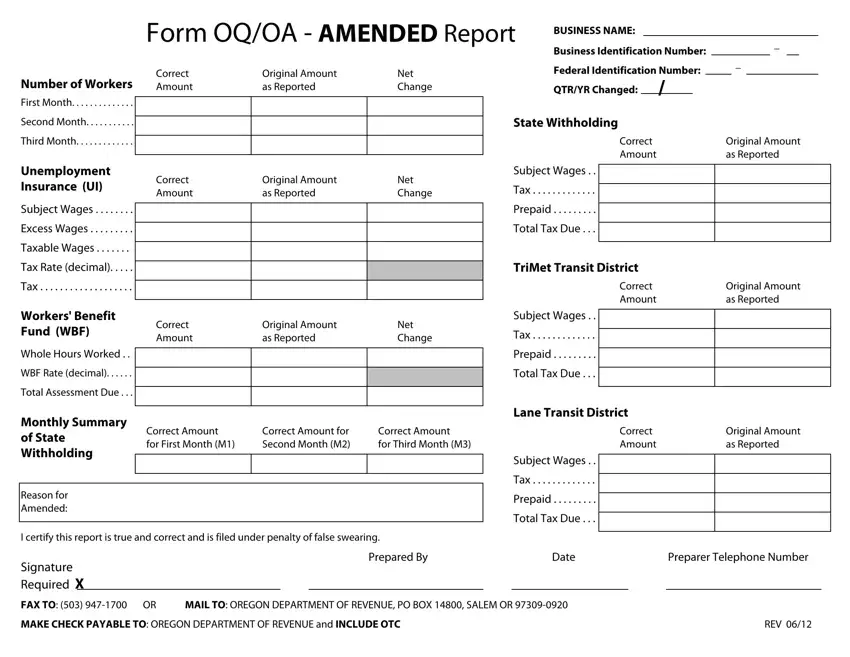

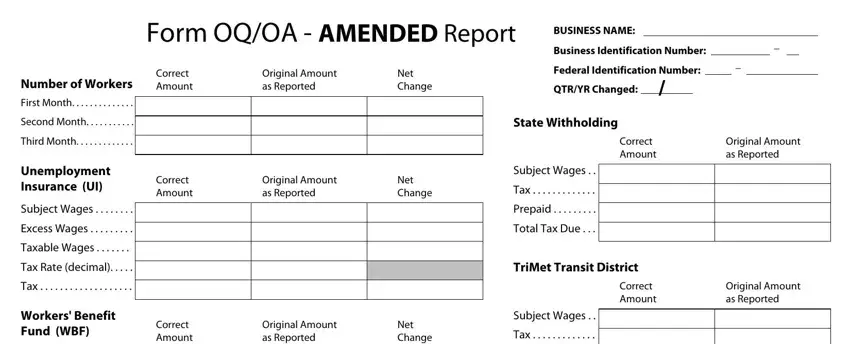

Type in the data requested by the software to prepare the file.

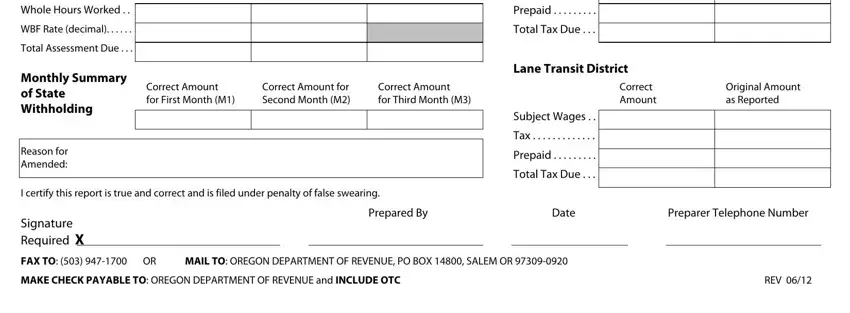

Write down the necessary data in the area Prepaid, Total Tax Due, Lane Transit District, Correct Amount for First Month M, Correct Amount for Second Month M, Correct Amount for Third Month M, Correct Amount, Original Amount as Reported, Subject Wages, Tax, Prepaid, Total Tax Due, Whole Hours Worked, WBF Rate decimal, and Total Assessment Due.

Step 3: Press the "Done" button. At that moment, you may export the PDF file - upload it to your device or forward it by means of electronic mail.

Step 4: Ensure you prevent potential problems by making no less than a pair of copies of the file.