In the landscape of compliance and financial transactions, the P-1 form serves a critical role, designed to bridge communication between employers or payors and their employees or payees concerning the provision of identifying numbers, typically social security numbers. This document, officially known as the Reasonable Cause Affidavit by Payor For Not Obtaining Payee’s Identifying Number, acts as a protective shield for employers against penalties for not capturing an employee's or payee's Social Security Number (SSN), under the conditions outlined by 26 U.S.C. §6724(a). It formalizes the attempt made by the employer to obtain this crucial piece of information and the payee's decision to decline providing it. Integral to this process is the demonstration of reasonable cause, showing that the employer's failure to secure the SSN was not due to willful neglect but rather the result of the employee's or payee's refusal. Employers are required to meticulously fill out the form, providing their details, affirmations, and the response they received from their employee or payee regarding the request for an identifying number. This affidavit supports compliance with the U.S. Treasury regulations, specifically Treasury Regulation 301.6109-1(c), by documenting the due diligence exercised by the payor in requesting the identifying information, thereby potentially waiving the standard penalty. The P-1 form thus plays a pivotal role in ensuring both parties' responsibilities are clearly delineated and formalized within the framework of federal tax regulations.

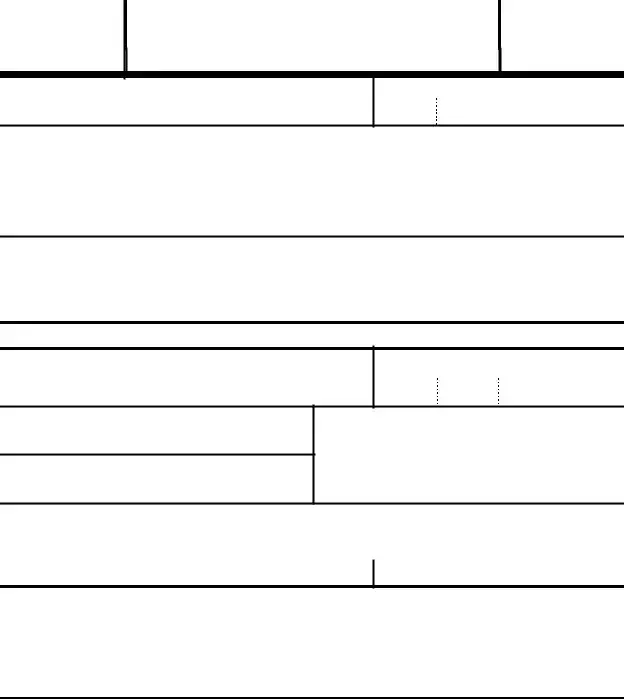

| Question | Answer |

|---|---|

| Form Name | Form P-1 |

| Form Length | 1 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 15 sec |

| Other names | obtaining payee online, form reasonable cause, payor not payee, payor i identifying |

Form

Reasonable Cause Affidavit by Payor

For Not Obtaining Payee’s Identifying Number

uRelease From

Employer’s/Payor’s name and address

Employer identification number

Employer/Payor statement:

I _______________________________, being an officer of _____________________________________,

hereby state that I have asked for the identifying number of the employee/payee,

_____________________________________ who has declined to provide an identifying number. I am filing

this affidavit in accordance with 26 USC 6724, waiver of penalty (26 USC 6724(a)) assessed under the code upon a showing of reasonable cause, and Treasury Regulation

I certify that the information stated here is correct and that I asked the employee/payee for a taxpayer ID number (Social security number) and that the employee/payee declined to provide such number.

Employer/Payor signature

u |

Date u |

|

Employee/Payee information

Type or print employee/payee first name and initial |

Last name |

Social security number (write “None” if you do not have a SSN or “Declined” if you do not wish to provide a SSN)

Home address (number and street or rural route)

City or town, State and ZIP code

Employee/payee statement:

I ____________________________________ have

declined to provide an identifying number to my employer/payor, __________________________.

I certify that the information stated here is correct and the employer/payor did ask me for a taxpayer ID number (social security number) and that I declined to provide such number.

Employee/payee signature

u

Date u

26 USC §6724, waiver of penalty (26 USC §6724(a)) assessed under the code upon a showing of reasonable cause, and Treasury Regulation

does not know the SSN of the other person, and has complied with the request provision of this paragraph, he shall sign an affidavit on the transmittal document forwarding such returns, statements, or other documents to the Internal Revenue Service so stating. A payor is required to request the identifying number of the payee. If after such request has been made, the payee does not furnish the payor with an identifying number, the penalty ($50.00) will not be assessed against the payor, if it is shown that such failure is due to reasonable cause and not willful neglect. [See also 26 USC §6724, waiver of penalty (26 USC §6724(a)) assessed under the code upon a showing of reasonable cause.]

Public