The p85 form pdf filling in process is easy. Our editor lets you work with any PDF document.

Step 1: Select the orange button "Get Form Here" on the following page.

Step 2: Now, you can edit the p85 form pdf. The multifunctional toolbar permits you to add, erase, alter, highlight, as well as carry out several other commands to the words and phrases and areas inside the file.

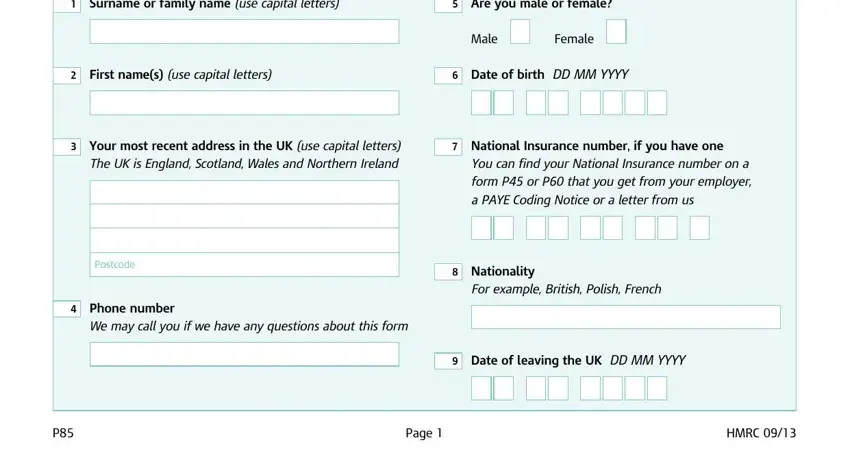

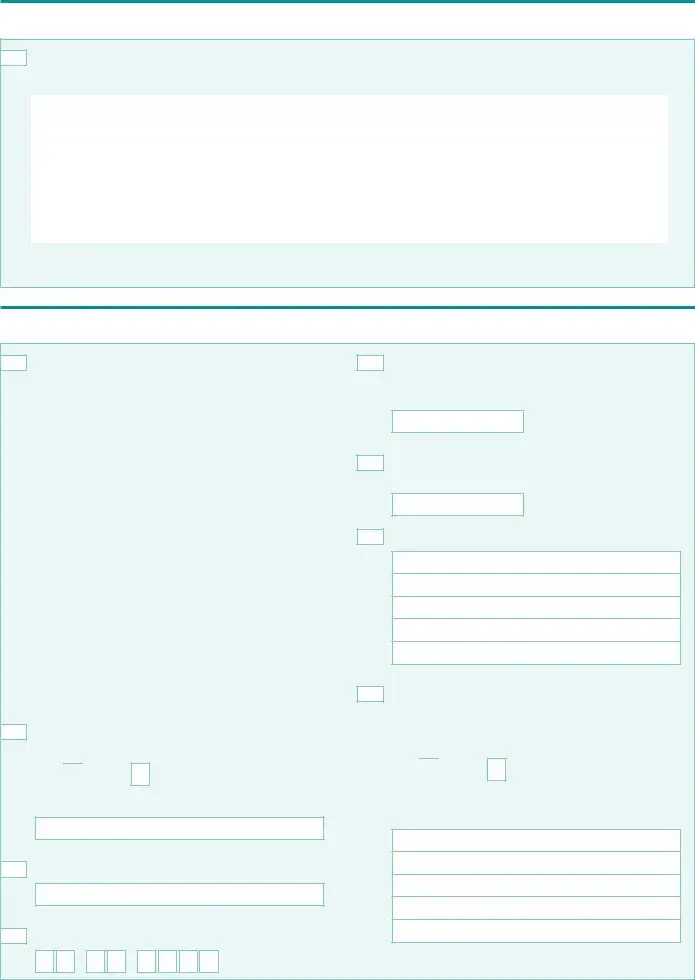

Enter the data required by the program to prepare the document.

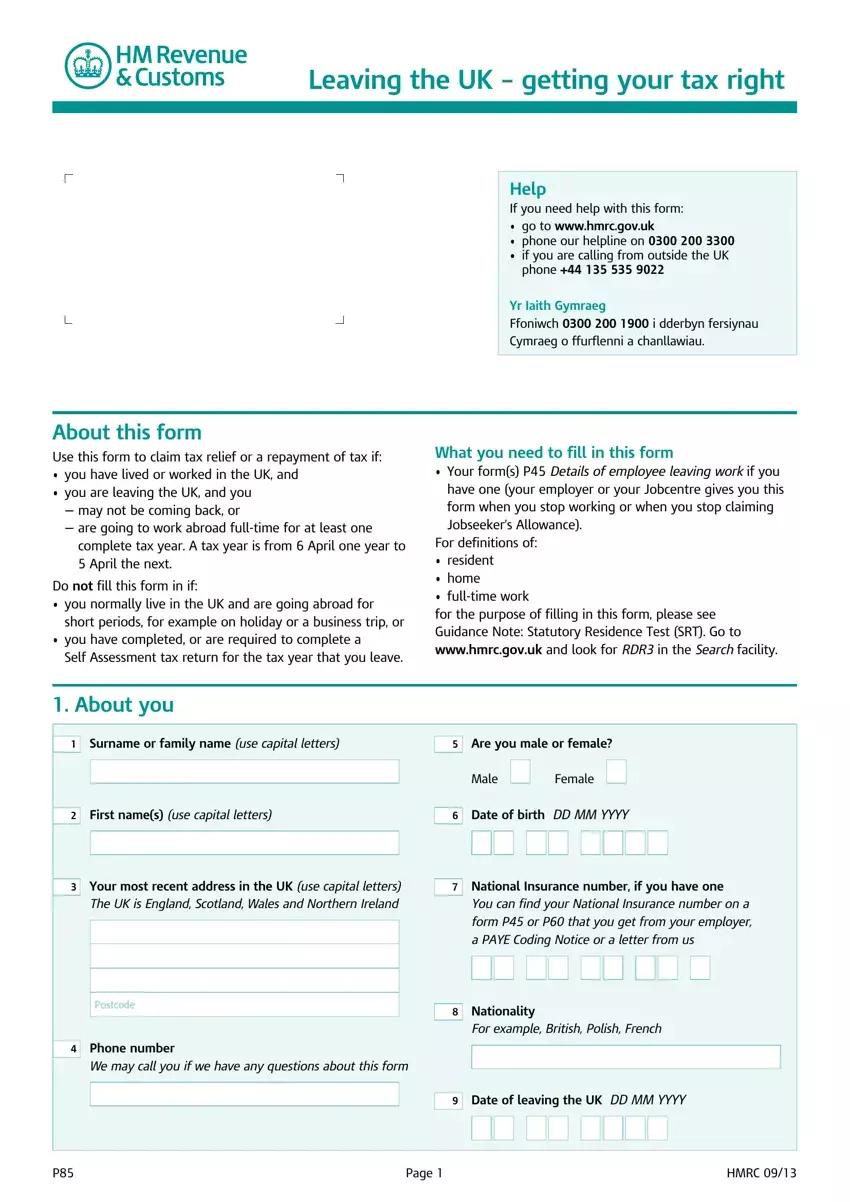

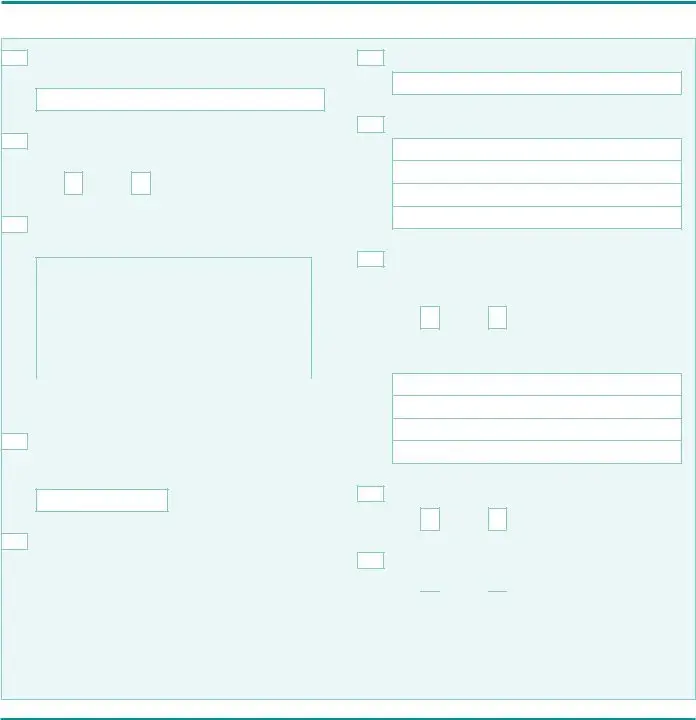

Fill in the Surname or family name use, Are you male or female, Male, Female, First names use capital letters, Date of birth DD MM YYYY, Your most recent address in the, National Insurance number if you, You can find your National, Postcode, Phone number, We may call you if we have any, Nationality, For example British Polish French, and Date of leaving the UK DD MM YYYY field with the particulars required by the application.

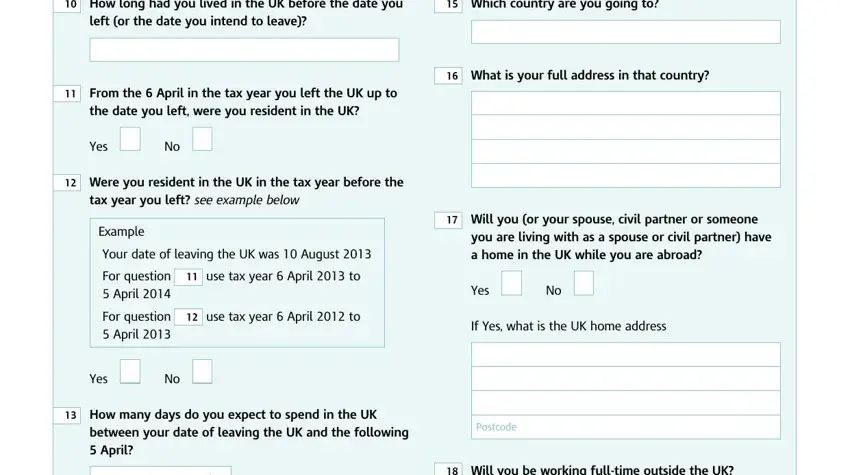

You will be instructed to write down the particulars to help the program fill in the section How long had you lived in the UK, Which country are you going to, left or the date you intend to, What is your full address in that, From the April in the tax year, the date you left were you, Yes, Were you resident in the UK in, tax year you left see example below, Example, Your date of leaving the UK was, For question use tax year April, For question use tax year April, Yes, and Will you or your spouse civil.

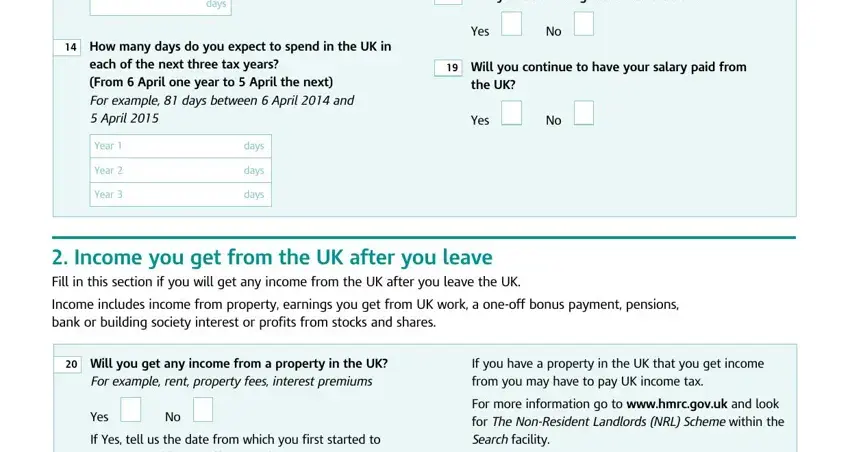

The space days, Will you be working fulltime, How many days do you expect to, each of the next three tax years, Yes, Will you continue to have your, the UK, Yes, Year, Year, Year, days, days, days, and Income you get from the UK after is going to be where you can indicate all parties' rights and obligations.

Finalize by looking at the following fields and filling them out accordingly: If Yes tell us the date from which, and Page.

Step 3: Select the button "Done". The PDF form is available to be transferred. You may obtain it to your computer or send it by email.

Step 4: To avoid possible forthcoming troubles, it is important to possess at the very least two duplicates of each file.

No

No

No

No

No

No