Navigating the intricacies of homeownership and property taxes can often seem like a daunting endeavor, especially when it comes to seeking reimbursements or deductions that you're entitled to. One crucial tool in this process for many homeowners is the Form PTR-1A, a document designed primarily to verify property taxes for the years 2005 and 2006. This form serves a dual purpose: it not only aids applicants in asserting their eligibility for property tax reimbursements but also specifies the method for calculating the amount they're eligible to receive back. Applicants are required to provide detailed personal information, including Social Security numbers and the specifics of their property's location. Additionally, homeowners must disclose if the property is co-owned with someone other than a spouse or if the property includes multiple housing units, which directly influences the reimbursement calculation. The tax collector's role is pivotal in completing the latter portion of the form, as they confirm the actual amounts concerning property taxes levied, paid, and any deductions or credits applied within the specified years. Understanding the completion and submission of Form PTR-1A is vital for homeowners looking to navigate the financial aspects of their property taxes effectively.

| Question | Answer |

|---|---|

| Form Name | Form Ptr 1A |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | nj ptr 1a form qualifier, filers, reimbursement, ptr 1a |

Form

Homeowners

Verification of 2005 and 2006 Property Taxes

(Use blue or black ink. See instructions for completion on back.)

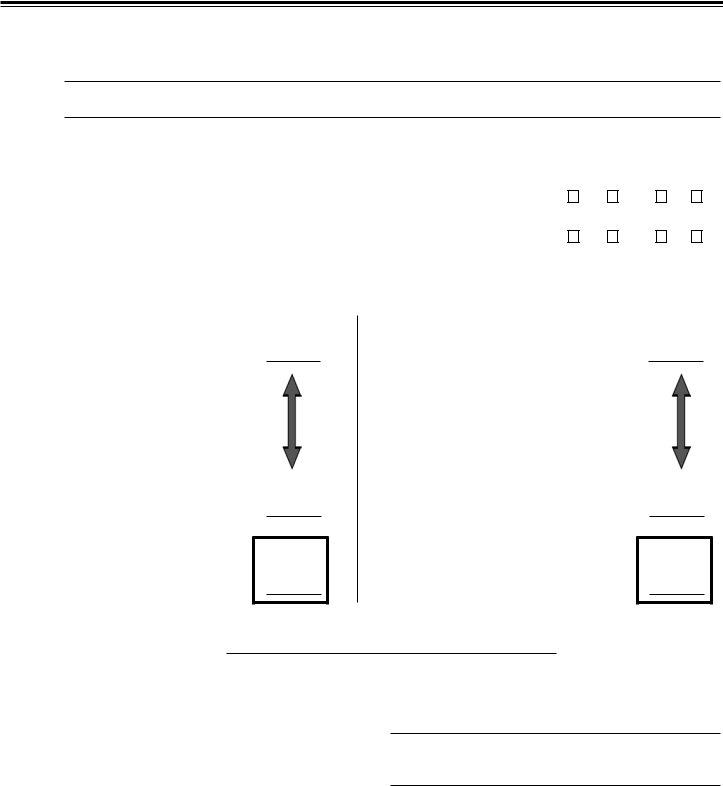

Part I — To Be Completed by Applicant (Part II to be completed by tax collector)

Social Security Number |

– |

– |

Spouse’s Social Security Number |

– |

– |

Name

Last Name, First Name, and Initial (Joint filers enter first name and initial of each - Enter spouse’s last name ONLY if different)

Address

Street |

|

City |

State |

|

|

|

|

Zip Code |

|

|||||||

Block |

|

Lot |

|

Qualifier |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2005 |

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

2006 |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

||||||

A. Did you own your principal residence with someone who was not your spouse? |

|

Yes |

|

No |

|

Yes |

No |

|

||||||||

|

|

|

|

|

% |

|

|

|

% |

|

|

|||||

B. If yes, indicate the share (percentage) of the property that you (and your spouse) owned. |

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

C. Does your principal residence have more than one unit? |

|

Yes |

|

No |

|

Yes |

No |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|||||||

D. If yes, indicate the share (percentage) of the property used as your principal residence. |

|

|

|

% |

|

|

|

% |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

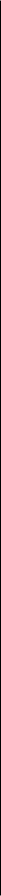

Part II — To Be Completed by Tax Collector

|

2005 Property Taxes |

|

|||

1. |

Total Amount Levied by Municipality (before |

|

|||

|

Deductions and/or Credits are subtracted) |

$ |

|||

2. |

Total Amount Paid |

|

|

|

|

|

by Homeowner(s) |

$ |

|

|

|

3. |

Senior Citizen’s Deduction |

$ |

|

|

|

4. |

Veteran’s Deduction |

$ |

|

|

|

5. |

REAP Credit |

$ |

|

|

|

6. |

Total Deductions and Credits |

|

|

|

|

|

(Add Lines 2, 3, 4, and 5) |

|

|

$ |

|

If Line 6 is equal to Line 1, complete Line 7

7. Enter amount from Line 6. If applicant |

|

answered “Yes” to Questions A and/or |

|

C above, the amount on Line 7 must be |

|

apportioned. See instructions on back |

$ |

Applicant enters this amount on Line 14, Form

|

2006 Property Taxes |

|

|||

1. |

Total Amount Levied by Municipality (before |

|

|||

|

Deductions and/or Credits are subtracted) |

$ |

|||

2. |

Total Amount Paid |

|

|

|

|

|

by Homeowner(s) |

$ |

|

|

|

3. |

Senior Citizen’s Deduction |

$ |

|

|

|

4. |

Veteran’s Deduction |

$ |

|

|

|

5. |

REAP Credit |

$ |

|

|

|

6. |

Total Deductions and Credits |

|

|

|

|

|

(Add Lines 2, 3, 4, and 5) |

|

|

$ |

|

If Line 6 is equal to Line 1, complete Line 7

7. Enter amount from Line 6. If applicant |

|

answered “Yes” to Questions A and/or |

|

C above, the amount on Line 7 must be |

|

apportioned. See instructions on back |

$ |

Applicant enters this amount on Line 13, Form

I certify that I am the local tax collector of, where the above property is located. I further certify that the

(Name)

(Title)

(If you complete this form, be sure to enclose it with your Form

Form

Part I – To Be Completed by Applicant

Social Security Number. If your marital status as of De- cember 31, 2006, was single, you must enter your social security number in the space provided on Form

Name and Address. Print or type your name (last name first) and complete address of the property for which you are claiming the reimbursement in the spaces provided.

Also include your spouse’s name if filing jointly.

Block/Lot/Qualifier. Enter the block and lot number of the principal residence for which you are claiming the re- imbursement in the spaces provided. Include qualifier if applicable. (Only condominiums may have qualifiers as- signed to them.)

A.Multiple Owners. Check “Yes” only if you owned your principal residence with someone else (other than your spouse). For example, you and your sister own the home you live in. If you (and your spouse) were the sole owner(s), check “No.”

B.Percentage of Ownership. If you answered “Yes” at Line A, enter the share (percentage) of the property that you (and your spouse) owned. For example, if you and your spouse own your principal residence equally with your daughter, you and your spouse own

C.

NOTE: Residents of

D.Percentage of Occupancy. If you answered “Yes” at Line C, enter the share (percentage) of the property used as your principal residence. For example, if you and your spouse own a duplex and live in

Part II – To Be Completed by Tax Collector

Enter the appropriate amounts for calendar years 2005 and 2006 as follows:

Line 1. Enter the amount of property taxes levied by the municipality before any deductions and/or credits are subtracted (e.g., senior citizen’s deduction).

Line 2. Enter the total amount of property taxes paid by, or on behalf of, the homeowner(s). Enter only amounts actually due and paid for each calendar year.

Line 3. Enter the amount of any senior citizen’s deduc- tion the homeowner(s) received for each calendar year.

Line 4. Enter the amount of any veteran’s deduction the homeowner(s) received for each calendar year.

Line 5. Enter the amount of any Regional Efficiency Aid Program (REAP) credit the homeowner(s) received for each calendar year.

Line 6. Add Lines 2, 3, 4, and 5 and enter the total on Line 6. Compare Lines 1 and 6 for each calendar year.

•If Line 6 is equal to Line 1 for both years, complete the balance of Form

•If Line 6 is not equal to Line 1 for both years, the applicant is not eligible for a property tax reim- bursement. Do not complete the balance of

Form

Line 7. If the applicant answered “No” to the questions at both Line A and Line C, enter the amount of property taxes from Line 6.

If the applicant answered “Yes” at either Line A or Line C, the amount of property taxes to be entered on Line 7 must be apportioned. If title to the property is held by the eligible applicant with others as tenants in common or joint tenants (except in the case of husband and wife), or if the property consists of more than one unit, the applicant is only eligible for the proportionate share of the reimbursement which reflects the percentage of ownership or the percentage of occupancy.

Multiple Owners. If the applicant answered “Yes” at Part I, Line A, multiply the amount of property taxes on Line 6 by the percentage of ownership shown at Part I, Line B, and enter the result on Line 7.

If the applicant answered “Yes” to the questions at both Lines A and C in the same year, multiply the amount of property taxes on Line 6 by the percentage of occupancy shown at Part I, Line D, and enter the result on Line 7.

Certification. Complete the certification portion of Form