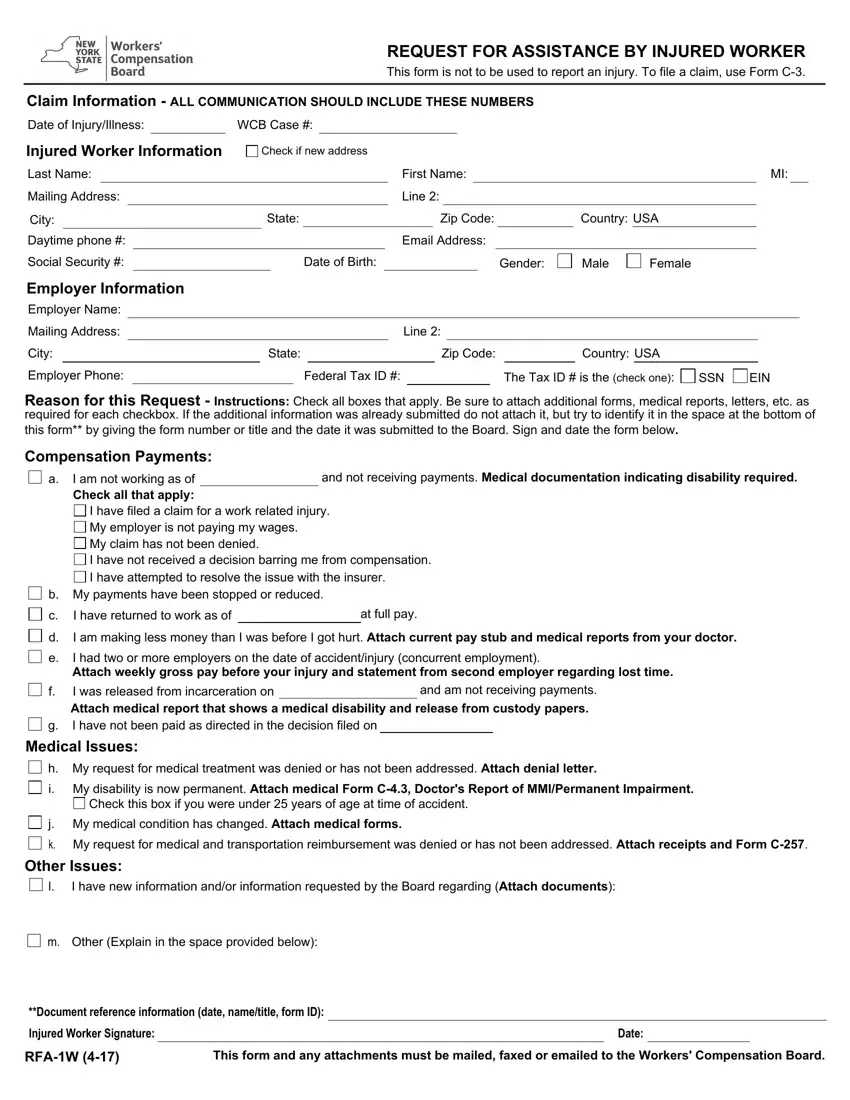

To the Injured Worker - General Information On Using This Form

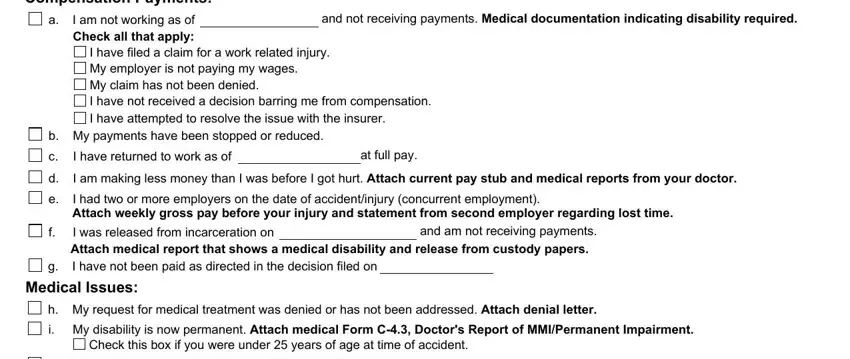

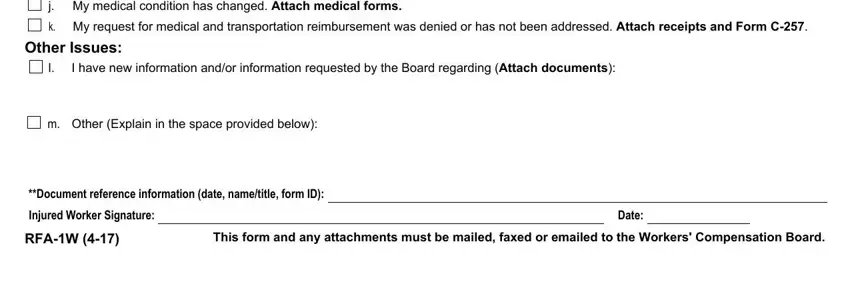

You may file this form (RFA-1W) and any attachments with the Workers' Compensation Board when you want the Board to take a specific action in your claim, or if you need to alert the Board to any problem or situation that is affecting your claim. Many of the most frequently requested actions/situations are listed as either compensation payment issues (items a through g), or medical issues (items h through k), but you are not limited to those listed. Check all that apply and/or add additional information or explanation in the space provided (l or m).

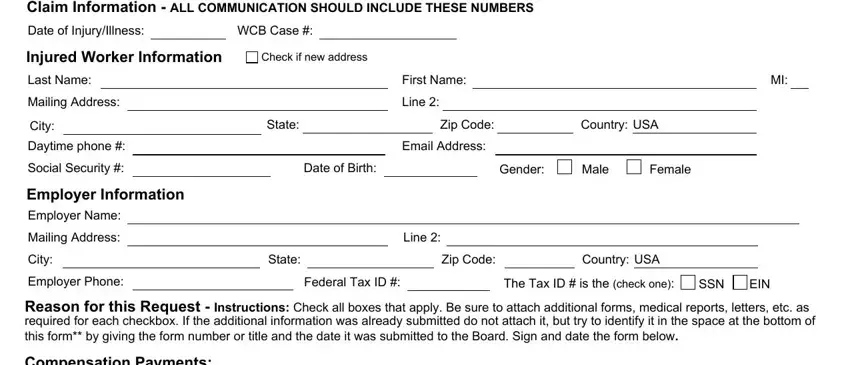

Complete the identifying information at the top of Form RFA-1W and send the form, WITH ALL APPLICABLE INFORMATION ATTACHED*, to:

Workers' Compensation Board

PO Box 5205

Binghamton, NY 13902-5205

Address for Email Filing: wcbclaimsfiling@wcb.ny.gov

Statewide Fax Line: (877) 533-0337

The Board will contact you and all parties when it takes action on your claim.

*After each check box you will see the information needed in bold letters. For example, if you are letting the Board know that your disability is now permanent (box i), the information required is Form C-4.3, Doctor's Report of MMI/Permanent Impairment.

YOU MUST SEND A COPY OF THIS FORM TO THE INSURER(S), OR DIRECTLY TO THE EMPLOYER OR ITS THIRD PARTY ADMINISTRATOR IF THE EMPLOYER IS SELF-INSURED.

If you have any other concerns, you may contact the Board's ADVOCATE FOR INJURED WORKERS at (800) 580-6665. Additional information about other Board services may be obtained at the Board's website: www.wcb.ny.gov. If you would like to follow your claim on-line, you can register for eCase using the registration instructions available on the Board's website under the eCase link.

You have the right to legal representation. A lawyer cannot charge you directly for representation in a workers' compensation claim. If there is an award in your claim, any legal fee request must be approved by the Board and will be deducted from the award to you by the insurer and paid directly to the lawyer.

Medical Treatment - In addition to medical services of less than $1000.00 in value, most medical services covered by the Medical Treatment Guidelines (regardless of the cost) do not require medical authorization. For these types of services, the Health Provider may provide treatment and bill the insurer. If there is no response within 45 days of receipt of the bill, the Health Provider may file for an administrative award on Form HP-1. Certain treatments covered within the Medical Treatment Guidelines, such as complex surgical procedures, do require prior authorization. In addition to these treatment types, when medical services are $1000.00 or more in value and fall outside the Medical Treatment Guidelines, the Health Provider is to contact the insurer or self-insured employer for authorization. The Health Provider must also file Form C-4AUTH with the insurer or self-insured employer and the Board. If denying Medical Treatment Guideline services or medical services of $1000.00 or more in value, the insurer or self-insured employer is required to file Form C-8.1A and provide conflicting medical evidence.

ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD PRESENTS, CAUSES TO BE PRESENTED, OR PREPARES WITH KNOWLEDGE OR BELIEF THAT IT WILL BE PRESENTED TO, OR BY AN INSURER, OR SELF INSURER, ANY INFORMATION CONTAINING ANY FALSE MATERIAL STATEMENT OR CONCEALS ANY MATERIAL FACT SHALL BE GUILTY OF A CRIME AND SUBJECT TO SUBSTANTIAL FINES AND IMPRISONMENT.

Notification Pursuant to the New York Personal Privacy Protection Law (Public Officers Law Article 6-A) and the Federal Privacy Act of 1974 (5 U.S.C. § 552a). The Workers' Compensation Board's (Board’s) authority to request that injured worker's provide personal information, including their social security number, is derived from the Board’s investigatory authority under Workers' Compensation Law (WCL) § 20, and its administrative authority under WCL § 142. This information is collected to assist the Board in investigating and administering claims in the most expedient manner possible and to help it maintain accurate claim records. Providing your social security number to the Board is voluntary. There is no penalty for failure to provide your social security number on this form; it will not result in a denial of your claim or a reduction in benefits. The Board will protect the confidentiality of all personal information in its possession, disclosing it only in furtherance of its official duties and in accordance with applicable state and federal law.

I have filed a claim for a work related injury.

I have filed a claim for a work related injury.

My employer is not paying my wages.

My employer is not paying my wages.

My claim has not been denied.

My claim has not been denied.

I have not received a decision barring me from compensation.

I have not received a decision barring me from compensation.

I have attempted to resolve the issue with the insurer.

I have attempted to resolve the issue with the insurer.

b. My payments have been stopped or reduced.

b. My payments have been stopped or reduced.

e.

e.