Our top rated programmers worked hard to develop the PDF editor we are pleased to deliver to you. The application makes it possible to easily complete wisconsin ces number lookup and will save you precious time. You just have to try out this particular guideline.

Step 1: Choose the "Get Form Now" button to start out.

Step 2: At the moment, you can start modifying your wisconsin ces number lookup. Our multifunctional toolbar is at your disposal - insert, remove, alter, highlight, and conduct similar commands with the content material in the document.

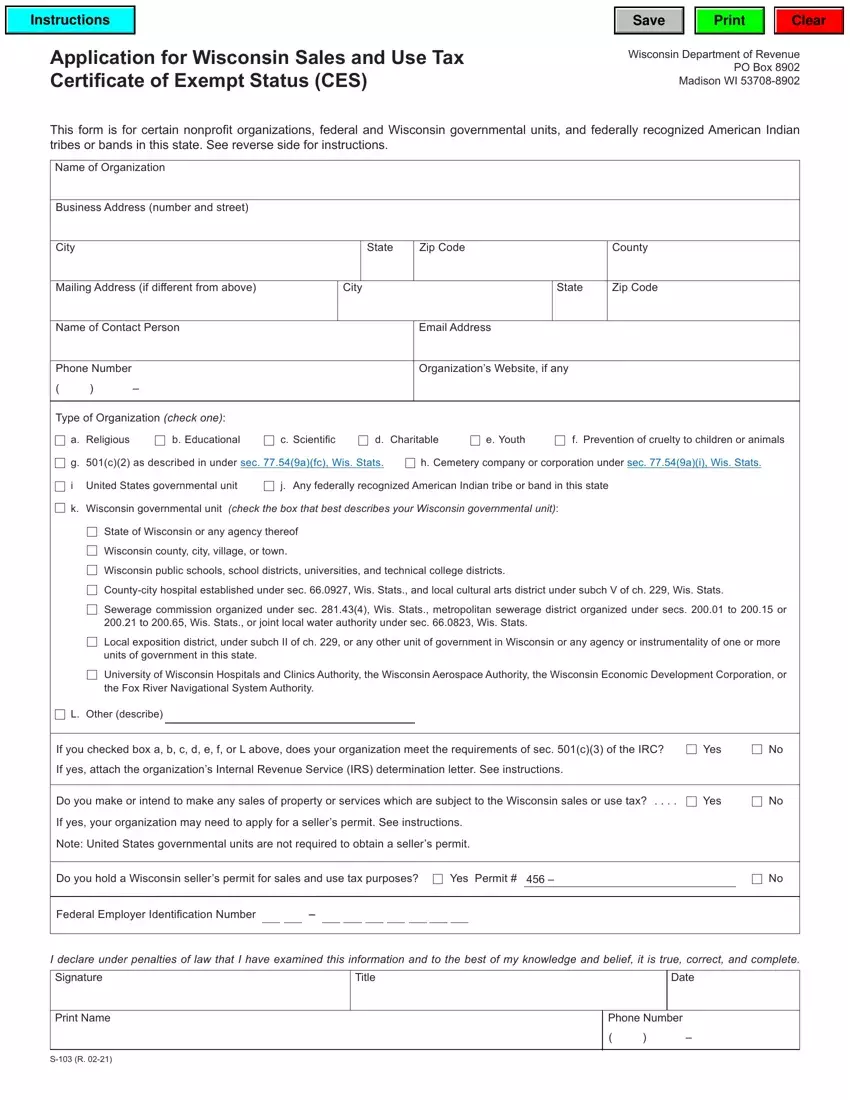

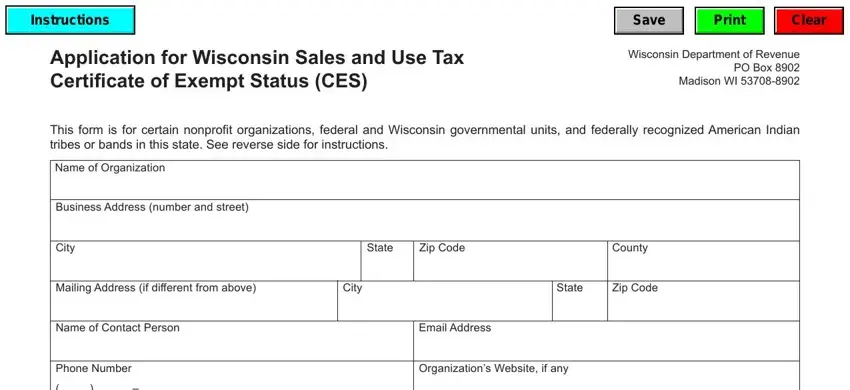

For every single area, add the information requested by the program.

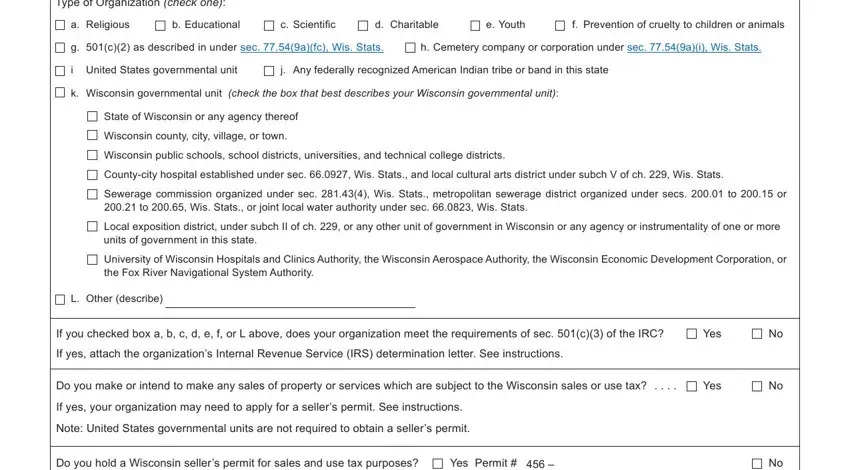

Indicate the data in Type of Organization check one, a Religious, b Educational, c Scientific, d Charitable, e Youth, f Prevention of cruelty to, g c as described in under sec afc, h Cemetery company or corporation, i United States governmental unit, j Any federally recognized, k Wisconsin governmental unit, State of Wisconsin or any agency, Wisconsin county city village or, and Wisconsin public schools school.

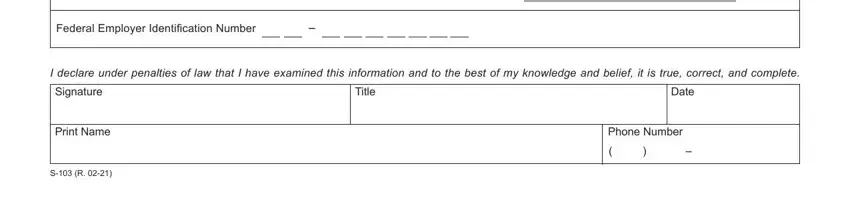

It is important to give particular details in the section Federal Employer Identification, I declare under penalties of law, Signature, Print Name, S R, Title, Date, and Phone Number.

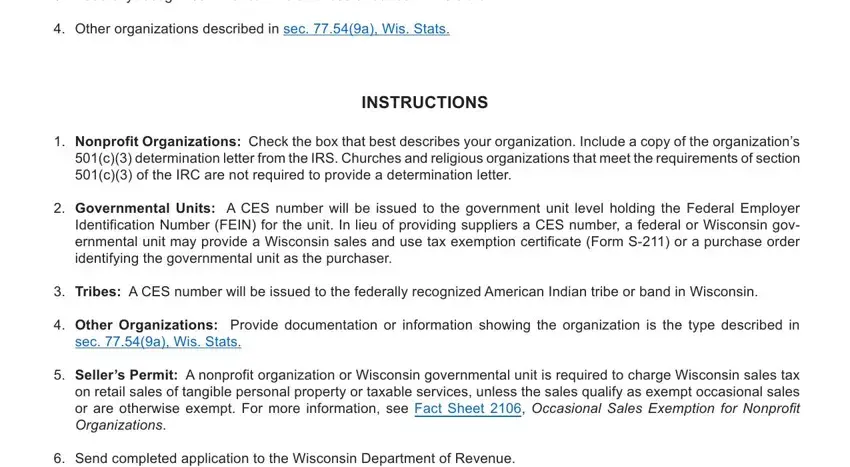

The Federally recognized American, Other organizations described in, INSTRUCTIONS, Nonprofit Organizations Check the, Governmental Units A CES number, Tribes A CES number will be, Other Organizations Provide, sec a Wis Stats, Sellers Permit A nonprofit, and Send completed application to the area has to be used to put down the rights or obligations of both parties.

Step 3: After you have hit the Done button, your document is going to be available for export to every electronic device or email you indicate.

Step 4: Get duplicates of the form. This may protect you from forthcoming problems. We do not look at or disclose your data, as a consequence feel comfortable knowing it is safe.