You are able to prepare CALIFORNIA effectively by using our PDF editor online. Our tool is consistently evolving to grant the very best user experience achievable, and that is because of our resolve for continual improvement and listening closely to user opinions. To get started on your journey, take these basic steps:

Step 1: Press the orange "Get Form" button above. It will open our pdf tool so you could begin completing your form.

Step 2: This editor grants the capability to change PDF files in various ways. Transform it by writing any text, adjust what's originally in the document, and put in a signature - all within the reach of several clicks!

This PDF doc will require some specific details; to ensure correctness, you need to take into account the next tips:

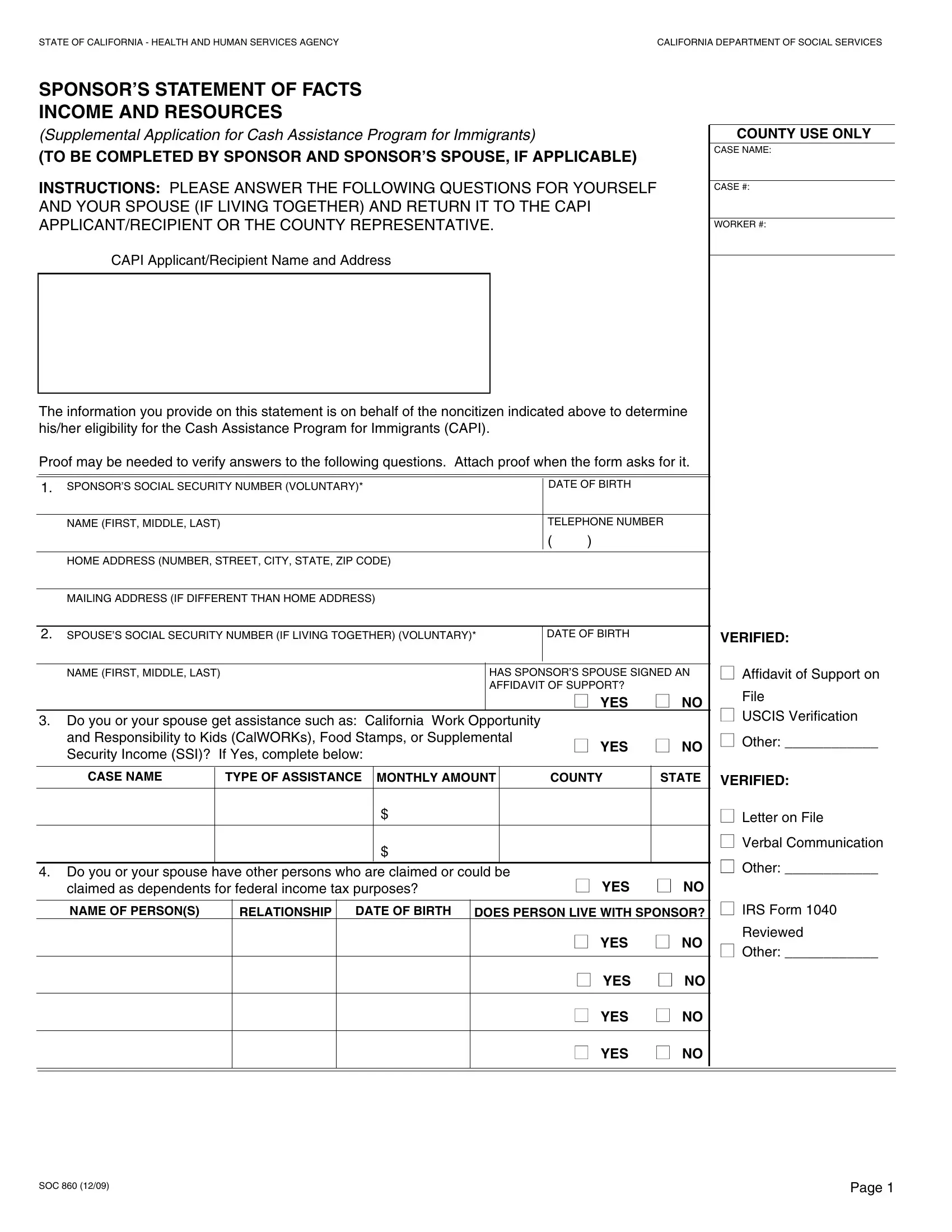

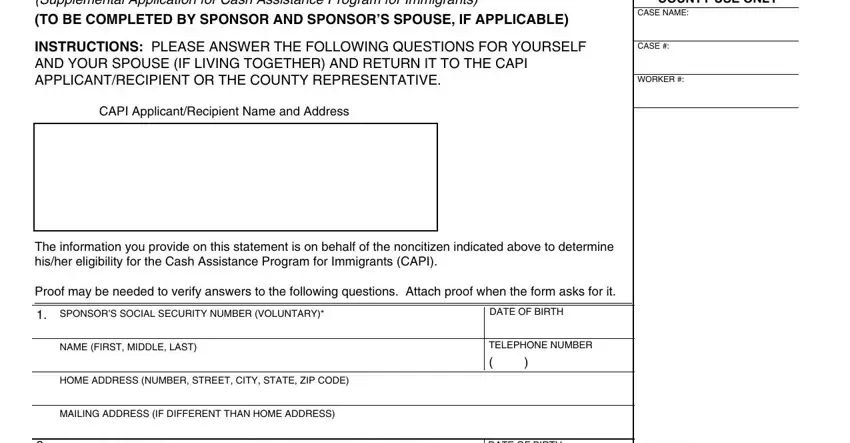

1. For starters, when filling in the CALIFORNIA, beging with the section that includes the next fields:

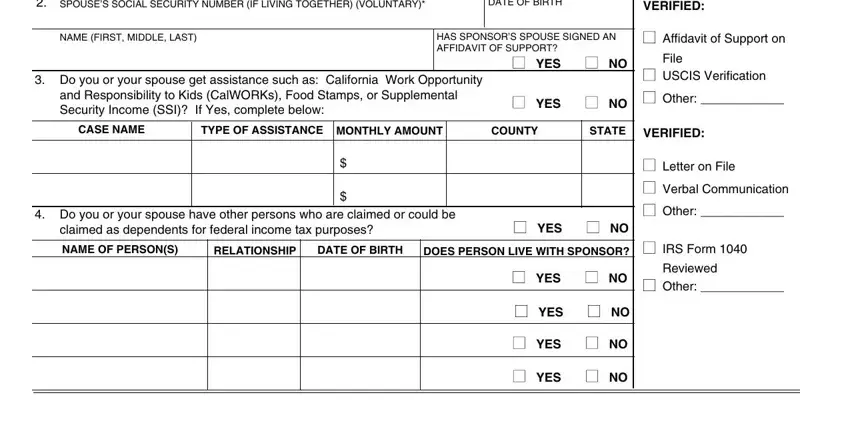

2. Now that the previous part is complete, you're ready put in the necessary specifics in SPOUSES SOCIAL SECURITY NUMBER IF, DATE OF BIRTH, VERIFIED, NAME FIRST MIDDLE LAST, HAS SPONSORS SPOUSE SIGNED AN, YES NO, Do you or your spouse get, and Responsibility to Kids, YES NO, Affidavit of Support on, File, USCIS Verification, Other, CASE NAME, and TYPE OF ASSISTANCE so that you can go to the next part.

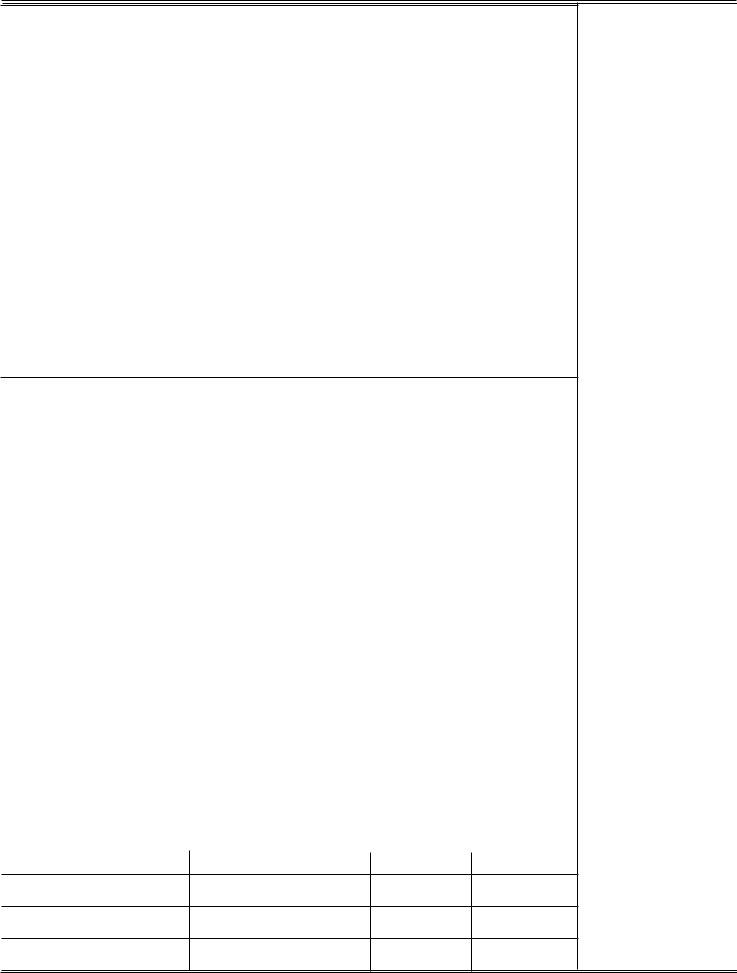

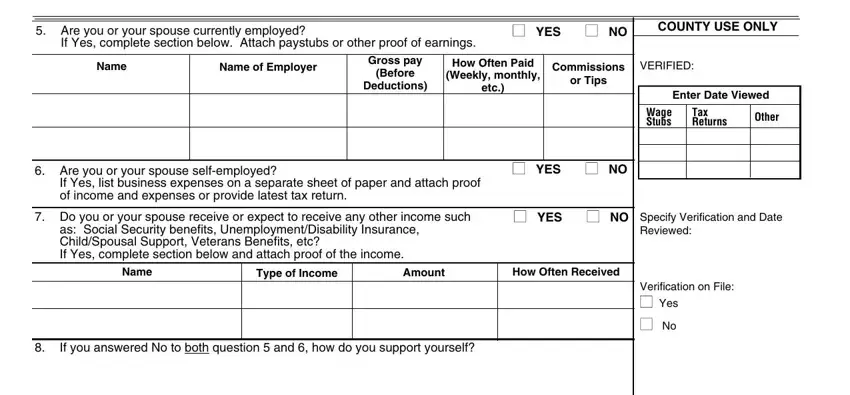

3. Completing Are you or your spouse currently, If Yes complete section below, YES NO, COUNTY USE ONLY, Name, Name of Employer, Gross pay, Before, Deductions, How Often Paid, Weekly monthly, etc, Commissions, VERIFIED, and or Tips is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

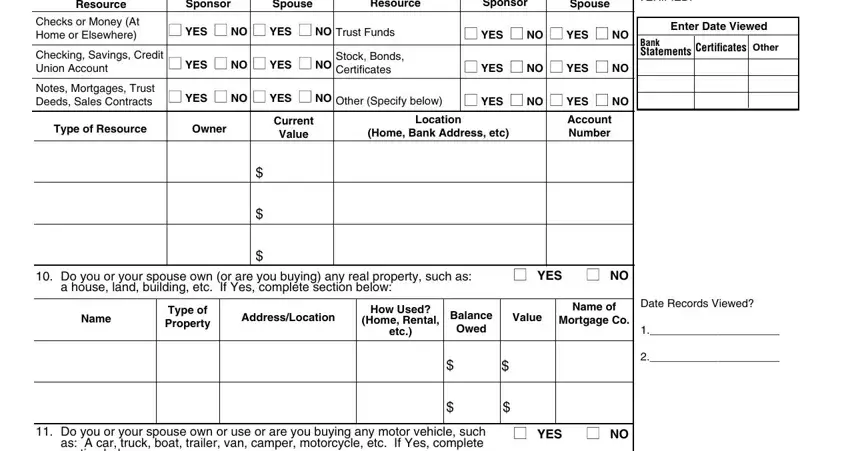

4. Your next part requires your details in the following places: Resource, Sponsor, Spouse, Resource, Sponsor, Spouse, Checks or Money At Home or, Checking Savings Credit Union, Notes Mortgages Trust Deeds Sales, YES NO, YES NO, Trust Funds, YES NO, YES NO, and YES NO. Just be sure you fill out all of the required details to go forward.

As to YES NO and Sponsor, be certain that you do everything correctly in this current part. Both of these are viewed as the key ones in the file.

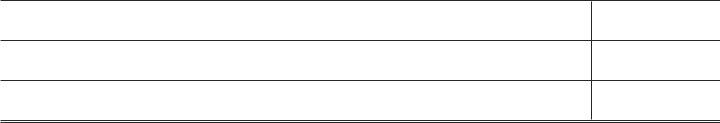

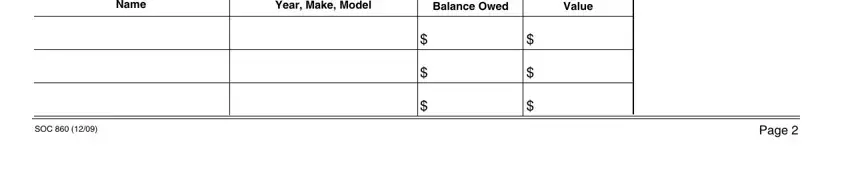

5. This last notch to finalize this form is crucial. Be certain to fill out the necessary fields, like Name, Year Make Model, Balance Owed, Value, SOC, and Page, prior to submitting. Neglecting to do this could lead to a flawed and potentially unacceptable paper!

Step 3: Check what you've entered into the blank fields and click on the "Done" button. Join us today and instantly access CALIFORNIA, all set for download. All alterations made by you are preserved , which means you can customize the form later if necessary. We do not share any information that you provide when completing forms at our website.