Our best computer programmers have worked collectively to build the PDF editor you are going to benefit from. The following application enables you to prepare social security administration form ssa 10 documentation promptly and conveniently. This is all you have to conduct.

Step 1: Hit the orange button "Get Form Here" on the web page.

Step 2: You can now manage your social security administration form ssa 10. This multifunctional toolbar can help you include, remove, improve, and highlight text or perhaps conduct many other commands.

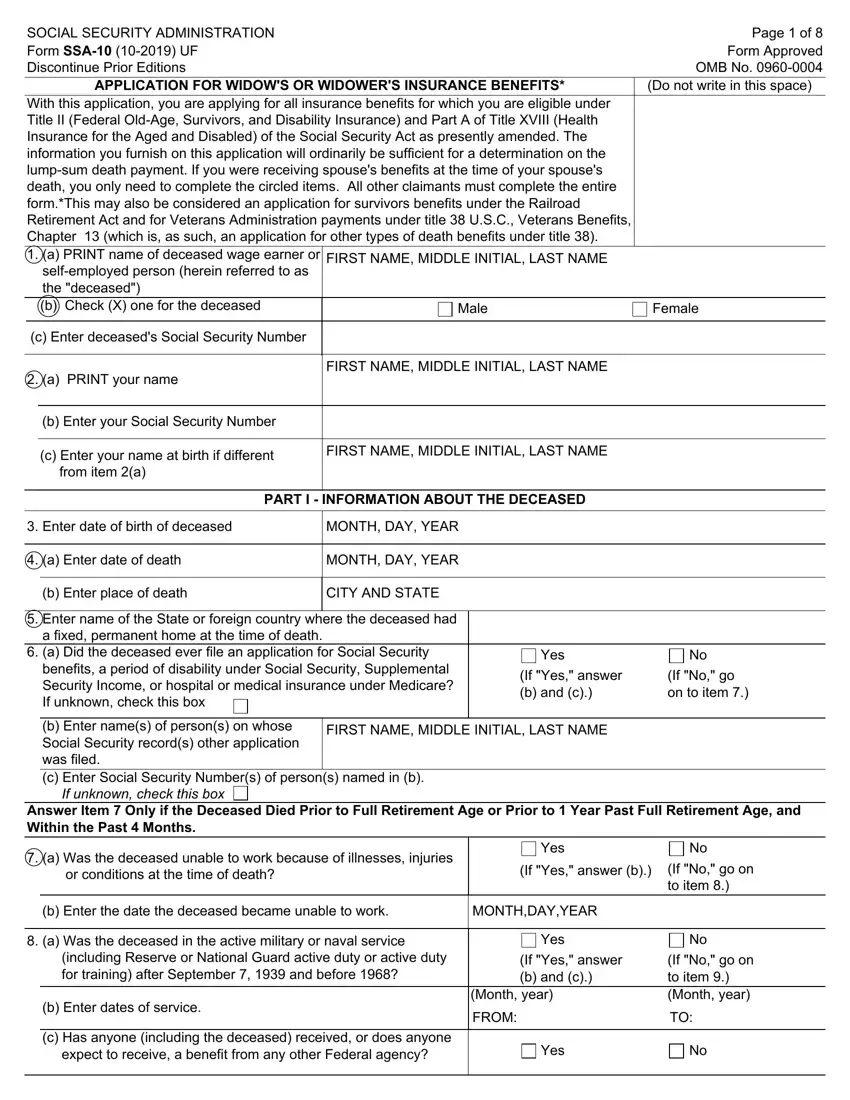

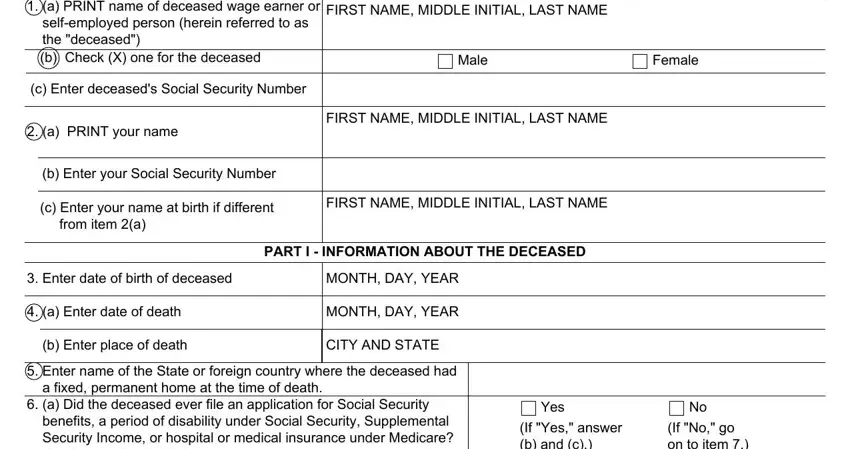

Get the social security administration form ssa 10 PDF and provide the content for each part:

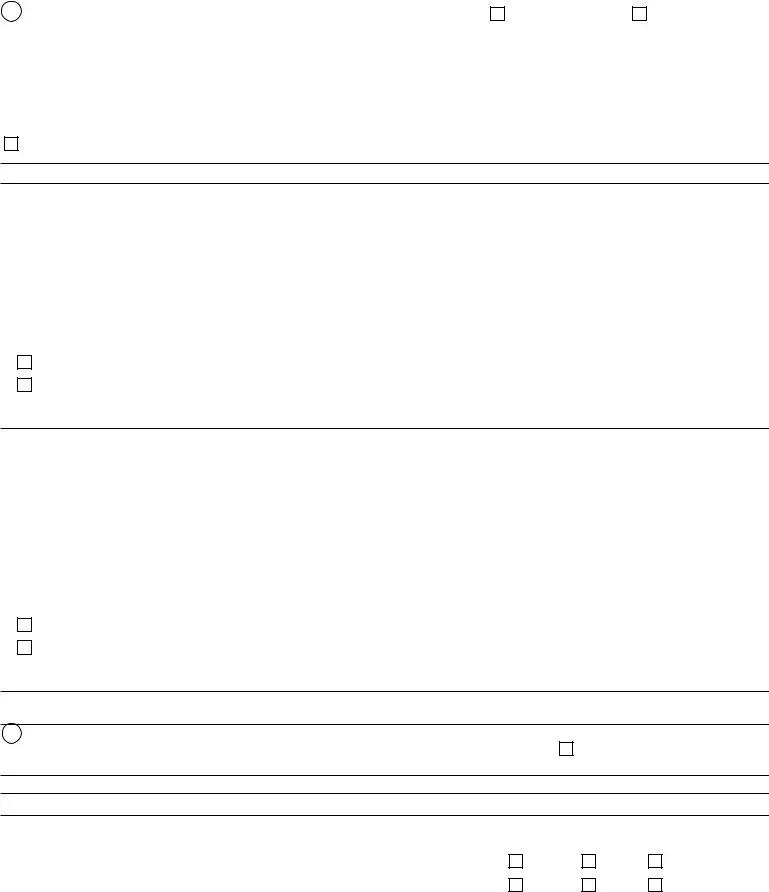

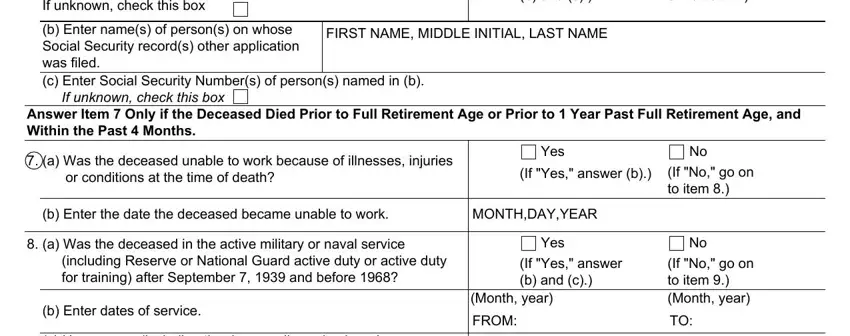

You should put down your particulars within the part Enter name of the State or, If Yes answer b and c, No If No go on to item, b Enter names of persons on whose, FIRST NAME MIDDLE INITIAL LAST NAME, Answer Item Only if the Deceased, a Was the deceased unable to work, Yes, If Yes answer b, If No go on to item, b Enter the date the deceased, MONTHDAYYEAR, a Was the deceased in the active, Yes, and If Yes answer b and c.

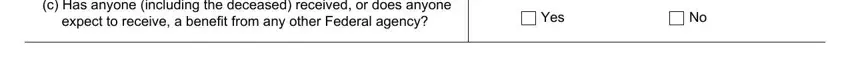

The system will ask you for particulars to automatically submit the area c Has anyone including the, and Yes.

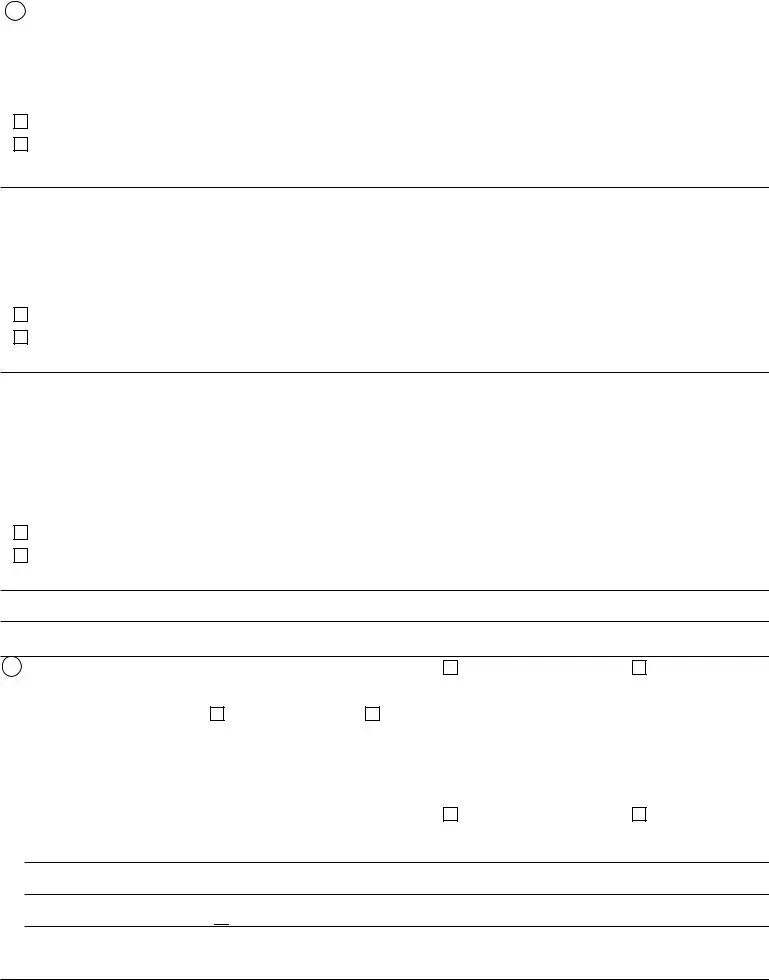

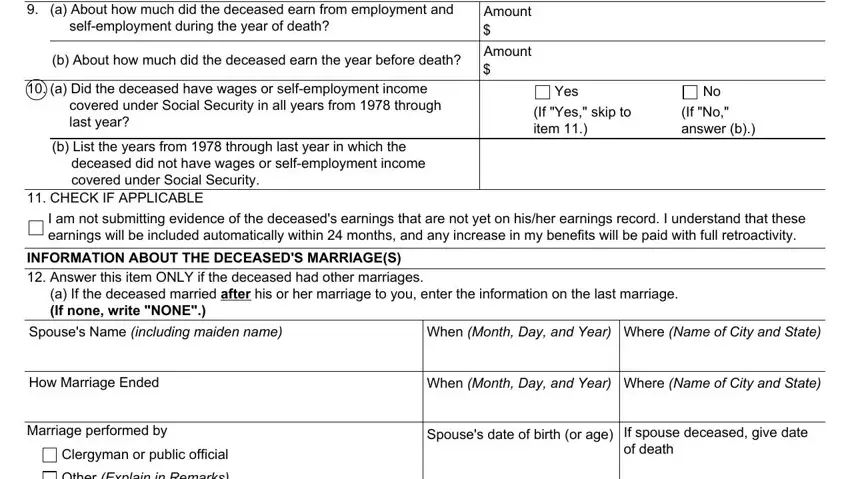

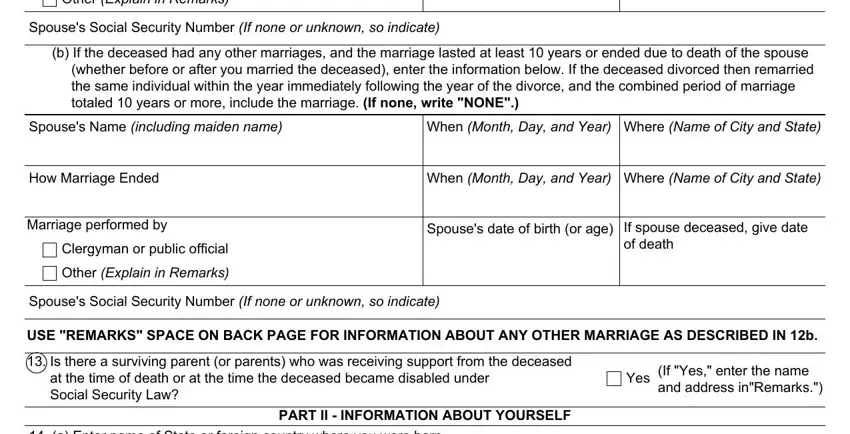

The Form SSA UF ANSWER ITEM ONLY IF, Amount, b About how much did the deceased, Amount, a Did the deceased have wages or, b List the years from through, CHECK IF APPLICABLE, Yes, If Yes skip to item, No If No answer b, I am not submitting evidence of, INFORMATION ABOUT THE DECEASEDS, When Month Day and Year Where Name, How Marriage Ended, and When Month Day and Year box will be the place to insert the rights and obligations of both sides.

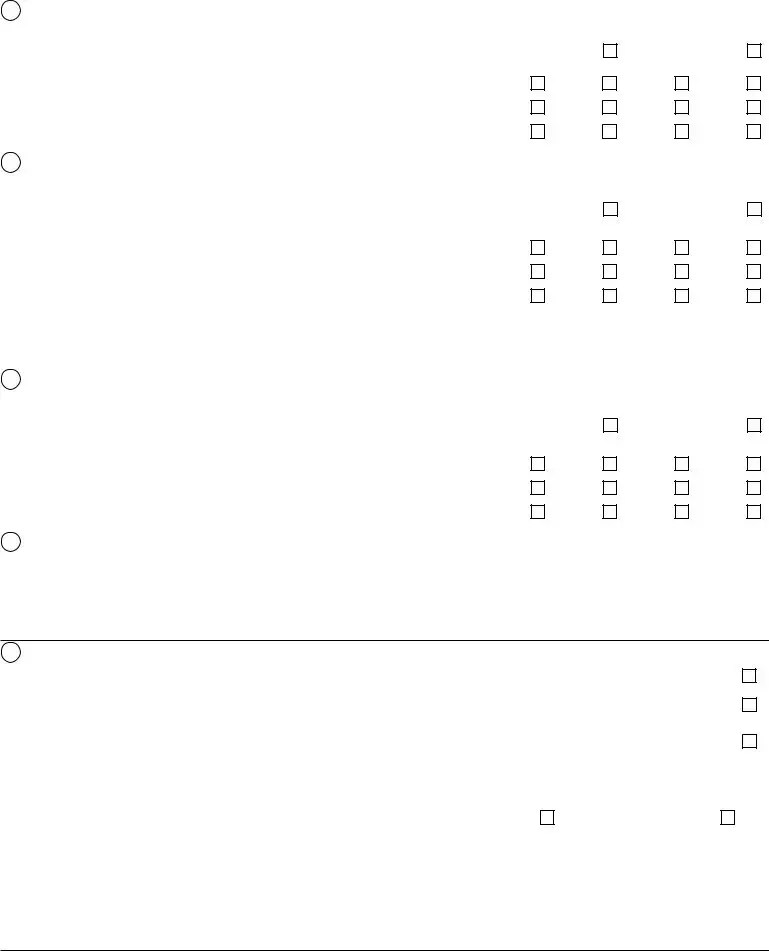

Complete the file by looking at these particular sections: Other Explain in Remarks, Spouses Social Security Number If, b If the deceased had any other, Spouses Name including maiden name, When Month Day and Year Where Name, How Marriage Ended, When Month Day and Year, Where Name of City and State, Marriage performed by, Clergyman or public official, Other Explain in Remarks, Spouses date of birth or age, If spouse deceased give date of, Spouses Social Security Number If, and USE REMARKS SPACE ON BACK PAGE FOR.

Step 3: Choose "Done". You can now upload your PDF file.

Step 4: In order to prevent all of the troubles in the future, be sure to create as a minimum two or three duplicates of your form.