The Social Security Administration (SSA) has a form known as SSA-581-OP65, a crucial document for individuals or organizations needing to obtain earnings data from the SSA. This form serves as an authorization for the Social Security Administration to release an itemized statement of earnings reported to an individual's social security record for specified years. Designed to facilitate a range of requests, including but not limited to personal record keeping, legal proceedings, or pension fund management, this form is necessary for the Sheet Metal Workers National Pension Fund, highlighted as the requesting organization in the given example. Located in Fairfax, VA, this organization, like many others, relies on accurate earnings data for its operations. Applicants must fill in personal details, including Social Security Number (SSN), and specify the years for which earnings data is requested. Importantly, the form comes with a declaration under penalty of perjury, underscoring the serious legal obligation of the applicant to provide truthful information. Moreover, the SSA provides a Privacy Act Statement and a notice on the use of personal information, reassuring applicants about the confidentiality and restricted use of the data provided. The form also underscores the voluntary nature of providing information, while also hinting at potential implications of failing to supply the required data, which might affect the timely and accurate processing of claims. This document emphasizes the administration's commitment to privacy and the efficient handling of personal earnings data, as well as the legal framework that applicants engage with when submitting this form. The deadline for submitting the form to the SSA, outlined to be within 60 days from the date of signing, ensures a measure of timeliness and urgency in the processing of such requests.

| Question | Answer |

|---|---|

| Form Name | Form Ssa 581 Op65 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | authorizes, ssa 581 op 59, STE, SSN |

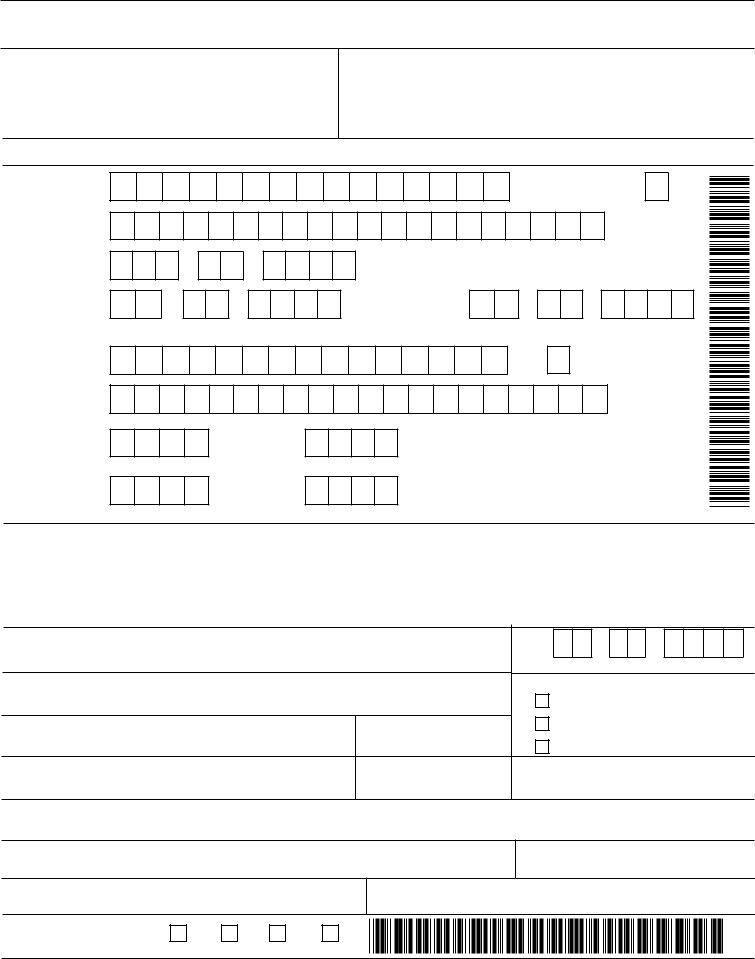

Social Security Administration |

Form Approved |

|

OMB No. |

||

|

Authorization to Obtain Earnings Data from the

Social Security Administration

Social Security Administration |

|

completed |

PO Box 33011 |

form to: |

Baltimore, MD |

Requesting |

SSA Job No 8279 Index 1 |

organization: |

SHEET METAL WORKERS |

|

NATIONAL PENSION FUND |

|

8403 BLVD, STE 300 |

|

FAIRFAX, VA |

Number Holder's Information

First Name:

Last Name:

SSN:

Date of Birth:

Middle Initial:

|

|

|

|

||

Date of Death: |

|

||||

Month |

Day |

Year |

Month |

Day |

Year |

Other First, Middle Initial, and Last Name Used to Report Earnings:

Year(s) |

Y |

Y |

Y |

Y |

|

Requested: |

|||||

|

|

|

|

||

|

Y |

Y |

Y |

Y |

through

Y Y Y Y

through

Y Y Y Y

I am the individual to whom the record/information applies or that person's parent (if a minor) or legal guardian, or a person who is authorized to sign on behalf of the individual to whom the record/information applies. Please furnish the requesting organization, or its designees, an itemized statement of all amounts of earnings reported to my record, or to the record identified above, for the periods specified on this form. Please include the identification numbers, names, and addresses of the reporting employers. I declare under penalty of perjury that I have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my knowledge.

Signature of Number Holder (or authorized representative)

Date

M M

D D Y Y Y Y

Printed Name (if other than |

|

Relationship (if other than number holder) |

number holder) |

|

Spouse |

Address |

State |

Legal Representative |

|

|

Other (specify) |

City |

ZIP Code |

Phone Number |

Requesting Organization's Information

SSA must receive this form within 60 days from the date signed by the Number Holder (or Authorized Representative)

Signature of Organization Official

Date

Phone Number

Fax Number

FOR SSA USE ONLY

1

2

3

4

Form |

Page 1 |

IMPORTANT INFORMATION

Privacy Act Statement

Collection and Use of Personal Information

Section 205(c)(2)(A) of the Social Security Act, as amended, authorizes us to collect this information. We will use the information you provide to obtain earnings data. Furnishing us this information is voluntary. However, failing to provide us with all or part of the information may prevent an accurate and timely decision on any claim filed. We rarely use the information you supply us for any purpose other than to produce an itemized statement of earnings. However, we may use the information for the administration of our programs including sharing information:

1.To comply with Federal laws requiring the release of information from our records (e.g., to the Government Accountability Office and Department of Veterans Affairs); and,

2.To facilitate statistical research, audit, or investigative activities necessary to ensure the integrity and improvement of our programs (e.g., to the Bureau of the Census and to private entities under contract with us).

A complete list of when we may share your information with others, called routine uses, is available in our Privacy Act System of Records Notice

We may share the information you provide to other health agencies through computer matching programs. Matching programs compare our records with records kept by other Federal, State or local government agencies. We use the information from these programs to establish or verify a person’s eligibility for federally funded or administered benefit programs and for repayment of incorrect payments or delinquent debts under these programs.

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C.

§3507, as amended by section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 2 minutes to read the instructions, gather the facts, and answer the questions. Send only comments relating to our time estimate above to: SSA, 6401 Security Blvd, Baltimore, MD

Form |

Page 2 |