Reset Form

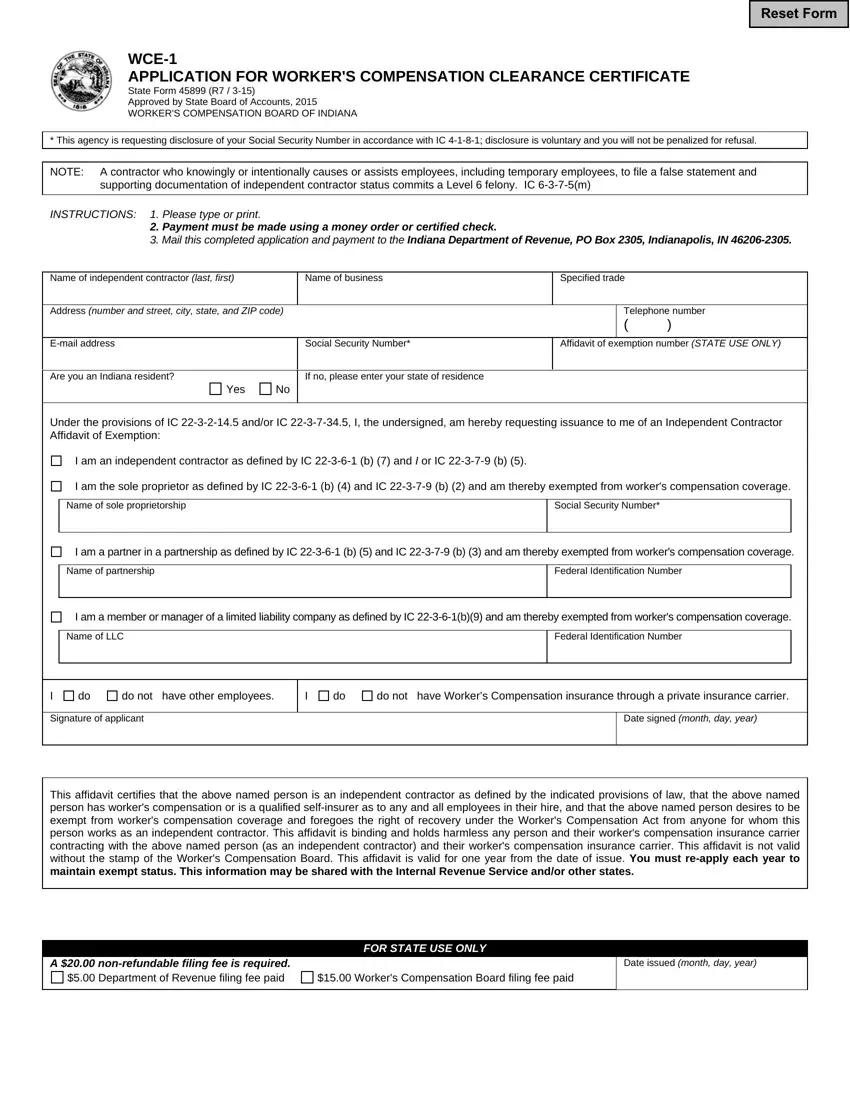

WCE-1

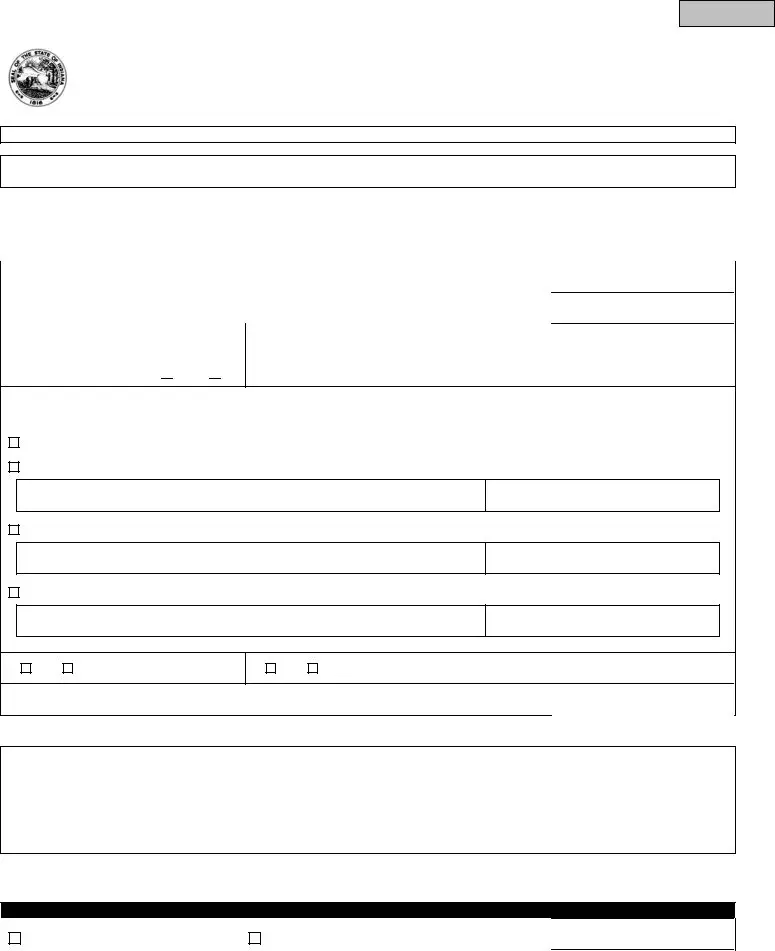

APPLICATION FOR WORKER'S COMPENSATION CLEARANCE CERTIFICATE

State Form 45899 (R7 / 3-15)

Approved by State Board of Accounts, 2015

WORKER'S COMPENSATION BOARD OF INDIANA

* This agency is requesting disclosure of your Social Security Number in accordance with IC 4-1-8-1; disclosure is voluntary and you will not be penalized for refusal.

NOTE: A contractor who knowingly or intentionally causes or assists employees, including temporary employees, to file a false statement and supporting documentation of independent contractor status commits a Level 6 felony. IC 6-3-7-5(m)

INSTRUCTIONS: 1. Please type or print.

2.Payment must be made using a money order or certified check.

3.Mail this completed application and payment to the Indiana Department of Revenue, PO Box 2305, Indianapolis, IN 46206-2305.

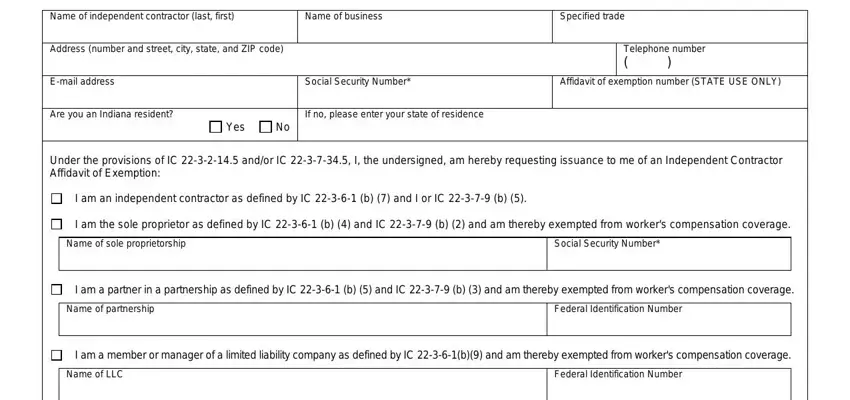

Name of independent contractor (last, first) |

Name of business |

Specified trade |

|

|

|

|

Telephone number |

Address (number and street, city, state, and ZIP code) |

|

|

|

|

|

( |

) |

|

|

|

exemption number (STATE USE ONLY) |

E-mail address |

Social Security Number* |

Affidavit of |

|

|

|

|

|

Are you an Indiana resident? |

If no, please enter your state of residence |

|

|

|

Yes

Yes  No

No

Under the provisions of IC 22-3-2-14.5 and/or IC 22-3-7-34.5, I, the undersigned, am hereby requesting issuance to me of an Independent Contractor Affidavit of Exemption:

I am an independent contractor as defined by IC 22-3-6-1 (b) (7) and I or IC 22-3-7-9 (b) (5).

I am the sole proprietor as defined by IC 22-3-6-1 (b) (4) and IC 22-3-7-9 (b) (2) and am thereby exempted from worker's compensation coverage.

Name of sole proprietorship

I am a partner in a partnership as defined by IC 22-3-6-1 (b) (5) and IC 22-3-7-9 (b) (3) and am thereby exempted from worker's compensation coverage.

Federal Identification Number

I am a member or manager of a limited liability company as defined by IC 22-3-6-1(b)(9) and am thereby exempted from worker's compensation coverage.

Federal Identification Number

I |

do |

do not have other employees. |

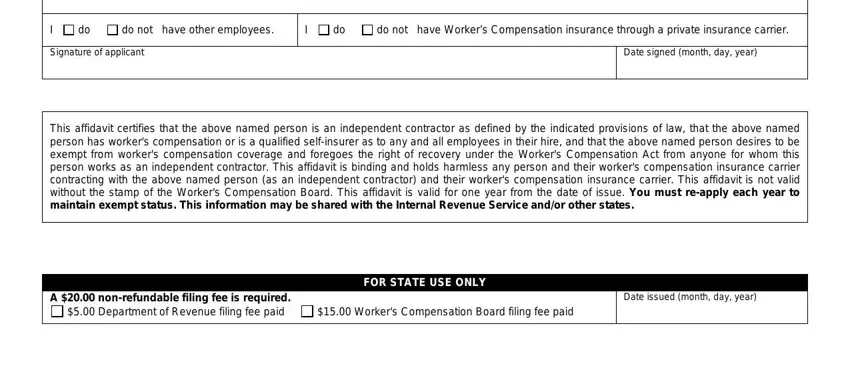

Signature of applicant

I |

do |

do not have Worker’s Compensation insurance through a private insurance carrier. |

|

|

|

Date signed (month, day, year) |

|

|

|

|

|

|

|

This affidavit certifies that the above named person is an independent contractor as defined by the indicated provisions of law, that the above named person has worker's compensation or is a qualified self-insurer as to any and all employees in their hire, and that the above named person desires to be exempt from worker's compensation coverage and foregoes the right of recovery under the Worker's Compensation Act from anyone for whom this person works as an independent contractor. This affidavit is binding and holds harmless any person and their worker's compensation insurance carrier contracting with the above named person (as an independent contractor) and their worker's compensation insurance carrier. This affidavit is not valid without the stamp of the Worker's Compensation Board. This affidavit is valid for one year from the date of issue. You must re-apply each year to maintain exempt status. This information may be shared with the Internal Revenue Service and/or other states.

|

FOR STATE USE ONLY |

A $20.00 non-refundable filing fee is required. |

|

$5.00 Department of Revenue filing fee paid |

$15.00 Worker's Compensation Board filing fee paid |

|

|

Date issued (month, day, year)

APPLICATION CHECKLIST

Part of State Form 45899

This Application for Certification of Exemption represents a statement by you that you are an independent contractor or otherwise not required to carry Worker's Compensation insurance on yourself under the Worker's Compensation Act of Indiana. The Indiana Department of Revenue may share this information with the Internal Revenue Service (IRS) and /or other states.

The statutes establishing this registration process state that an independent contractor is defined similarly to the IRS tax guidelines for determining independent contractor status. The IRS uses several factors to determine whether an individual is an independent contractor or an employee. Listed below are some of the characteristics of each. If you fail to meet these qualifications, you will not receive certification.

An independent contractor generally:

directs his own work and performs the work in the manner he chooses, without direction from a boss or general contractor;

sets his own hours;

may hire assistants;

provides his own tools and materials;

is paid by the job rather than by the hour;

may make a profit or suffer a loss on a job; and

is free to work for more than one person or firm and to offer his services to the general public.

An employee generally:

is under the control of his employer;

has income taxes withheld from his pay;

must work the hours specified by the employer;

receives pay on an hourly basis;

must perform the work in the manner indicated by the employer;

receives training, tools and equipment provided by the employer;

is not free to offer his services to any persons or firms or to the general public; and

can be fired at any time.

Are you new to the state of Indiana or the United States? If so, you will be required to submit verification of your residency. Some examples include:

valid Indiana Driver's License;

permanent Resident Card (green card);

copy of income tax return from another state;

copy of rental or property tax agreement;

voter's registration card;

Individual Tax Identification Number (ITIN) (resident aliens)

This application for a Certification of Exemption from worker's compensation in Indiana will be processed by verifying your status as an Independent Contractor. The Indiana Department of Revenue will examine your past tax records to determine if you have identified yourself as an independent contractor in past years and are current on your individual tax filings. Failure to comply will result in denial of certification.

IC 22-3-2-14.5 requires that you be certified by the Department of Revenue. The Certification is filed for you with the Indiana Worker's Compensation Board to obtain your Independent Contractor status. You are required to pay a $20 fee, $5 (non-refundable) to the Indiana Department of Revenue and $15 to the Indiana Worker's Compensation Board, for making the application. Please allow two (2) to three (3) weeks for the Department of Revenue and an additional seven (7) days for the Workers Compensation Board to process this request. If you do not meet the criteria for establishing your status as an independent contractor, you will be contacted with instructions on providing additional information, or notification of denial.

Your certification is not valid until the Worker's Compensation Board has stamped it. Mail your application to the Indiana Department of Revenue for processing. Upon approval of both the Department of Revenue and the Worker's Compensation Board, you will receive your validated Certificate of Exemption and a copy of Income Tax Information Bulletin #86 in the mail.

Note: Until/unless you receive a Certificate of Exemption from the Indiana Worker's Compensation Board, you are required to be covered by a Worker's Compensation policy under Indiana law. Even if you are exempt, you must cover any employees of your business.

Yes

Yes  No

No