Instructions - Form WD-10

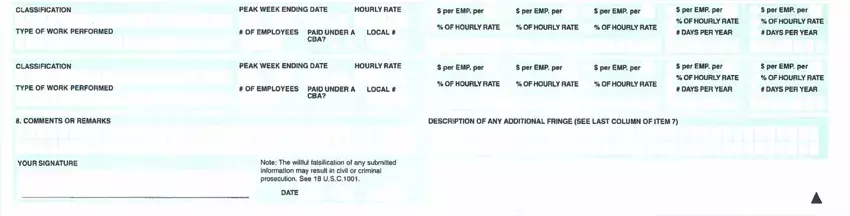

Note: The willful falsification of any submitted information may result In civil or criminal prosecution. See 18 U.S.C. 1001.

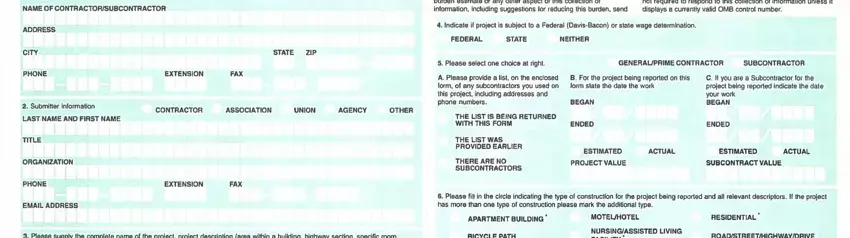

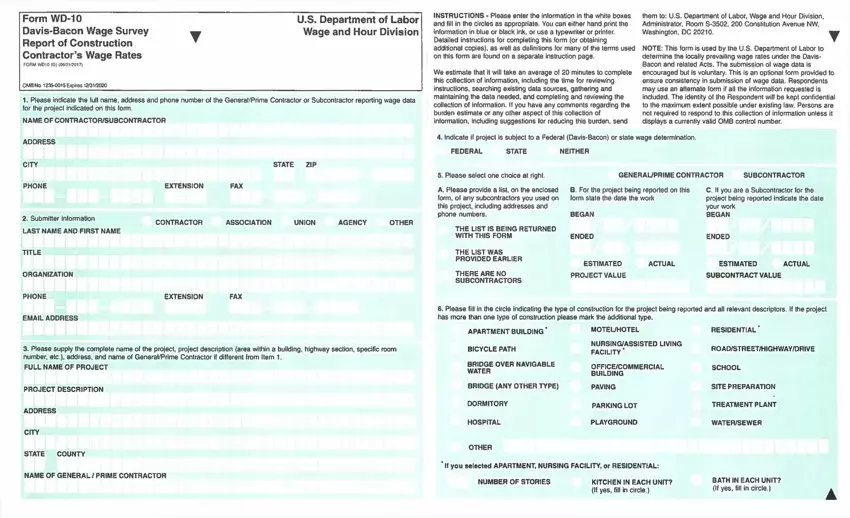

(Correct any of the preprinted information in items 1-8. If not preprinted, please complete.)

1.Self-explanatory.

2.Provide the name of the project, a short description, the street address, city, county and state.

3.If a general or prime contract, on a separate sheet identify by name, address and telephone number all of your subcontractors engaged on this project. Do not include those firms which supply materials only.

4.General or Prime Contractors Only. State the total project value.

Subcontractors Only. State the approximate value of your subcontract (not of the entire general contract).

5.General or Prime Contractors Only. State the date that any work started on the project.

Subcontractors Only. Indicate the date you started actual work on the project.

6.General or Prime Contractors Only. Give the project completion date and indicate if the date is the actual (that is, already completed) or estimated.

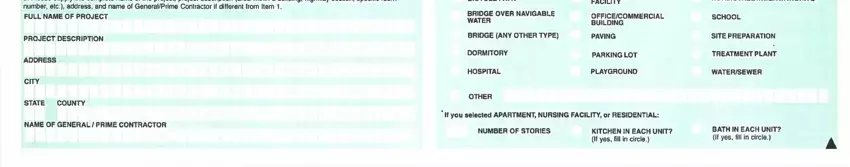

7.For residential building projects, state the number of stories and units.

8.For all projects, indicate whether the project is subject to a Federal (Davis-Bacon) wage determination, a State wage determination, or neither. If project is subject to both a Federal and State wage determination check both boxes.

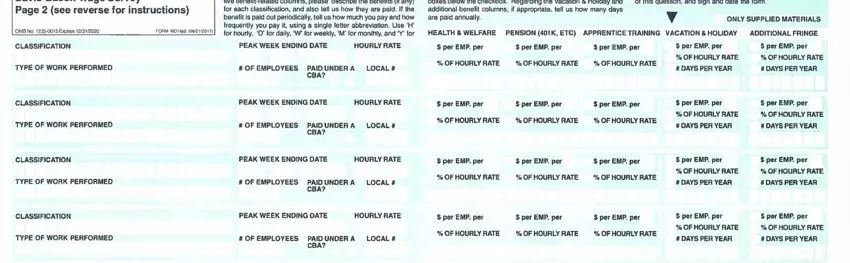

9.List all classifications employed on the project, including helpers a/,if any. Helpers, as defined below (regardless of job title), who are employed on the project should be listed with a notation indicating the journeyman craft they assist. Helpers who assist more than one journeyman craft should be listed with a notation indicating each journeyman craft classification they have assisted. Separately list employees in an apprenticeship program or in a formal training program approved by the U.S. Department of Labor, Bureau of Apprenticeship and Training (BAT) or a State Apprenticeship Agency recognized by BAT. However, information regarding apprentice and trainee wages and fringe benefits (items 13. and 14.) need not be provided.

10.Indicate by a check mark whether the contractor is signatory to a collective bargaining agreement under which the workers in each classification listed are paid.

11.Indicate the ending date (mo., day, yr.) of the workweek in which the wage rates were paid to each classification.

12.For each classification used on this project please fill in number employed during the week of peak employment of each craft. Indicate the number of employees paid at each given rate.

13.Indicate the basic hourly rate of pay for each classification. Do not give a pay range. If pay is for piece work, break it down to an hourly rate of pay for each piece rate worker. Do not group workers with one average hourly rate.

14.Indicate any bona fide fringe benefits b/paid each classification under the following categories:

a. Health and Welfare |

b. Pension |

c. Holiday and Vacation 03 |

d. Apprentice Training (App. Training) |

Give the hourly rate, or the percentage of the basic hourly rate paid, or other amounts (e.g., $15 per week, $30 per month) under the heading that most clearly describes the fringe benefit. If necessary, clarify or list any bona fide fringe benefit which does fit into the above categories in “Remarks” box.

15 - 17. Self-explanatory.

a/ A ”helper” as defined under the Davis-Bacon regulations (29 CFR 5.2(n) (4)) is a semi-skilled worker (rather than a skilled journeyman mechanic) who works under the direction of and assists a journeyman. Under the journeyman’s direction and supervision, the helper performs a variety of duties to assist the journeyman such as preparing, carrying, and furnishing materials, tools,equipment and supplies and maintaining them in order; cleaning and preparing work areas; lifting, positioning and holding materials or tools; and other related semi-skilled tasks as directed by the journeyman. A helper may use the tools of the trade at and under the direction of a journeyman. The particular duties performed by a helper vary according to area practice.

b/ Typically, bona fide fringe benefits include:

oHealth and Welfare - medical or hospital care, compensation for injuries or illness resulting from occupational activity, or insurance to provide any of the foregoing, unemployment benefits, life insurance disability or sickness or accident insurance.

oPensions - Retirement or Annuity cost or cost of insurance to provide such a benefit. o Holiday and Vacation.

o Apprentice Training - defrayment of cost of apprenticeship or similar training programs.

Report only the contributions made or costs incurred by the contractor or subcontractor (not the contributions or amounts paid by employees) for any of the types of fringe benefits noted above. Do not report any fringe benefit payments required by either Federal, State, or local law, such as worker’s compensation or unemployment insurance.

Public Burden Statement

We estimate that it will take an average of 20 minutes to complete this collection of information, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. If you have any comments regarding this burden estimate or any other aspect of this collection of information, including suggestions for reducing this burden, send them to the Wage and Hour Division, Department of Labor, Room S-3502, 200 Constitution Avenue, N.W., Washington, D.C. 20210

DO NOT SEND THE COMPLETED FORM TO THIS OFFICE |

*US GPO: 1996-418-422/52701 |