It is easy to fill out the form g 7 empty lines. Our tool makes it virtually effortless to edit any type of form. Listed below are the only four steps you need to follow:

Step 1: Choose the button "Get form here" to access it.

Step 2: Now it's easy to change your form g 7. Our multifunctional toolbar makes it possible to add, eliminate, improve, and highlight text as well as undertake several other commands.

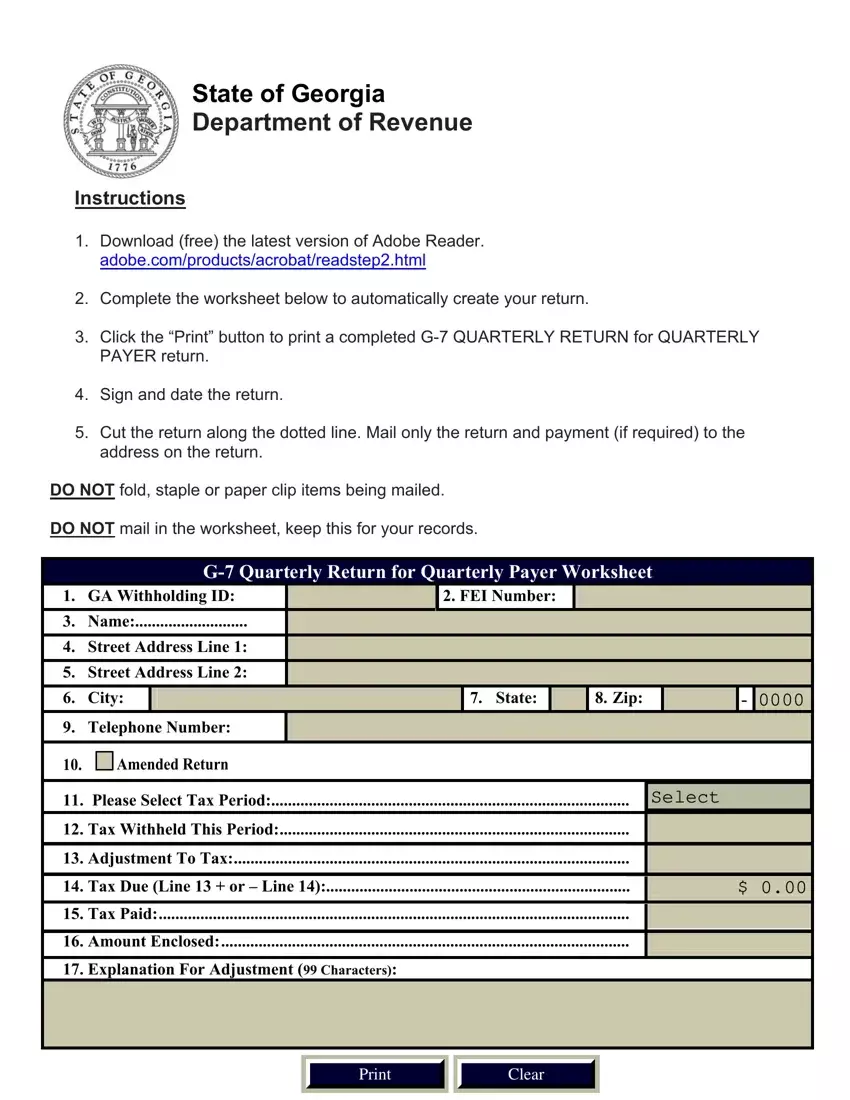

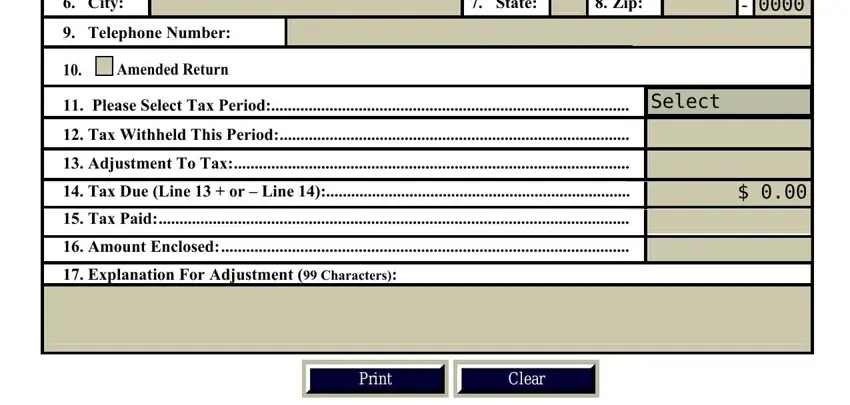

Please enter the following information to complete the form g 7 PDF:

Type in the required details in the area City, Telephone Number, Amended Return, State, Zip, Please Select Tax Period, Tax Withheld This Period, Adjustment To Tax, Tax Due Line or Line, Tax Paid, Amount Enclosed, and Explanation For Adjustment.

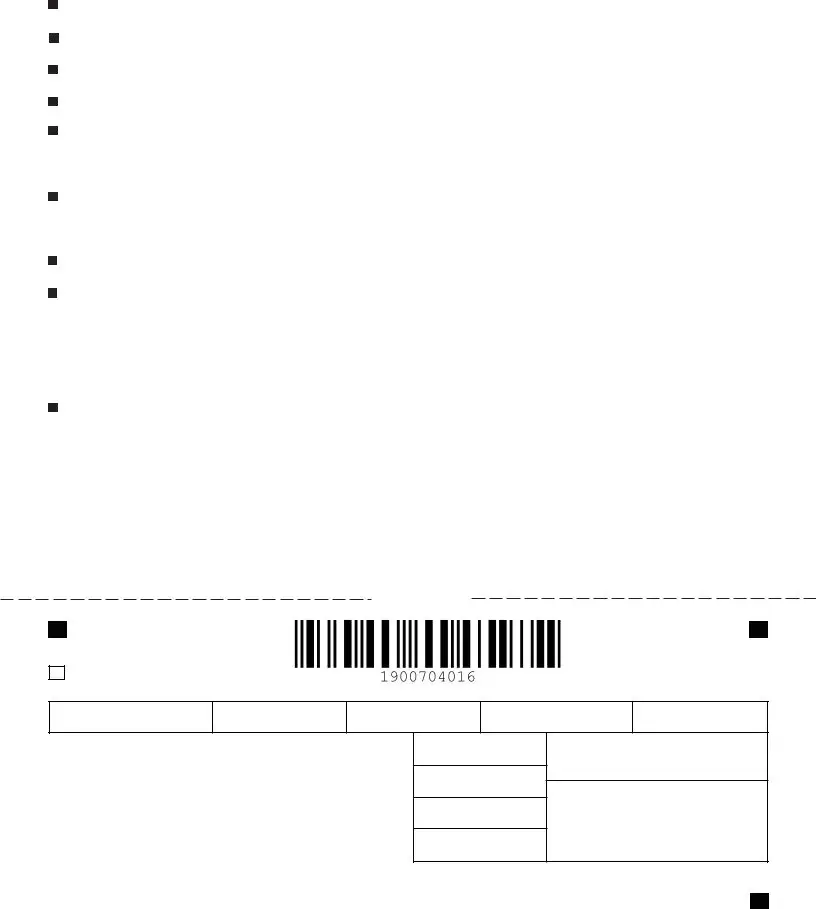

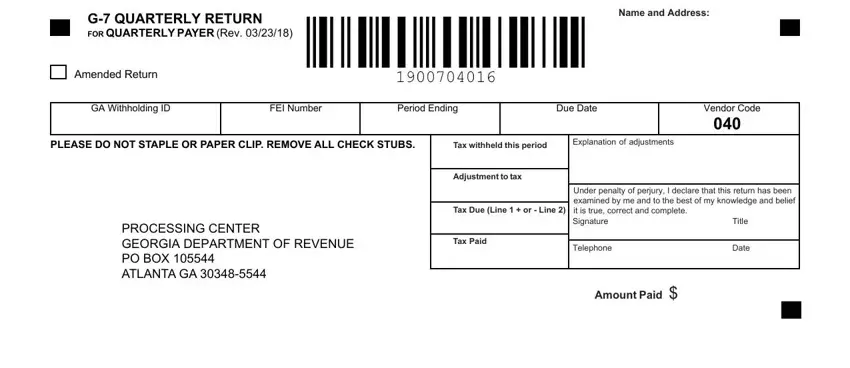

The application will demand for further information with a purpose to easily fill in the section G QUARTERLY RETURN FOR QUAR, TERLY PAYER Rev, Amended Return, Cut on dotted line, Name and Address, GA Withholding ID, FEI Number, Period Ending, Due Date, Vendor Code, PLEASE DO NOT STAPLE OR PAPER CLIP, Tax withheld this period, Explanation of adjustments, PROCESSING CENTER GEORGIA, and Adjustment to tax.

Step 3: Click the "Done" button. Now you may export the PDF document to your electronic device. Additionally, it is possible to deliver it by means of email.

Step 4: To protect yourself from potential upcoming concerns, be sure you obtain more than two or three duplicates of every document.