The objective powering our PDF editor was to allow it to be as simple to use as it can be. You'll find the general process of creating 2018 schedule stress-free in the event you comply with the next steps.

Step 1: Select the orange "Get Form Now" button on this webpage.

Step 2: After you've accessed the 2018 schedule edit page, you'll discover all actions you can undertake with regards to your file within the top menu.

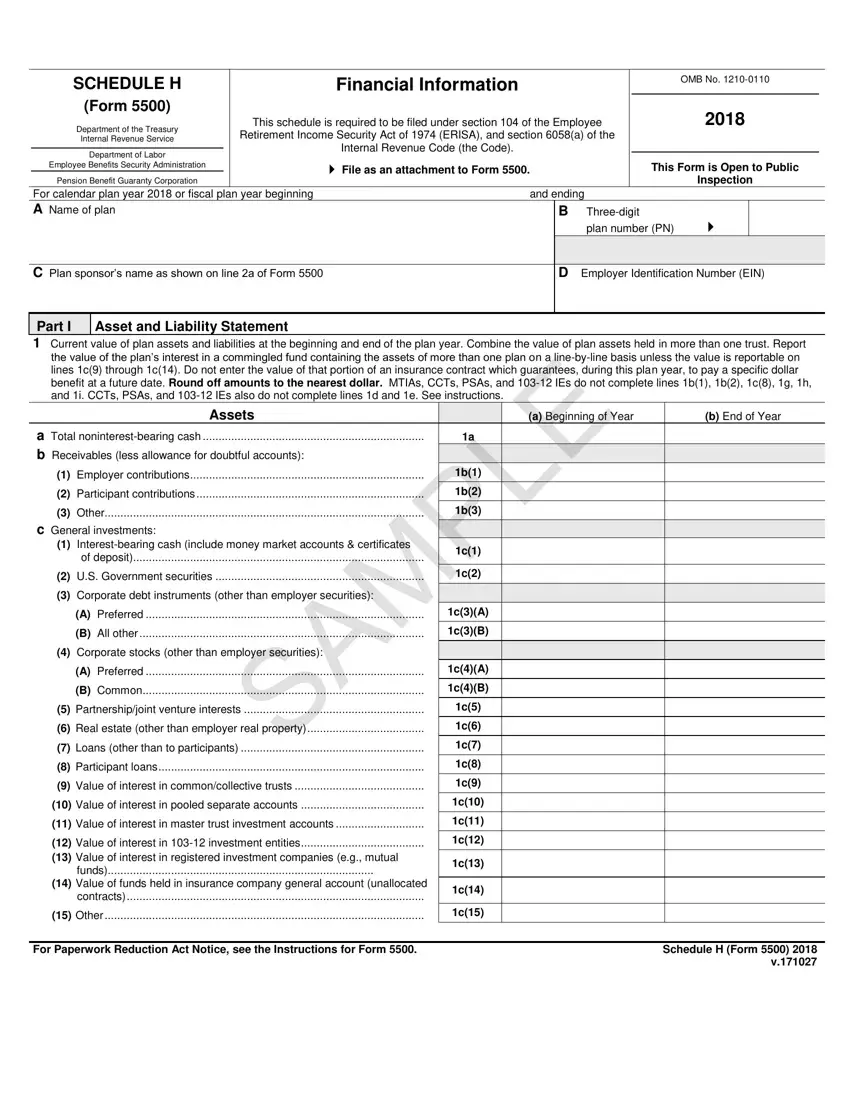

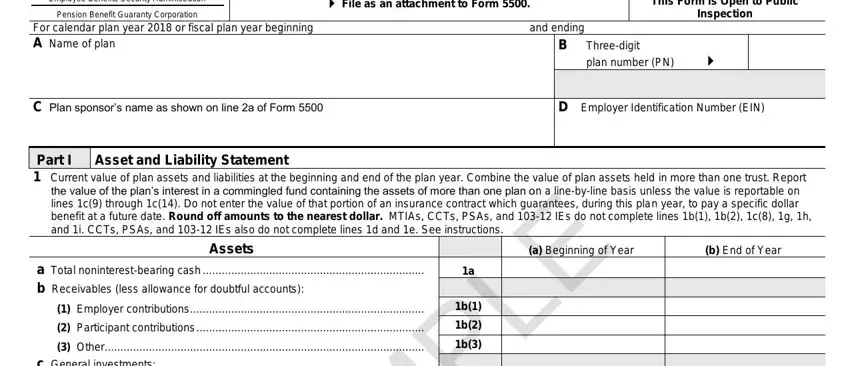

Enter the required material in every single section to get the PDF 2018 schedule

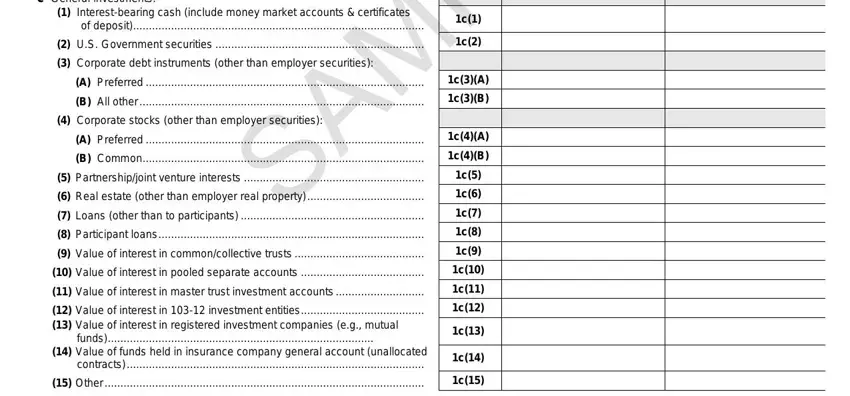

In the c General investments, Interestbearing cash include, of deposit, US Government securities, Corporate debt instruments other, A Preferred, B All other, Corporate stocks other than, A Preferred, B Common, Partnershipjoint venture, Real estate other than employer, Loans other than to participants, Participant loans, and Value of interest in field, put down your data.

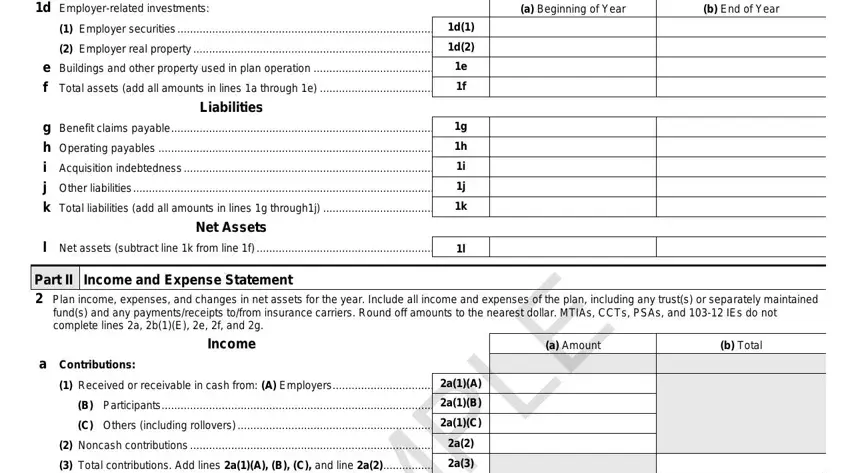

Note down the required information when you are on the d Employerrelated investments, Employer securities d, Employer real property d, e Buildings and other property, a Beginning of Year, b End of Year, Liabilities, g Benefit claims payable g h, l Net assets subtract line k from, Net Assets, Part II Income and Expense, funds and any paymentsreceipts, Income, a Amount, and b Total part.

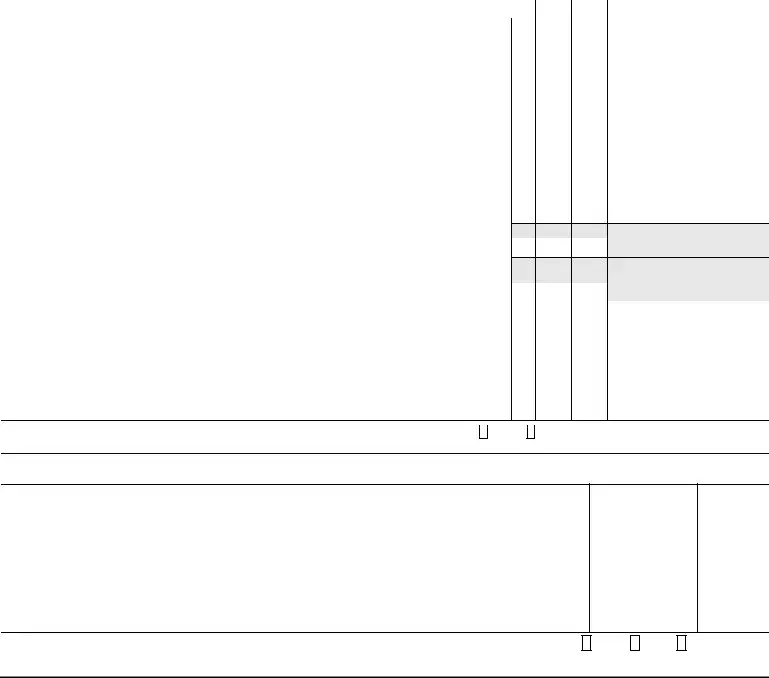

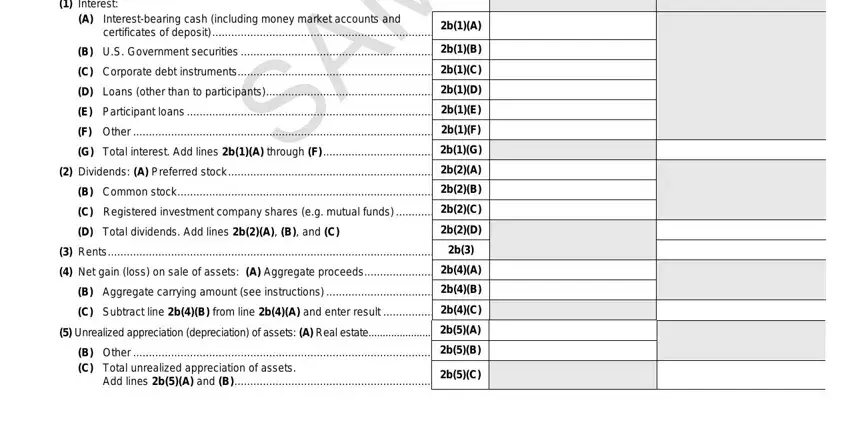

The Interest A, Interestbearing cash including, B US Government securities bB C, D Total dividends Add lines bA B, Rents b Net gain loss on sale, and Add lines bA and B section is the place where each side can put their rights and obligations.

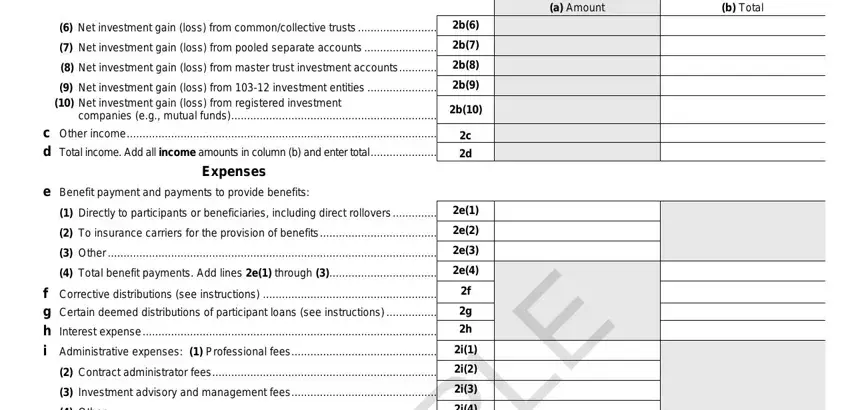

Finish by reading the following fields and completing the required details: a Amount, b Total, Net investment gain loss from, companies eg mutual funds c Other, e Benefit payment and payments to, Expenses, Directly to participants or, f Corrective distributions see, Contract administrator fees, Investment advisory and, and Other Total administrative.

Step 3: Hit the Done button to save the form. At this point it is obtainable for transfer to your gadget.

Step 4: Prepare a copy of every single form. It would save you time and allow you to refrain from challenges in the long run. Keep in mind, your data won't be used or viewed by us.