It really is not hard to fill in the horace mann annuity withdrawal form. Our PDF editor was developed to be easy-to-use and let you complete any PDF quickly. These are the four actions to follow:

Step 1: Choose the "Get Form Now" button to begin.

Step 2: Now you can modify your horace mann annuity withdrawal form. This multifunctional toolbar will allow you to insert, delete, transform, and highlight text or perhaps perform other sorts of commands.

These particular segments will frame the PDF file that you will be filling out:

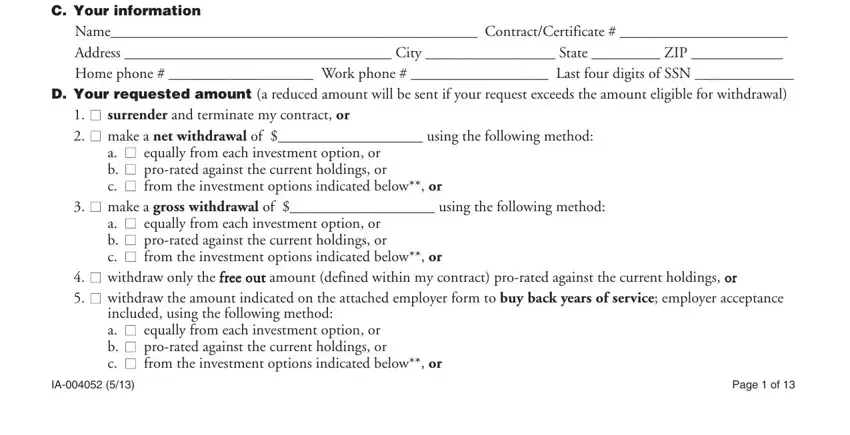

You have to prepare the C Your information, Name ContractCertificate Address, surrender and terminate my, a equally from each investment, make a gross withdrawal of, a equally from each investment, withdraw only the free out, included using the following, and Page of field with the essential particulars.

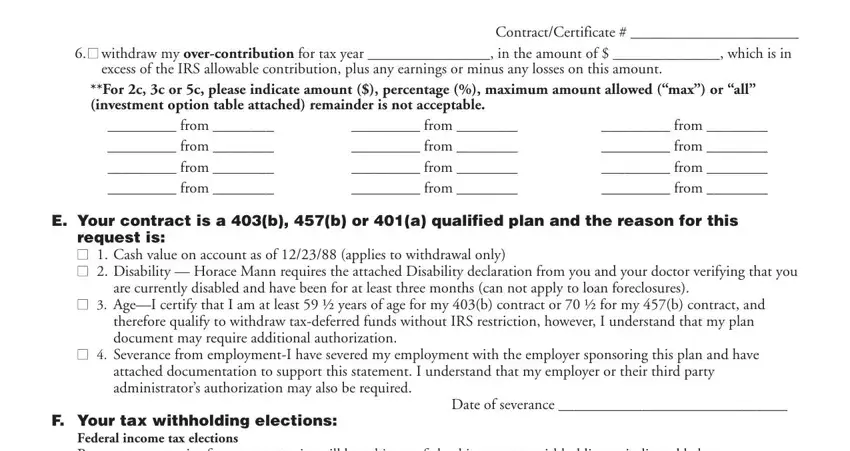

Identify the main information about the ContractCertificate withdraw, excess of the IRS allowable, For c c or c please indicate, from from from from, from from from from, from from from from, E Your contract is a b b or a, request is Cash value on account, are currently disabled and have, AgeI certify that I am at least, therefore qualify to withdraw, Severance from employmentI have, Date of severance, F Your tax withholding elections, and Federal income tax elections box.

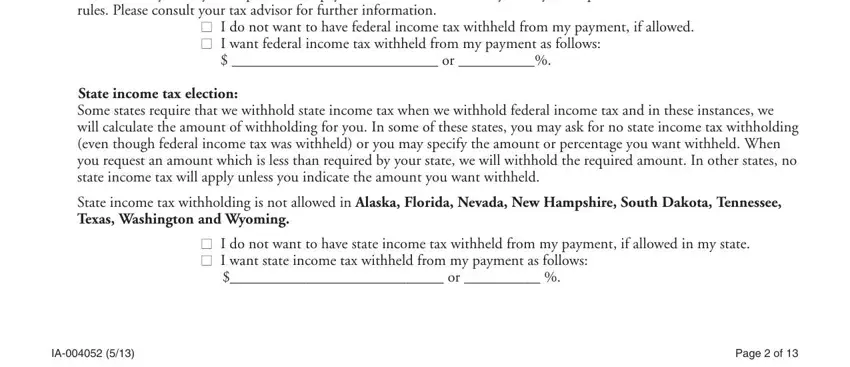

You have to define the rights and obligations of all parties in section If you elect not to have federal, I do not want to have federal, State income tax election Some, State income tax withholding is, I do not want to have state, and Page of.

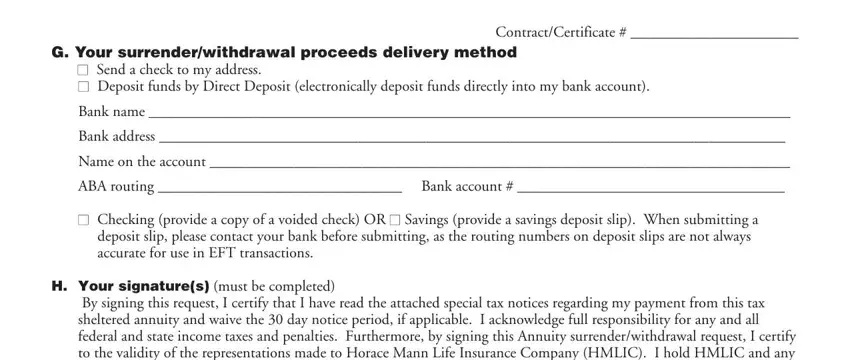

Review the sections G Your surrenderwithdrawal, Send a check to my address, ContractCertificate, Bank name, Bank address, Name on the account, ABA routing Bank account, Checking provide a copy of a, H Your signatures must be completed, and By signing this request I certify and next complete them.

Step 3: After you've clicked the Done button, your form should be available for transfer to any type of electronic device or email address you indicate.

Step 4: Prepare a copy of each single form. It will certainly save you time and permit you to avoid problems in the future. Keep in mind, the information you have is not used or analyzed by us.