It is really simple to fill out the how to drop off taxes at h r block gaps. Our editor makes it nearly effortless to edit any type of form. Down below are the only four steps you'll want to consider:

Step 1: You should press the orange "Get Form Now" button at the top of the following web page.

Step 2: Now it's easy to manage the how to drop off taxes at h r block. The multifunctional toolbar allows you to insert, eliminate, alter, and highlight content as well as undertake other sorts of commands.

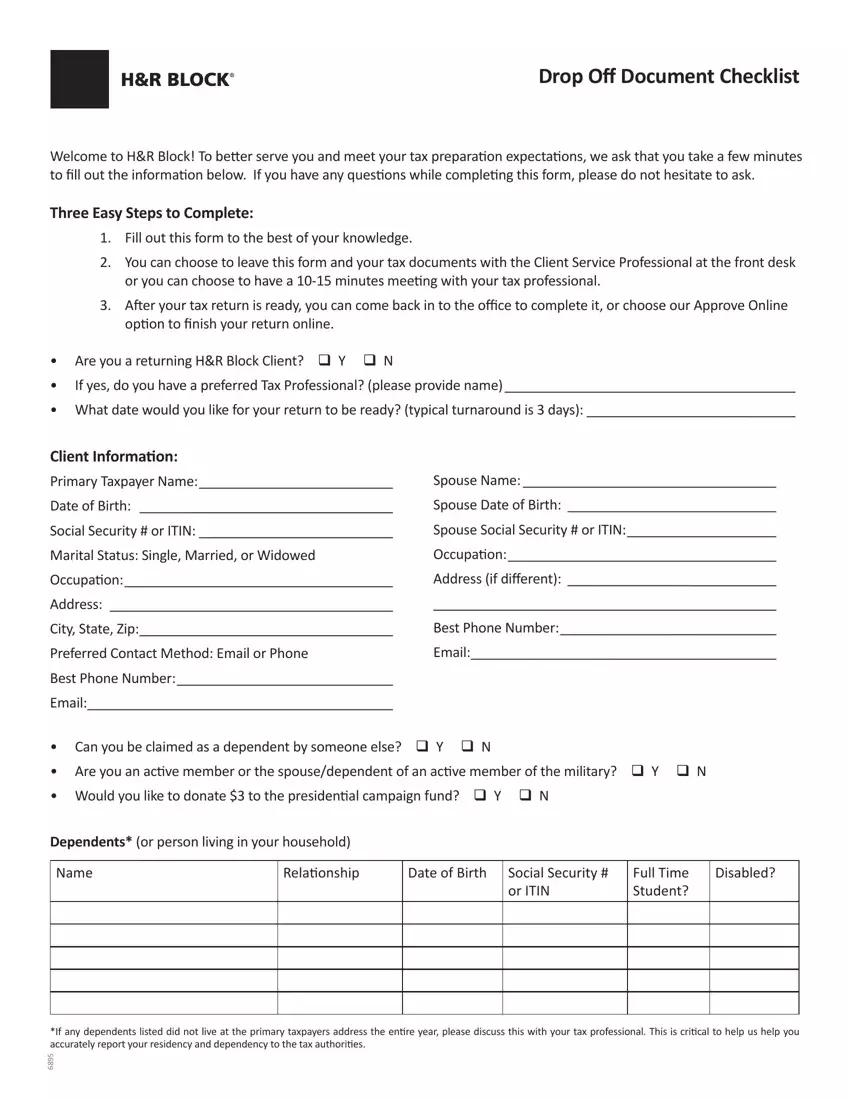

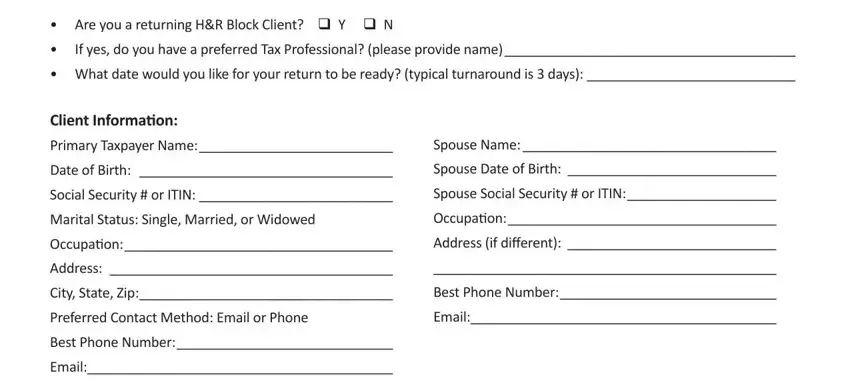

The next sections will make up the PDF file:

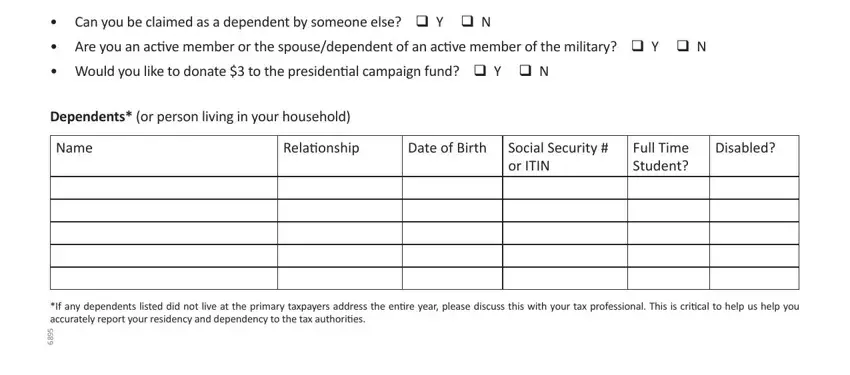

Put the appropriate details in the Can you be claimed as a dependent, Are you an acive member or the, Would you like to donate to the, Dependents or person living in, Name, Relaionship, Date of Birth, Social Security or ITIN, Full Time Student, Disabled, and If any dependents listed did not part.

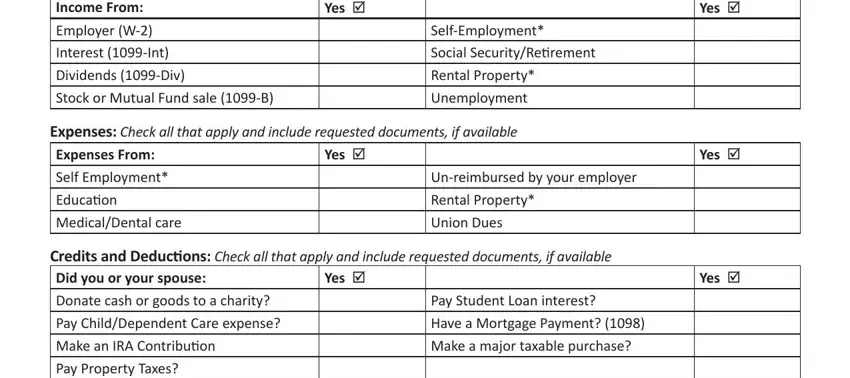

Type in the essential details when you are on the Income Check all that apply and, SelfEmployment Social, Yes, Expenses Check all that apply and, Yes, Unreimbursed by your employer, Credits and Deducions Check all, Pay Student Loan interest Have a, Yes, Yes, Yes, and Yes section.

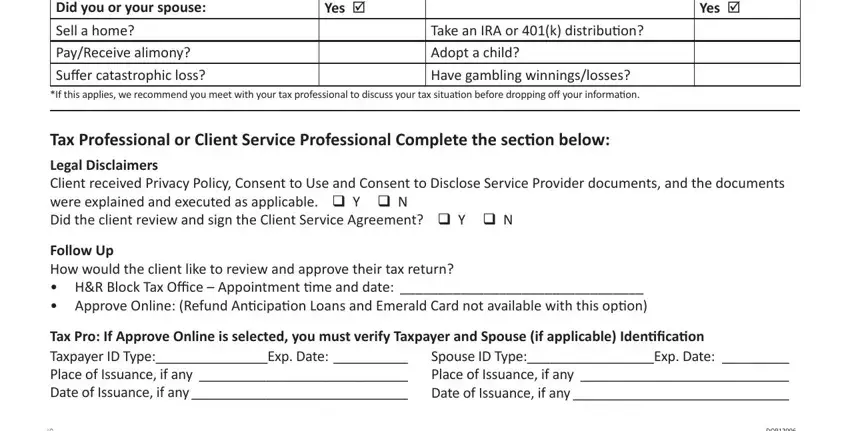

Make sure you specify the rights and obligations of the sides within the Did you or your spouse Sell a home, Take an IRA or k distribuion Adopt, Yes, Yes, Tax Professional or Client Service, Follow Up How would the client, Tax Pro If Approve Online is, Spouse ID TypeExp Date Place of, and DOP box.

Step 3: Choose the button "Done". The PDF form is available to be exported. It is possible to obtain it to your laptop or email it.

Step 4: It could be easier to save duplicates of the document. You can rest easy that we won't display or see your data.