We have used the hard work of our best software engineers to build the PDF editor you may want to work with. The software will let you fill out the tax write off checklist document with ease and don’t waste precious time. What you need to undertake is comply with the following easy-to-follow steps.

Step 1: Press the orange "Get Form Now" button on the website page.

Step 2: When you have accessed the tax write off checklist editing page you can discover each of the options you'll be able to conduct regarding your template in the top menu.

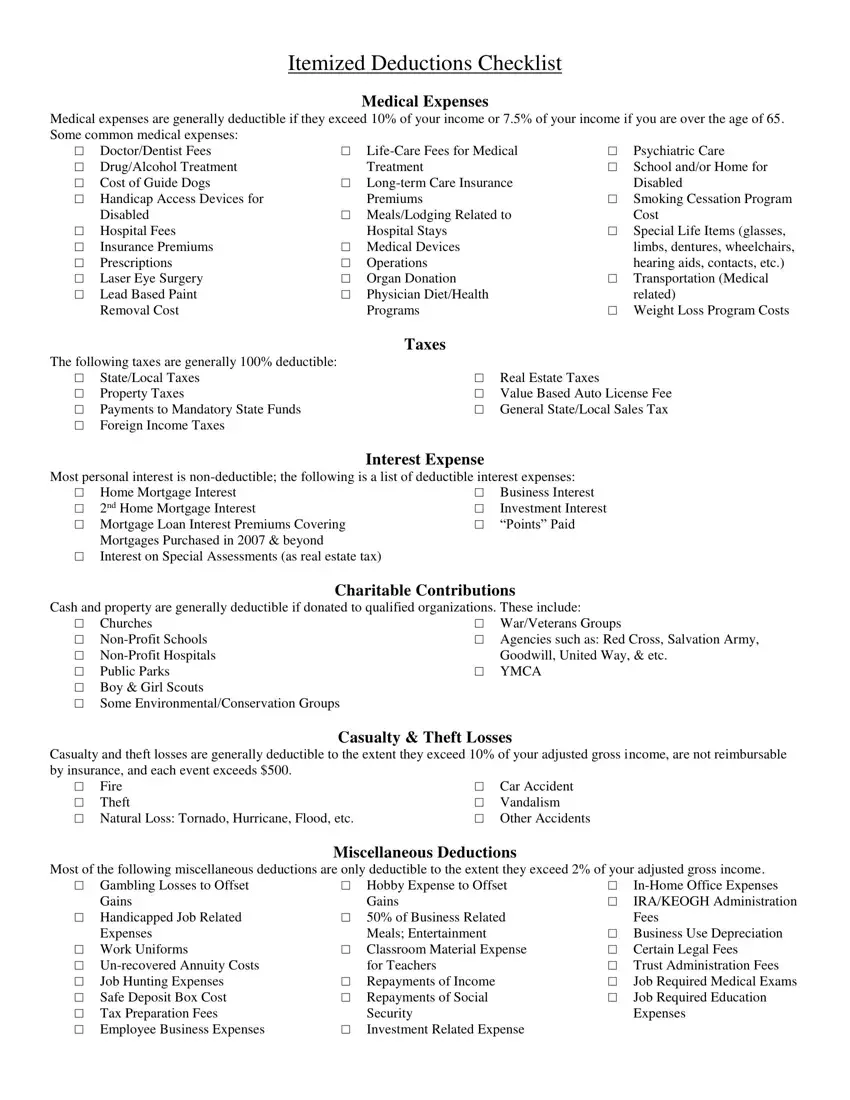

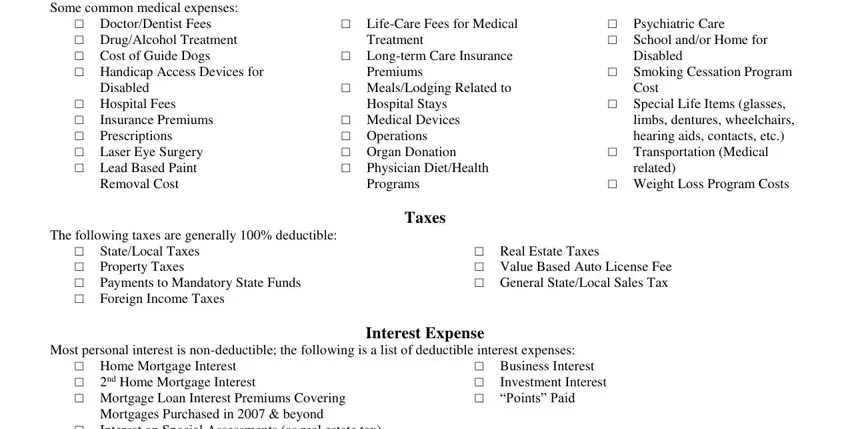

Type in the essential content in each section to complete the PDF tax write off checklist

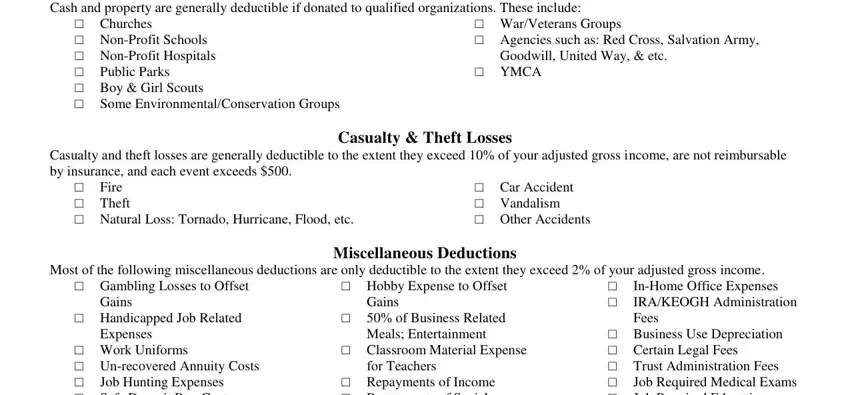

Write the demanded particulars in the Cash and property are generally, Churches NonProfit Schools, WarVeterans Groups Agencies such, Goodwill United Way etc, YMCA, Casualty Theft Losses Casualty, Fire Theft Natural Loss Tornado, Car Accident Vandalism Other, Most of the following, Gambling Losses to Offset, Gains, Handicapped Job Related, Expenses, Work Uniforms Unrecovered Annuity, and Job Hunting Expenses Safe Deposit segment.

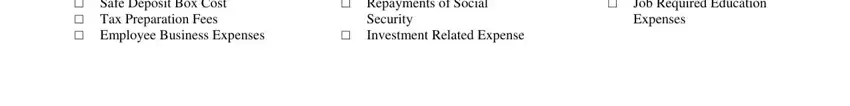

In the Job Hunting Expenses Safe Deposit, Repayments of Income Repayments of, Security Investment Related Expense, and Job Required Medical Exams Job segment, focus on the crucial data.

Step 3: As soon as you hit the Done button, your prepared form may be transferred to any kind of your devices or to electronic mail chosen by you.

Step 4: Produce copies of your template. This will save you from possible difficulties. We don't watch or share the information you have, as a consequence you can relax knowing it's going to be secure.