The procedure of filling in the SSN is very easy. Our experts made certain our software is not hard to understand and can help prepare any PDF in a short time. Consider some of the steps you'll want to take:

Step 1: Step one will be to click the orange "Get Form Now" button.

Step 2: At this point, you are on the file editing page. You can add text, edit current data, highlight specific words or phrases, insert crosses or checks, add images, sign the form, erase needless fields, etc.

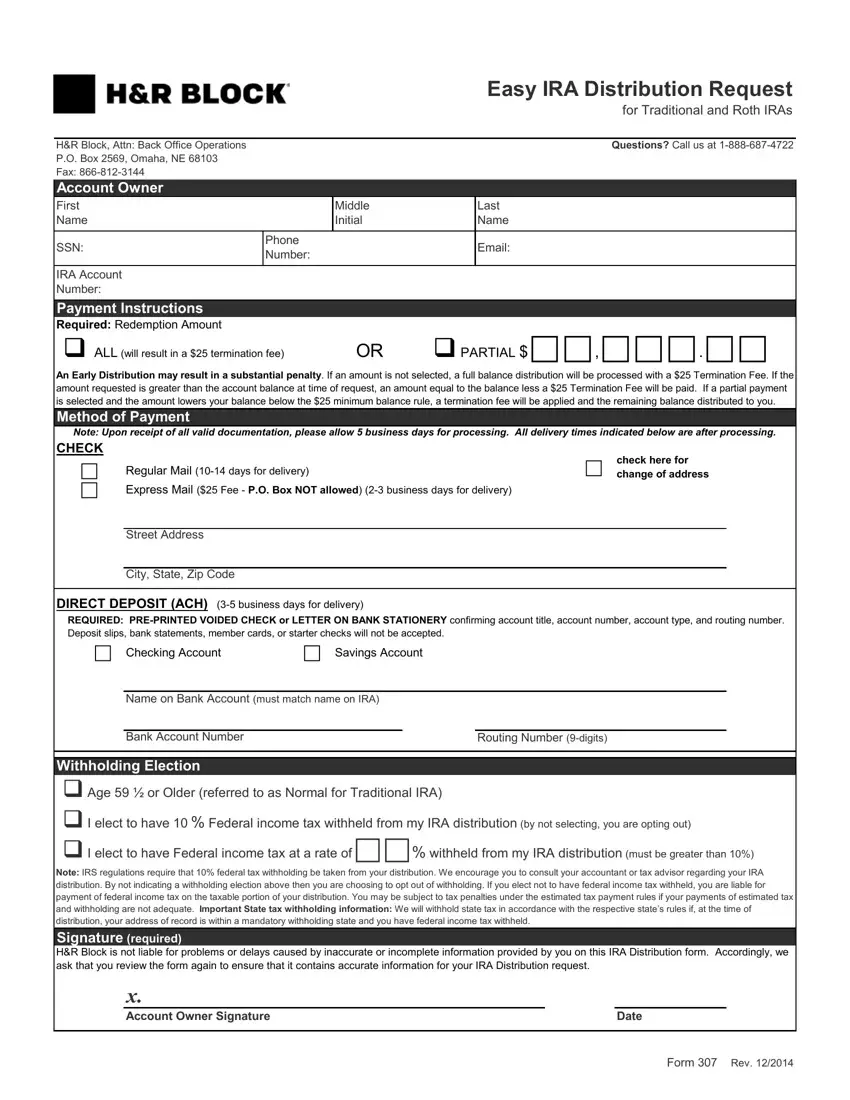

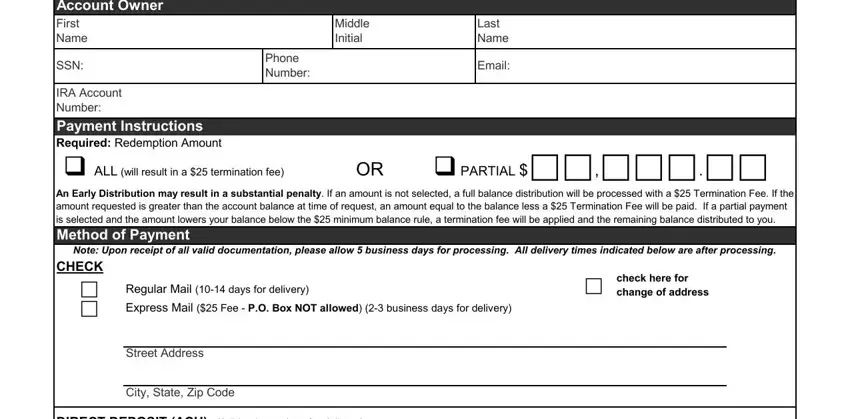

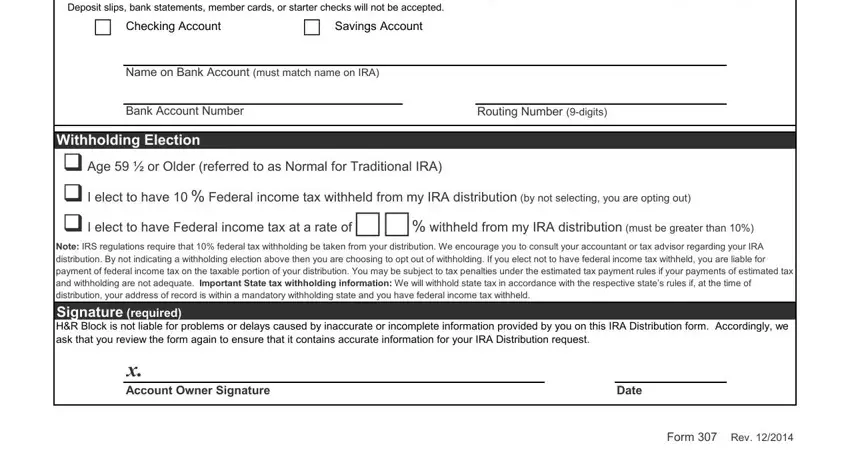

You will have to provide the following information if you need to fill in the file:

Within the field REQUIRED PREPRINTED VOIDED CHECK, Checking Account, Savings Account, Name on Bank Account must match, Bank Account Number, Routing Number digits, Withholding Election Age or, Note IRS regulations require that, x Account Owner Signature, Date, and Form Rev enter the information which the application requires you to do.

Step 3: In case you are done, click the "Done" button to upload your PDF form.

Step 4: Make a minimum of several copies of the form to keep clear of any kind of possible challenges.