The PDF editor was created with the objective of making it as effortless and intuitive as possible. These steps can make filling in the federal forms tax quick and simple.

Step 1: Click on the "Get Form Here" button.

Step 2: At the moment, you are able to edit your federal forms tax. The multifunctional toolbar enables you to include, eliminate, change, highlight, and also perform many other commands to the words and phrases and fields inside the document.

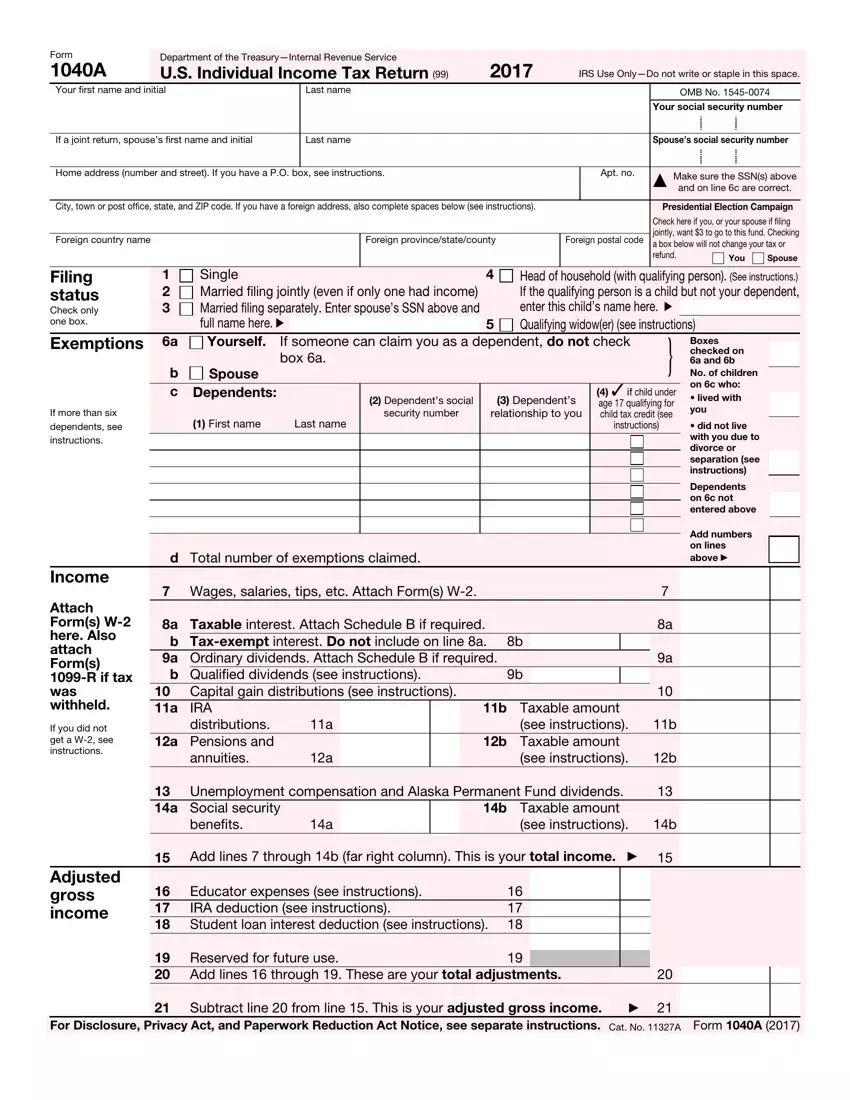

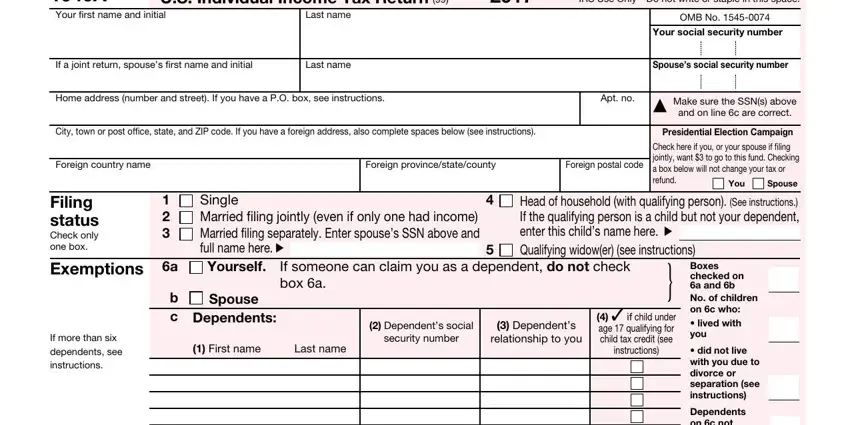

For every single segment, add the details demanded by the program.

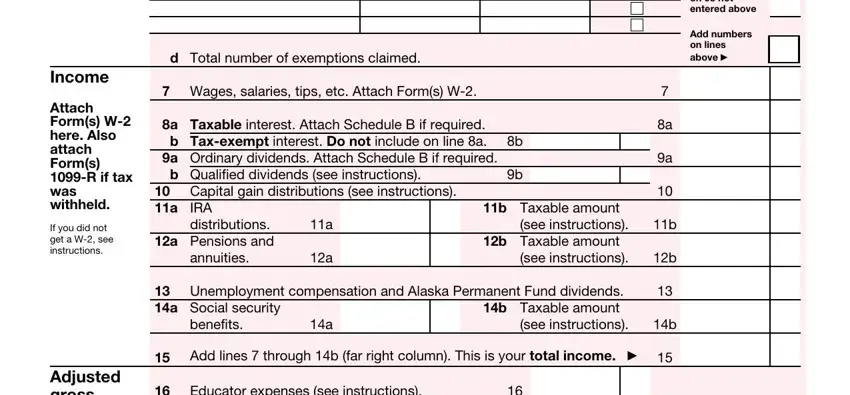

Fill in the Dependents on c not entered above, Add numbers on lines above, Income, Attach Forms W here Also attach, If you did not get a W see, d Total number of exemptions, Wages salaries tips etc Attach, a Taxable interest Attach Schedule, b Qualified dividends see, Capital gain distributions see, IRA distributions, a Pensions and annuities, b Taxable amount see instructions, Unemployment compensation and, and Adjusted gross income areas with any information that will be demanded by the software.

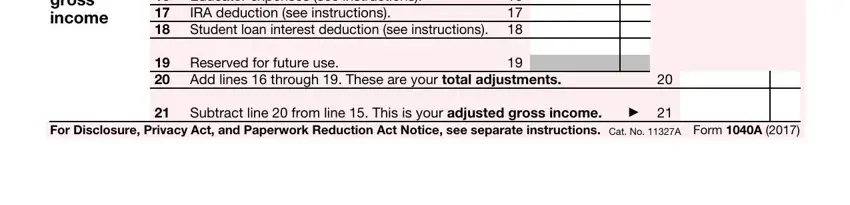

Indicate the necessary information in Adjusted gross income, Educator expenses see instructions, Reserved for future use Add lines, and Subtract line from line This is segment.

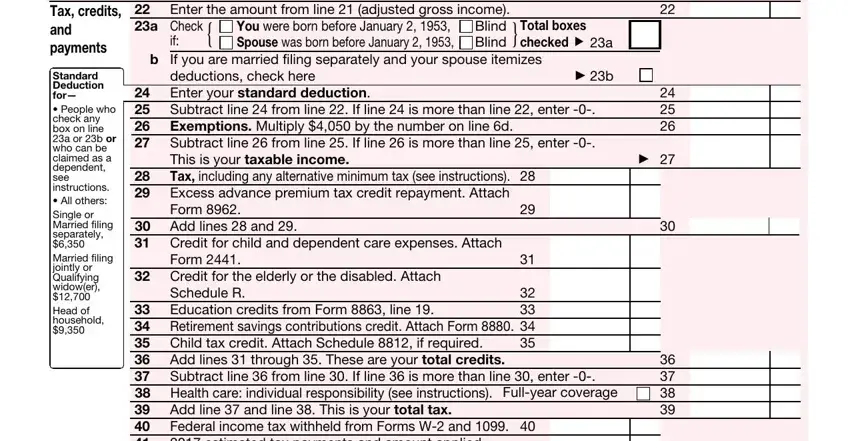

You should spell out the rights and responsibilities of each side in box Form A Tax credits a Check and, Enter the amount from line, Blind Total boxes, checked a, deductions check here b Enter, Subtract line from line If, This is your taxable income Tax, Excess advance premium tax, Form Add lines and, Credit for child and dependent, Form, Credit for the elderly or the, Schedule R Education credits from, Child tax credit Attach, and Add lines through These are your.

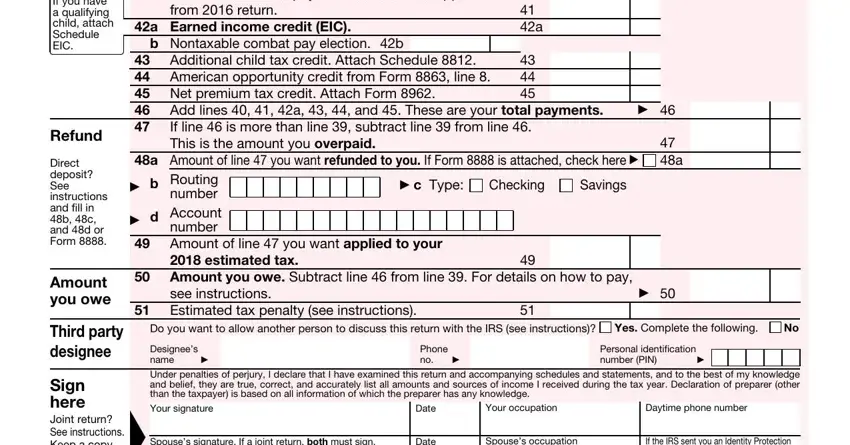

Finalize by reading the following areas and submitting the required particulars: Child tax credit Attach, Add lines through These are your, a Earned income credit EIC, b Nontaxable combat pay election b, Additional child tax credit Attach, Net premium tax credit Attach, Add lines a and These are, a Amount of line you want, c Type, Checking, Savings, Amount of line you want applied, estimated tax, Amount you owe Subtract line, and see instructions Estimated tax.

Step 3: Click the "Done" button. So now, it is possible to export your PDF document - upload it to your device or send it by using email.

Step 4: Prepare a duplicate of every form. It will certainly save you some time and permit you to keep clear of misunderstandings in the long run. By the way, your data won't be revealed or monitored by us.