We used the top-rated website developers to set-up our PDF editor. Our app will assist you to fill out the how do i report someone to the irs file with no trouble and won't take up a great deal of your energy. This easy-to-follow guide can help you get started.

Step 1: Click the orange button "Get Form Here" on the web page.

Step 2: So you are on the file editing page. You may edit and add information to the document, highlight specified content, cross or check particular words, add images, insert a signature on it, delete unwanted areas, or take them out completely.

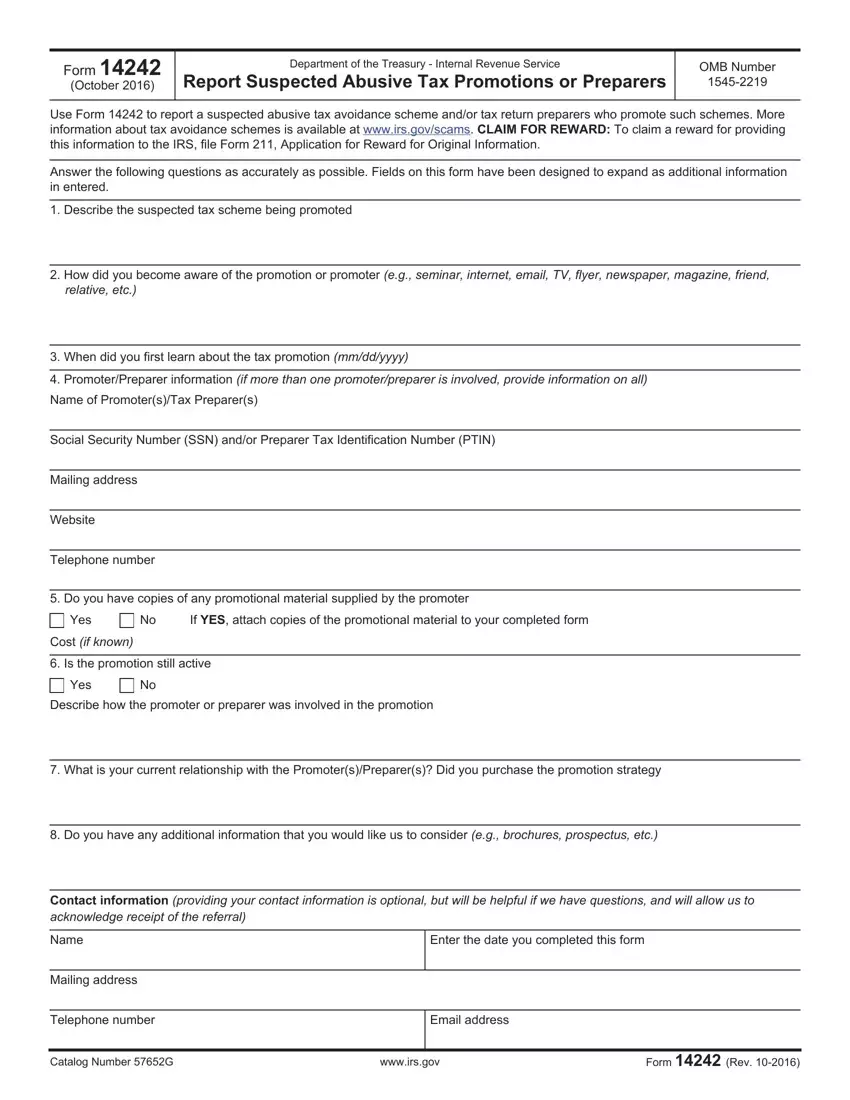

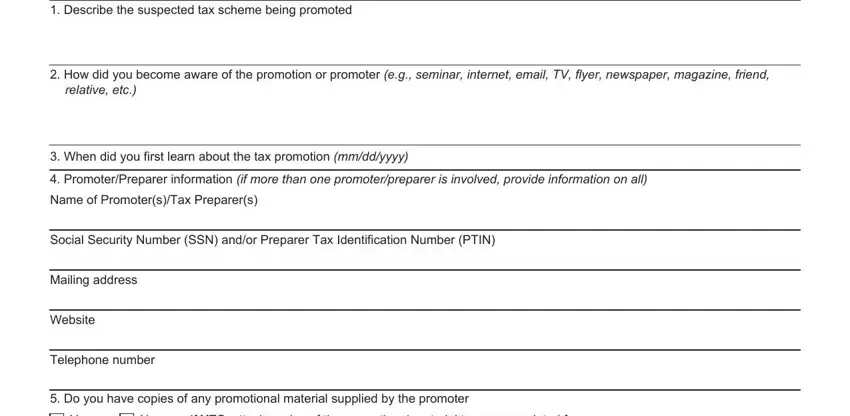

Prepare the following areas to create the form:

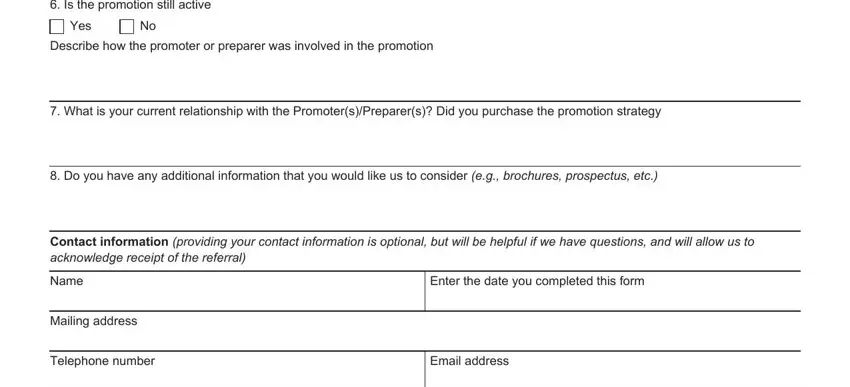

In the Is the promotion still active, Yes, Describe how the promoter or, What is your current relationship, Do you have any additional, Contact information providing your, Name, Mailing address, Enter the date you completed this, Telephone number, and Email address area, type in your information.

It is crucial to provide some data within the field Catalog Number G, wwwirsgov, and Form Rev.

Step 3: Click the button "Done". The PDF document can be exported. You may download it to your computer or send it by email.

Step 4: Make a duplicate of every single document. It can save you time and enable you to stay away from difficulties in the future. Also, the information you have isn't distributed or checked by us.