Closing Date Extension Addendum

Sometimes when there is an unforeseen circumstance or emergency, a closing date extension may be needed. Both the buyer and seller have to agree on a closing date extension for it to be accepted.

This guide will cover all of the parts needed to have a closing date extension addendum. It will also provide a template for creating the addendum to real estate purchase contract and ensuring that both parties have all of the information they need.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

What Is a Closing Date Extension Addendum?

A closing date extension addendum is when the parties both agree to extend the date at which the buyer may close on the property. A closing date may be needed for several reasons, but it is usually when there is an unforeseen circumstance that affects the buyer, seller, or both.

Typical issues are usually with the title, buyer’s financing, buyer’s need to sell their property, or another reason that is deemed acceptable by the seller. Sometimes, according to the printable purchase and sale agreement, the seller does not need to grant an extension for the above circumstances.

In this case, the buyer may want to request the earnest money be returned to them. Sometimes the buyer may be more or less motivated depending on the market conditions. If they have changed to benefit the seller, he or she will probably grant an extension to still obtain the agreed-upon sales price.

Why Use a Closing Date Extension?

A closing date may be necessary if you are experiencing issues with the financing or title. It can give you more time to gather all the information and money you need to buy the home. It might also be needed if you require extra time to process your mortgage application. Most purchase agreements will give a closing date extension of up to 14 days.

If you miss the closing date as the buyer, the real estate sales contract is in jeopardy and you need to request an extension. You might even consider requesting the extension as soon as you experience an issue so that fewer problems can occur.

Reasons Not to Extend the Closing Date

While a closing date extension may seem annoying or like the end of the world, sometimes it may be necessary to close the deal and get the money. In some cases, though, it may be best not to extend the closing date.

If you notice the other party suddenly changing or not willing to answer your questions when it comes to why they may want to extend the closing date, it might best to walk away. You don’t want to work with someone who isn’t upfront or honest.

If the buyer is unorganized or shady about their financing, tell them you won’t grant the extension. Some purchase agreements make you grant at least one extension, but don’t give them too much time or grant a second one if they seem unwilling to work with you properly.

Closing dates are also often negotiated with the real estate agent. If the agent recommends you not to extend the closing date for various reasons, you may want to heed their advice.

There are some reasons though the buyer must extend the date. Check to make sure they are being honest and still plan to make the sale.

What Are the Basic Components of the Addendum?

Each closing date extension addendum should consist of a few key components to ensure that the paperwork has all the necessary items.

Buyer’s name

The buyer’s name should be listed in full and written the exact same way that it’s stated in the original application and contract.

Seller’s name

Same as with the buyer’s name, the seller’s name should be included and written in full. Write it the same as in the original contract.

Execution date

Write down the date the closing extension addendum request date and the date it was agreed upon. Write down the day, month, and year.

Closing date

You will now indicate the period of extension up to the closing date past the original purchase’s agreement date. State the correct day, month, and year.

Signatures

The signatures on this document need to have all the same ones as on the original contract. It will not be considered valid if it doesn’t have the same signatures. The buyer and seller will both record their signatures, the current date, and print their names. The last signature will be by the agent.

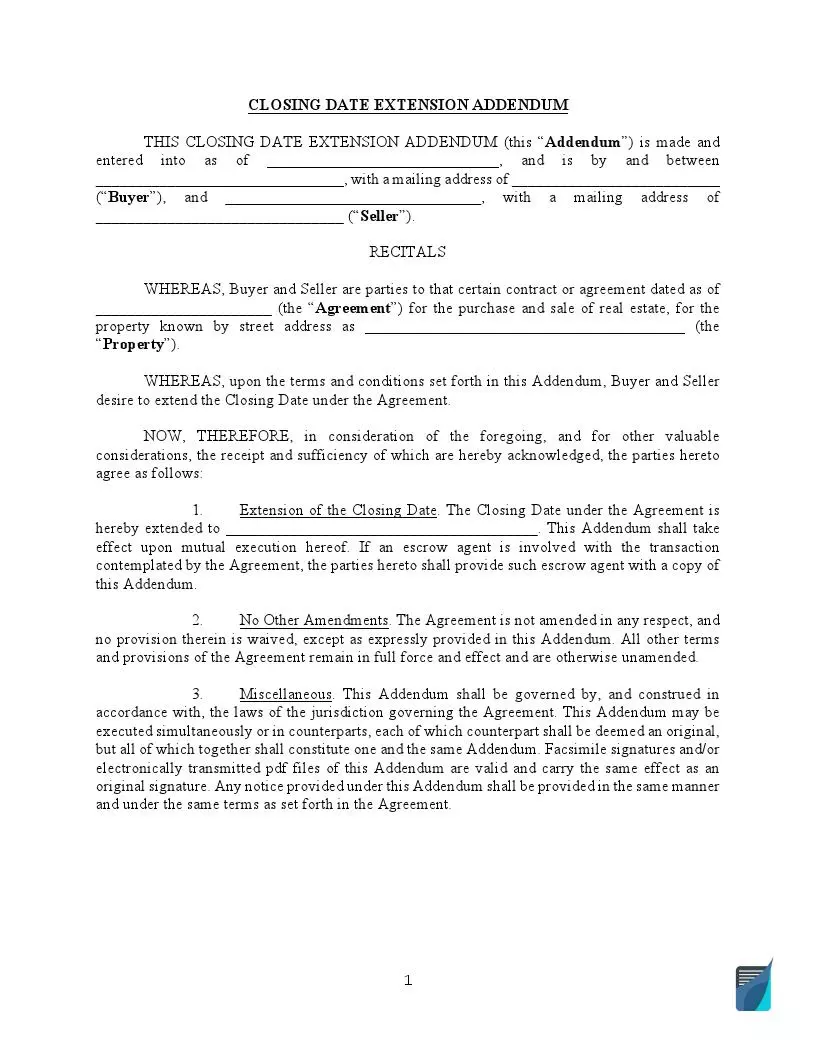

Filling Out the Closing Date Extension Addendum Template

The template is pretty straightforward and should only take a few moments to fill out. Make sure to read every part and fill out the information correctly to avoid errors.

Indicate the Buyer and Seller

In the first section, you will write the names and addresses of the buyer and the seller. Make sure they are the same as in the original contract.

Indicate property information

In the second section, you will write the original purchase agreement date and the address of the property that is being sold.

Indicate a new closing date

Write the new closing date that was agreed upon by the seller and the buyer

Signatures

At the bottom of the page, make sure to print and sign. The buyer and seller should both write their names and signatures the same way they are shown in the original contract.