There is nothing challenging related to filling out the Michigan Form F 6 once you open our tool. By taking these easy steps, you're going to get the prepared PDF file within the minimum time period feasible.

Step 1: Choose the button "Get form here" to access it.

Step 2: The document editing page is presently open. You can include information or modify present data.

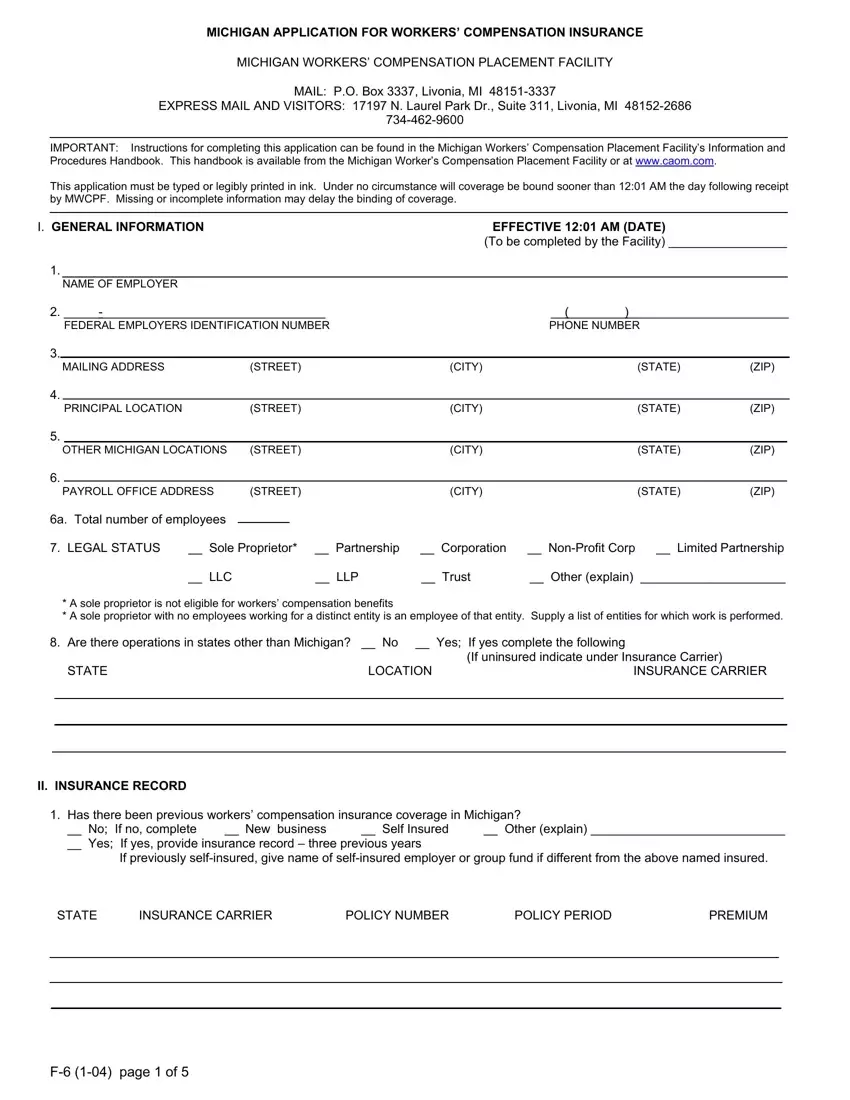

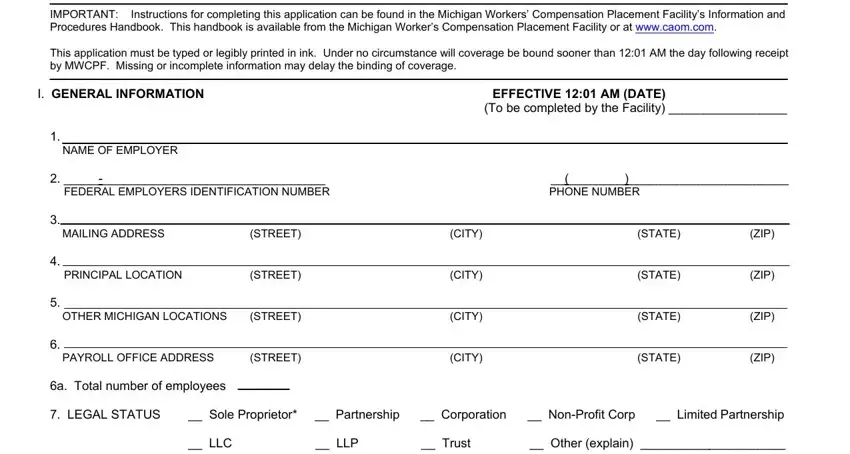

To prepare the Michigan Form F 6 PDF, provide the details for each of the segments:

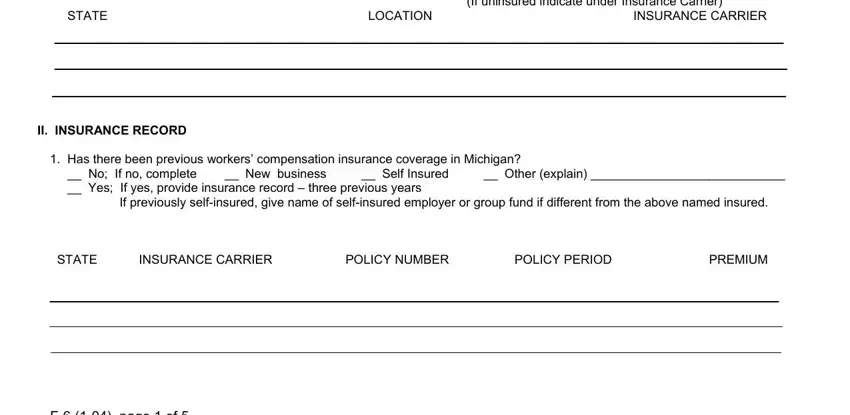

Put down the details in the Are there operations in states, II INSURANCE RECORD, Has there been previous workers, STATE INSURANCE CARRIER POLICY, and F page of area.

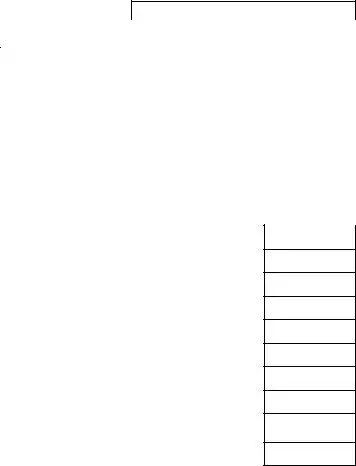

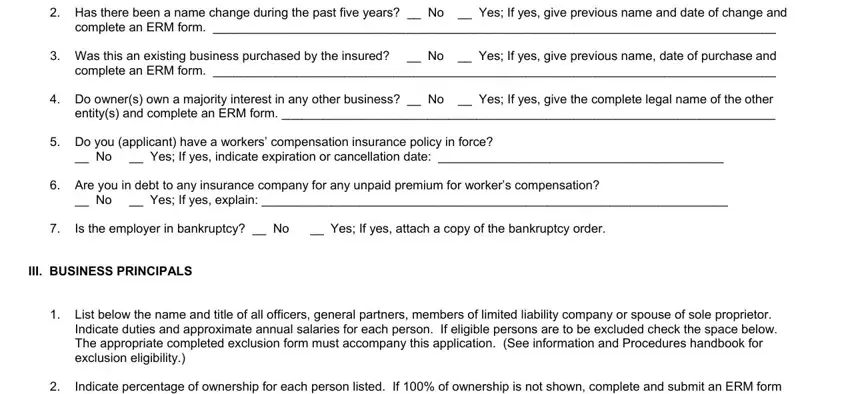

Note any data you need in the space Has there been a name change, complete an ERM form, Was this an existing business, Do owners own a majority interest, Do you applicant have a workers, No Yes If yes indicate, Are you in debt to any insurance, No Yes If yes explain, Is the employer in bankruptcy No, III BUSINESS PRINCIPALS, List below the name and title of, and Indicate percentage of ownership.

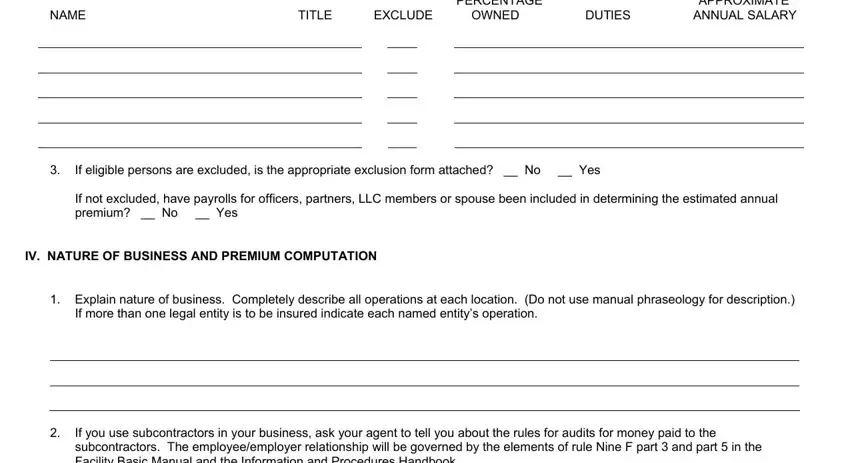

The area PERCENTAGE APPROXIMATE NAME TITLE, If eligible persons are excluded, If not excluded have payrolls for, IV NATURE OF BUSINESS AND PREMIUM, Explain nature of business, If more than one legal entity is, and If you use subcontractors in your should be where to include each side's rights and responsibilities.

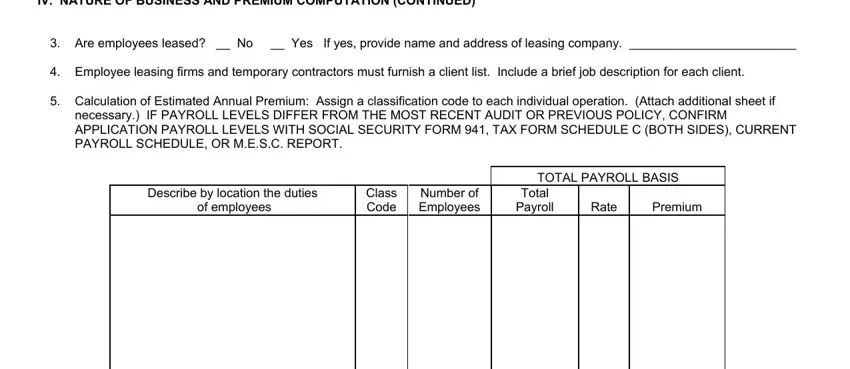

Review the fields IV NATURE OF BUSINESS AND PREMIUM, Are employees leased No Yes If, Employee leasing firms and, Calculation of Estimated Annual, necessary IF PAYROLL LEVELS DIFFER, Describe by location the duties of, Class Code, Number of Employees, Total Payroll, Rate, Premium, and TOTAL PAYROLL BASIS and then complete them.

Step 3: Click the "Done" button. Now you may upload the PDF file to your electronic device. Besides, you can easily forward it via email.

Step 4: You can create copies of the file torefrain from any type of potential difficulties. Don't get worried, we do not reveal or monitor your details.