Filling out monthly cash flow plan is easy. Our team made our PDF tool to really make it simple to operate and assist you to fill out any PDF online. Listed below are steps that you need to go through:

Step 1: In order to start, hit the orange button "Get Form Now".

Step 2: You can now update the monthly cash flow plan. Our multifunctional toolbar can help you include, eliminate, change, and highlight content material or perhaps undertake many other commands.

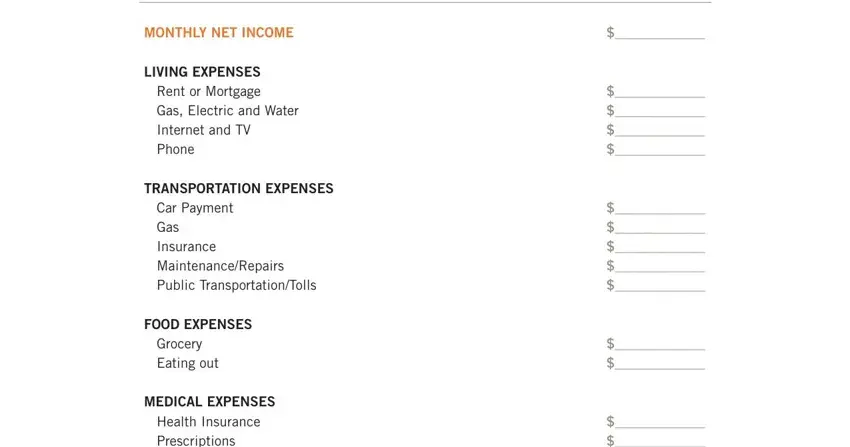

These particular segments will make up the PDF file that you will be filling out:

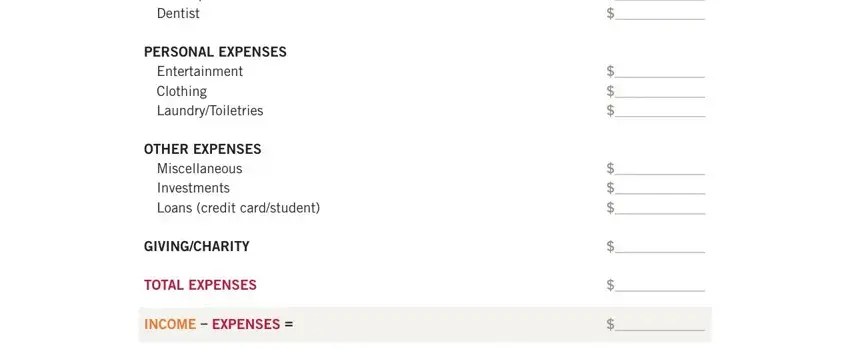

Please write down the essential information in the MEDICAL EXPENSES Health Insurance, PERSONAL EXPENSES Entertainment, OTHER EXPENSES Miscellaneous, GIVINGCHARITY, TOTAL EXPENSES, and INCOME EXPENSES space.

Step 3: As soon as you've hit the Done button, your form will be obtainable for transfer to each gadget or email you specify.

Step 4: It could be simpler to save copies of your file. There is no doubt that we won't distribute or view your details.