By using the online editor for PDFs by FormsPal, you can easily complete or modify request for mortgage assistance forms right here and now. FormsPal professional team is ceaselessly endeavoring to improve the tool and make it much easier for clients with its handy features. Enjoy an ever-improving experience now! Starting is simple! Everything you need to do is stick to the following easy steps directly below:

Step 1: Simply click on the "Get Form Button" above on this site to launch our form editing tool. There you will find everything that is necessary to work with your file.

Step 2: Once you start the file editor, you'll notice the form ready to be filled out. Other than filling out various blanks, you might also do other actions with the file, such as adding custom text, changing the original textual content, adding illustrations or photos, placing your signature to the form, and more.

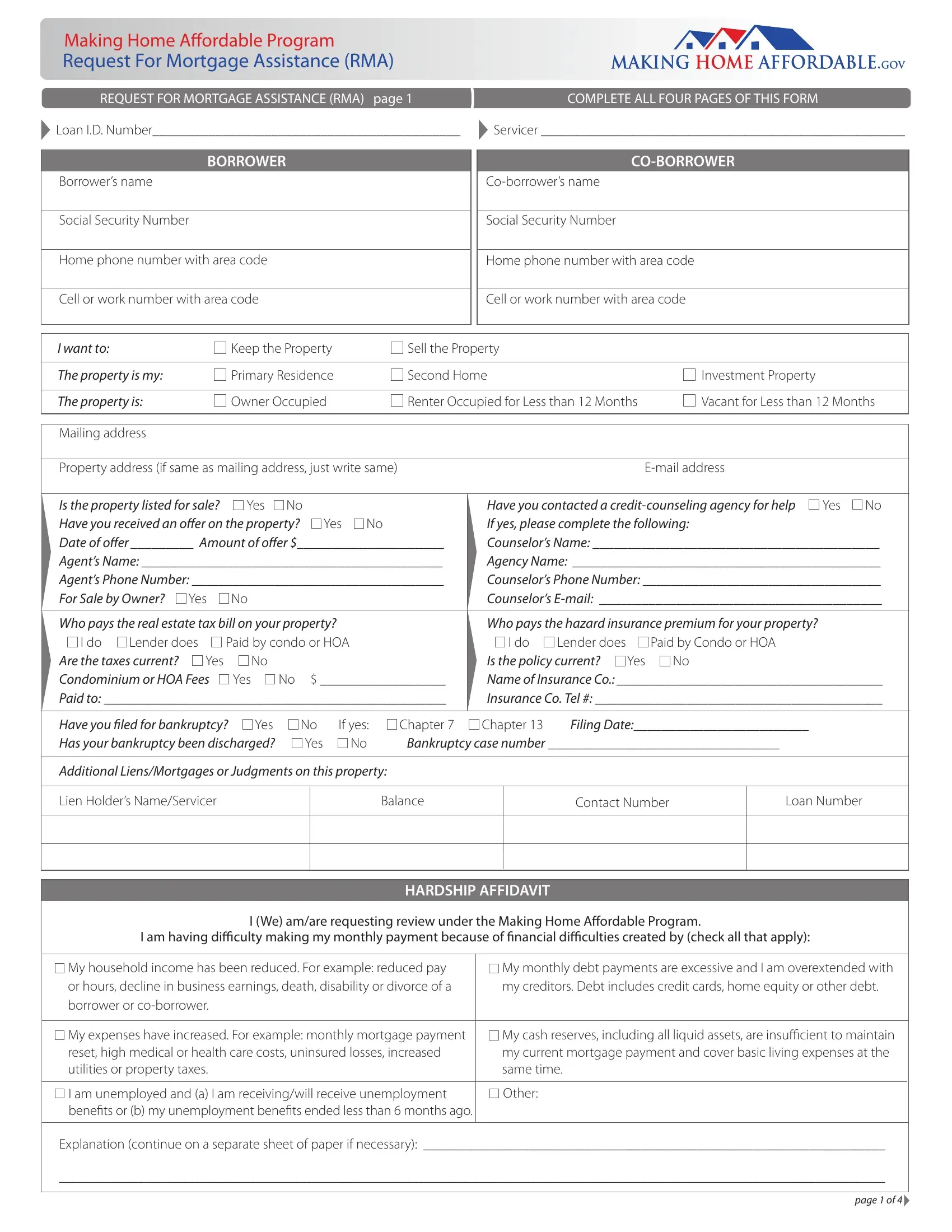

With regards to the blanks of this specific PDF, here's what you should know:

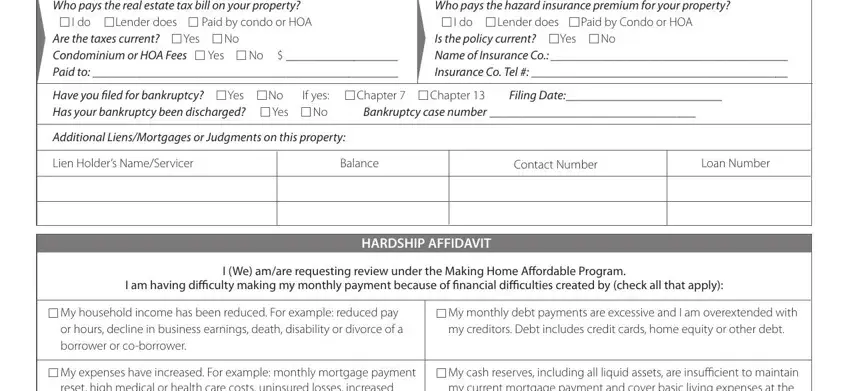

1. It's essential to complete the request for mortgage assistance forms correctly, thus be attentive when working with the areas including these blanks:

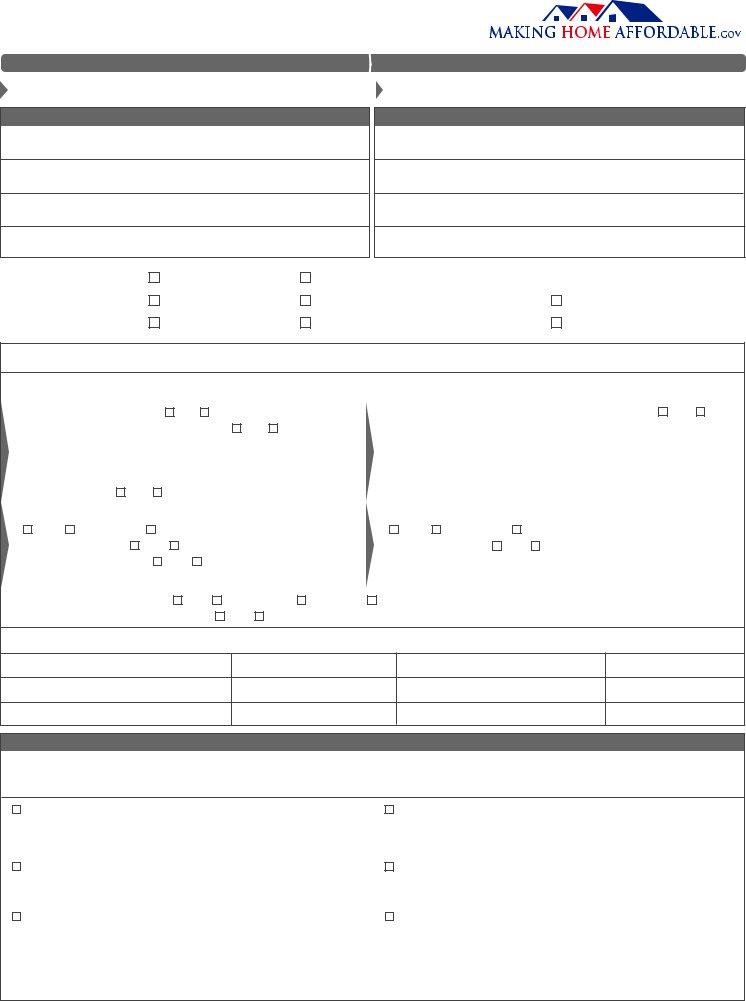

2. Your next stage is usually to complete all of the following blanks: Who pays the real estate tax bill, Who pays the hazard insurance, Have you iled for bankruptcy Yes, Additional LiensMortgages or, Lien Holders NameServicer, Balance, Contact Number, Loan Number, HARDSHIP AFFIDAVIT, I am having diiculty making my, I We amare requesting review under, My household income has been, My monthly debt payments are, My expenses have increased For, and My cash reserves including all.

Always be very mindful when filling in Who pays the hazard insurance and I am having diiculty making my, since this is the part where many people make some mistakes.

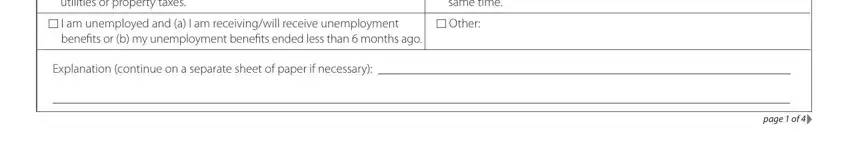

3. This subsequent step is considered relatively straightforward, My expenses have increased For, My cash reserves including all, I am unemployed and a I am, Other, Explanation continue on a separate, and page of - each one of these blanks has to be filled in here.

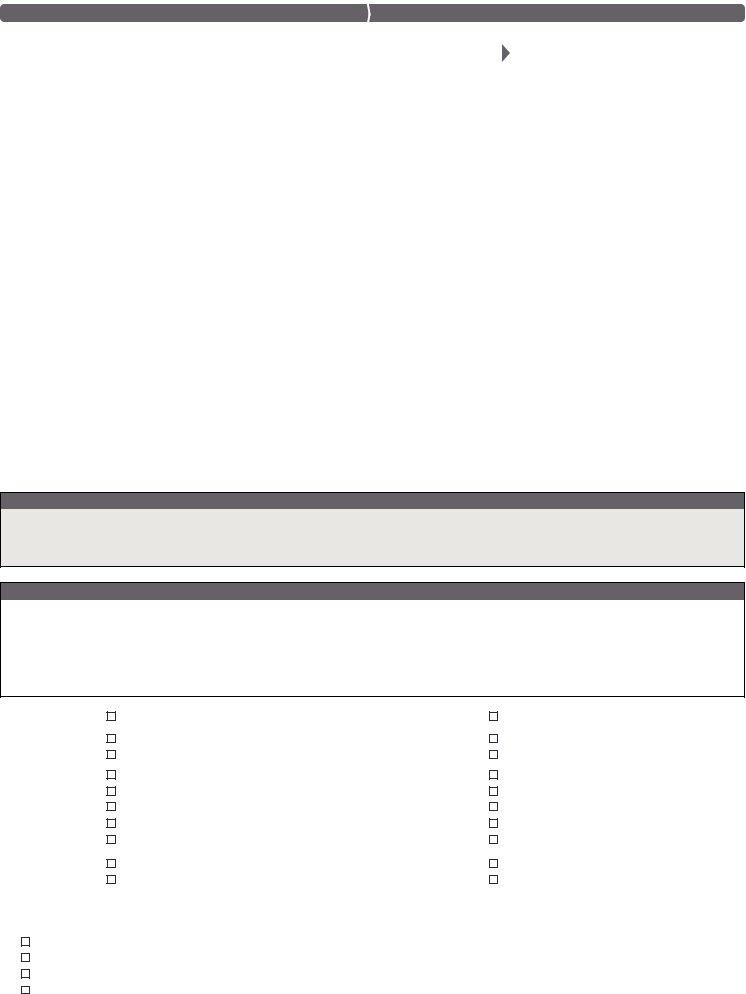

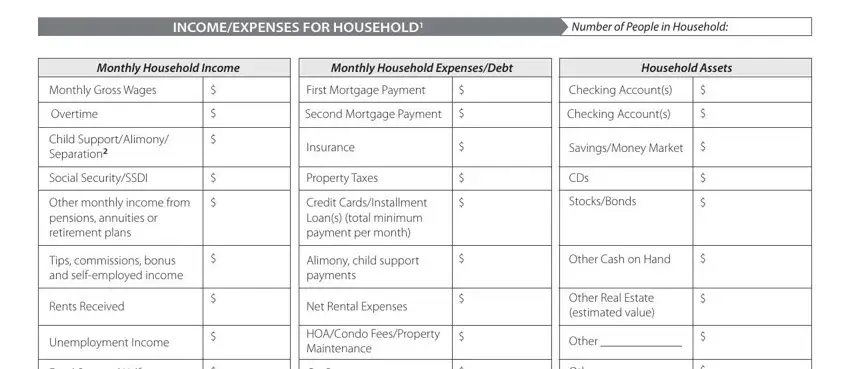

4. This next section requires some additional information. Ensure you complete all the necessary fields - INCOMEEXPENSES FOR HOUSEHOLD, Number of People in Household, Monthly Household Income, Monthly Household ExpensesDebt, Household Assets, Monthly Gross Wages, Overtime, Child SupportAlimony Separation, Social SecuritySSDI, Other monthly income from pensions, Tips commissions bonus and, Rents Received, Unemployment Income, Food StampsWelfare, and First Mortgage Payment - to proceed further in your process!

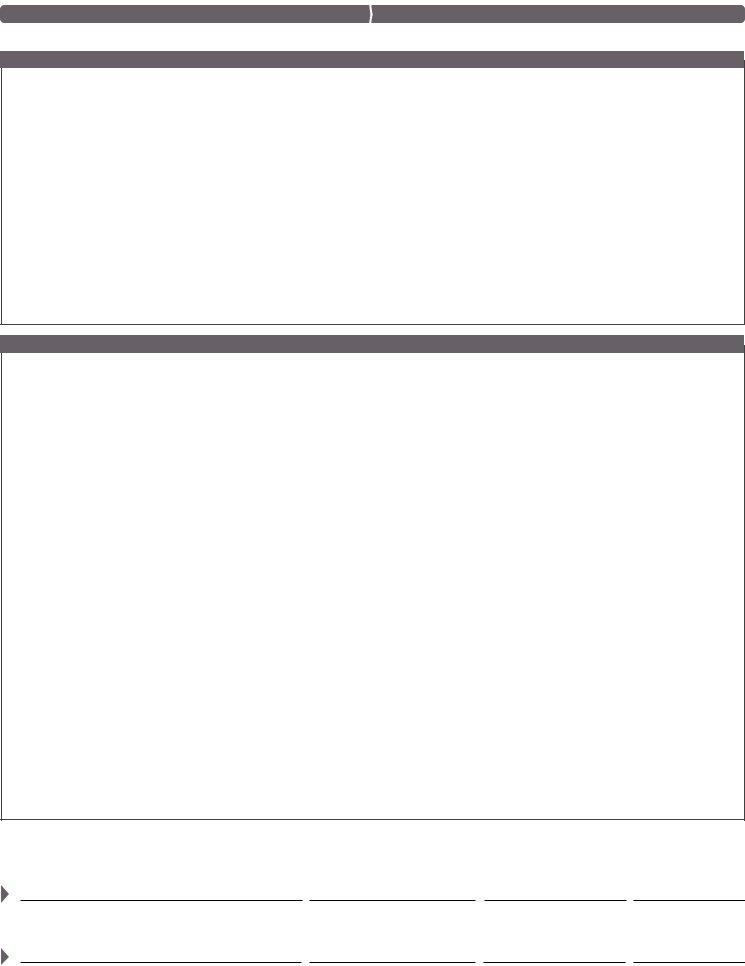

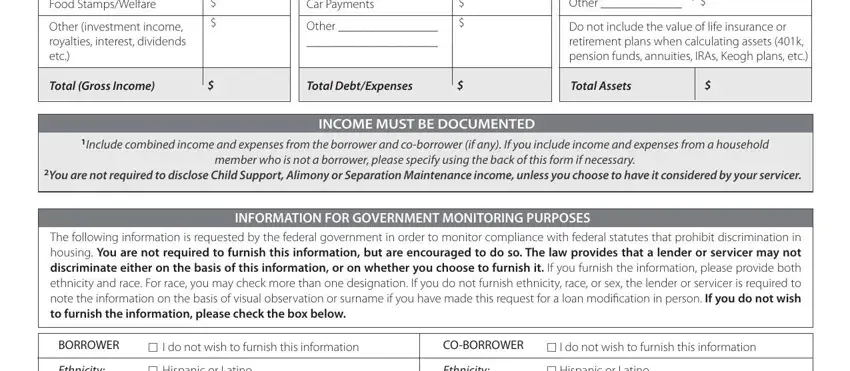

5. Because you come close to the completion of your file, you'll notice just a few more things to undertake. Particularly, Food StampsWelfare, Other investment income royalties, Car Payments, Other, Other, Do not include the value of life, Total Gross Income, Total DebtExpenses, Total Assets, Include combined income and, member who is not a borrower, You are not required to disclose, INCOME MUST BE DOCUMENTED, INFORMATION FOR GOVERNMENT, and The following information is must all be filled in.

Step 3: When you have looked over the information in the file's blank fields, click "Done" to conclude your document generation. Create a 7-day free trial account with us and gain instant access to request for mortgage assistance forms - download or modify inside your personal cabinet. When you work with FormsPal, you can fill out forms without the need to get worried about personal information leaks or data entries being shared. Our protected system ensures that your private details are stored safely.