The notion powering our PDF editor was to ensure it is as user-friendly as possible. You will find the entire process of filling in nj1040nr instructions trouble-free once you keep to these particular steps.

Step 1: Select the button "Get Form Here" on the website and next, click it.

Step 2: Once you've entered your nj1040nr instructions edit page, you'll discover all options you can take regarding your file at the top menu.

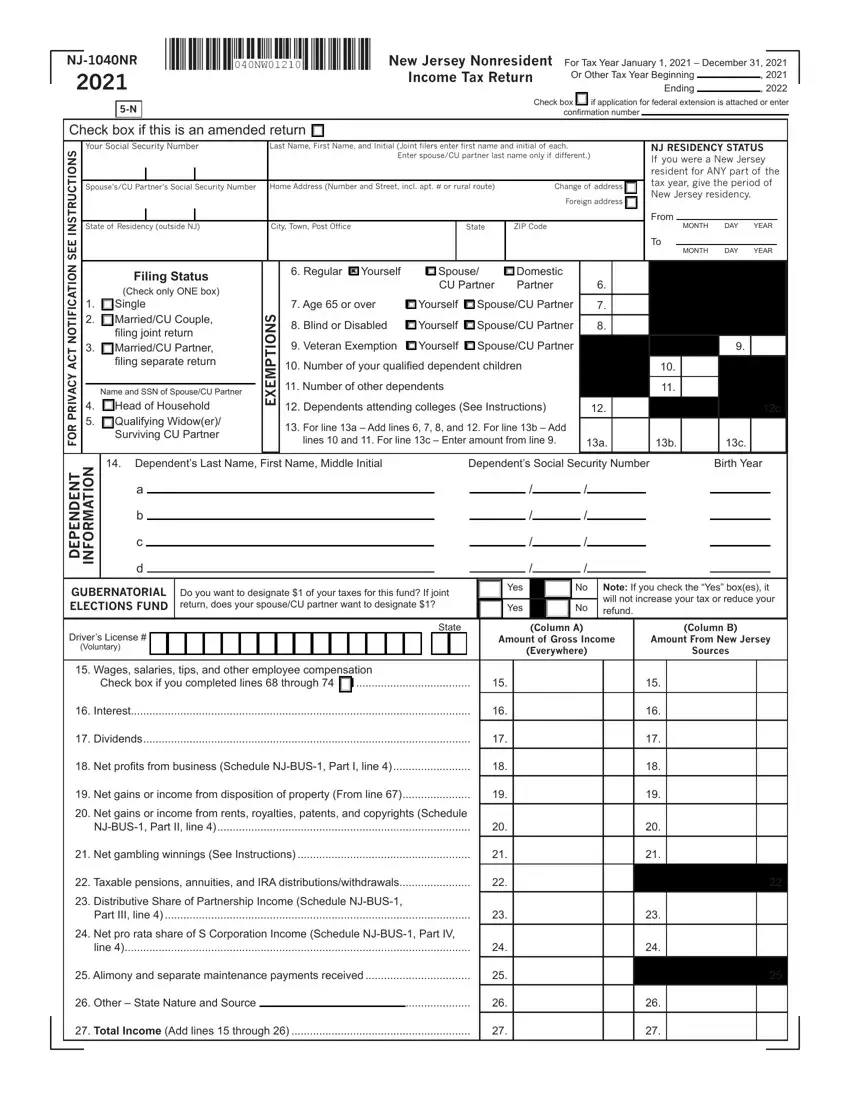

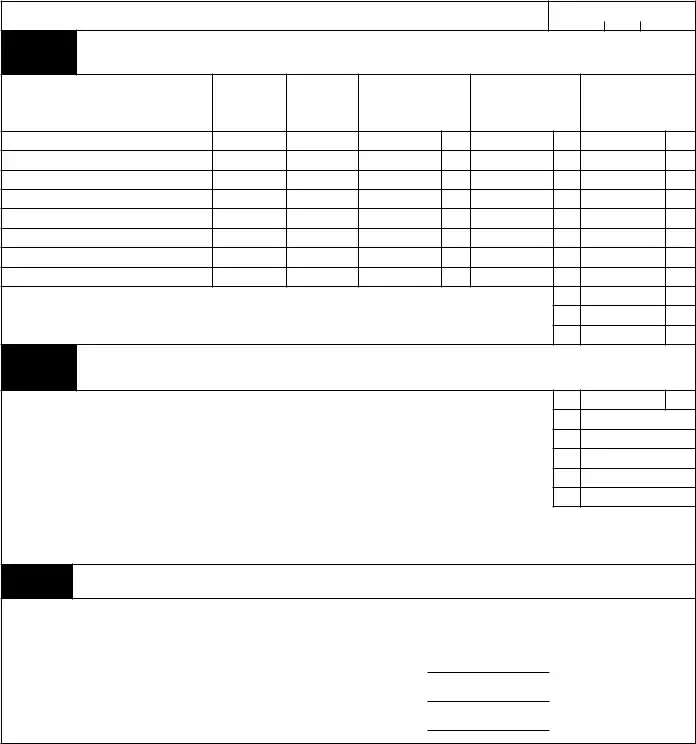

Type in the content requested by the application to get the form.

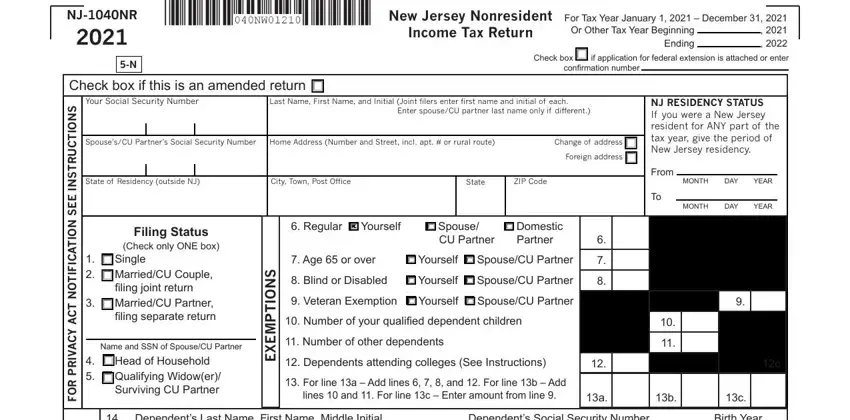

Include the expected data in the T N E D N E P E D, N O I T A M R O F N, Dependents Last Name First Name, Dependents Social Security Number, Birth Year, GUBERNATORIAL ELECTIONS FUND, Do you want to designate of your, Yes, Yes, Note If you check the Yes boxes it, Drivers License, Voluntary, State, Column A Amount of Gross Income, and Column B Amount From New Jersey segment.

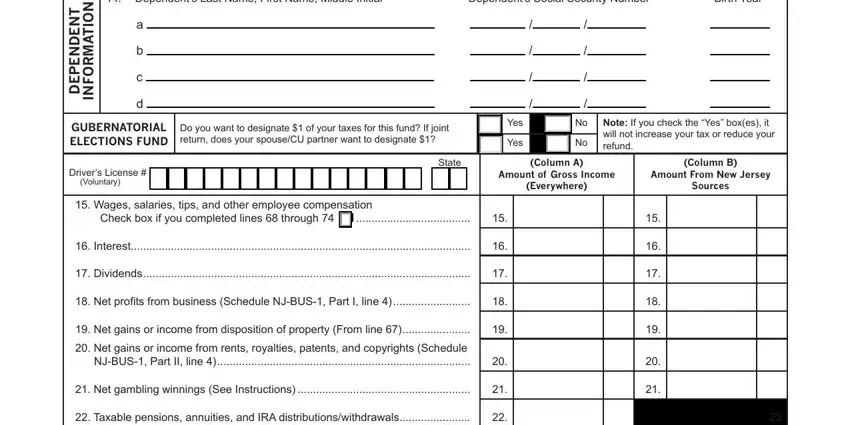

Note the crucial particulars in Distributive Share of Partnership, Part III line, Net pro rata share of S, line, Alimony and separate maintenance, Other State Nature and Source, and Total Income Add lines through field.

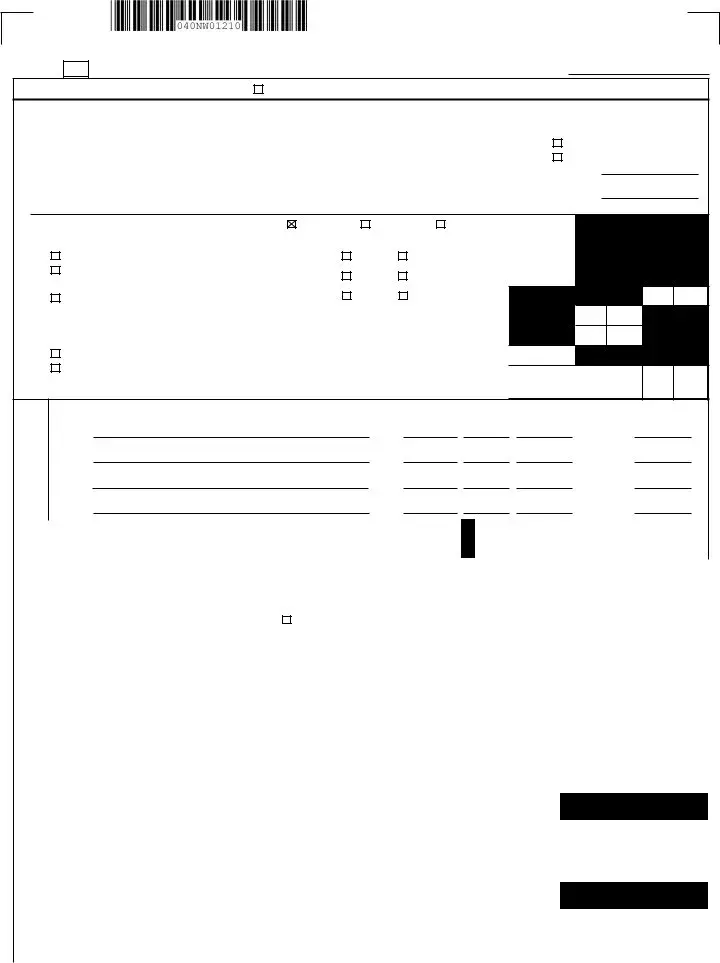

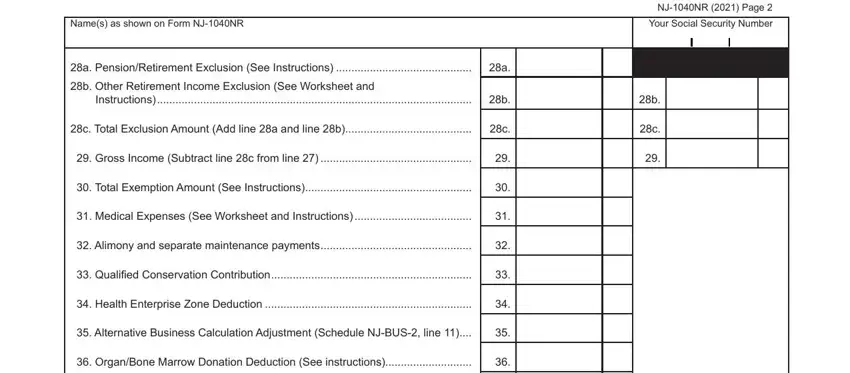

You will have to describe the rights and obligations of all parties in field Names as shown on Form NJNR, NJNR Page, Your Social Security Number, a PensionRetirement Exclusion See, b Other Retirement Income, Instructions, c Total Exclusion Amount Add line, Gross Income Subtract line c from, Total Exemption Amount See, Medical Expenses See Worksheet, Alimony and separate maintenance, Qualified Conservation, Health Enterprise Zone Deduction, Alternative Business Calculation, and OrganBone Marrow Donation.

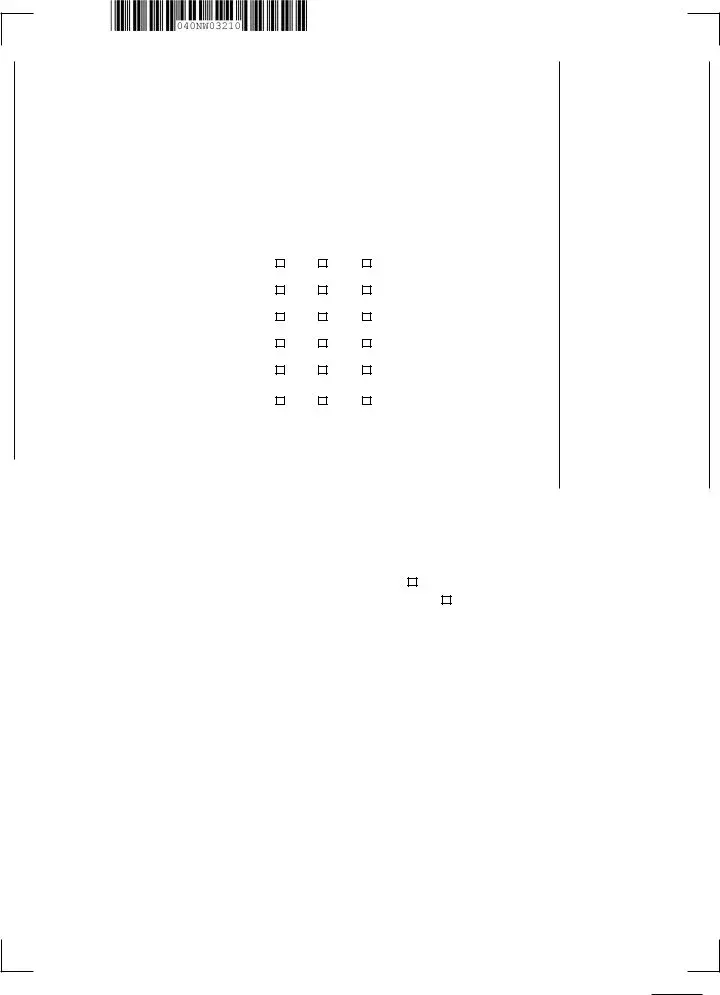

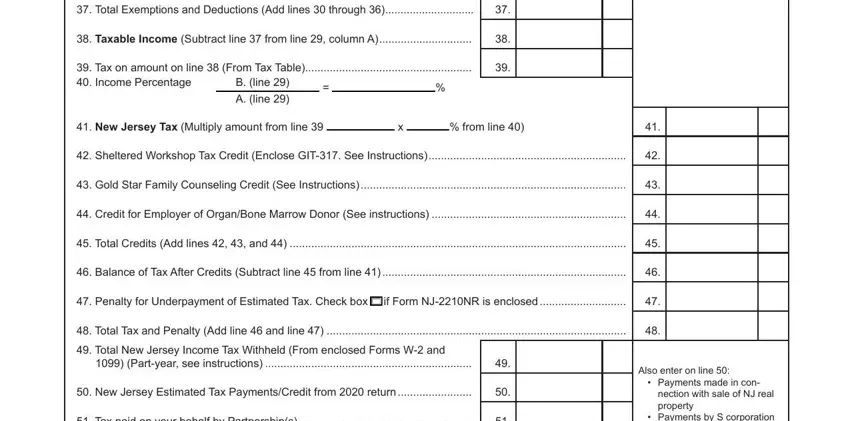

Finish by taking a look at the next sections and filling them in as needed: Total Exemptions and Deductions, Taxable Income Subtract line, Tax on amount on line From Tax, B line A line, New Jersey Tax Multiply amount, from line, Sheltered Workshop Tax Credit, Gold Star Family Counseling, Credit for Employer of OrganBone, Total Credits Add lines and, Balance of Tax After Credits, Penalty for Underpayment of, if Form NJNR is enclosed, Total Tax and Penalty Add line, and Total New Jersey Income Tax.

Step 3: Once you have hit the Done button, your form is going to be available for export to any kind of device or email address you identify.

Step 4: Create copies of your template. This can prevent upcoming worries. We cannot watch or share the information you have, thus be sure it will be secure.