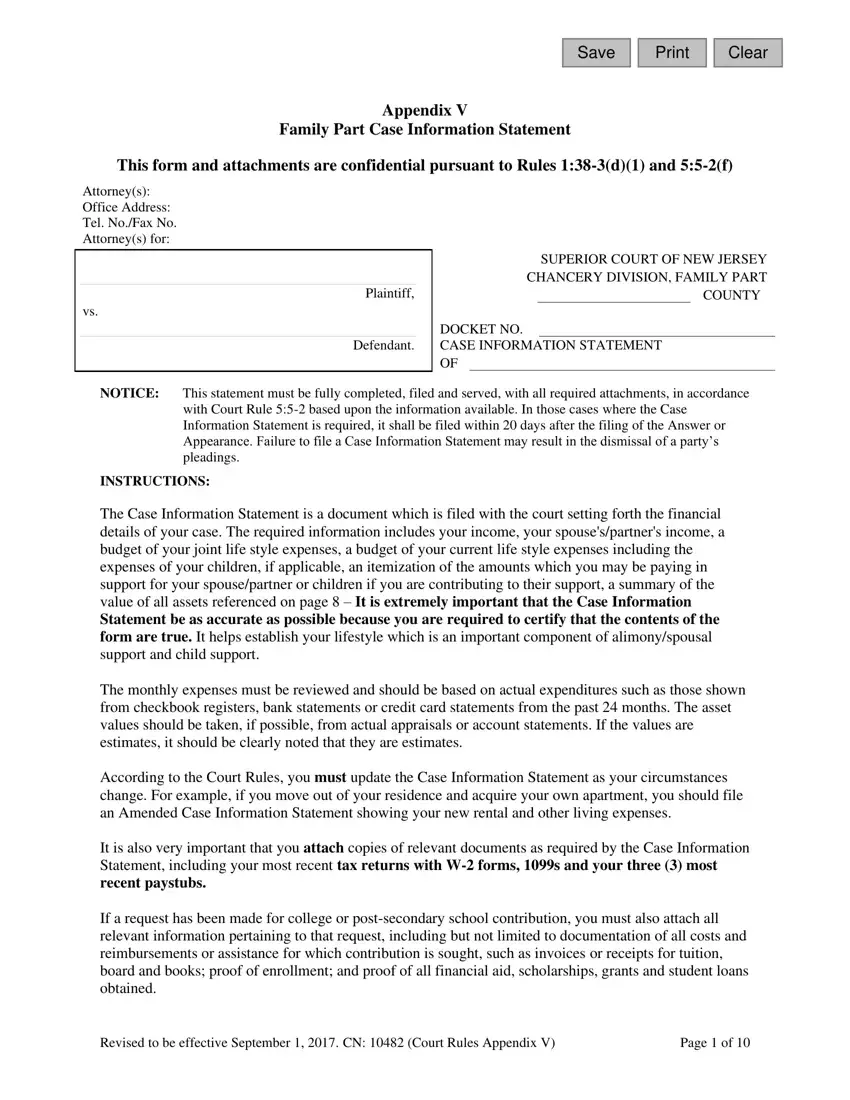

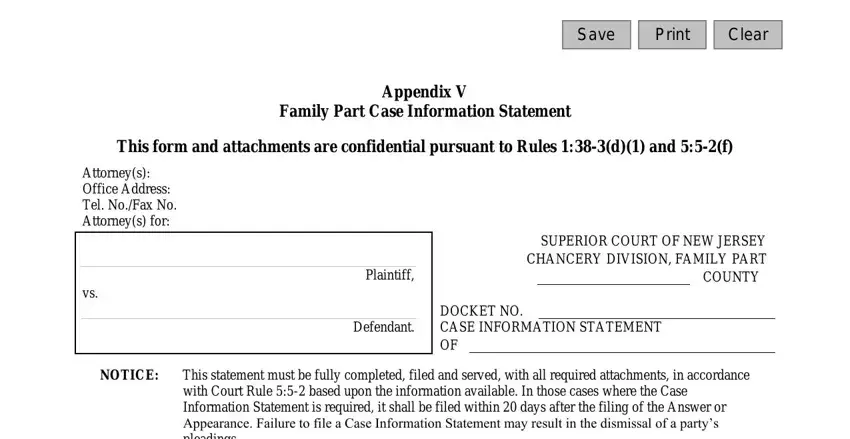

Our PDF editor was created to be as easy as possible. While you comply with the following steps, the procedure for filling in the nj case info document is going to be effortless.

Step 1: Choose the button "Get Form Here" on this site and press it.

Step 2: Now, you are on the document editing page. You can add content, edit existing data, highlight certain words or phrases, insert crosses or checks, add images, sign the file, erase unwanted fields, etc.

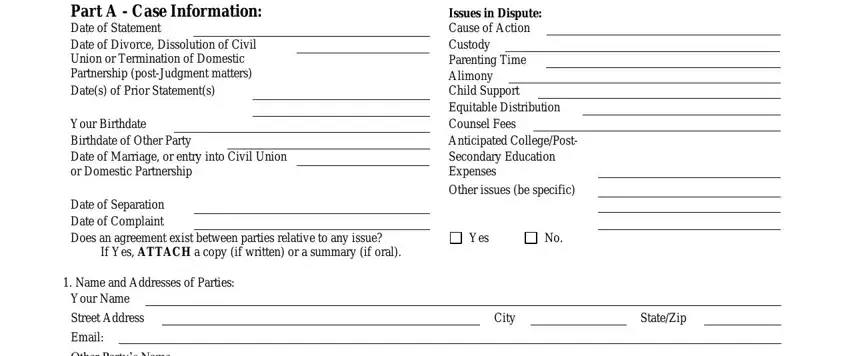

The PDF document you decide to fill out will cover the next parts:

Write the necessary information in the Other, issues, be, specific Yes, Name, and, Addresses, of, Parties Your, Name Street, Address Email, Other, Party, s, Name City, and State, Zip area.

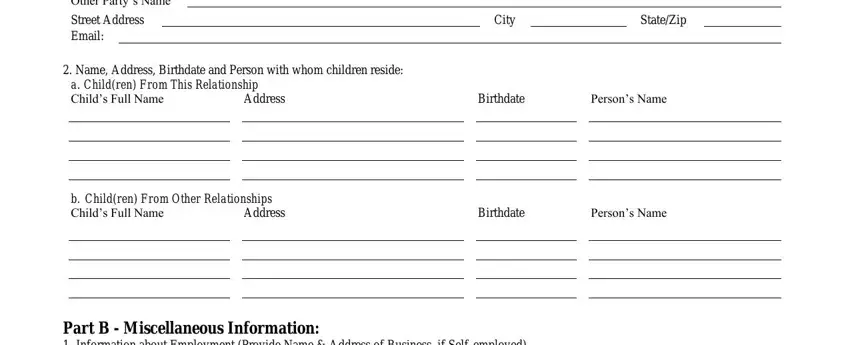

It is crucial to note particular details in the segment Other, Party, s, Name Street, Address, Email City, State, Zip Address, Address, Birthdate, Persons, Name Birthdate, and Persons, Name

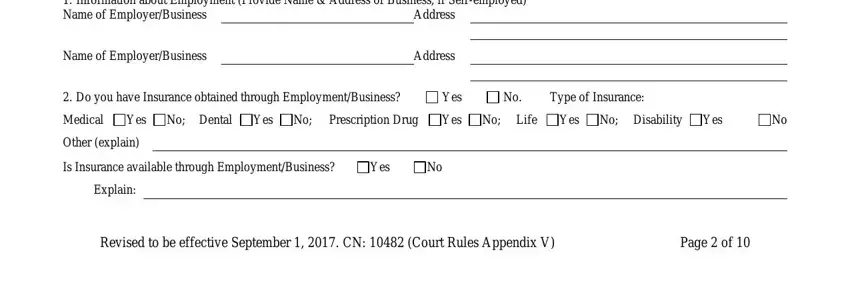

Please make sure to specify the rights and obligations of the parties inside the Address, Name, of, Employer, Business Address, Yes, Type, of, Insurance Yes, No, Life Yes, No, Disability, Yes Other, explain Yes, Explain, and Page, of paragraph.

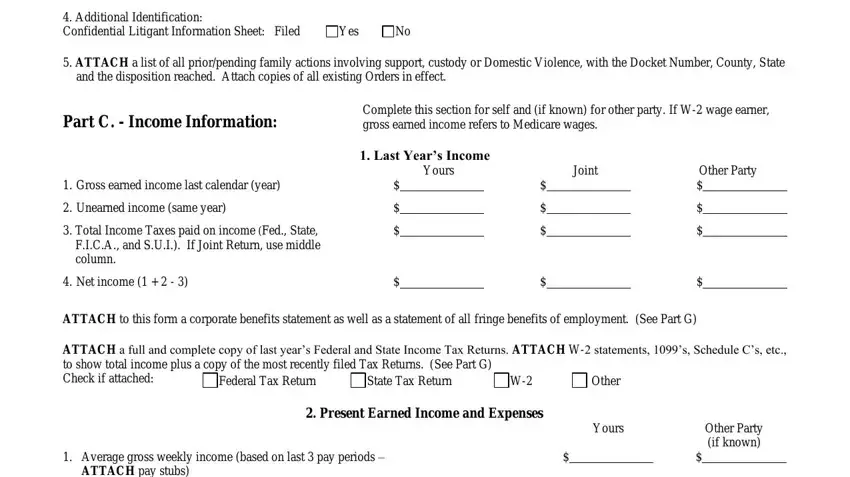

Fill in the document by taking a look at the next sections: Yes, Part, C, Income, Information Last, Years, Income Gross, earned, income, last, calendar, year Yours, Joint, Other, Party Unearned, income, same, year Net, income Federal, Tax, Return State, Tax, Return Other, Yours, Other, Party, if, known and Present, Earned, Income, and, Expenses

Step 3: Press the Done button to confirm that your completed file is available to be exported to any gadget you pick out or mailed to an email you indicate.

Step 4: Create duplicates of the file - it can help you avoid forthcoming problems. And don't get worried - we are not meant to publish or check your data.