It is very easy to fill in the nj reg registration form. Our PDF editor was made to be easy-to-use and let you fill in any document easily. These are the actions to follow:

Step 1: First, select the orange "Get form now" button.

Step 2: So you will be within the document edit page. It's possible to add, update, highlight, check, cross, add or erase fields or text.

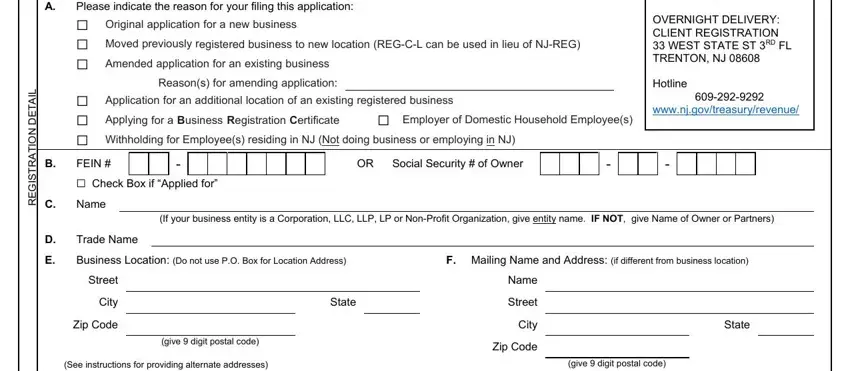

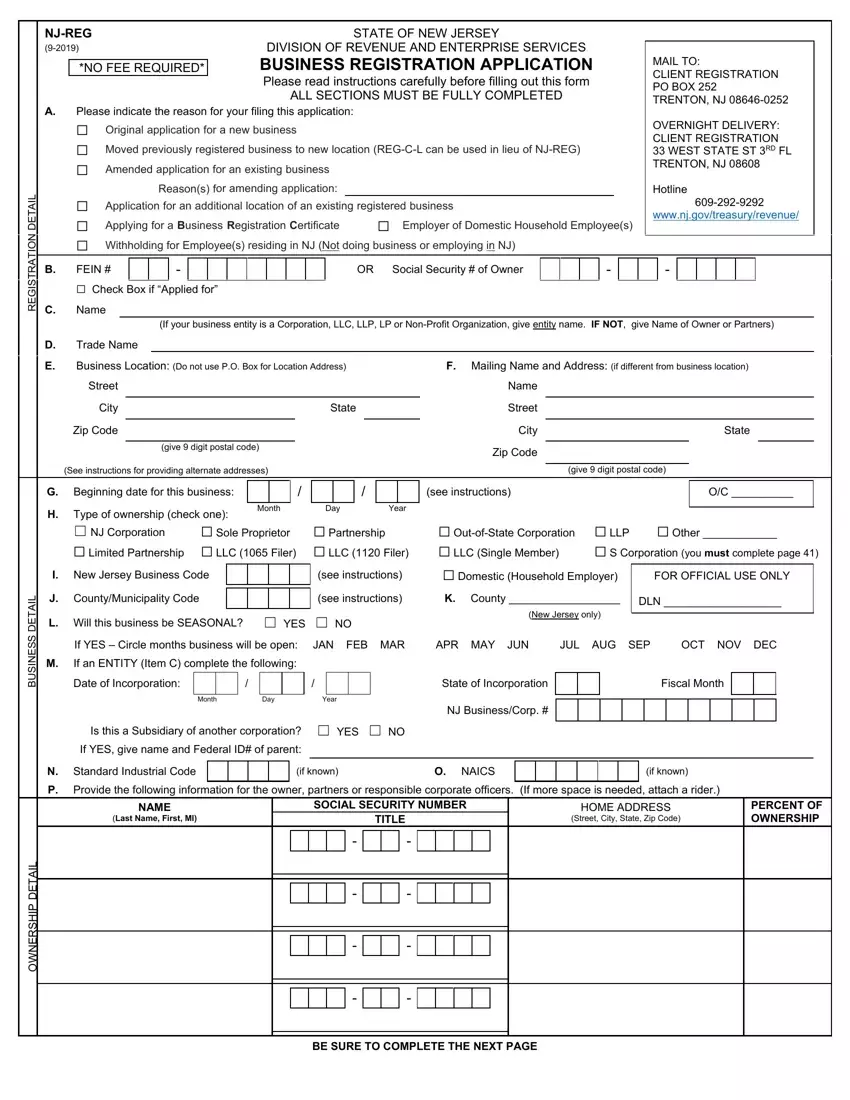

Complete the particular segments to prepare the template:

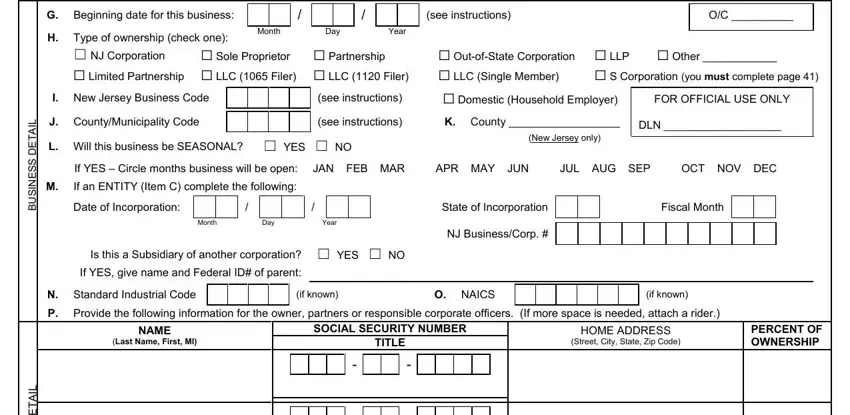

Type in the expected details in the space Beginning date for this business, see instructions, Type of ownership check one NJ, Sole Proprietor Partnership, Month, Day, Year, Limited Partnership LLC Filer, S Corporation you must complete, OutofState Corporation LLP LLC, Other, L A T E D S S E N S U B, L A T E D P H S R E N W O, I New Jersey Business Code, and see instructions.

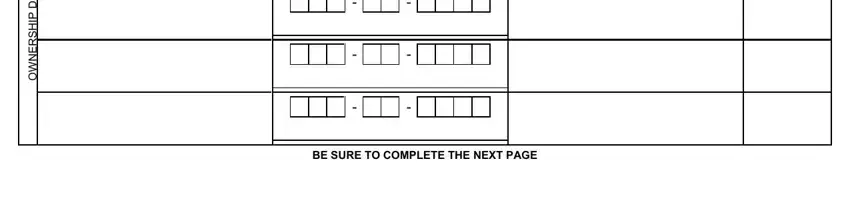

It's essential to write down certain data in the section L A T E D P H S R E N W O, and BE SURE TO COMPLETE THE NEXT PAGE.

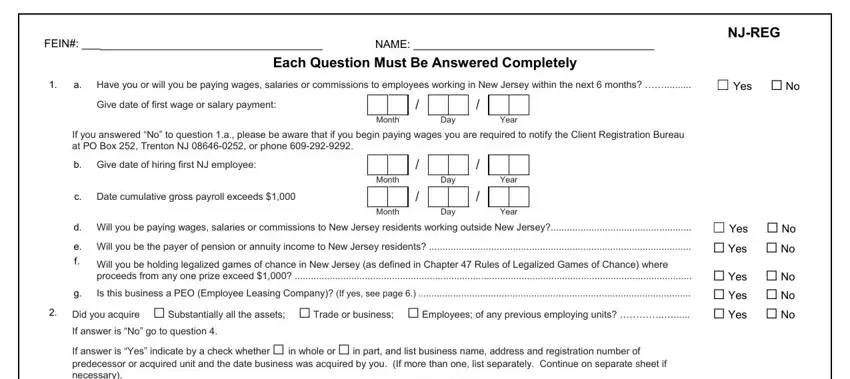

The FEIN, NAME, Each Question Must Be Answered, NJREG, a Have you or will you be paying, Give date of first wage or salary, Month, Day, Year, If you answered No to question a, b Give date of hiring first NJ, Date cumulative gross payroll, Month, Day, and Year field is the place where both parties can indicate their rights and obligations.

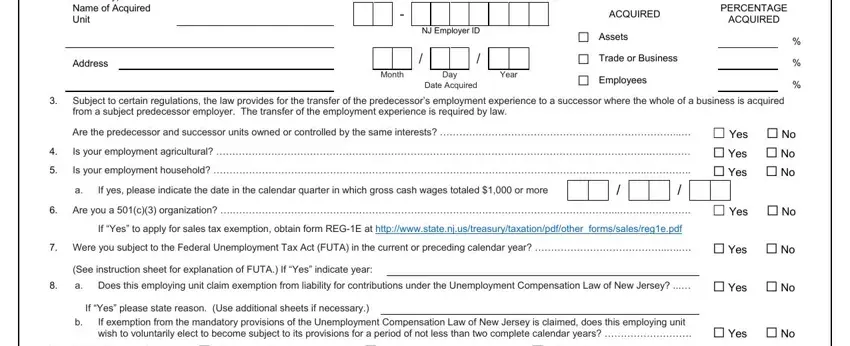

End by reading the following sections and completing them as needed: If answer is Yes indicate by a, ACQUIRED, Address, NJ Employer ID, Month, Day Date Acquired, Year, Assets, Trade or Business, Employees, PERCENTAGE ACQUIRED, Subject to certain regulations, from a subject predecessor, Are the predecessor and successor, and If yes please indicate the date in.

Step 3: As you choose the Done button, your ready document may be transferred to each of your devices or to email indicated by you.

Step 4: Produce a copy of every document. It will certainly save you time and permit you to remain away from concerns in the long run. By the way, the information you have isn't used or analyzed by us.

MAIL TO:

MAIL TO: