Filling out nj form st 50 is a breeze. Our team designed our PDF software to make it simple to operate and enable you to prepare any PDF online. Listed below are steps you will want to adhere to:

Step 1: The first thing should be to press the orange "Get Form Now" button.

Step 2: After you have accessed the nj form st 50 editing page you can find the whole set of options you'll be able to perform regarding your file in the upper menu.

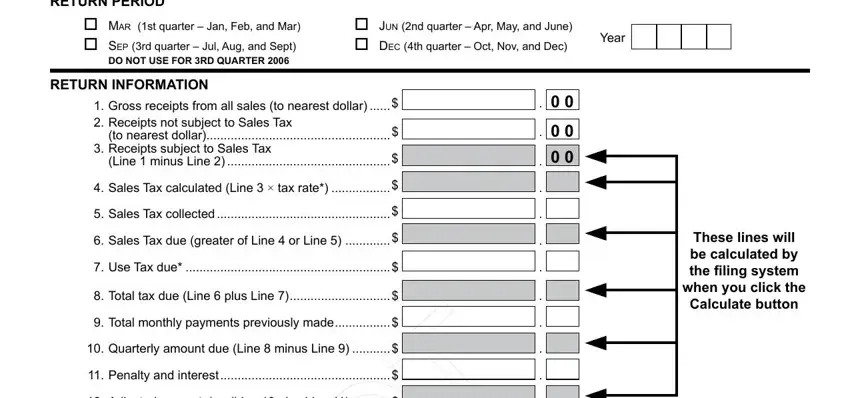

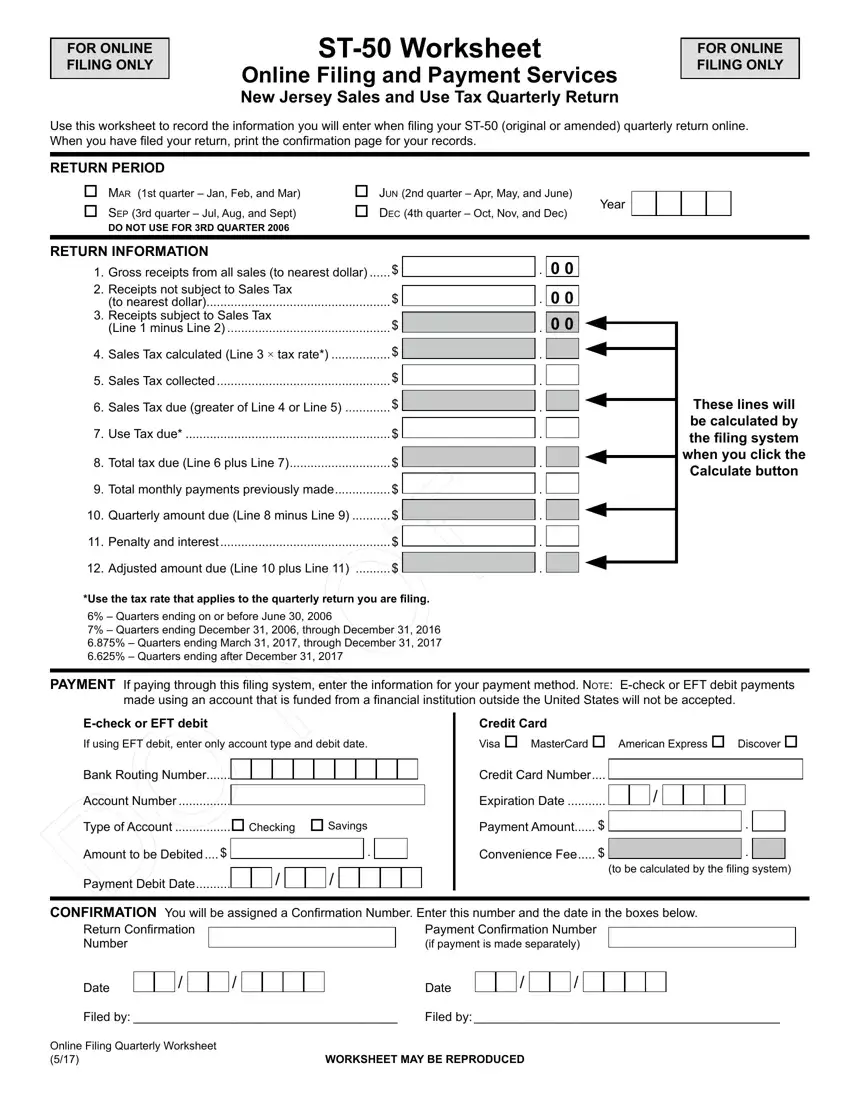

If you want to prepare the file, provide the data the software will request you to for each of the appropriate areas:

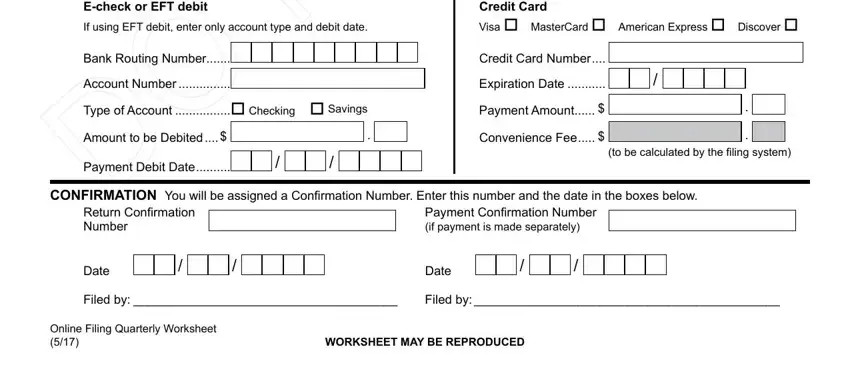

Include the necessary details in the Echeck or EFT debit, If using EFT debit enter only, Credit Card Visa MasterCard, Bank Routing Number, Account Number, Type of Account Checking Savings, Amount to be Debited, Payment Debit Date, Credit Card Number, Expiration Date, Payment Amount, Convenience Fee, to be calculated by the filing, CONFIRMATION You will be assigned, and Return Confirmation Number section.

Step 3: Press the button "Done". The PDF document may be transferred. You can save it to your computer or email it.

Step 4: Create duplicates of the form - it may help you keep clear of possible future worries. And fear not - we do not reveal or view your information.

.

.

.

.

.

.

.

.

.

.