It is possible to fill out the federal supporting statements form 2020 form with this PDF editor. The next actions can help you quickly get your document ready.

Step 1: Get the button "Get Form Here" and then click it.

Step 2: You are now on the document editing page. You can edit, add text, highlight particular words or phrases, place crosses or checks, and insert images.

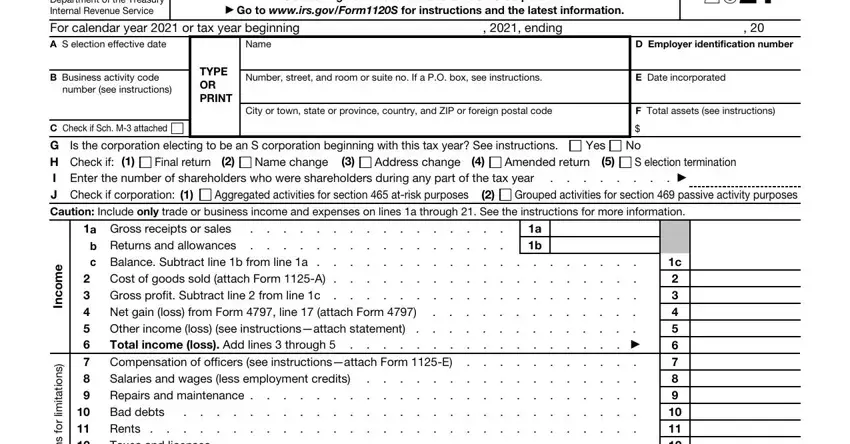

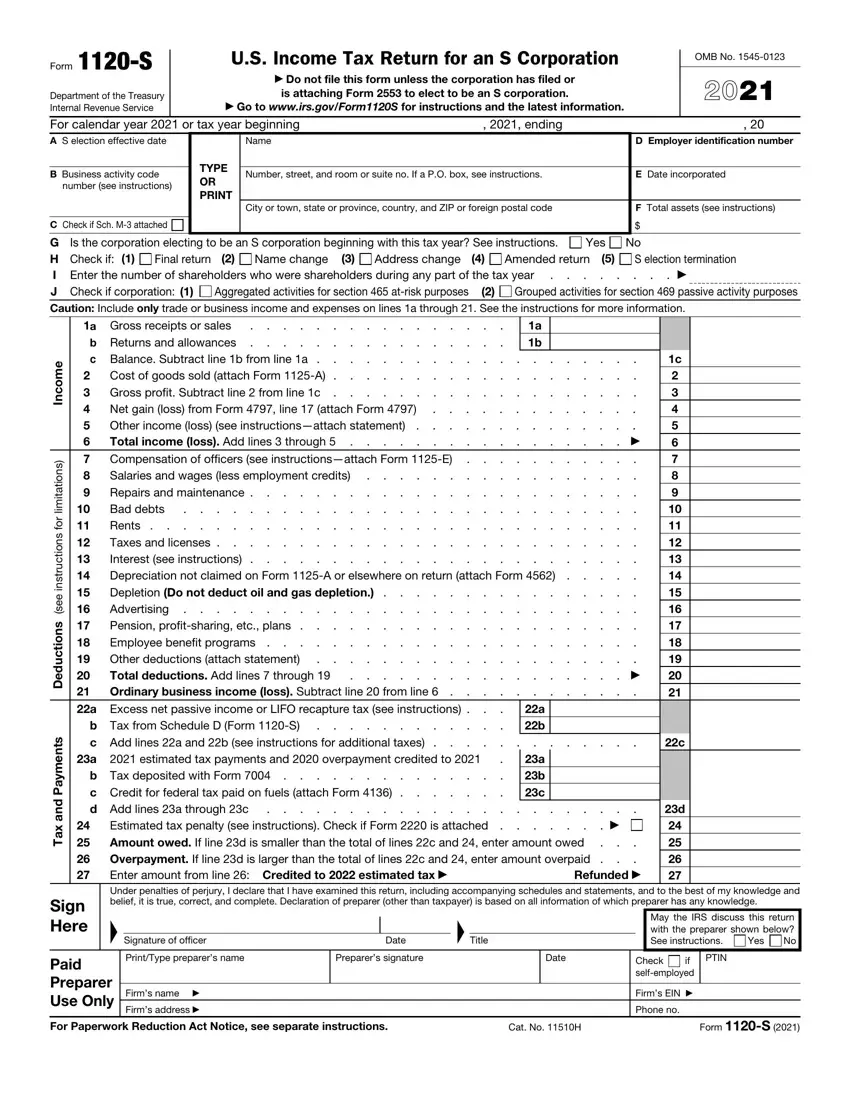

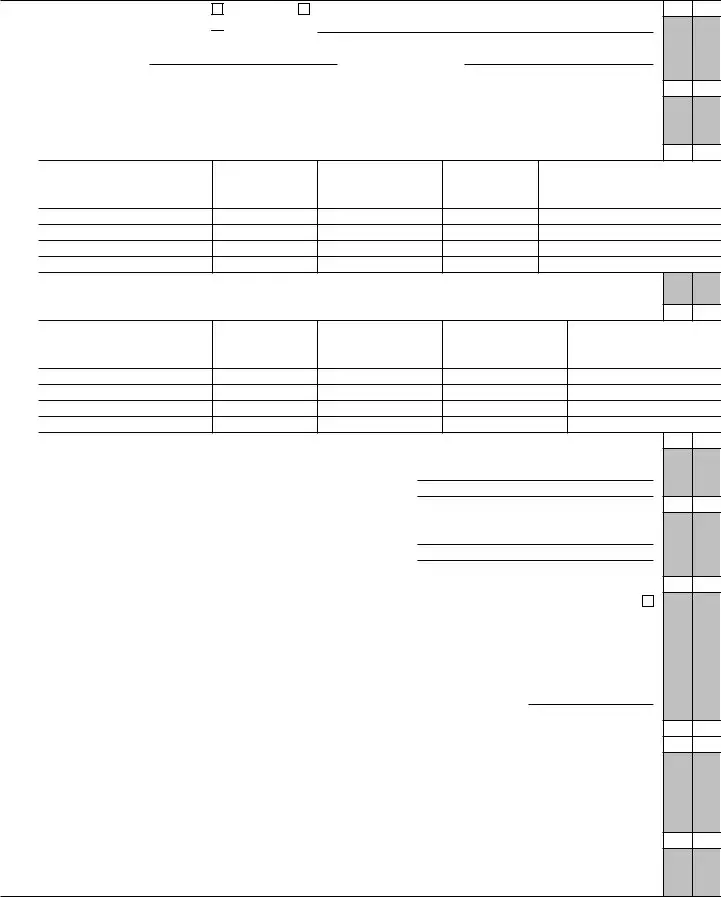

The PDF template you desire to create will include the following parts:

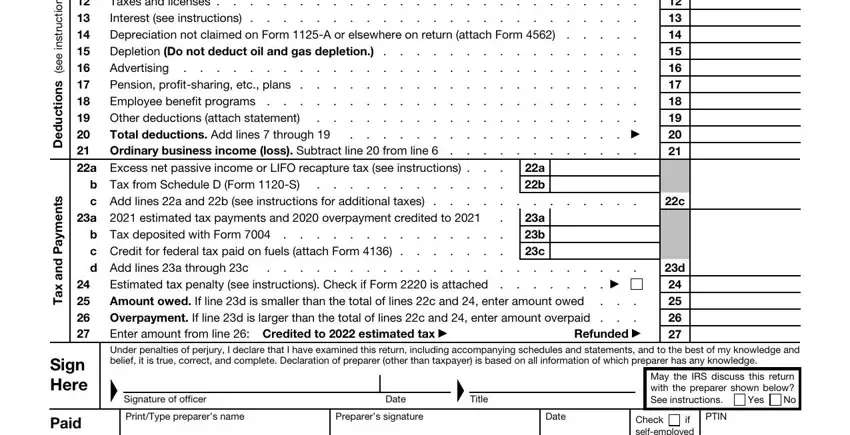

You have to fill up the s n o i t c u r t s n, a b, Compensation of officers, Salaries and wages less, a estimated tax, Total deductions Add lines, b Tax deposited with Form c, b Tax from Schedule D Form S c, Overpayment If line d is, a b a b c, e e s, s n o i t c u d e D, s t n e m y a P d n a x a T, Refunded, and Enter amount from line Credited space with the required information.

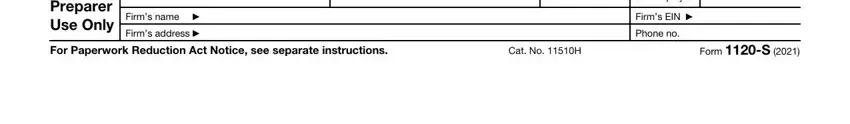

It is essential to write specific data inside the space Paid Preparer Use Only, Firms name, Firms address, Check if selfemployed, Firms EIN, Phone no, For Paperwork Reduction Act Notice, Cat No H, and Form S.

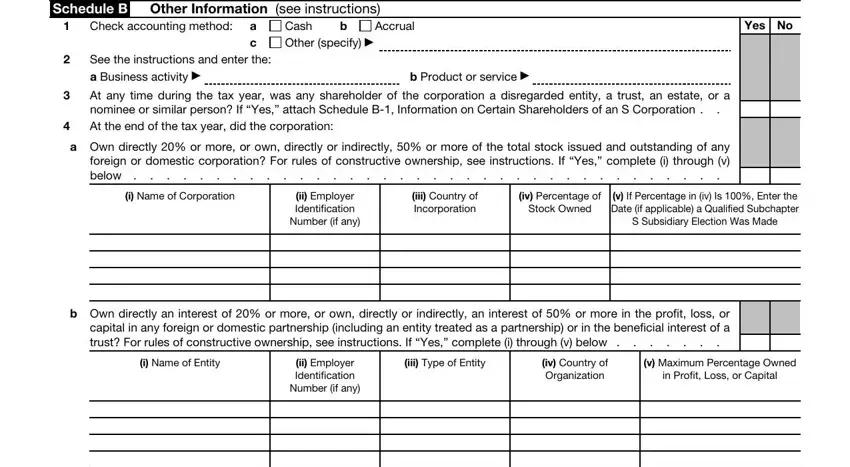

The Form S Schedule B Other, Check accounting method, a c, Cash Other specify, Accrual, Yes No, See the instructions and enter the, b Product or service, At any time during the tax year, Own directly or more or own, i Name of Corporation, ii Employer Identification Number, iii Country of Incorporation, iv Percentage of Stock Owned, and v If Percentage in iv Is Enter box will be your place to put the rights and obligations of either side.

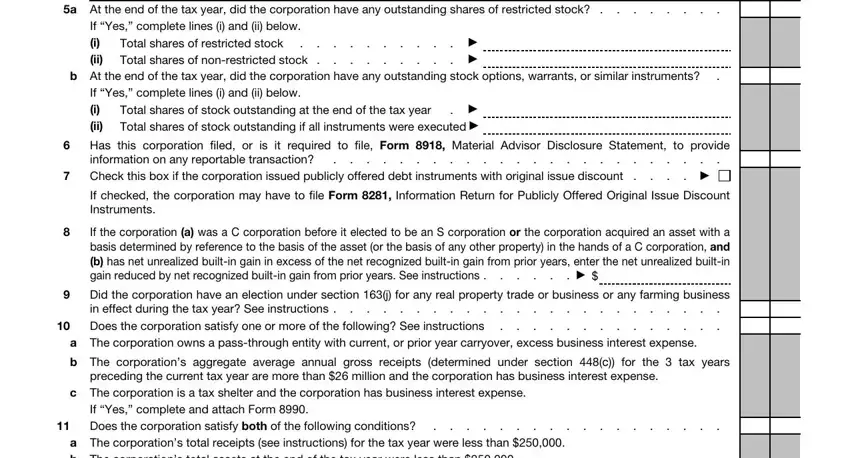

End by reading the next fields and completing them accordingly: a At the end of the tax year did, If Yes complete lines i and ii, b At the end of the tax year did, Total shares of restricted stock, If Yes complete lines i and ii, Total shares of stock outstanding, Has this corporation filed or is, If checked the corporation may, If the corporation a was a C, Did the corporation have an, a The corporation owns a, The corporations aggregate average, c The corporation is a tax shelter, If Yes complete and attach Form, and a The corporations total receipts.

Step 3: Choose the "Done" button. Then, you can export the PDF document - upload it to your device or deliver it by using email.

Step 4: To prevent any difficulties in the long run, you will need to create as much as several copies of the document.

Other (specify)

Other (specify)