A Payroll Check Template is a pre-designed document used by businesses to generate payroll checks for their employees. This template includes spaces for the payee’s name, the date, the amount payable, and details regarding deductions such as taxes, insurance, and retirement contributions. It may also feature the company’s name, bank account details, and a signature line for authorization. The template ensures that all payroll checks are uniform, which helps maintain a professional appearance and aids in the efficient processing of payments.

The purpose of the Payroll Check Template is to streamline the payroll process, ensuring that all employees receive accurate and timely payment for their services. It reduces the risk of errors in manual check writing and speeds up the process of issuing payments.

Other Financial Forms

Should you want to find more financial PDFs for you to edit and fill out online, the following are several of the forms searched often by our users. Besides that, keep in mind that you can upload, fill out, and edit any PDF document at FormsPal.

How to Create a Payroll Check

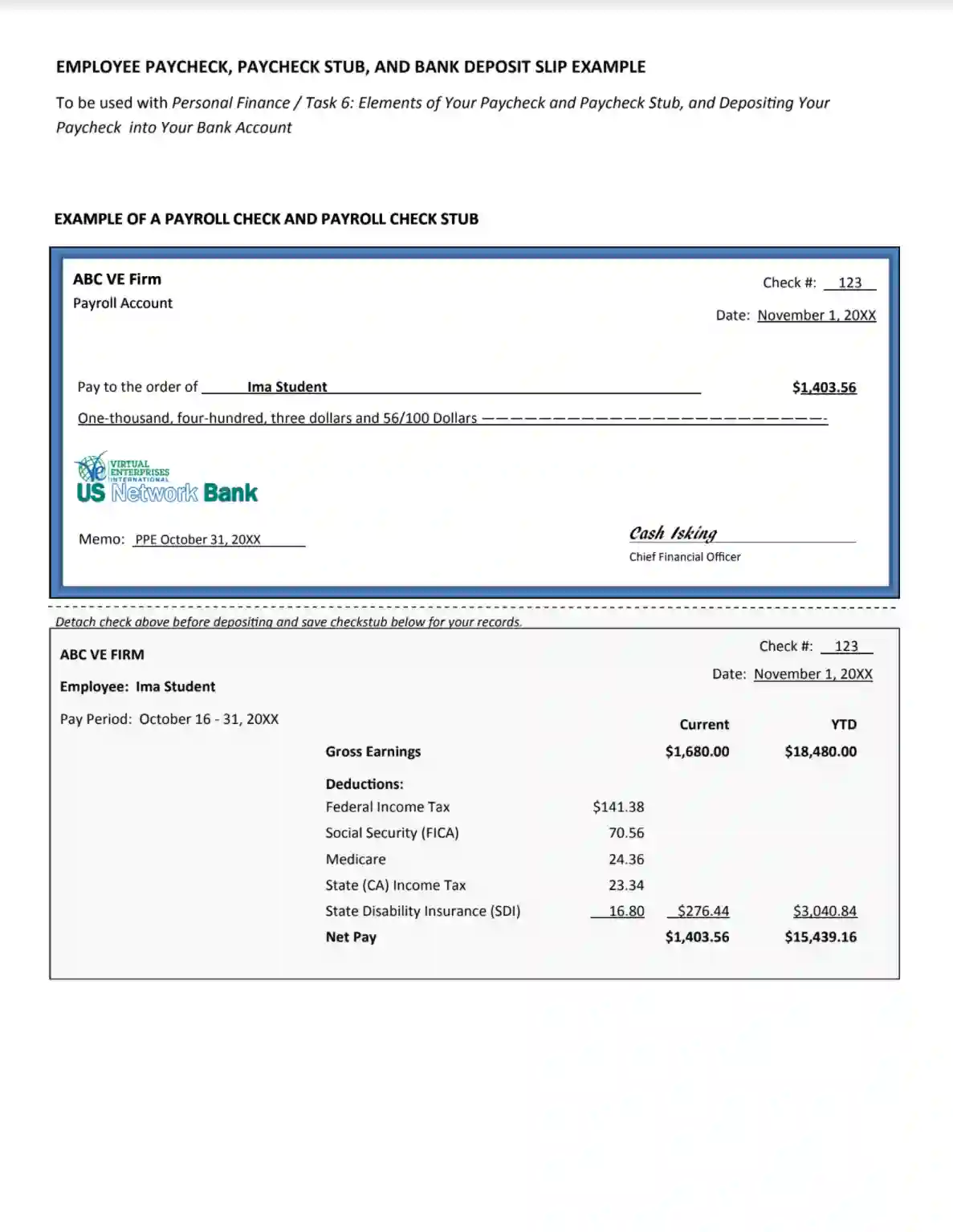

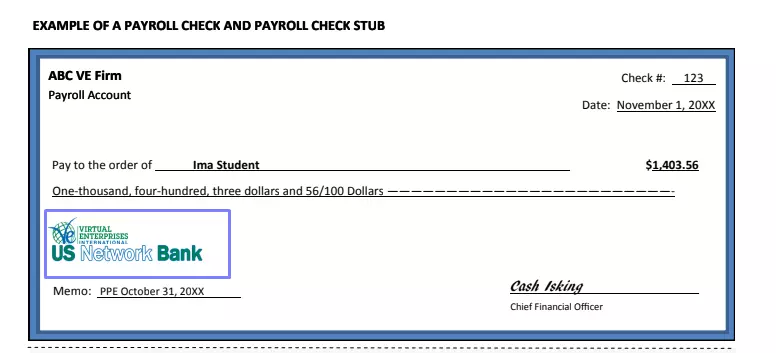

In the check, you indicate just a few details that are still enough for your worker to get the money. This includes the worker’s name, the sum to pay, and the entity’s details. Every check must be signed by the responsible entity representative; otherwise, it will not be accepted by the bank or any other financial institution.

There are two ways of making checks: they can be either made with your laptop or PC and printed or handwritten. If you prefer the second option, you must always have a sufficient number of printed empty templates you can fill out at any moment.

If it is more convenient to use your laptop and create a check there, try our advanced form-building software to download the easy-to-use Payroll Check Template.

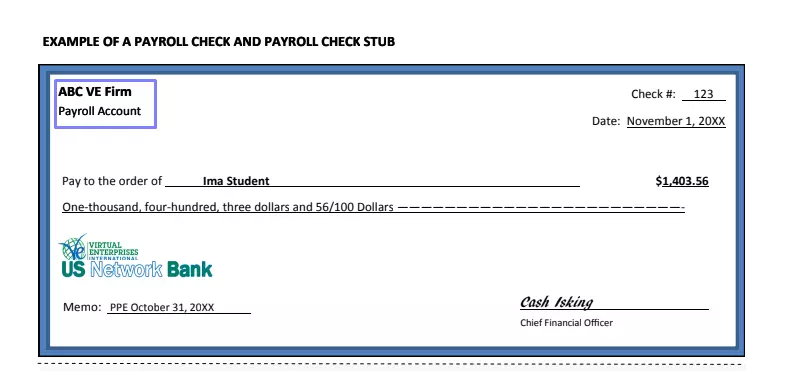

Indicate the Issuing Organization

To start, you should write the name of the organization that issues the check and pays to the worker. Indicate the account number below the name.

Write the Check Number and Date

On the right, you must specify the number of this specific check and the date when the organization is issuing it (typically, the date of signing).

Identify the Payee

You have to introduce the one who will receive the money. Place the recipient’s name in the “Pay to the order of” line.

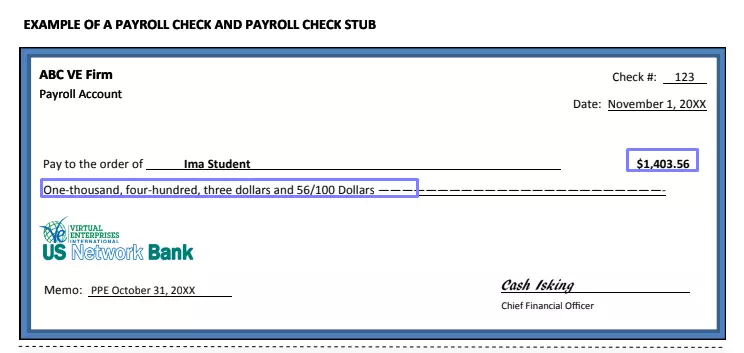

State the Sum

You must enter the amount to pay on the right-hand side (the same line as the name in this template). Write the sum in numbers. Below, decipher it in words. If the sum presumes cents, write them with a slash in a way shown in the template.

Each check must contain the bank’s details: name, logo, or address sometimes — depends on the check. Insert them on the left if you have nothing there.

Sign the Check

Your signature must be present on the check. Leave it in the designated line. Write your name and title as well.

Complete a Pay Stub

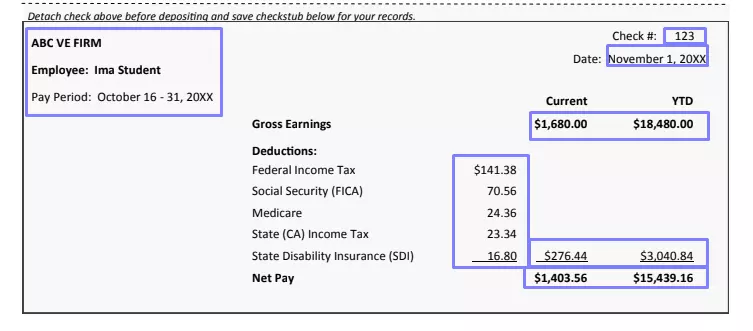

Below the check, you may see a pay stub that defines how much the worker has earned in a certain period, what has been deducted, and what the net sum to pay is. Fill out the stub with the demanded info.

You can give a copy of it to the employee, so they also understand the complete picture. Besides, you must keep this paper in your archives to prove the costs related to the worker’s earnings (that are your organization’s costs at the same time).

Pass the Check to the Worker

Your worker should be able to withdraw the money using this check, so you should pass the check to them when it is ready.

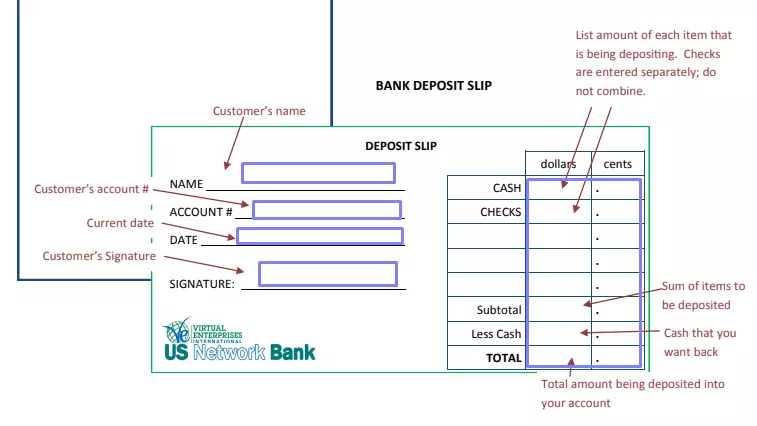

The worker then will fill out the backside of the Payroll Check Template when they arrive at the bank. There, they will leave their signature, write their name and account number, and insert numbers describing how to distribute the money (what will be issued as cash and what will go to the account).