Our top level software engineers have worked together to design the PDF editor that you could take advantage of. The following application enables you to prepare usps form 1164 e documentation shortly and without problems. This is certainly all you need to do.

Step 1: At first, select the orange "Get form now" button.

Step 2: When you enter our usps form 1164 e editing page, you will notice all of the options you may undertake regarding your file in the upper menu.

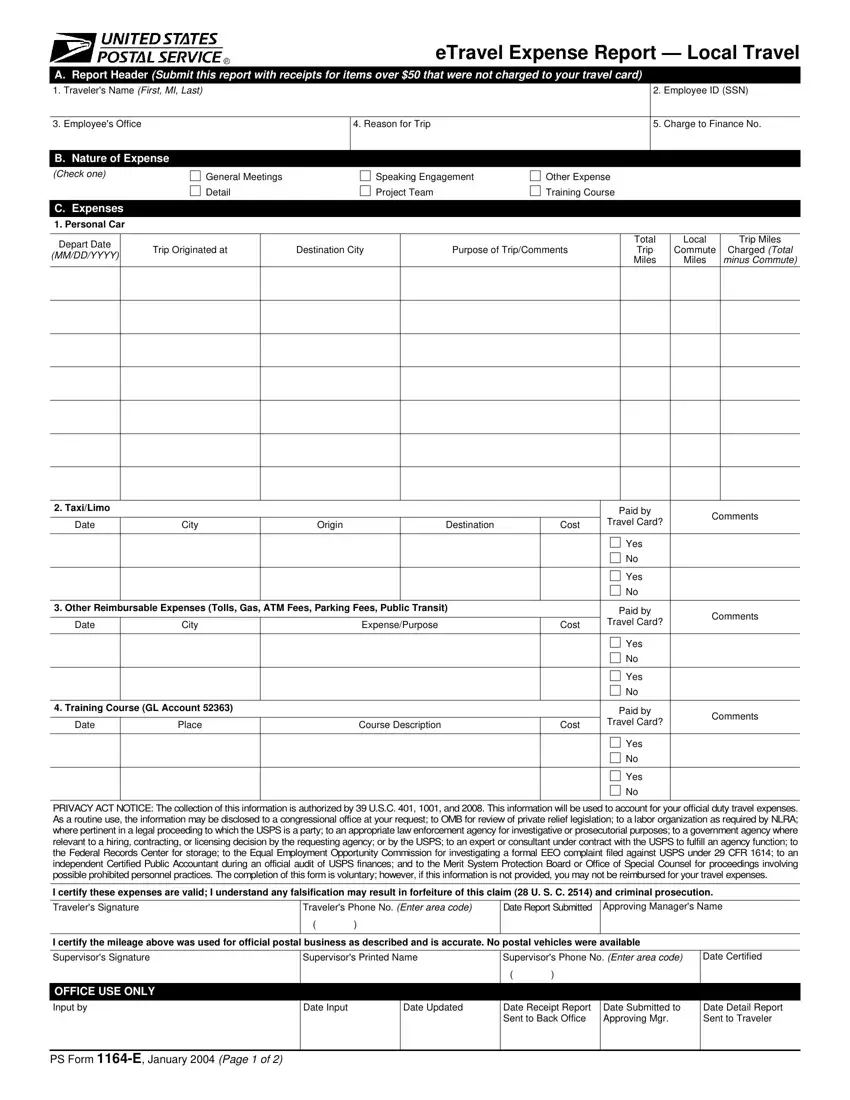

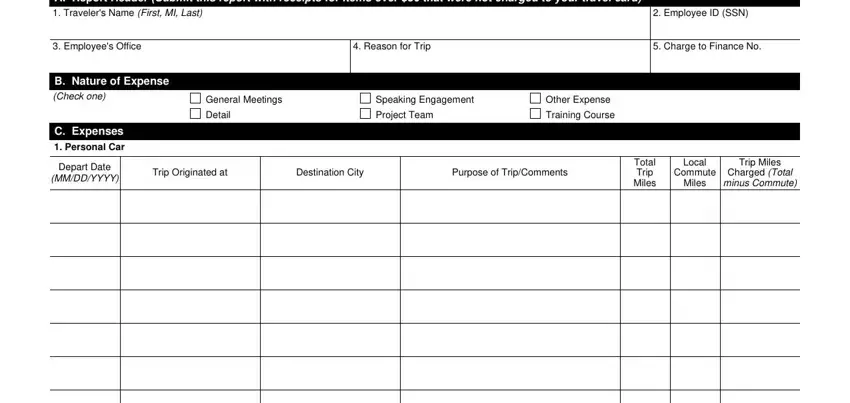

Please enter the next information to create the usps form 1164 e PDF:

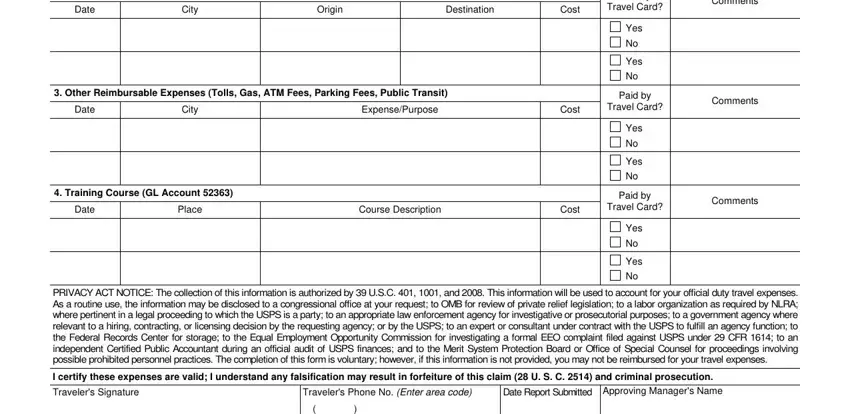

Feel free to enter the particulars within the field Date, City, Origin, Destination, Cost, Paid, by TravelCard, Comments, Yes, Yes, Date, City, Expense, Purpose Paid, by and TravelCard.

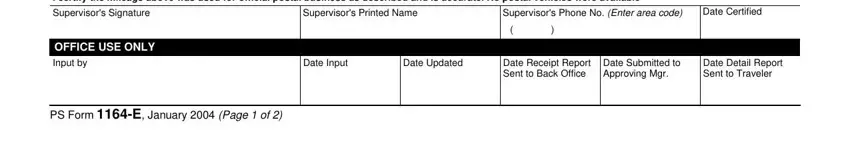

In the field dealing with Supervisors, Signature Supervisors, Printed, Name Supervisors, Phone, No, Enter, area, code Date, Certified OFFICE, USE, ONLY Input, by PS, FormE, January, Page, of Date, Input Date, Updated Date, Receipt, Report, Sent, to, Back, Office Date, Submitted, to, Approving, M, gr and Date, Detail, Report, Sent, to, Traveler it's essential to type in some vital particulars.

Step 3: Select "Done". It's now possible to export your PDF file.

Step 4: Prepare copies of the file. This may save you from future misunderstandings. We don't watch or distribute the information you have, hence you can be confident it is secure.