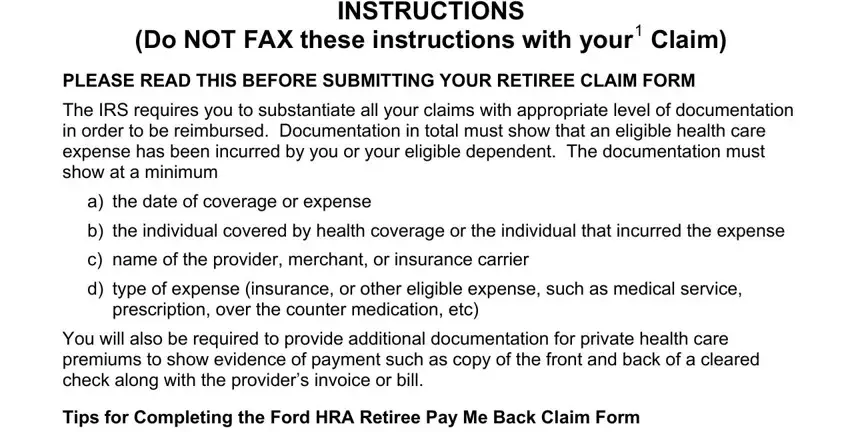

INSTRUCTIONS

(Do NOT FAX these instructions with your1 Claim)

PLEASE READ THIS BEFORE SUBMITTING YOUR RETIREE CLAIM FORM

The IRS requires you to substantiate all your claims with appropriate level of documentation in order to be reimbursed. Documentation in total must show that an eligible health care expense has been incurred by you or your eligible dependent. The documentation must show at a minimum

a)the date of coverage or expense

b)the individual covered by health coverage or the individual that incurred the expense

c)name of the provider, merchant, or insurance carrier

d)type of expense (insurance, or other eligible expense, such as medical service, prescription, over the counter medication, etc)

You will also be required to provide additional documentation for private health care premiums to show evidence of payment such as copy of the front and back of a cleared check along with the provider’s invoice or bill.

Tips for Completing the Ford HRA Retiree Pay Me Back Claim Form

XPrint, or write legibly.

XComplete a separate form for your Dependent, Spouse or Domestic Partner.

XMake sure you sign the form. If a person holding a Power of Attorney for the Retiree is signing, please make sure he or she signs the form in the following format “John Smith, Attorney in Fact for Jane Smith” [Make sure the Power of Attorney is either on file or submitted with the first claim.]

XThe account holder Name section should be completed with the Ford Retiree’s First and Last Name UNLESS you are a surviving spouse of a Ford Retiree where you will complete your name in the name field.

XIf you have a spouse, put your spouse’s Social Security Number (SSN) to better expedite your claim.

XKeep your original receipts, make copies — if your claim is incomplete, you will be required to resubmit the claim form and receipts. Send legible copies of your receipts.

XDo not submit premium expenses on this claim form for premiums paid to your health plan if you have elected the auto-reimbursement process with Extend Health.

1[As used on this form, “you,” “your” or “yours” refer to the Retiree.]

WW-HRA-PMB-FORD-INST (Jun 2008) |

Page 1 of 3 |

Ford HRA Retiree Pay Me Back Claim Form Instructions

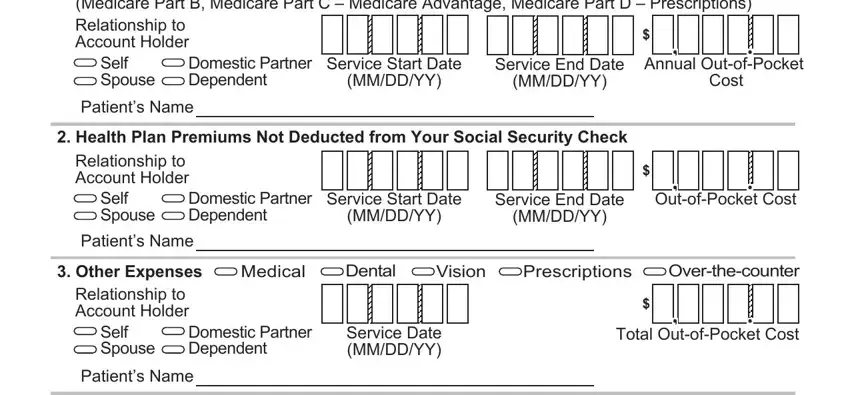

Section 1 – One Time Annual Request for Social Security Administration (SSA) Deduct Premiums (Medicare Part B, Medicare Part C – Medicare Advantage, Medicare Part D – Prescriptions)

XComplete this section if you are requesting reimbursement for a premium that is deducted from your Social Security Check.

XIn the “Service Start Date” boxes, enter the first of the month in which you are eligible for Medicare Part B, C or D for this year. In the “Service End Date” boxes, enter the last day of the year. (If eligible for Medicare Part B, C or D on January 1, this will be January 1 to December 31.)

XEnter the annual amount of your Medicare Part B, C or D expense (the monthly amount multiplied by the number of months of coverage.)

XInclude a copy of your Social Security “Cost of Living Statement” as proof of your expense (typically mailed starting in November the year before it becomes effective) or any other Medicare statement that clearly indicates your Medicare B, C or D premiums. If the cost is not deducted from your Social Security Check, please fill out Section 2 (Health Care Premiums Not Deducted from Your Social Security Check) on the claim form in order to be reimbursed.

XYou will be reimbursed on a pro-rated monthly basis based on your annual premiums and will not exceed the current balance in your account.

Section 2 – Health Care Premiums Not Deducted from Your Social Security Check

XComplete this section if you are requesting a lump sum reimbursement for Health Care premiums that:

-were not deducted from your Social Security Check, and

-you have paid to your health plan on an after-tax basis.

XMake sure to provide documentation such as a statement from your insurance carrier, or a copy of the front and back of a cleared check that shows the premiums you have paid.

XThe Service Start and End Dates should represent the period of coverage you have paid for and are seeking reimbursement for. These dates should match the statement from your health plan indicating the coverage period you have paid for.

XKeep your original receipts and make copies to fax or mail to WageWorks.

XNote: Pre-tax deductions for premiums from your payroll or your pension plan are not eligible for reimbursement.

WW-HRA-PMB-FORD-INST (Jun 2008) |

Page 2 of 3 |

Ford HRA Retiree Pay Me Back Claim Form Instructions

Section 3 – Other Expenses

XIf you are requesting reimbursement for other out-of-pocket expenses that you have paid for such as co-pays, dental services, eligible over-the-counter items or other eligible expenses, please complete this section.

XAcceptable forms of documentation to show the item was an eligible expense include a receipt or an explanation of benefits from your health plan.

XDocumentation should show the date of service, amount of the expense, and a description of the expense.

XWhen completing the claim form indicate who the expense was for.

XYou may add up more than one receipt or expenses incurred for several small eligible expenses and enter that amount on the claim form. When submitting several receipts or pieces of documentation please circle the expense amounts, date of service and description on each receipt or supporting documentation. Print the earliest service start date on the claim form if requesting reimbursement for several expenses. You will also need to indicate on the claim form who the expenses were for. (Self, Spouse, Dependent)

WW-HRA-PMB-FORD-INST (Jun 2008) |

Page 3 of 3 |

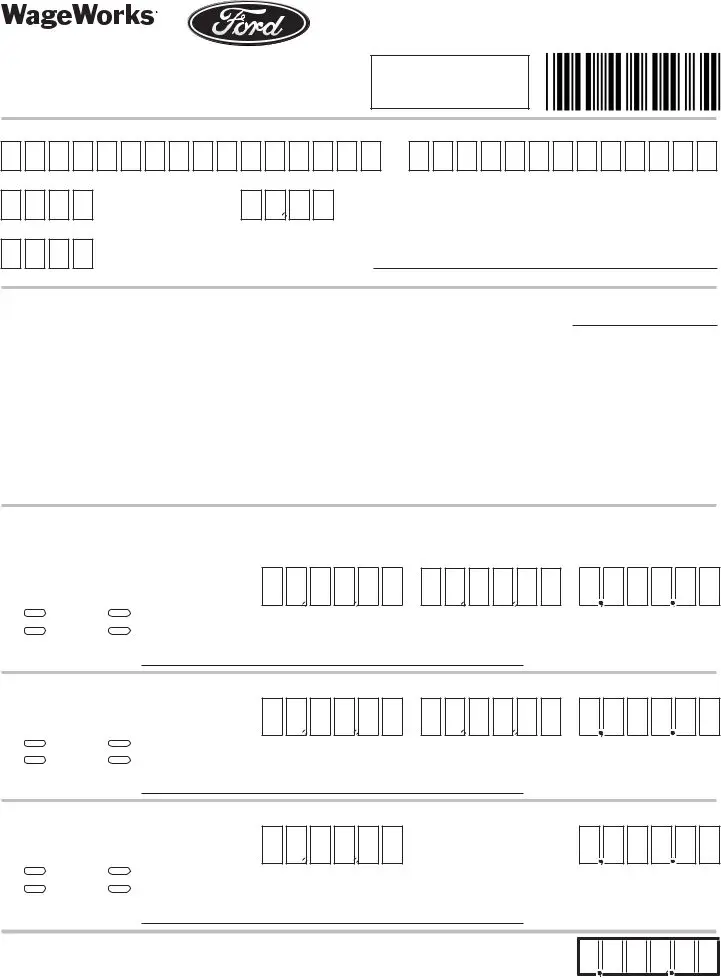

Health Reimbursement Arrangement (HRA)

www.wageworks.com |

RETIREE Pay Me Back Claim Form |

TOLL-FREE FAX: (877) 353-9236

Or, mail to: Claims Administrator, PO Box 14053, Lexington, KY 40512

DO NOT USE A FAX COVER SHEET

to ensure speedy processing.

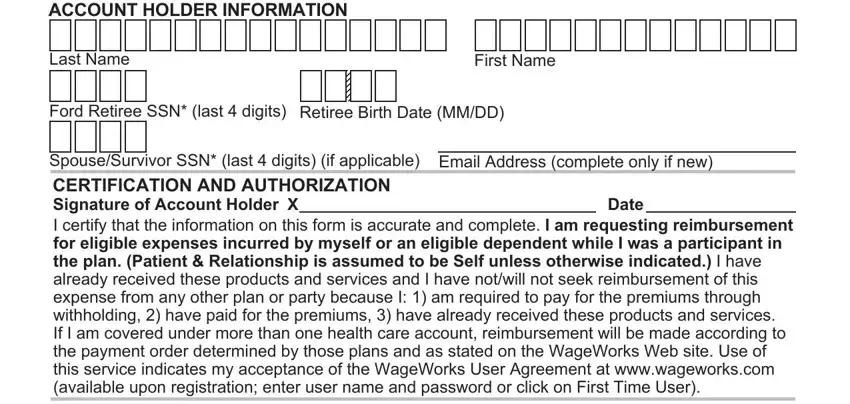

ACCOUNT HOLDER INFORMATION

Last Name

Ford Retiree SSN* (last 4 digits)

First Name

Retiree Birth Date (MM/DD)

Spouse/Survivor SSN* (last 4 digits) (if applicable) Email Address (complete only if new)

CERTIFICATION AND AUTHORIZATION

Signature of Account Holder X |

|

Date |

I certify that the information on this form is accurate and complete. I am requesting reimbursement for eligible expenses incurred by myself or an eligible dependent while I was a participant in the plan. (Patient & Relationship is assumed to be Self unless otherwise indicated.) I have already received these products and services and I have not/will not seek reimbursement of this expense from any other plan or party because I: 1) am required to pay for the premiums through withholding, 2) have paid for the premiums, 3) have already received these products and services. If I am covered under more than one health care account, reimbursement will be made according to the payment order determined by those plans and as stated on the WageWorks Web site. Use of this service indicates my acceptance of the WageWorks User Agreement at www.wageworks.com (available upon registration; enter user name and password or click on First Time User).

CLAIMS FOR OUT-OF-POCKET EXPENSES

1.One Time Annual Request for Social Security Administration (SSA) Deducted Premiums (Medicare Part B, Medicare Part C – Medicare Advantage, Medicare Part D – Prescriptions)

Relationship to |

|

|

Account Holder |

|

Self |

Domestic Partner |

Service Start Date |

Spouse |

Dependent |

(MM/DD/YY) |

Patient’s Name

Service End Date

(MM/DD/YY)

$

Annual Out-of-Pocket

Cost

2. Health Plan Premiums Not Deducted from Your Social Security Check

Relationship to

Account Holder

Self |

Domestic Partner |

Spouse |

Dependent |

Patient’s Name

Service Start Date

(MM/DD/YY)

Service End Date

(MM/DD/YY)

3.Other Expenses  Medical

Medical  Dental

Dental  Vision

Vision  Prescriptions

Prescriptions  Over-the-counter

Over-the-counter

Relationship to |

|

|

$ |

Account Holder |

|

|

|

Self |

Domestic Partner |

Service Date |

Total Out-of-Pocket Cost |

Spouse |

Dependent |

(MM/DD/YY) |

|

Patient’s Name

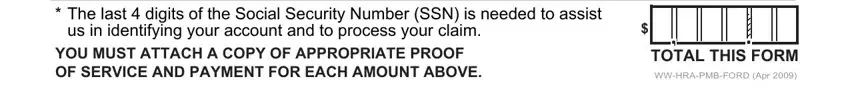

*The last 4 digits of the Social Security Number (SSN) is needed to assist us in identifying your account and to process your claim.

YOU MUST ATTACH A COPY OF APPROPRIATE PROOF OF SERVICE AND PAYMENT FOR EACH AMOUNT ABOVE.

$

TOTAL THIS FORM

WW-HRA-PMB-FORD (Apr 2009)

Medical

Medical  Dental

Dental  Vision

Vision  Prescriptions

Prescriptions  Over-the-counter

Over-the-counter