Quite a few tasks can be simpler than managing documentation working with this PDF editor. There isn't much you have to do to enhance the rental income form document - simply follow these steps in the following order:

Step 1: Hit the button "Get form here" to open it.

Step 2: You can find all of the actions you can undertake on your document once you have accessed the rental income form editing page.

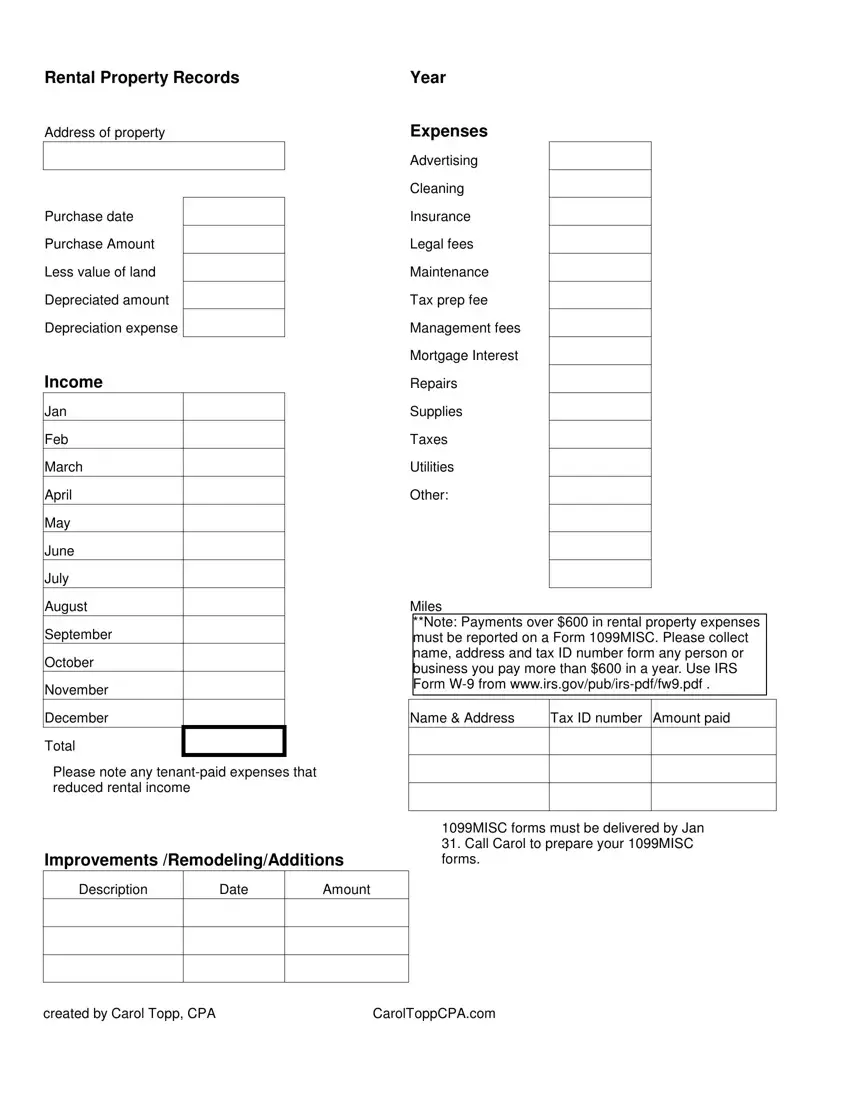

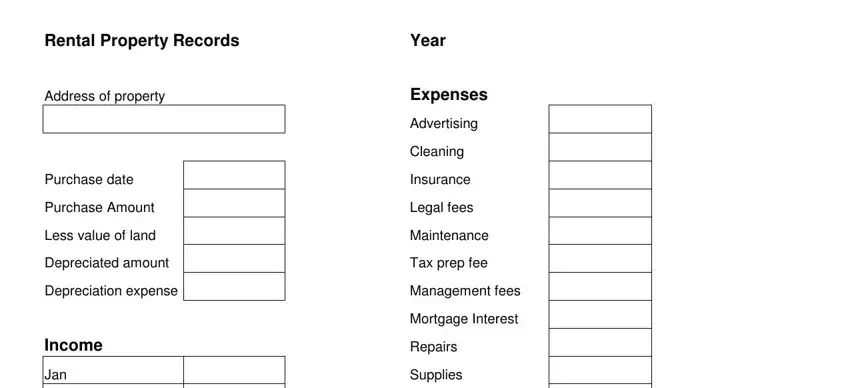

In order to fill in the rental income form PDF, enter the information for each of the parts:

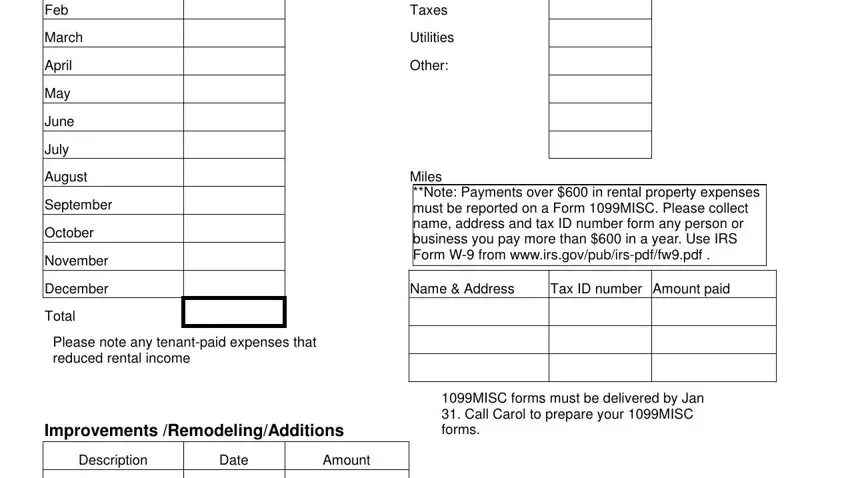

Fill out the Feb, March, April, May, June, July, August, September, October, November, December, Total, Taxes, Utilities, and Other space with all the information asked by the software.

Point out the considerable details about the created by Carol Topp CPA, and CarolToppCPAcom segment.

Step 3: Hit "Done". Now you can upload your PDF document.

Step 4: It may be easier to keep copies of the file. You can rest easy that we are not going to display or read your particulars.