We've applied the hard work of the best programmers to make the PDF editor you may want to benefit from. The software will permit you to fill in the rental verification form file effortlessly and don’t waste precious time. Everything you need to do is adhere to the following quick actions.

Step 1: Click the orange button "Get Form Here" on the following webpage.

Step 2: At the moment, it is possible to update your rental verification form. This multifunctional toolbar lets you insert, eliminate, transform, highlight, and do many other commands to the words and phrases and fields within the file.

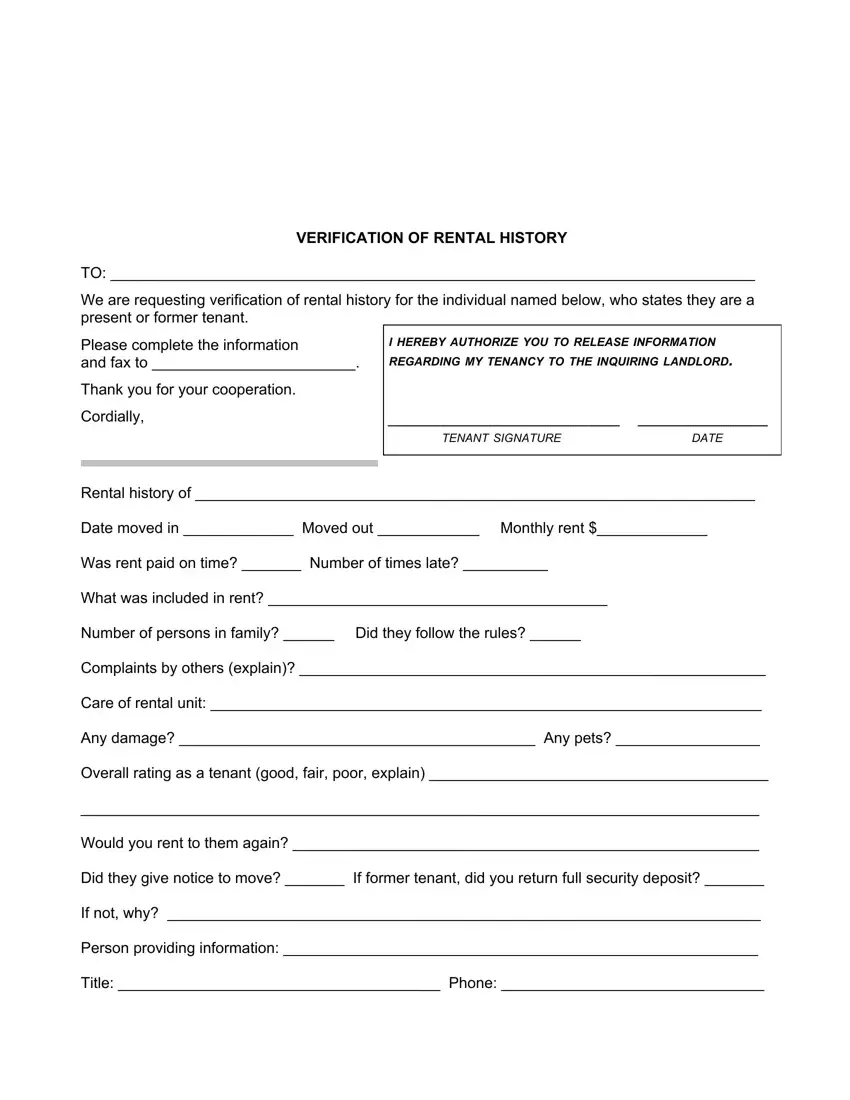

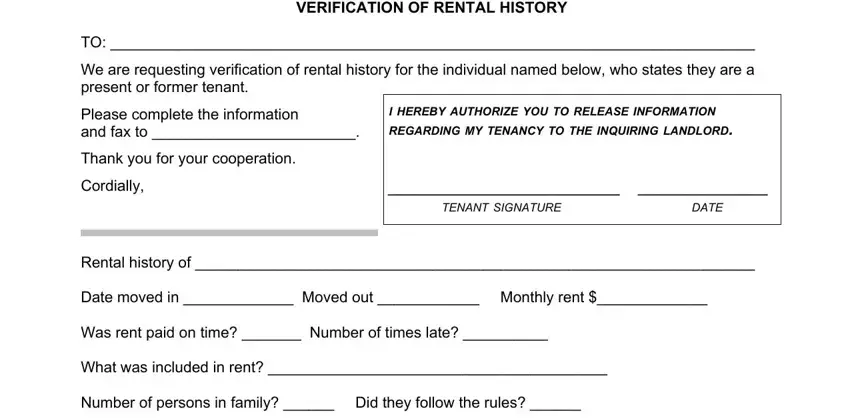

Prepare the rental verification form PDF and enter the material for every single section:

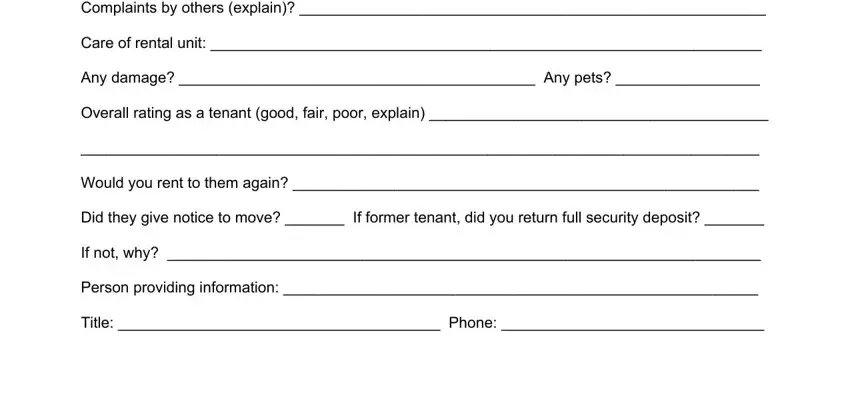

Put the asked details in the Complaints by others explain, Care of rental unit, Any damage Any pets, Overall rating as a tenant good, Would you rent to them again, Did they give notice to move If, If not why, Person providing information, and Title Phone area.

Step 3: Press the button "Done". The PDF form can be exported. It's possible to save it to your pc or send it by email.

Step 4: Be sure to keep away from forthcoming complications by generating a minimum of two duplicates of your document.