Any time you would like to fill out power, you won't need to download and install any sort of applications - just make use of our online tool. To retain our editor on the forefront of practicality, we aim to implement user-driven features and improvements regularly. We're at all times looking for feedback - play a vital role in reshaping PDF editing. Starting is simple! All that you should do is take these basic steps below:

Step 1: Hit the "Get Form" button above. It will open our editor so that you can begin filling in your form.

Step 2: After you access the editor, you will get the document ready to be filled out. Besides filling out different blank fields, you might also perform several other things with the PDF, namely putting on your own text, modifying the initial textual content, inserting illustrations or photos, affixing your signature to the PDF, and more.

With regards to the fields of this particular document, here is what you need to do:

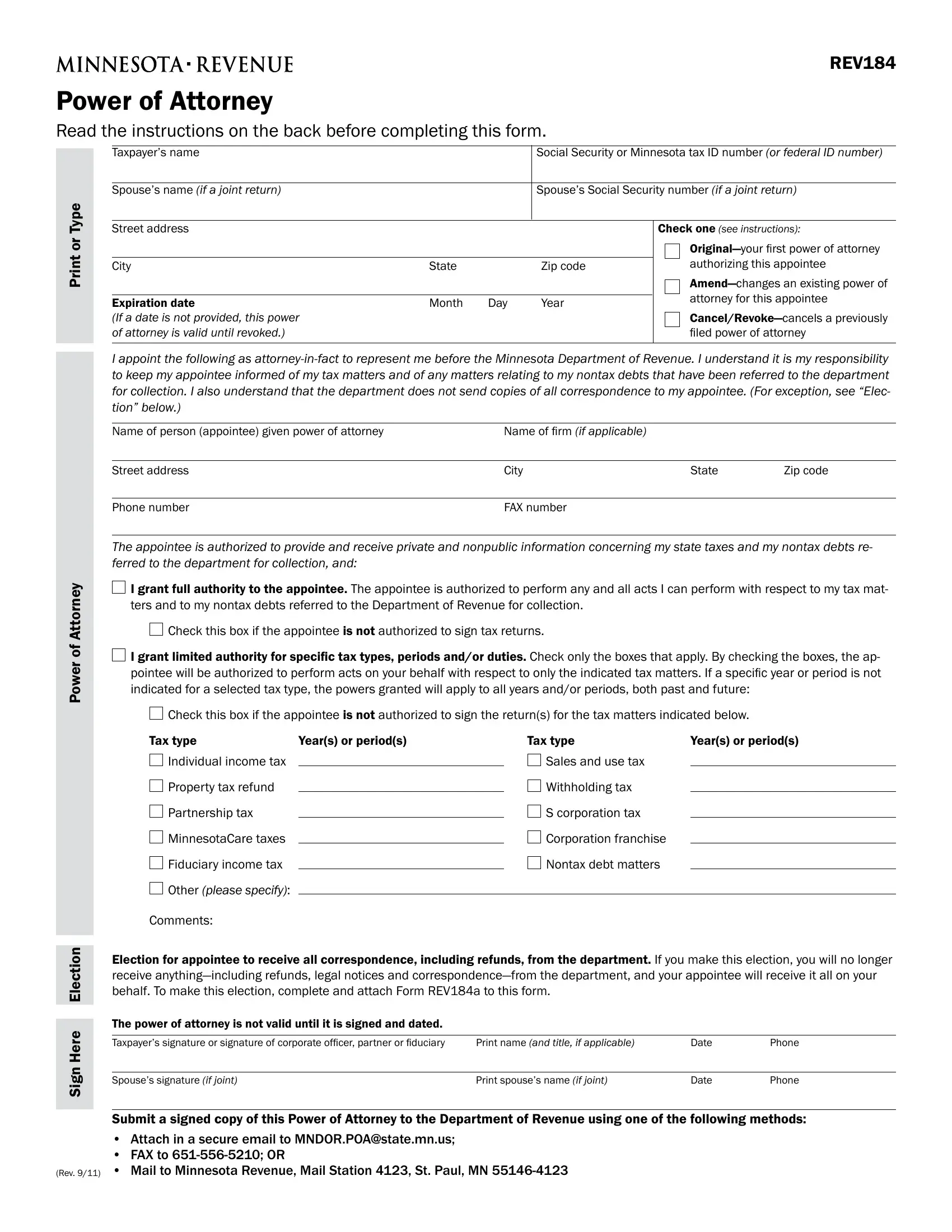

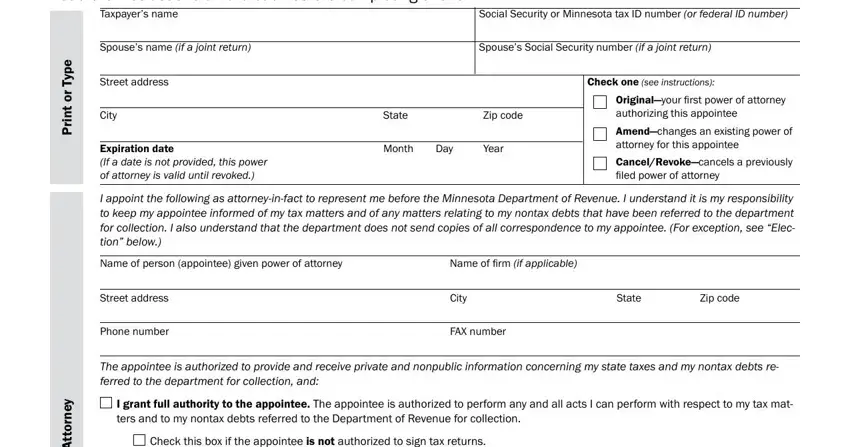

1. To get started, when filling in the power, start out with the page that features the next fields:

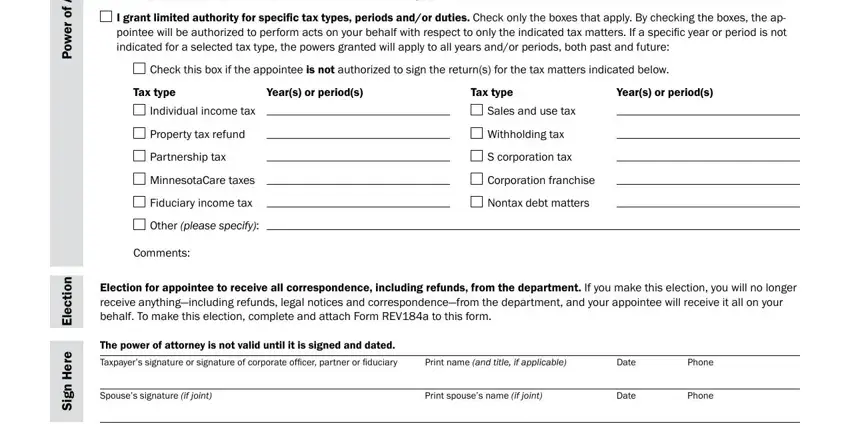

2. Once this section is filled out, proceed to enter the applicable information in all these: Check this box if the appointee is, I grant limited authority for, Check this box if the appointee is, Tax type, Years or periods, Tax type, Years or periods, Individual income tax, Property tax refund, Partnership tax, MinnesotaCare taxes, Fiduciary income tax, Other please specify, Comments, and Sales and use tax.

It is possible to get it wrong when filling in your Other please specify, hence make sure to take a second look before you decide to send it in.

Step 3: Look through the information you've typed into the form fields and click the "Done" button. Find your power once you register here for a free trial. Readily use the form from your FormsPal cabinet, with any modifications and changes conveniently saved! FormsPal is devoted to the personal privacy of all our users; we make sure that all information entered into our tool is protected.