Through the online PDF editor by FormsPal, you can easily complete or change rpd crs form right here and now. The tool is constantly updated by our team, acquiring useful functions and growing to be greater. It just takes several simple steps:

Step 1: Just click the "Get Form Button" at the top of this webpage to open our pdf file editing tool. Here you'll find everything that is necessary to work with your file.

Step 2: After you open the online editor, you will see the document ready to be filled out. In addition to filling out different blanks, it's also possible to do many other actions with the form, specifically adding any textual content, changing the original text, inserting images, putting your signature on the document, and much more.

It is actually straightforward to fill out the form adhering to our detailed guide! Here is what you must do:

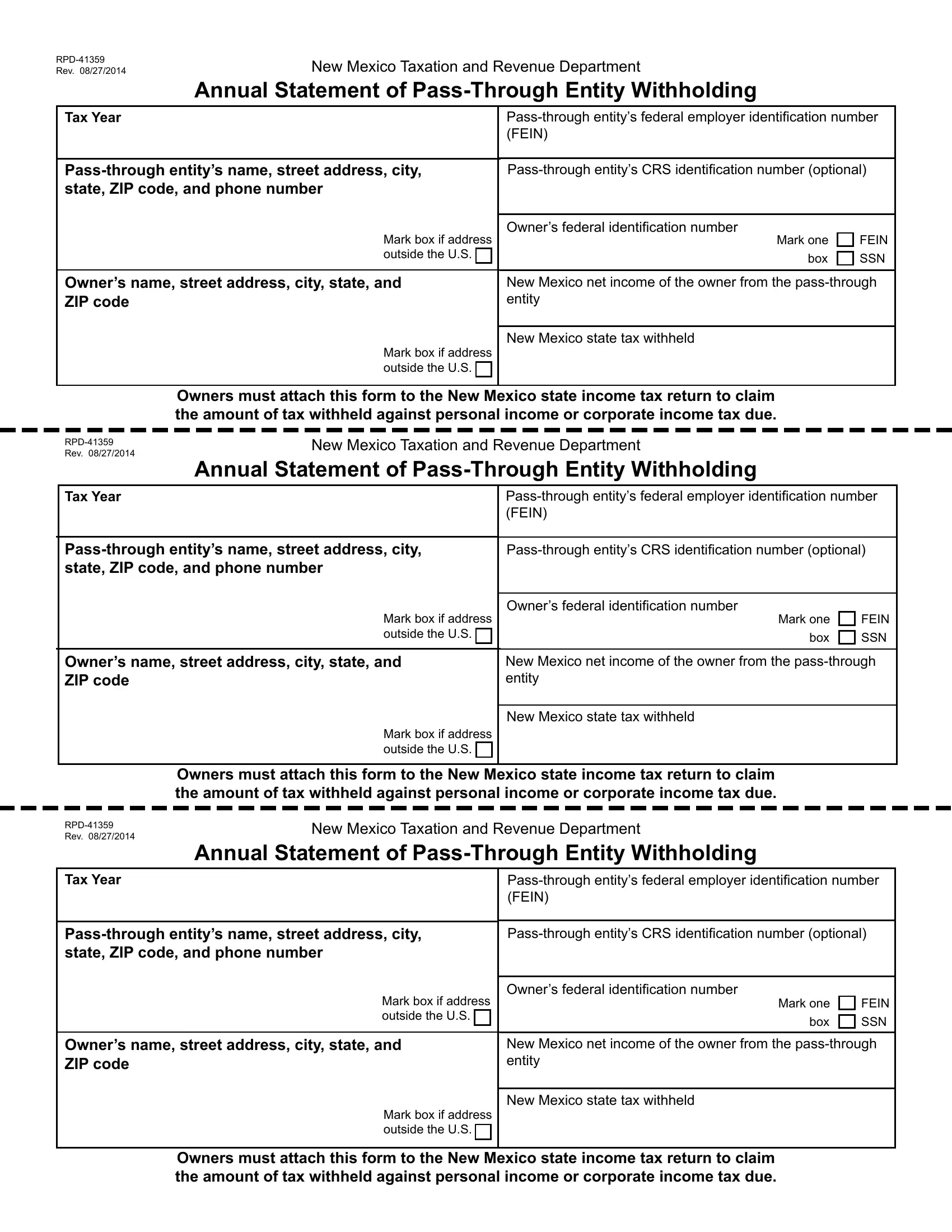

1. Fill out the rpd crs form with a selection of necessary blanks. Gather all of the required information and make sure there's nothing forgotten!

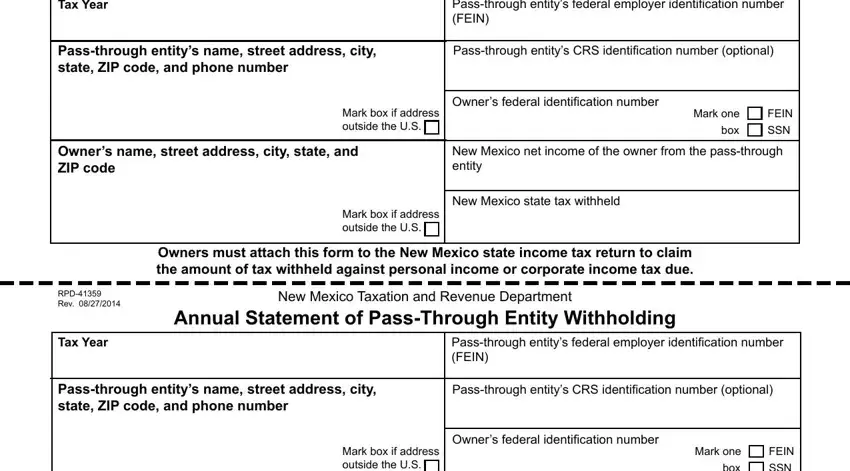

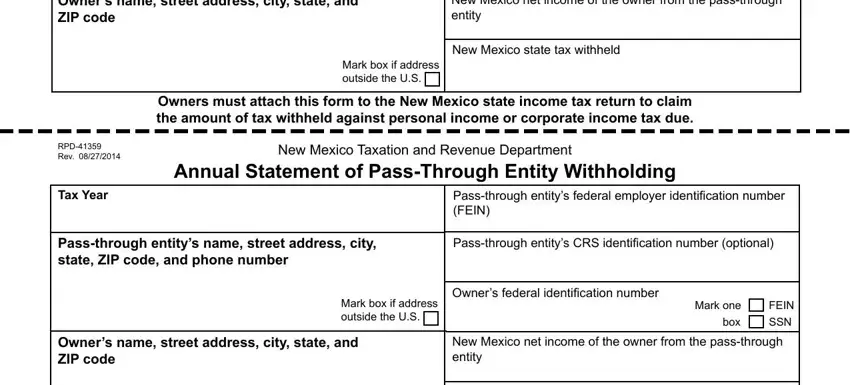

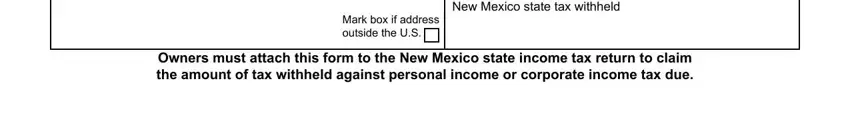

2. Once your current task is complete, take the next step – fill out all of these fields - Owners name street address city, New Mexico net income of the owner, RPD Rev, Tax Year, New Mexico state tax withheld, Mark box if address outside the US, Owners must attach this form to, New Mexico Taxation and Revenue, Annual Statement of PassThrough, Passthrough entitys federal, Passthrough entitys CRS, Passthrough entitys name street, Owners name street address city, New Mexico net income of the owner, and Mark box if address outside the US with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

Always be very careful when completing Owners name street address city and Owners name street address city, as this is the section where many people make a few mistakes.

3. The following section focuses on Mark box if address outside the US, New Mexico state tax withheld, and Owners must attach this form to - fill in all these fields.

Step 3: Make sure that the information is right and then click on "Done" to conclude the project. Go for a 7-day free trial account at FormsPal and get immediate access to rpd crs form - with all adjustments saved and available from your FormsPal account page. We don't share the information you enter whenever completing forms at our site.