Our leading computer programmers have worked together to implement the PDF editor that you may begin using. This application makes it easy to complete rut 50 form forms immediately and effortlessly. This is certainly everything you should undertake.

Step 1: Select the button "Get Form Here" on the following website and click it.

Step 2: Once you've entered the editing page rut 50 form, you should be able to find each of the options readily available for your document in the top menu.

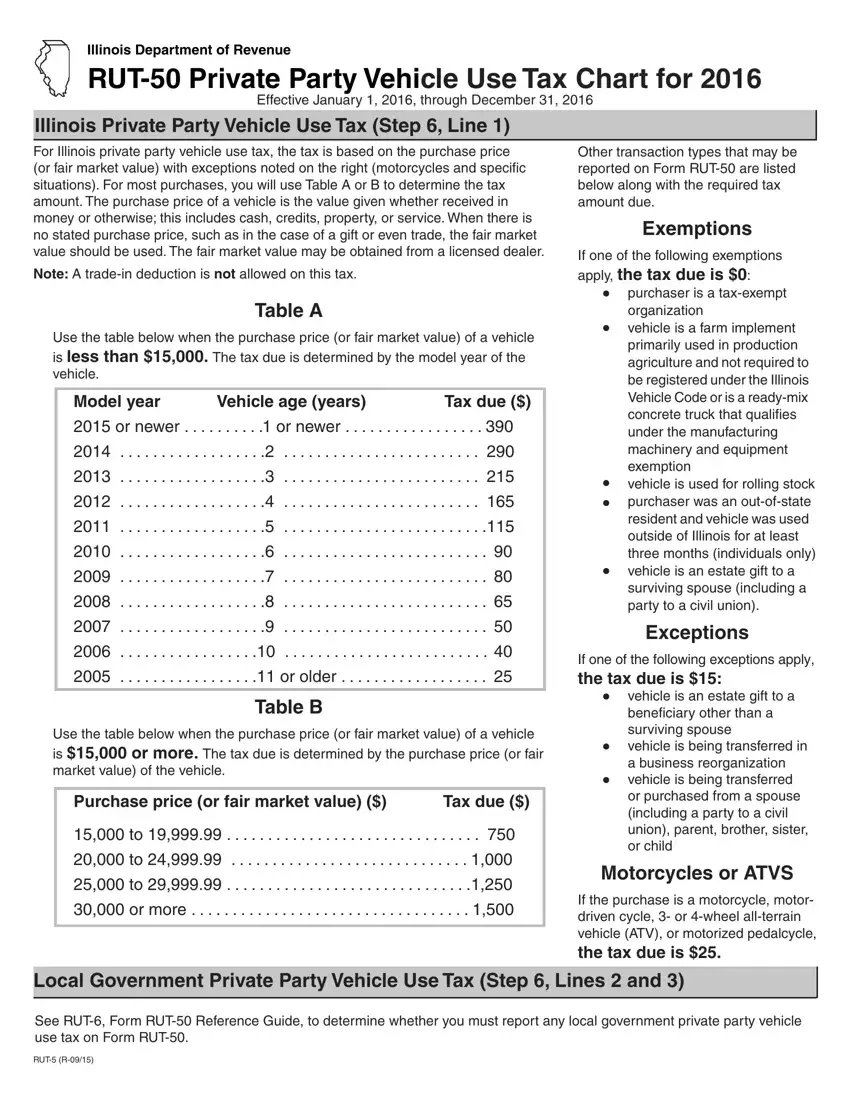

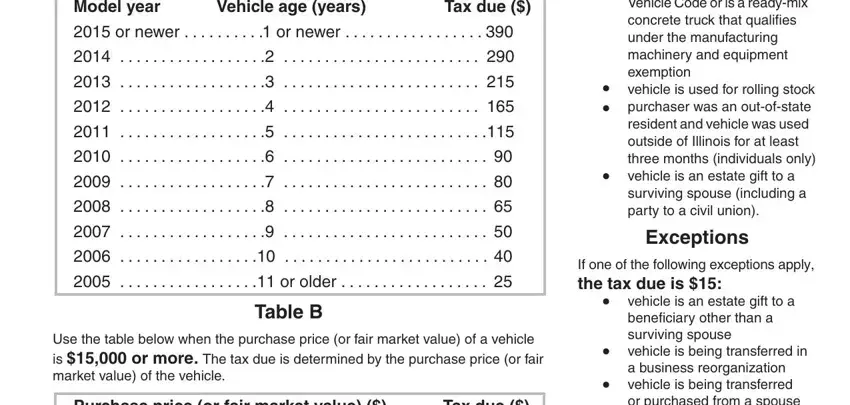

The next areas will create the PDF file that you'll be creating:

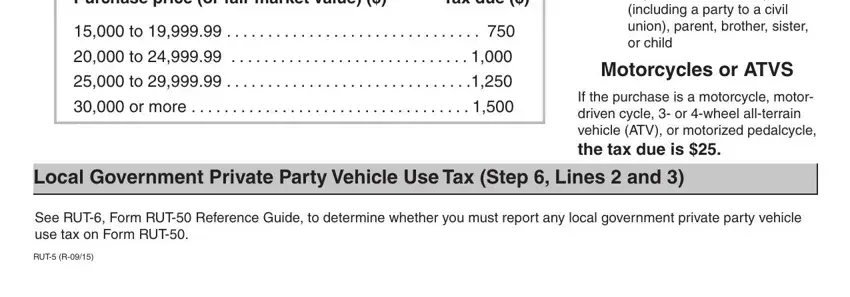

The system will demand you to fill out the Purchase price or fair market, Tax due, or more, vehicle is an estate gift to a, Motorcycles or ATVS, If the purchase is a motorcycle, Local Government Private Party, See RUT Form RUT Reference Guide, and RUT R section.

Step 3: Hit the button "Done". Your PDF document may be exported. You can easily upload it to your device or send it by email.

Step 4: Make sure to remain away from forthcoming problems by creating minimally a pair of copies of the form.