The Form SSA-8202-BK, officially endorsed by the Social Security Administration (SSA), plays a critical role in the ongoing evaluation of individuals' eligibility for Supplemental Security Income (SSI) payments. This form serves as a comprehensive declaration by the recipients concerning various aspects of their current living situation, financial status, and other vital information that could affect their SSI benefits. Recipients are required to provide updates on changes to their address, living arrangements, financial assistance received, employment and self-employment income, other earnings such as pensions or alimony, and property ownership among others. Furthermore, it inquires about changes related to health insurance coverage that does not include Medicare or Medicaid, participation in the food stamp program, and potential legal issues that might influence eligibility. The SSA mandates reporting of any alterations within 10 days after the end of the month in which the change happened, emphasizing the significance of timely and accurate submission to avoid penalties. Through filling out the SSA-8202-BK form, SSI recipients affirm their commitment to compliance with program requirements, ensuring that benefits are correctly allocated based on the most up-to-date personal information. This document, therefore, is not only a bureaucratic formality but a crucial link in the chain that upholds the integrity and effectiveness of the SSI program.

| Question | Answer |

|---|---|

| Form Name | Ssa 8202 Bk Form |

| Form Length | 7 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 45 sec |

| Other names | ssa 8202 bk security form, ssa form 8202 bk, ssa blank printable form ssa 8202 bk, 8202 bk |

SOCIAL SECURITY ADMINISTRATION

TEL |

FORM APPROVED |

|

OMB No. |

STATEMENT FOR DETERMINING

CONTINUING ELIGIBILITY FOR SUPPLEMENTAL

SECURITY INCOME PAYMENT

If the name and address below are not correct, please cross out the part that is wrong and write in the correct information.

•

For Official Use Only

El SSN

Spouse's Name

Spouse's SSN

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Check the Ones That Apply |

|

|

|

|

|

DO CODE |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

C |

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

NC |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

J |

K |

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

L |

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interviewer's Initials |

|

|

|

|

|

|

Date |

Received |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WHEN ANSWERING THESE QUESTIONS, REFER TO THIS DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. SINCE THE DATE ABOVE , have you moved to a new address? |

|

|

|

|

|

|

|

|

|

YES |

NO |

|||||

|

|

If ''YES,'' please give your new address: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDRESS (Number, Street, City, State, ZIP Code) |

|

|

DATE YOU MOVED |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. SINCE THE DATE ABOVE , have you spent a full calendar month |

in a hospital, nursing home or |

|

|

|||||||||||||

|

|

any place other than where you live? (Also, include trips outside of the United States that lasted 30 |

|

|

|||||||||||||

|

|

days or more.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|

|

If " YES ," please give the following information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

NAME(S) OF PLACE(S) WHERE YOU STAYED: |

ADDRESS(ES) (Number, Street, City State, ZIP Code) |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

DATE(S) FIRST STAYED (month/day/year) |

DATE(S) LEFT (month/day/year) |

|

|

||||||||||||

3.SINCE THE DATE ABOVE, has anyone moved into or out of the place where you live

(also, report births and deaths of people living with you)? |

|

|

|

YES |

NO |

If " YES ," please explain in the REMARKS section on pages 4 and 5 of this form.

4.SINCE THE DATE ABOVE, has anyone given you (or your spouse living with you) any

money, food, or a free place to live, or helped you pay your bills or your rent? |

|

|

|

YES |

NO |

If YES , please give the following information:

TYPE OF HELP |

HOW OFTEN YOU RECEIVED HELP |

AMOUNT OF HELP |

5.SINCE THE DATE ABOVE , have you, or your spouse living with you, earned money from working or do you expect to earn money from working in the next

|

14 months? (DO NOT COUNT earnings from |

|

|

|

|

|

|

|

YES |

NO |

||

|

If you have earned money from working, please give the following |

|

|

|

|

|

|

|

|

|

||

|

information: |

|

|

|

|

|

|

|

|

|

|

|

|

a. Amount(s) of Earning for Past Months: |

|

|

|

|

|

|

|

|

|

||

|

Name of Worker |

Employer's |

Gross Wages |

|

|

|

|

Dates of |

|

|

||

|

Name, Address, and Phone Number |

|

|

|

|

|

Employment |

|

|

|||

|

|

Amount |

How Often Paid |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From: |

|

|

||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To: |

|

|

||||

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

From: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To: |

|

|

||||

|

|

|

|

|

|

|

|

|

||||

Form |

|

|

|

|

|

|

PAGE 1 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

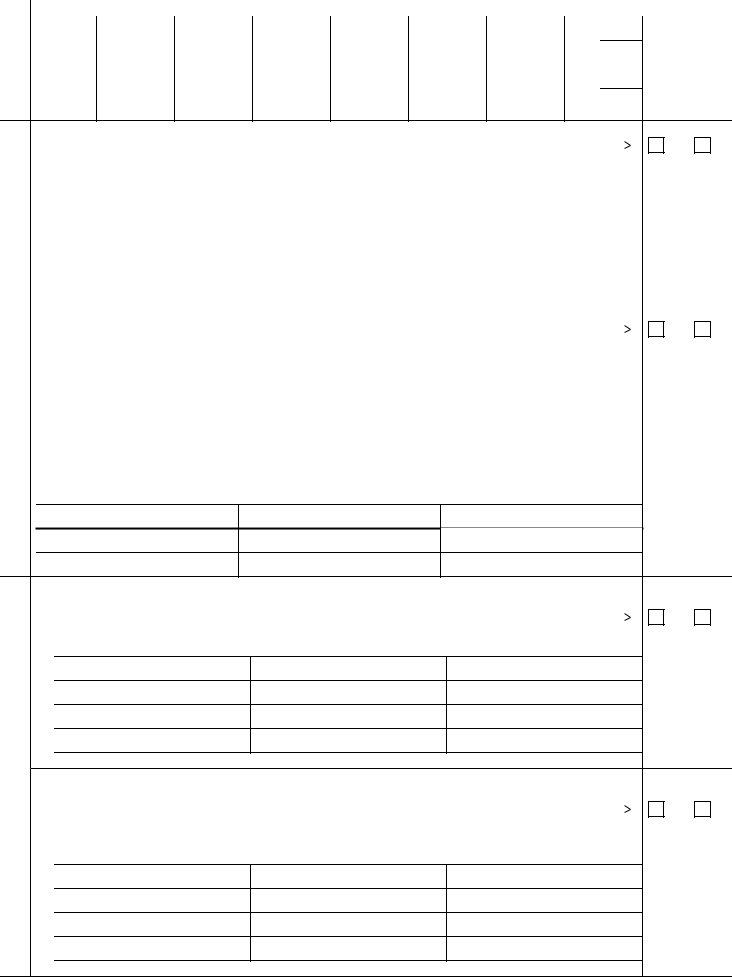

5. |

b. Estimates of Earnings for this Month and Future Months |

|

|

|

|

|

|

|

||||||||

|

|

Month |

|

Month |

|

Month |

|

Month |

Month |

|

Month |

|

Month |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

Amount $ |

$ |

$ |

$ |

|

$ |

$ |

$ |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Month |

|

Month |

|

Month |

|

Month |

Month |

|

Month |

|

Month |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amount |

$ |

$ |

$ |

$ |

|

$ |

$ |

$ |

|

|

|||||

|

|

|

|

|

||||||||||||

6.SINCE DATE ON PAGE 1 , have you, or your spouse living with you, been

|

or expect to be |

|

|

|

|

|

|

|

YES |

NO |

||||||||||

|

If |

YES , please give the following information: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Self- |

Type of |

|

Last Year's |

|

|

This Year's Estimated |

Dates of Self- |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

Employed Person |

Income |

|

Gross |

Net Income |

|

Gross |

|

Net Income |

Employment |

|

|

||||||||

|

|

Income |

(or Loss) |

|

Income |

|

(or Loss) |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

From: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

To: |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

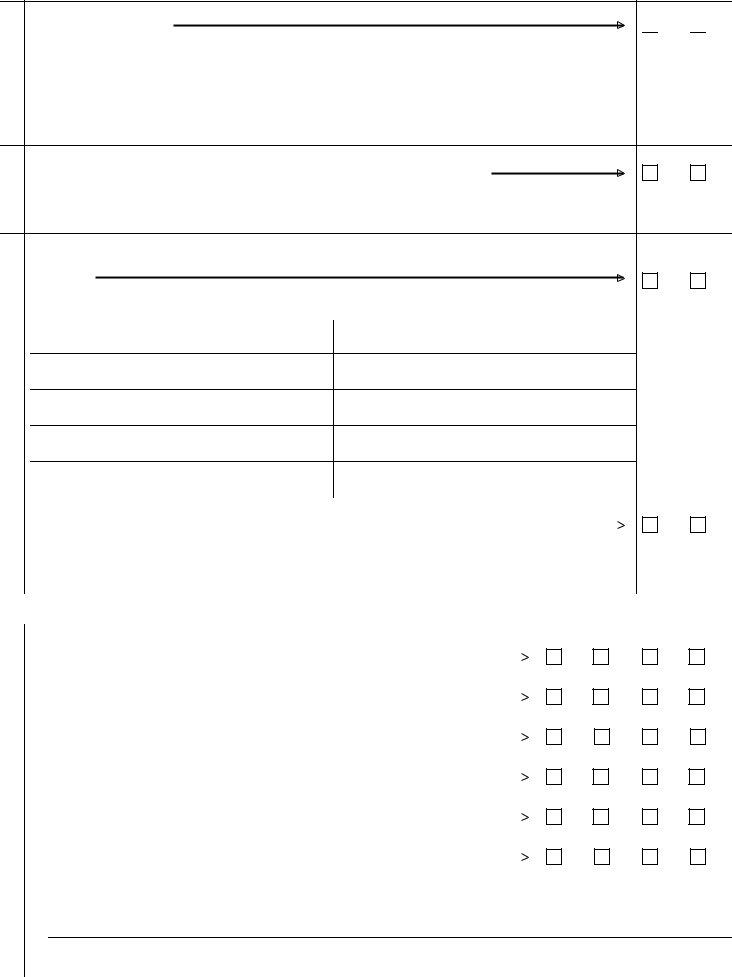

7. |

SINCE DATE ON PAGE 1, have you, or your spouse living with you, received any of |

|

|

|

||||||||||||||||

|

the following payments? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|||

|

• |

Support (alimony, child support) |

|

• |

Rental Income |

|

|

|

|

|

|

|

|

|||||||

|

• |

Interest/dividends (from bank accounts) |

• |

Pensions/Annuities |

|

|

|

|

|

|

|

|||||||||

|

• |

Any other cash payments or checks |

|

• |

Temporary Assistance for Needy Families |

|

|

|||||||||||||

|

|

(gifts, sick benefits, unemployment, or |

• |

Other |

|

|

|

|

|

|

|

|

||||||||

|

|

worker's compensation) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

DO NOT COUNT — Social Security, SSI, Food Stamps, Federal Civil Service Pensions, Railroad Retirement, Temporary Assistance for Needy Families or Veterans' Benefits

If you (or your spouse living with you) RECEIVED ANY OF THE PAYMENTS LISTED ABOVE, please give the following information:

TYPE OF PAYMENT RECEIVED |

PAYMENT AMOUNT |

HOW OFTEN RECEIVED |

8.a. Do you, or your spouse living with you, have any checking or savings accounts or any other funds in the bank? Include any accounts where you have direct deposit of

any money. |

|

|

|

YES NO |

If YES, please give the following information:

Name and Address of Financial Institution |

Type of Account |

Account Balance |

b. Does your name, or the name of your spouse living with you, appear on any other account |

|

|

|

|

that you do not consider your own? Include any accounts where you have direct deposit of any |

|

|

|

|

money. |

|

|

|

YES NO |

If YES, please give the following information: |

|

|

|

|

Name and Address of Financial Institution

Type of Account

Account Balance

Form

PAGE 2

9.

Do you, or your spouse living with you, have any cash at home, stocks, bonds, notes, or certificates of deposit?

If YES, please give the following information:

WHAT YOU HAVE |

THE VALUE OF WHAT YOU HAVE |

|

|

|

|

|

|

YES NO

10. Do you, or your spouse living with you, own any land or buildings or does your name appear |

|

on a deed or mortgage of any land or building where YOU DO NOT LIVE? |

YES NO |

This includes inherited property, property outside the United States and/or any property your name is on with other members of your family.

11.SINCE THE DATE ON PAGE 1, have you (or your spouse living with you) sold, transferred title, disposed of, or given away any money, or other property, including money or property in foreign

countries? |

YES |

NO |

|

If YES , please give the following information:

|

|

|

WHAT YOU SOLD, TRANSFERRED TITLE, |

THE VALUE OF THE PROPERTY |

|

DISPOSED OF, OR GAVE AWAY |

||

|

12. SINCE THE DATE ON PAGE 1, have you (or your spouse living with you) had any change |

|

|

|

|

|

|

|||||||||||||

|

in health insurance coverage or other insurance that pays for medical bills? |

|

|

|

|

|

|

|

|

YES |

NO |

||||||||

|

DO NOT INCLUDE |

|

|

|

|

|

|

|

|||||||||||

|

DO INCLUDE |

|

|

|

|

|

|

||||||||||||

|

|

for any reason. |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF YOU LIVE IN CALIFORNIA , PLEASE DO NOT ANSWER QUESTION 13 BELOW. |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13. |

|

|

|

|

|

|

|

|

|

|

|

|

You |

|

|

|

|

Your Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

a. Are you currently receiving food stamps? |

|

|

|

|

|

|

|

YES |

NO |

YES |

NO |

|||||||

|

If YES, go to "b." If NO, go to ''c.'' |

|

|

|

|

|

|

|

|||||||||||

|

b. Have you received a recertification notice within the past 30 days? |

|

|

|

YES |

NO |

YES |

NO |

|||||||||||

|

If YES, go to "e." If NO, go to question 14. |

|

|

|

|

|

|

|

|||||||||||

|

c. Have you filed for food stamps in the last 60 days? |

|

|

|

|

|

YES |

NO |

YES |

NO |

|||||||||

|

If YES, go to "d." If NO, go to ''e.'' |

|

|

|

|

|

|

|

|||||||||||

|

d. Have you received a favorable decision? |

|

|

|

|

YES |

NO |

YES |

NO |

||||||||||

|

If YES, go to question 14. If NO, go to "e." |

|

|

|

|

|

|

|

|||||||||||

|

e. Is everyone in the household applying for or receiving SSI? |

|

|

YES |

NO |

YES |

NO |

||||||||||||

|

|

|

|

||||||||||||||||

|

If YES go to "f." If NO, go to question 14. |

|

|

|

|

|

|

|

|||||||||||

|

f. May I take your food stamp application today? |

|

|

|

|

|

YES |

NO |

YES |

NO |

|||||||||

|

If YES, go to question 14. If NO, explain in "g." |

|

|

|

|

|

|

|

|||||||||||

|

g. Explanation |

|

|

|

|

|

|

|

|||||||||||

Form |

PAGE 3 |

||

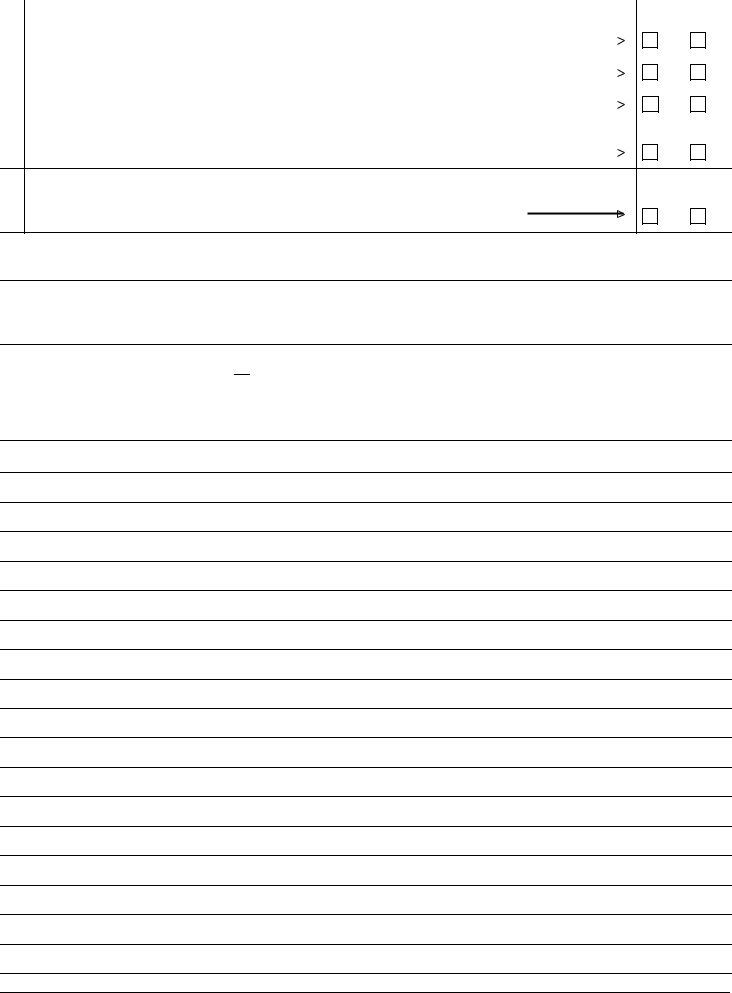

14. |

Please answer the following questions: |

|

|

|||||||

|

a. Are you age 62 or older? |

|

|

|

|

|

|

|

YES |

NO |

|

b. If you are age 50 or older, are you a widow(er)? |

|

|

|

|

|

YES |

NO |

||

|

c. If you are age 50 or older and divorced, is your divorced spouse deceased? |

|

|

|

|

YES |

NO |

|||

|

d. If you were disabled before age 22, do you have a parent who is age 62 or older, |

|

|

|||||||

|

or disabled, or deceased? |

|

|

|

|

YES |

NO |

|||

15.SINCE THE DATE ON PAGE 1, has a warrant been issued for your arrest in connection with a crime, or an attempt to commit a crime, that is a felony (or in New Jersey, a high misdemeanor) or

for violation of a condition of probation or parole under Federal or State law? |

YES |

NO |

|

If the address where you live is different from the address where you get your mail, please give the address where you live:

Address (Number, Street, City, State, ZIP Code)

Paperwork Reduction Act Statement - This information collection meets the requirements of 44 U.S.C. §3507, as amended by Section 2 of the Paperwork Reduction Act of 1995. You do not need to answer these questions unless we display a valid Office of Management and Budget control number. We estimate that it will take about 11 minutes to read the instructions, gather the facts, and answer the questions. SEND THE COMPLETED FORM TO YOUR LOCAL SOCIAL SECURITY OFFICE. To find the nearest office, call

REMARKS

Form |

PAGE 4 |

REMARKS (Continued)

IMPORTANT INFORMATION

•Failure to report any change within 10 days after the end of the month in which the change occurs could result in a penalty deduction.

•If you are disabled or blind, you must continue to accept any appropriate vocational rehabilitation services offered to you by the State agency to which we refer you.

AUTHORIZATIONS/SIGNATURES (Write in Ink)

I/We give permission for the Social Security Administration to check the information I/we have given on this form and to ask my employer(s) for information about my/our wages.

I/We declare under penalty of perjury that I/we have examined all the information on this form, and on any accompanying statements or forms, and it is true and correct to the best of my/our knowledge.

RECIPIENT SIGNATURE (Write in ink)

|

|

Your Signature (First name, middle initial, last name) |

Date |

Sign |

|

Here |

|

|

|

Spouse's Signature (First name, middle initial, last name) (Sign Only if Receiving |

Date |

SSI Payments) |

|

Sign |

|

Here |

|

|

|

WITNESSES (Write in ink) |

|

Area Code and Tele- phone Number Where You Can Be Reached

()

If you sign by mark (X), two people who know you must witness your signing. The witnesses must sign below and give their full names and addresses.

1. Signature of Witness

Address (Number, Street, City, State, ZIP Code)

2. Signature of Witness

Address (Number, Street, City, State, ZIP Code)

REPRESENTATIVE PAYEE (Write in ink)

|

Your Title or Relationship to the Recipient |

Area Code and Telephone Number |

Address (Number, Street, City, State, ZIP Code) |

|

|

|

Where You Can Be Reached |

|

|

|

|

( |

) |

|

|

|

|

|

|

Your full name (First name, middle initial, last |

name) |

|

Date |

|

Please print here

Please sign here

Form |

PAGE 5 |

KEEP THIS PAGE FOR YOUR RECORDS

NAME |

|

|

|

|

|

|

SOCIAL SECURITY NUMBER |

|

|

|

|

|

DATE |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/ |

|

|

|

/ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

NAME |

|

|

|

|

|

|

SOCIAL SECURITY NUMBER |

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

/ |

/ |

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Telephone Number (include area code) to call |

Social Security Office you may visit in person or mail things to: |

||||||||||||||||||||||||||

if you have a question or something to report. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

( |

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Privacy Act

Statement

Collection and Use of Personal Information Section 1611(c) of the Social Security Act, and 20 CFR 416.204, authorizes us to collect this information. The information you provide us on this form will be used to determine if you continue to be eligible for supplemental security income payments. Completion of this form is voluntary; however, failure to provide all or part of the information could prevent an accurate and timely decision on your continuing eligibility for benefits. We rarely use this information you supply for any purpose other than for determining continuing eligibility. However, we may use it for the administration and integrity of Social Security programs. We may also disclose information to another person or to another agency in accordance with approved routine uses, which include but are not limited to the following:

1.To enable a third party or an agency to assist Social Security in establishing rights to Social Security benefits and/or coverage;

2.To comply with Federal laws requiring the release of information from Social Security records (e.g., to the Government Accountability Office and Department of Veterans' Affairs);

3.To make determinations for eligibility in similar health and income maintenance programs at the Federal, State, and local level; and,

4.To facilitate statistical research, audit, or investigative activities necessary to assure the integrity and improvement of Social Security programs. We may also use the information you provide in computer matching programs. Matching programs compare our records with records kept by other Federal, State, or local government agencies. Information from these matching programs can be used to establish or verify a person's eligibility for

You Must |

The amount of your SSI check is based on the information you tell us. To continue getting the right |

|||

Report |

payment amount, you must report certain changes that happen to you. |

|

|

|

Certain |

You must tell us about changes within 10 days after the month they happen. If you do not report |

|||

Changes |

changes, we may have to take as much as $25, $50, or $100 out of future checks you receive. |

|||

|

You must also report changes in income for your ineligible spouse or children who live with you, or your sponsor or |

|||

|

sponsor's spouse if you are an alien. You must also report if any of these people buy or sell anything of value. |

|||

|

Remember, changes could make your check bigger or smaller. A List of Most of the Changes You Must Report Is |

|||

|

On The Next Page. |

|

|

|

|

|

|

|

|

How To |

There are several ways you can report changes: |

|

|

|

Report |

• |

Call us, toll free, at |

|

|

Changes |

|

|

||

• |

Call your local Social Security Office at the number above. |

|

|

|

|

|

|

||

|

• |

By mail or in person |

|

|

|

|

|

||

Are You |

If you would like to work or if you are already working and would like to earn more, you should know about SSI rules |

|||

Working |

known as work incentives. These rules can help you keep your Medicaid and help you keep getting some SSI even though |

|||

or Would |

you are working. |

|

|

|

You Like |

|

|

|

|

to work |

If you want to know more about these rules, call us, toll free, at |

or write |

||

|

or visit any Social Security office. |

|

|

|

|

If you call or visit, ask to speak to someone about work incentives. |

|

|

|

|

|

|

||

Important |

You can apply for food stamps at the Social Security Office if you and everyone in your household get or apply for |

|||

Facts About |

SSI. |

|

|

|

Food Stamps |

The Social Security Office will help you fill out the food stamp application. You do not have to go to the food stamp |

|||

|

||||

|

office to apply. |

|

|

|

|

|

|

||

Form |

PAGE 6 |

|||

CHANGES TO REPORT

WHERE YOU LIVE - You must report to Social Security if:

•You move.

•You (or your spouse) leave your household for a calendar month or longer. For example, you enter

a hospital or visit a relative.

•You leave the United States for 30 days or more.

•You enter a jail, prison, or other penal institution.

•You are released from a hospital, nursing home, etc.

•You are no longer a legal resident of the United States.

HOW YOU LIVE - You must report to Social Security if:

•Someone moves into or out of your household.

•The amount of money you pay toward household expenses changes.

•There are births and deaths of any people with whom you live.

•Your marital status changes:

-You get married, separated, divorced, or your marriage is annulled.

-You separate from your spouse or start living together again after a separation.

-You begin living with someone as husband and wife.

INCOME - You must report to Social Security if:

•The amount of money (or checks or any other type of payment) you receive from someone or someplace goes up or down or you start to receive money (or checks or any other type of payment).

•You start work or stop work.

•Your earnings go up or down.

HELP YOU GET FROM OTHERS - You must report to Social Security if:

• The amount of help (money, food, clothing, or |

• |

Someone stops helping you. |

payment of household expenses) you receive goes |

• |

Someone starts helping you. |

up or down. |

|

|

THINGS OF VALUE THAT YOU OWN - You must report to Social Security if:

•The value of your resources goes over $2,000 when you add them all together ($3,000 if you are married and live with your spouse).

•You sell or give any things of value away.

•You buy or are given anything of value.

A WARRANT HAS BEEN ISSUED FOR YOUR ARREST - You must report to Social Security if:

•You flee prosecution or to avoid custody or confine- ment after conviction for a crime, or an attempt to commit a crime, which is a felony (or in New Jersey, a high misdemeanor).

•You violate a condition of your parole or probation under Federal or State law.

YOU ARE BLIND OR DISABLED - You must report to Social Security if:

•Your condition improves or your doctor says you can return to work.

•You go to work.

YOU ARE UNMARRIED AND UNDER AGE 22 - You must report to Social Security if:

•You are under age 18 and live with your parent(s), ask your parents to report if they have a change in income, a change in their marriage, a change in the value of anything they own, or either has a change in residence.

•You get married.

•There are changes in the income, school attendance (if between the ages of 18 and 21), or marital status of ineligible children who live in your household.

YOUR IMMIGRATION AND NATURALIZATION SERVICE (INS) STATUS CHANGES - You must report any changes to Social Security.

YOU ARE A REPRESENTATIVE PAYEE - You must report to Social Security if:

•The person for whom you receive SSI checks has any of the changes listed above. (You may be held liable if you do not report changes that could affect the SSI recipient's payment amount, and he/she is overpaid.)

•You will no longer be able or no longer wish to act as the person's representative payee.

Form |

PAGE 7 |