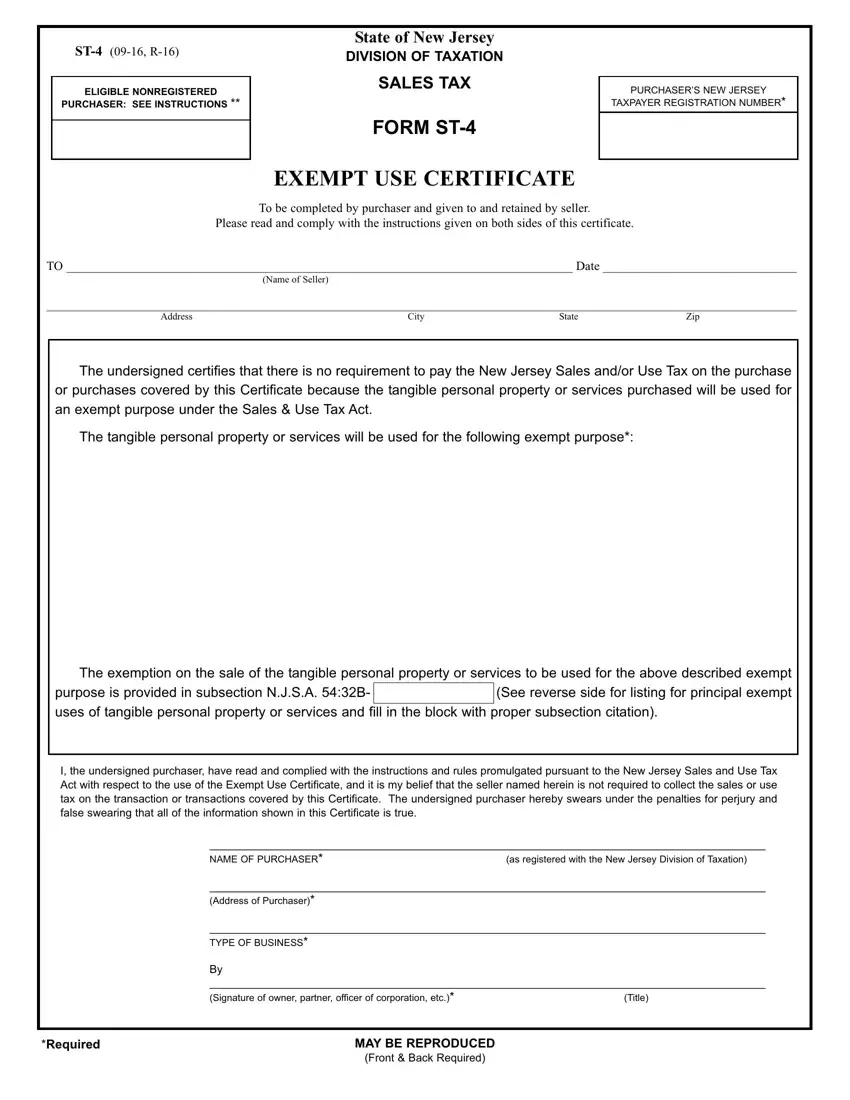

ST-4 (09-16, R-16)

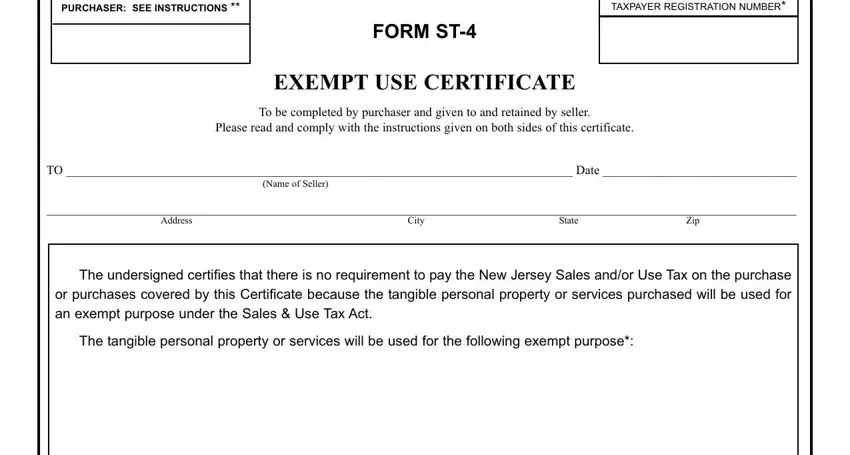

ELIGIBLE NONREGISTERED

PURCHASER: SEE INSTRUCTIONS **

State of New Jersey

DIVISION OF TAXATION

SALES TAX

FORM ST-4

EXEMPT USE CERTIFICATE

PURCHASER’S NEW JERSEY

TAXPAYER REGISTRATION NUMBER*

To be completed by purchaser and given to and retained by seller.

Please read and comply with the instructions given on both sides of this certificate.

TO _________________________________________________________________________________ Date _______________________________

(Name of Seller)

________________________________________________________________________________________________________________________

The undersigned certifies that there is no requirement to pay the New Jersey Sales and/or Use Tax on the purchase or purchases covered by this Certificate because the tangible personal property or services purchased will be used for an exempt purpose under the Sales & Use Tax Act.

The tangible personal property or services will be used for the following exempt purpose*:

The exemption on the sale of the tangible personal property or services to be used for the above described exempt

purpose is provided in subsection N.J.S.A. 54:32B-

(See reverse side for listing for principal exempt uses of tangible personal property or services and fill in the block with proper subsection citation).

(See reverse side for listing for principal exempt uses of tangible personal property or services and fill in the block with proper subsection citation).

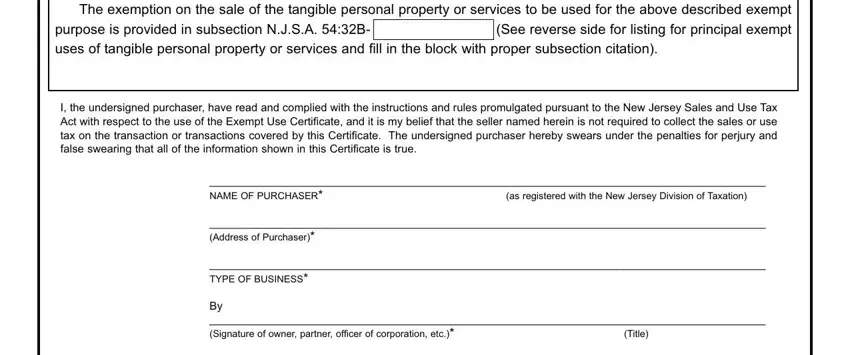

I, the undersigned purchaser, have read and complied with the instructions and rules promulgated pursuant to the New Jersey Sales and Use Tax Act with respect to the use of the Exempt Use Certificate, and it is my belief that the seller named herein is not required to collect the sales or use tax on the transaction or transactions covered by this Certificate. The undersigned purchaser hereby swears under the penalties for perjury and false swearing that all of the information shown in this Certificate is true.

__________________________________________________________________________________________

|

NAME OF PURCHASER* |

(as registered with the New Jersey Division of Taxation) |

|

__________________________________________________________________________________________ |

|

(Address of Purchaser)* |

|

|

__________________________________________________________________________________________ |

|

TYPE OF BUSINESS* |

|

|

By |

|

|

__________________________________________________________________________________________ |

|

(Signature of owner, partner, officer of corporation, etc.)* |

(Title) |

|

|

|

*Required |

MAY BE REPRODUCED |

|

INSTRUCTIONS FOR USE OF EXEMPT USE CERTIFICATES - ST-4 |

(09-16) |

1.Registered sellers who accept fully completed exemption certificates within 90 days subsequent to the date of sale are relieved of liability for the collection and payment of sales tax on the transactions covered by the exemption certificate. The following information must be obtained from a purchaser in order for the exemption certificate to be fully completed:

•Purchaser’s name and address;

•Type of business;

•Reasons(s) for exemption;

•Purchaser’s New Jersey tax identification number or, for a purchaser that is not registered in New Jersey, the Federal employer identification number or out-of-State registration number. Individual purchasers must include their driver’s license number;

•If a paper exemption certificate is used (including fax), the signature of the purchaser.

The seller’s name and address are not required and are not considered when determining if an exemption certificate is fully completed. A seller that enters data elements from paper into an electronic format is not required to retain the paper exemption certificate.

The seller may, therefore, accept this certificate as a basis for exempting sales to the signatory purchaser and is relieved of liability even if it is determined that the purchaser improperly claimed the exemption. If it is determined that the purchaser improperly claimed an exemption, the purchaser will be held liable for the nonpayment of the tax.

2.Retention of Certificates - Certificates must be retained by the seller for a period of not less than four years from the date of the last sale covered by the certificate. Certificates must be in the physical possession of the seller and available for inspection.

3.Acceptance of an exemption certificate in an audit situation – On and after October 1, 2011, if the seller either has not obtained an exemption certificate or the seller has obtained an incomplete exemption certificate, the seller has at least 120 days after the Division’s request for substantiation of the claimed exemption to either:

1.Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that:

(a)was statutorily available on the date of the transaction, and

(b)could be applicable to the item being purchased, and

(c)is reasonable for the purchaser’s type of business; OR

2.Obtain other information establishing that the transaction was not subject to the tax.

If the seller obtains this information, the seller is relieved of any liability for the tax on the transaction unless it is discovered through the audit process that the seller had knowledge or had reason to know at the time such information was provided that the information relating to the exemption claimed was materially false or the seller otherwise knowingly participated in activity intended to purposefully evade the tax that is properly due on the transaction. The burden is on the Division to establish that the seller had knowledge or had reason to know at the time the information was provided that the information was materially false.

4.Common exempt uses of property or services for which the ST-4 is applicable follow.

NOTE: The descriptions are general and do not necessarily cover every exempt use or service or every condition for exemption. Further information is available from the Division of Taxation.

•Sales of machinery and equipment for use directly and primarily in the production of property by manufacturing, processing, assembling or refining. N.J.S.A. 54:32B-8.13a.

•Sales of equipment to a telecommunication service provider subject to the jurisdiction of the BPU or the FCC for use directly and primarily in providing interactive telecommunications services for sale. N.J.S.A. 54:32B-8.13c.

•Sales of tangible personal property for use directly and exclusively in experimental research and development in the laboratory sense. N.J.S.A. 54:32B- 8.14.

•Sales of wrapping materials or non-returnable containers for use in the delivery of tangible personal property or sales of containers for use in a farming enterprise. N.J.S.A. 54:32B-8.15.

•Sales of busses to regulated bus companies for public passenger transportation or to carriers for use in school children transportation services. N.J.S.A. 54:32B-8.28.

•Sales of equipment for use directly and primarily in the production department of a newspaper plant or for use in the production of property for sale by a commercial printer. N.J.S.A. 54:32B-8.29.

•Sales of advertising material to be published in a newspaper. N.J.S.A. 54:32B-8.30.

•Sales of aircraft or repair services to an “air carrier,” and repairs to certain business aircraft, including machinery or equipment installed on such. N.J.S.A. 54:32B-8.35.

•Sales of equipment used exclusively to sort and prepare solid waste for recycling or in recycling (does not include motor vehicles). N.J.S.A. 54:32B- 8.36.

•Sales of printed advertising materials for out-of-state distribution and sales of direct-mail processing services rendered in connection with the distribution of such materials to out-of-state recipients. N.J.S.A. 54:32B-8.39.

•Sales of commercial trucks, truck tractors and semi-trailers which are properly registered and 1) have a gross vehicle weight rating in excess of 26,000 pounds; or 2) are operated actively and exclusively for the carriage of interstate freight under a certificate or permit issued by the Interstate Commerce Commission; or 3) are registered as a farm vehicle under the Motor Vehicle Statute (N.J.S.A. 39:3-24 and 25) and have a gross vehicle weight rating in excess of 18,000 pounds. N.J.S.A. 54:32B-8.43.

INSTRUCTIONS FOR USE OF EXEMPT USE CERTIFICATES - ST-4 |

(09-16) |

•Sales of machinery and equipment used directly and primarily in producing broadcast programming or cable/satellite television programming. N.J.S.A. 54:32B-8.13e.

•Sales of tangible property for use directly and primarily in the production of film or video for sale, including motor vehicles, parts, supplies and services to such property.. N.J.S.A. 54:32B-8.49.

•Sales of commercial ships and charges for components, repair and alteration services for commercial ships. N.J.S.A. 54:32B-8.12.

•Sales of materials, such as chemicals and catalysts, used to induce or cause a refining or chemical process. N.J.S.A. 54:32B-8.20

•Sales of electronically delivered computer software that is used directly and exclusively in the conduct of the purchaser’s business, trade, or occupation. N.J.S.A. 54:32B-8.56.

**5. Eligible Nonregistered Purchaser - If the purchaser is not required to be registered for sales and use tax purposes in New Jersey, in the box at the top, left corner of the form marked “Eligible Nonregistered Purchaser” the purchaser is required to place one of the following in order of preference: 1) the Federal Identification Number of the business; 2) out of state registration number.

Private reproduction of both sides of the Exempt Use Certificates may be made without the prior permission of the Division of Taxation.

FOR MORE INFORMATION: Read publication S&U-6 (Sales Tax Exemption Administration) at

http://www.state.nj.us/treasury/taxation/pdf/pubs/sales/su6.pdf

DO NOT MAIL THIS FORM TO THE DIVISION OF TAXATION

This form is to be completed by purchaser and given to and retained by seller.

(See reverse side for listing for principal exempt uses of tangible personal property or services and fill in the block with proper subsection citation).

(See reverse side for listing for principal exempt uses of tangible personal property or services and fill in the block with proper subsection citation).