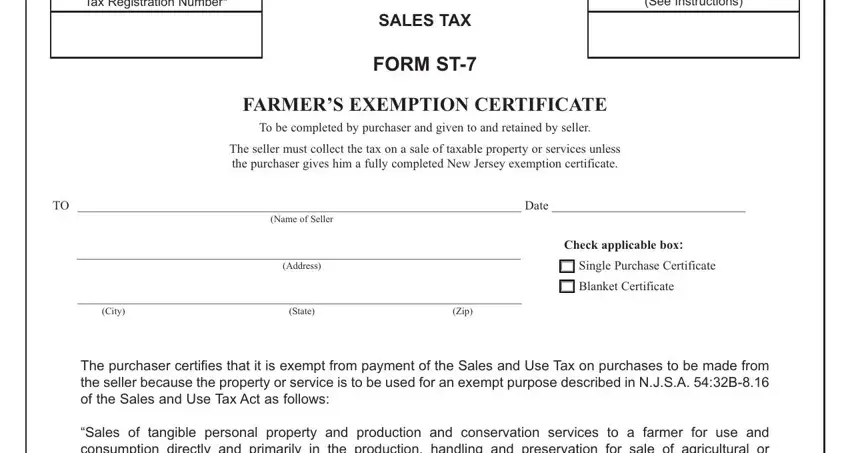

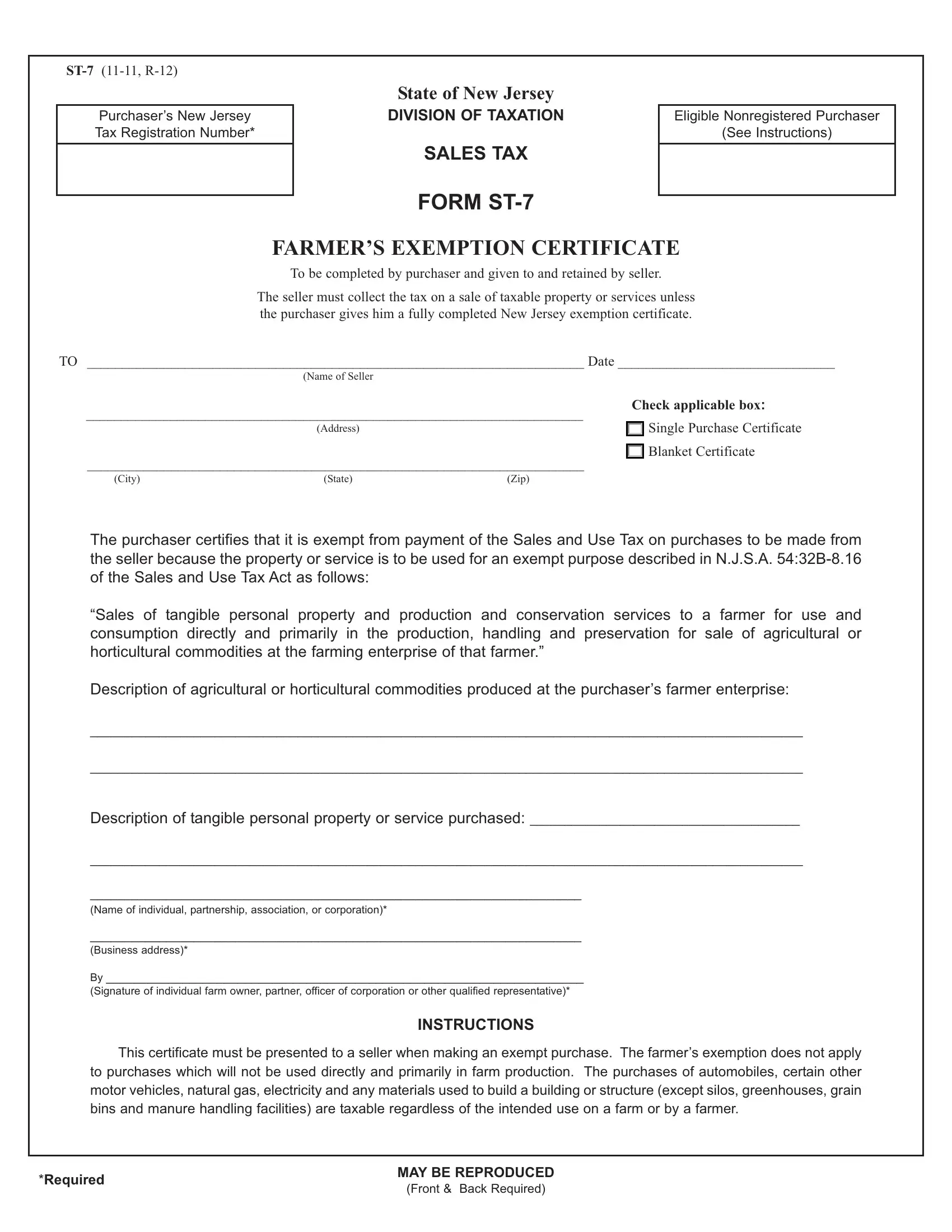

ST-7 (11-11, R-12)

Purchaser’s New Jersey Tax Registration Number*

State of New Jersey

DIVISION OF TAXATION

SALES TAX

FORM ST-7

Eligible Nonregistered Purchaser

(See Instructions)

FARMER’S EXEMPTION CERTIFICATE

To be completed by purchaser and given to and retained by seller.

The seller must collect the tax on a sale of taxable property or services unless the purchaser gives him a fully completed New Jersey exemption certificate.

TO _______________________________________________________________________ Date _______________________________

|

(Name of Seller |

|

|

|

_______________________________________________________________________ |

Check applicable box: |

|

|

|

(Address) |

|

|

Single Purchase Certificate |

_______________________________________________________________________ |

|

Blanket Certificate |

|

|

|

(City) |

(State) |

(Zip) |

|

|

The purchaser certifies that it is exempt from payment of the Sales and Use Tax on purchases to be made from the seller because the property or service is to be used for an exempt purpose described in N.J.S.A. 54:32B-8.16 of the Sales and Use Tax Act as follows:

“Sales of tangible personal property and production and conservation services to a farmer for use and consumption directly and primarily in the production, handling and preservation for sale of agricultural or horticultural commodities at the farming enterprise of that farmer.”

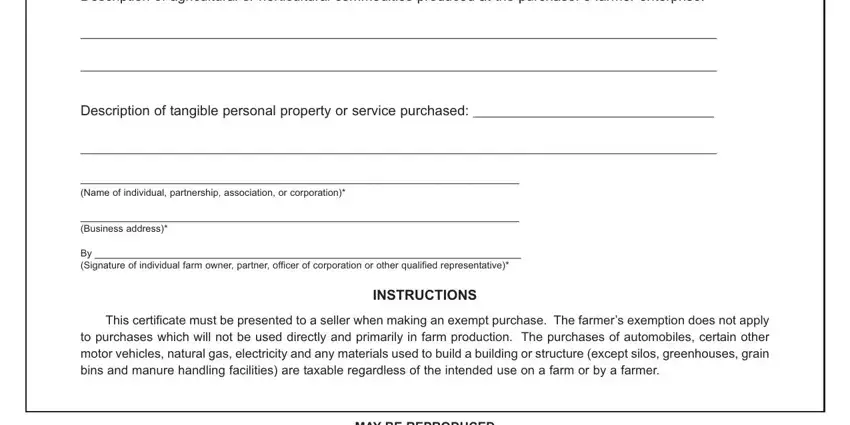

Description of agricultural or horticultural commodities produced at the purchaser’s farmer enterprise:

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

Description of tangible personal property or service purchased: _______________________________________

_______________________________________________________________________________________________________

_______________________________________________________________________

(Name of individual, partnership, association, or corporation)*

_______________________________________________________________________

(Business address)*

By _____________________________________________________________________

(Signature of individual farm owner, partner, officer of corporation or other qualified representative)*

INSTRUCTIONS

This certificate must be presented to a seller when making an exempt purchase. The farmer’s exemption does not apply to purchases which will not be used directly and primarily in farm production. The purchases of automobiles, certain other motor vehicles, natural gas, electricity and any materials usedto builda building or structure (except silos, greenhouses, grain bins and manure handling facilities) are taxable regardless of the intended use on a farm or by a farmer.

|

*Required |

MAYBE REPRODUCED |

|

(Front & Back Required) |

|

|

INSTRUCTIONS FOR USE OFFARMER’S EXEMPTION CERTIFICATE (ST-7)

1.ScopeofFarmer’sExemption-This certificate may be used only by businesses that are treated as “farming enterprises” under N.J.S.A. 54:32B-8.16 of the Sales and Use TaxAct. A“farming enterprise” means an enterprise using land to raise agricultural or horticultural commodities for sale. Farming enterprises include, but are not limited to, enterprises producing dairy products, poultry, feed crops, fruit, vegetables, livestock, fur animals, timber, ornamental plants, bees and apiary products.

NOTE: For sales and use tax purposes, a “farming enterprise” does not include an enterprise that is primarily engaged in boarding or training horses or in selling agricultural or horticultural products produced by others.

The farmer’s exemption applies only to sales of tangible personal property or services which will be used directly and primarily in agricultural or horticultural production. It does not apply to sales of: motor vehicles, natural gas, electricity, or property to be used to construct a building or structure (with the exception of silos, greenhouses, grain bins, or manure handling facilities).

NOTE: Whenpurchasingatruckortrucktractorwithagrossvehicleweightratingofmorethan18,000poundswhichisregisteredwiththeNewJersey Division of MotorVehicles as a farm vehicle or a commercial over-the-road truck with a gross vehicle weight rating over 26,000 pounds which isregisteredinNewJersey,thepurchasermustuseanExemptUseCertificate(ST-4)ratherthanaFarmer’sExemptionCertificate. SeeN.J.S.A. 54:32B-8.43.

2.Registered sellers who accept fully completed exemption certificates within 90 days subsequent to the date of sale are relieved of liability for the collection and payment of sales tax on the transactions covered by the exemption certificate. The following information must be obtained from a purchaser in order for the exemption certificate to be fully completed:

•Purchaser’s name and address;

•Type of business;

•Reasons(s) for exemption;

•Purchaser’s New Jersey tax identification number or, for a purchaser that is not registered in New Jersey, the Federal employer identification number or out-of-State registration number. Individual purchasers must include their driver’s license number;

•If a paper exemption certificate is used (including fax), the signature of the purchaser.

The seller’s name andaddressare not required and are not considered when determining if an exemption certificate is fully completed. A seller that enters data elements from paper into an electronic format is not required to retain the paper exemption certificate.

The seller may, therefore, accept this certificate as a basis for exempting sales to the signatory purchaser and is relieved of liability even if it is determined that the purchaser improperly claimed the exemption. If it is determined that the purchaser improperly claimed an exemption, the purchaser will be held liable for the nonpayment of the tax.

3.Retention of Certificates - Certificates must be retained by the seller for a period of not less than four years from the date of the last sale covered by the certificate. Certificates must be in the physical possession of the seller and available for inspection.

4.Acceptance of an exemption certificate in an audit situation – On and after October 1, 2011, if the seller either has not obtained an exemption certificate or the seller has obtained an incomplete exemption certificate, the seller has at least 120 days after the Division’s request for substantiation of the claimed exemption to either:

1.Obtain a fully completed exemption certificate from the purchaser, taken in good faith, which, in an audit situation, means that the seller obtain a certificate claiming an exemption that:

(a)was statutorily available on the date of the transaction, and

(b)could be applicable to the item being purchased, and

(c)is reasonable for the purchaser’s type of business; OR

2.Obtain other information establishing that the transaction was not subject to the tax.

If the seller obtains this information, the seller is relieved of any liability for the tax on the transaction unless it is discovered through the audit process that the seller had knowledge or had reason to know at the time such information was provided that the information relating to the exemption claimed was materially false or the seller otherwise knowingly participated in activity intended to purposefully evadethetaxthatisproperlydueonthetransaction.TheburdenisontheDivisiontoestablishthatthesellerhadknowledgeorhadreason to know at the time the information was provided that the information was materially false.

5.Blanket Certificates - Aseller may permit a purchaser to file a blanket Farmer’s Exemption Certificate to cover future purchases of similar items of tangible personal property. However, each subsequent sales slip or purchase invoice based on such blanket certificate must be clearly marked with the purchaser’s name, address, and identification number.

6.Eligible NonregisteredPurchaser- If the purchaser is not required to be registered with the New Jersey Division ofTaxation and does not have a New JerseyTax Registration Number, the purchaser is required to place either his Federal Identification Number or, if a sole proprietor, the last three digits of his Social Security Number in the box at the top, right corner of the form marked “Eligible Nonregistered Purchaser.” Note: Any New Jersey farmer who is not a sole proprietor, or who sells any goods or services subject to sales tax, or who is an employer, must be registered with the New Jersey Division of Taxation and therefore cannot be an “eligible nonregistered purchaser”.

REPRODUCTION OFFARMER’S EXEMPTION CERTIFICATES:

Private reproduction of both sides of these certificates may be made without the prior permission of the Division of Taxation

FOR MORE INFORMATION:

Call the Customer Service Center (609) 292-6400. Send an e-mail to: nj.taxation@treas.state.nj.us. Write to: New Jersey Division of Taxation, Information and Publications Branch, PO Box 281, Trenton, NJ 08695-0281.