|

Due date of return. File Form 1040 or |

The Families First Coronavirus Re- |

$72,000 or less, or make an appointment |

|

don’t live in theDRAFTDistrict of Columbia. If |

ASfile yourOF2021 return after November 30, |

|

1040-SR by April 18, 2022. The due |

sponse Act (FFCRA) helped self-em- |

to visit a Taxpayer Assistance Center. |

|

date is April 18, instead of April 15, be- |

ployed individuals affected by coronavi- |

Direct deposit now available for re- |

|

cause of the Emancipation Day holiday |

rus by providing paid sick leave and |

turns filed late. You can now receive a |

|

in the District of Columbia – even if you |

paid family leave credits equivalent to |

direct deposit of your refund even if you |

|

|

|

|

those that employers are required to pro- |

|

|

2021 |

|

December 3, |

|

you live in Maine or Massachusetts, you |

vide their employees for qualified sick |

2022. |

|

|

|

|

|

|

have until April 19, 2022. That is be- |

leave wages and qualified family leave |

Expanded dependent care assistance. |

|

cause of the Patriots' Day holiday in |

wages. The COVID-related Tax Relief |

ARP expanded the child and dependent |

|

those states. |

|

Act of 2020 extended the period during |

care tax credit for 2021 by making it re- |

|

Tuition and fees deduction not availa- |

which individuals can claim these cred- |

fundable for certain taxpayers and mak- |

|

its. For more information, see the in- |

|

ble. The tuition and fees |

deduction is |

ing it larger. For 2021, the dollar limit |

|

structions for Form 7202 and Schedule |

|

not available after 2020. Instead, the in- |

on |

qualifying |

expenses |

increases |

to |

|

3, line 13b. |

|

|

come limitations for the lifetime learn- |

|

$8,000 for one |

qualifying person |

and |

|

Extension and expansion of credits for |

|

ing credit have been increased. See |

$16,000 for two or more qualifying per- |

|

Form 8863 and its instructions. |

sick and family leave. The American |

sons. The rules for calculating the credit |

|

Economic |

impact payment—EIP 3. |

Rescue Plan Act of 2021, enacted on |

have also changed; the percentage of |

|

Any economic impact payment you re- |

March 11, 2021 (ARP) provides that |

qualifying expenses eligible for the |

|

ceived is not taxable for federal income |

certain self-employed individuals can |

credit has increased, along with the in- |

|

tax purposes, but will reduce your re- |

claim credits for up to 10 days of “paid |

come limit at which the credit begins |

|

covery rebate credit. |

|

sick leave,” and up to 60 days of “paid |

phasing out. Additionally, for taxpayers |

|

2021 Recovery rebate credit. This |

family leave,” if they are unable to work |

who receive dependent care benefits |

|

or telework due to circumstances related |

from their employer, the dollar limit of |

|

credit is figured like last year's economic |

to coronavirus. Self-employed individu- |

the exclusion amount increases for 2021. |

|

impact payment, EIP 3, except eligibili- |

als may claim these credits for the peri- |

For more information, see the Instruc- |

|

ty and the amount of the credit are based |

od beginning on April 1, 2021, and end- |

tions for Form 2441 and Pub. 503. |

|

|

on your tax year 2021 information. See |

ing September 30, 2021. For more |

Child tax credit. Under ARP, the child |

|

the instructions for line 30 and the Re- |

information, see the instructions for |

|

covery Rebate Credit Worksheet to fig- |

Form 7202 and Schedule 3, line 13h. |

tax credit has been enhanced for 2021. |

|

ure your credit amount. |

|

Form 9000, Alternative Media Prefer- |

The child tax credit has been extended |

|

Standard deduction amount in- |

to qualifying children under age 18. De- |

|

ence. Beginning in 2021, taxpayers |

pending on modified adjusted gross in- |

|

creased. For 2021, the standard deduc- |

with print disabilities can use Form |

come, you may receive an enhanced |

|

tion amount has been increased for all |

9000, Alternative Media Preference, to |

credit amount of up to $3,600 for a qual- |

|

filers. The amounts are: |

|

elect to receive notices from the IRS in |

ifying child under |

age |

6 and up |

to |

|

• Single or Married filing separate- |

an alternative format including Braille, |

$3,000 for a qualifying child over age 5 |

|

ly—$12,550. |

|

large print, audio, and electronic. You |

and under age 18. The enhanced credit |

|

• Married filing jointly or Qualify- |

can attach Form 9000 to your Form |

amount begins to phase out where modi- |

|

ing widow(er)—$25,100. |

|

1040 or 1040-SR or you can mail it sep- |

fied |

|

adjusted |

gross |

income exceeds |

|

• Head of household—$18,800. |

arately. For more information, see Form |

$150,000 in the case of a joint return or |

|

Virtual currency. If, in 2021, you en- |

9000. |

|

surviving spouse, $112,500 in the case |

|

gaged in a transaction involving virtual |

All taxpayers now eligible for Identity |

of a head of household, and $75,000 in |

|

currency, you will need to answer “Yes” |

Protection PIN. Beginning in 2021, the |

all other cases. |

|

|

|

|

|

to the question on page 1 of Form 1040 |

IRS Identity Protection PIN (IP PIN) |

If you (or your spouse if filing joint- |

|

or 1040-SR. See Virtual Currency, later, |

Opt-In Program has been expanded to |

ly) lived in the United States for more |

|

for information on transactions involv- |

all taxpayers who can properly verify |

than half the year, the child tax credit |

|

ing virtual currency. Do not leave this |

their identity. An IP PIN helps prevent |

will be fully refundable even if you don't |

|

field blank. The question must be an- |

your social security number from being |

have earned income. If you don't meet |

|

swered by all taxpayers, not just taxpay- |

used to file a fraudulent federal income |

this residency requirement, your child |

|

ers who engaged in a transaction involv- |

tax return. You can use the Get An IP |

tax credit will be a combination of a |

|

ing virtual currency. |

|

PIN tool on IRS.gov to request an IP |

nonrefundable child tax credit and a re- |

|

Credits for sick and family leave for |

PIN, file Form 15227 if your income is |

fundable additional child tax credit, as |

|

certain |

self-employed |

individuals. |

|

|

was the case in 2020. The credit for oth- |

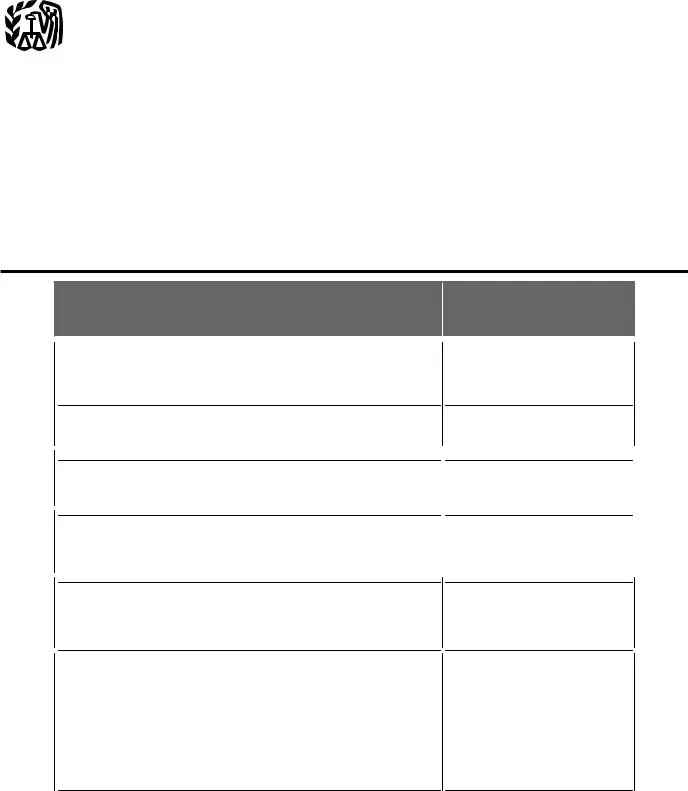

1040

1040

Helpful Hints

Helpful Hints Schedule 2, Part I

Schedule 2, Part I

Schedule 2, Part II

Schedule 2, Part II