Our top web developers have worked together to implement the PDF editor you are going to take advantage of. This particular software makes it simple to get utah seller financing addendum documents shortly and conveniently. This is certainly all you have to conduct.

Step 1: On the following website page, hit the orange "Get form now" button.

Step 2: The document editing page is now open. It's possible to add information or manage present information.

Enter the required material in every single section to fill out the PDF utah seller financing addendum

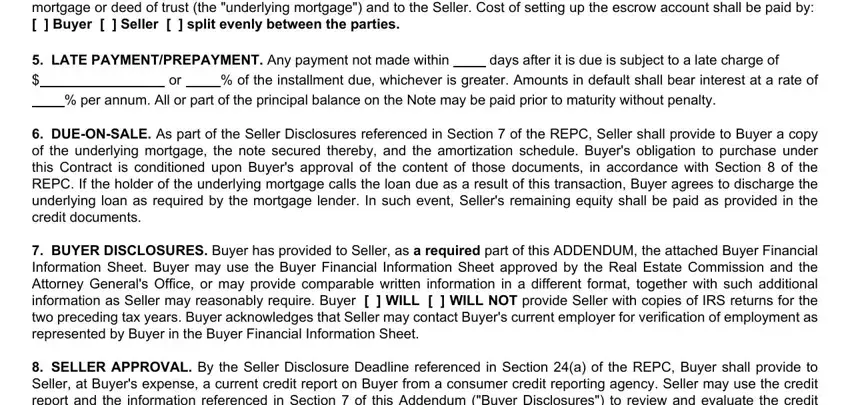

Write the expected particulars in the PAYMENT Buyers payments under, LATE PAYMENTPREPAYMENT Any, of the installment due whichever, days after it is due is subject to, per annum All or part of the, DUEONSALE As part of the Seller, BUYER DISCLOSURES Buyer has, and SELLER APPROVAL By the Seller box.

Write the vital data when you are on the SELLER APPROVAL By the Seller, Page of, and Buyers Initials Date Sellers area.

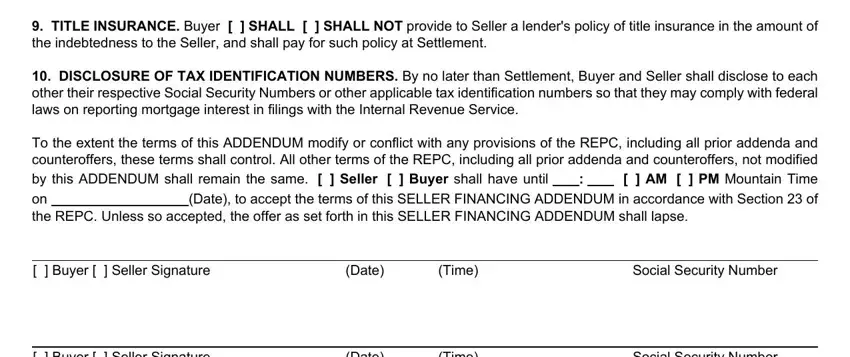

The Failure to Cancel or Resolve, TITLE INSURANCE Buyer SHALL, DISCLOSURE OF TAX IDENTIFICATION, To the extent the terms of this, Buyer, Seller Signature, Date, Time, Social Security Number, Buyer, Seller Signature, Date, Time, and Social Security Number space is the place where each side can indicate their rights and obligations.

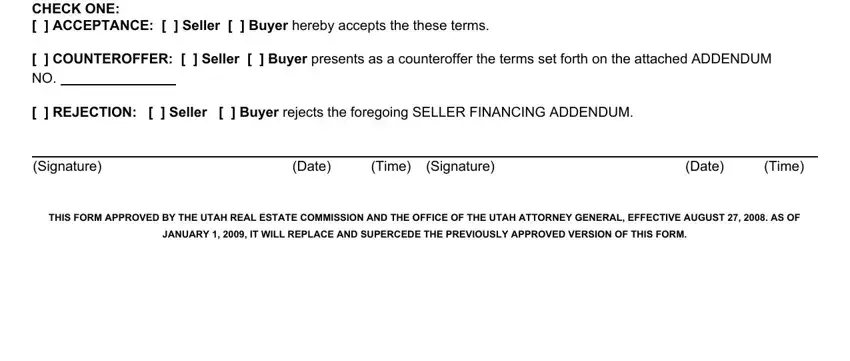

End by analyzing the following sections and filling them in as required: CHECK ONE ACCEPTANCE Seller, COUNTEROFFER Seller Buyer, REJECTION, Seller, Buyer rejects the foregoing, Signature, Date, Time, Signature, Date, Time, THIS FORM APPROVED BY THE UTAH, and JANUARY IT WILL REPLACE AND.

Step 3: Once you've hit the Done button, your form will be available for transfer to every device or email you identify.

Step 4: You will need to create as many copies of your file as possible to remain away from possible misunderstandings.