Using the online PDF editor by FormsPal, you can easily fill in or alter Wisconsin Wt 7 Tax Form here. In order to make our tool better and simpler to work with, we continuously develop new features, with our users' suggestions in mind. Getting underway is easy! All you should do is adhere to the following easy steps down below:

Step 1: First, open the tool by pressing the "Get Form Button" above on this webpage.

Step 2: With our advanced PDF editor, you can do more than simply fill in blanks. Edit away and make your forms appear high-quality with customized textual content incorporated, or modify the file's original content to excellence - all that comes with the capability to add any type of images and sign the file off.

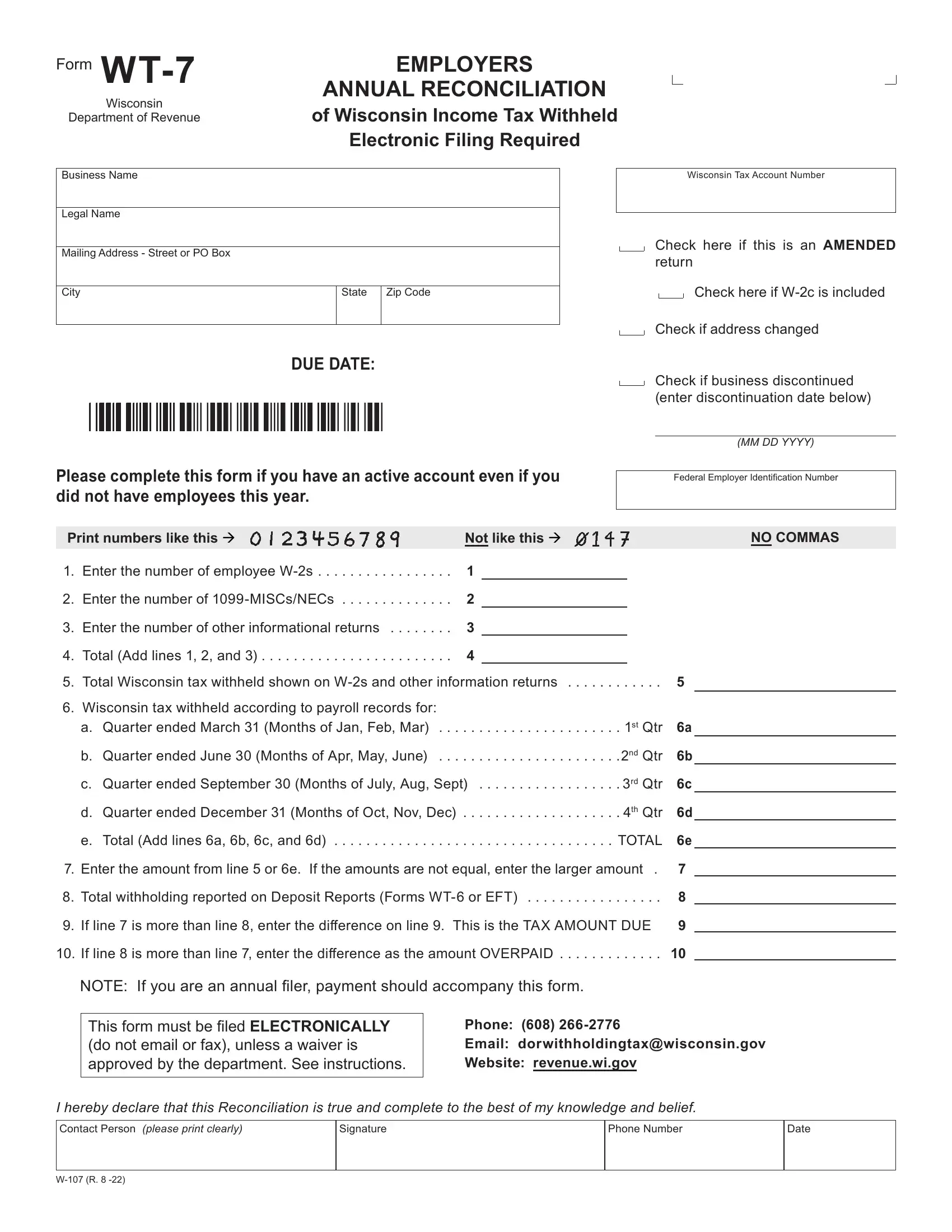

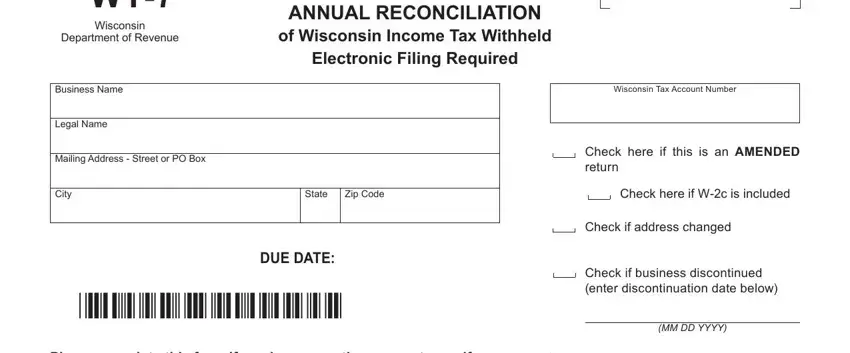

This PDF doc needs specific details; to ensure correctness, you should take note of the tips just below:

1. While filling in the Wisconsin Wt 7 Tax Form, ensure to complete all of the essential blanks within the associated part. This will help to expedite the work, enabling your information to be processed quickly and appropriately.

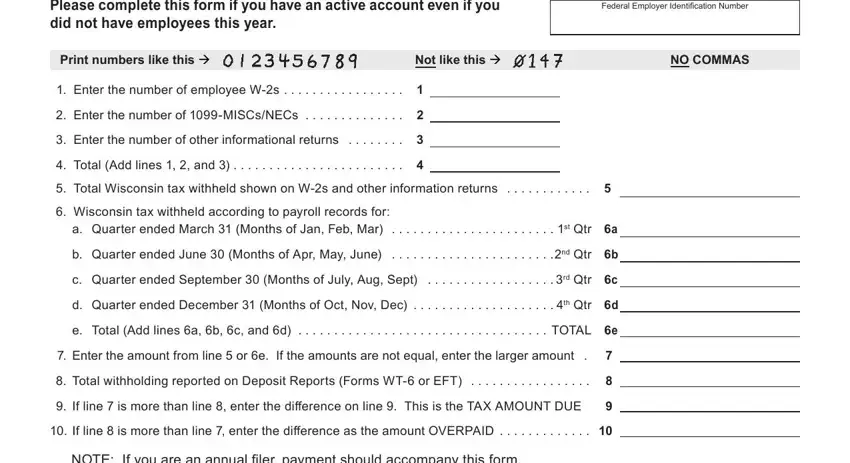

2. Your next stage would be to fill out all of the following blank fields: Please complete this form if you, Federal Employer Identification, Print numbers like this, Not like this, NO COMMAS, Enter the number of employee Ws, Enter the number of MISCsNECs, Enter the number of other, Total Add lines and, Total Wisconsin tax withheld, Wisconsin tax withheld according, a Quarter ended March Months of, b Quarter ended June Months of, c Quarter ended September Months, and d Quarter ended December Months.

Always be really careful when filling out Please complete this form if you and Print numbers like this, since this is the section where a lot of people make some mistakes.

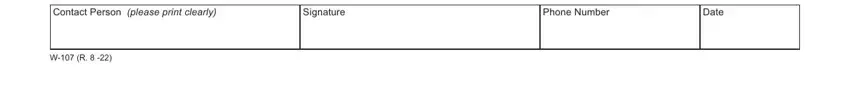

3. The next step is considered quite easy, I hereby declare that this, Phone Number, Signature, Date, and W R - each one of these blanks is required to be completed here.

Step 3: Right after you've reviewed the details in the document, simply click "Done" to complete your document creation. Obtain the Wisconsin Wt 7 Tax Form after you sign up for a free trial. Instantly get access to the document in your FormsPal account page, with any modifications and changes all synced! FormsPal ensures your information privacy via a protected method that never saves or distributes any sort of sensitive information provided. Be assured knowing your docs are kept protected any time you work with our editor!