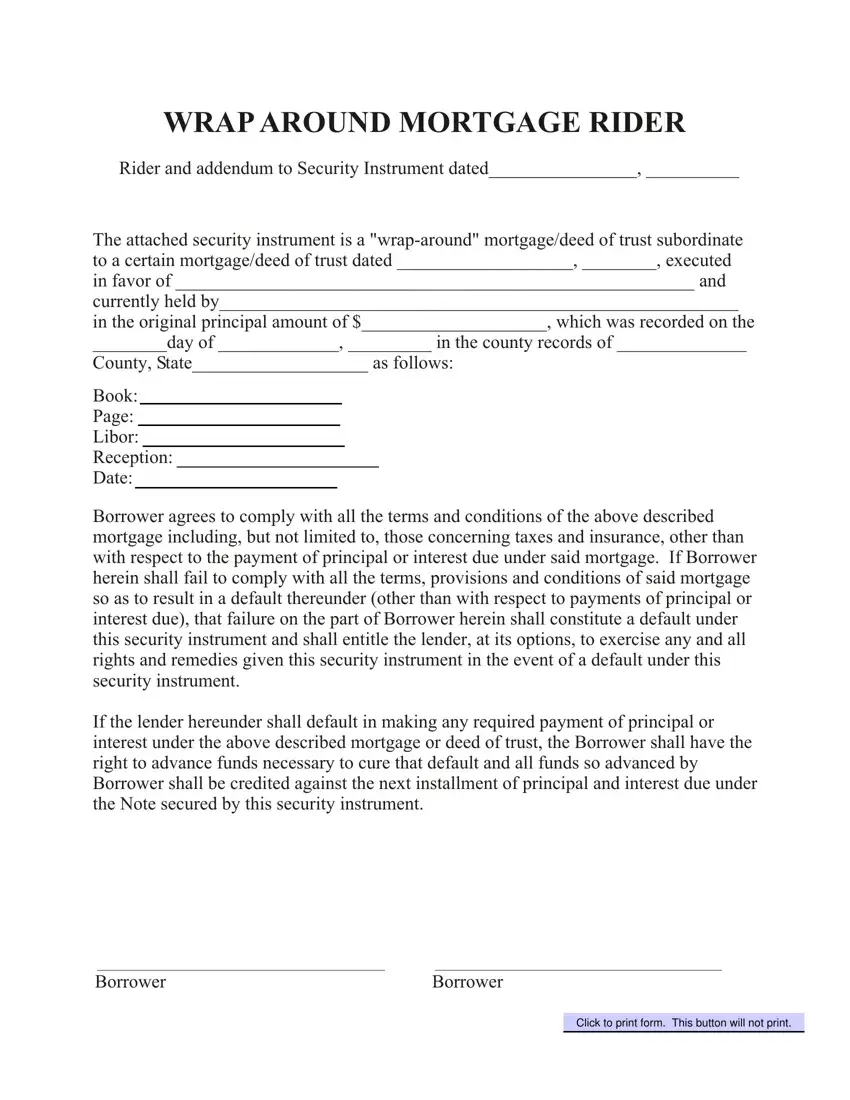

We have applied the efforts of the best computer programmers to create the PDF editor you may want to apply. The application will let you fill in the form wrap mortgage around document easily and don’t waste time. What you need to do is stick to the next easy-to-follow steps.

Step 1: Look for the button "Get Form Here" on the following site and hit it.

Step 2: At the moment, you can change your form wrap mortgage around. Our multifunctional toolbar lets you insert, delete, customize, highlight, and also undertake other sorts of commands to the content material and areas within the file.

The next parts are what you are going to complete to have the prepared PDF file.

The system will expect you to complete the field.

Step 3: As soon as you've clicked the Done button, your document is going to be available for upload to every electronic device or email address you indicate.

Step 4: You could make duplicates of your document toavoid any possible concerns. You should not worry, we cannot publish or track your information.