|

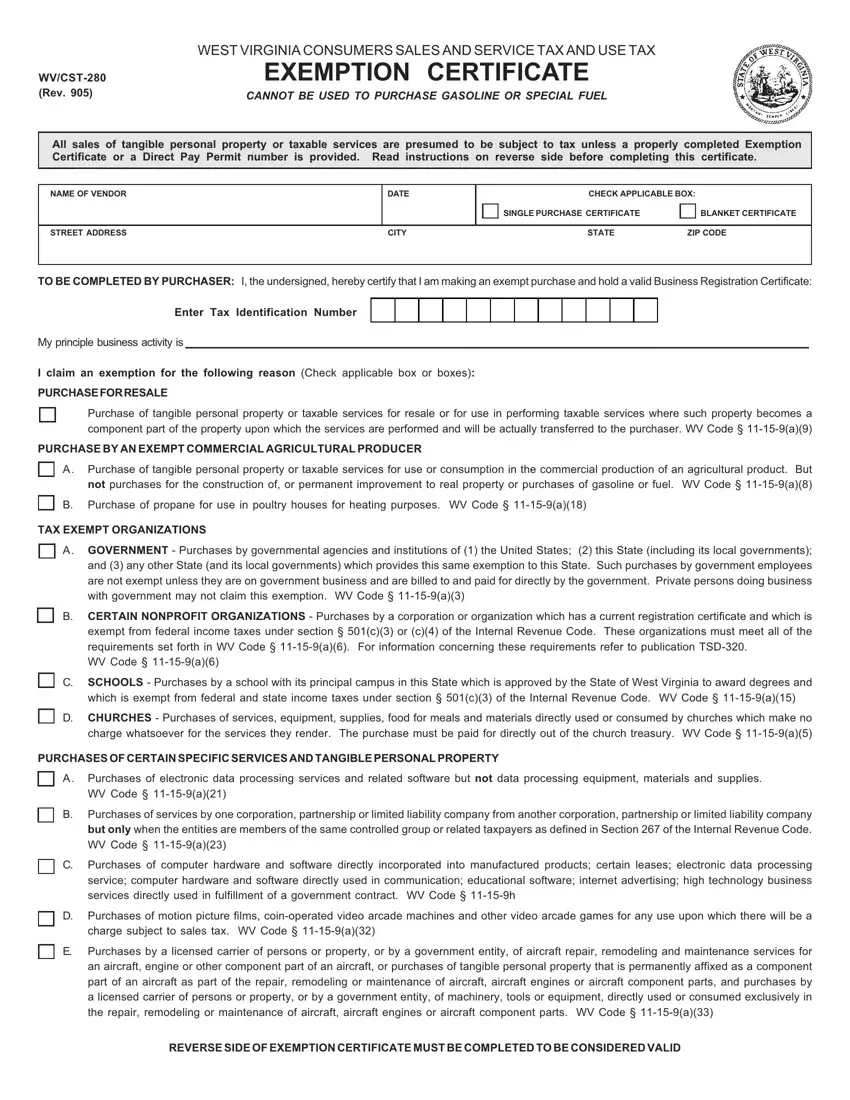

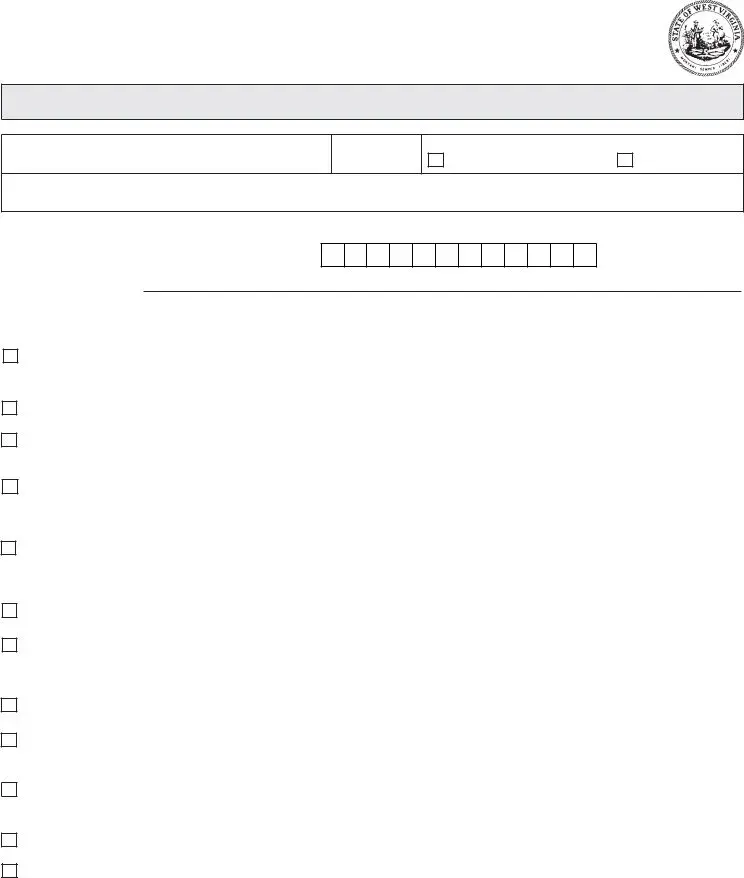

WEST VIRGINIA CONSUMERS SALES AND SERVICE TAX AND USE TAX |

WV/CST-280 |

EXEMPTION CERTIFICATE |

(Rev. 905) |

CANNOT BE USED TO PURCHASE GASOLINE OR SPECIAL FUEL |

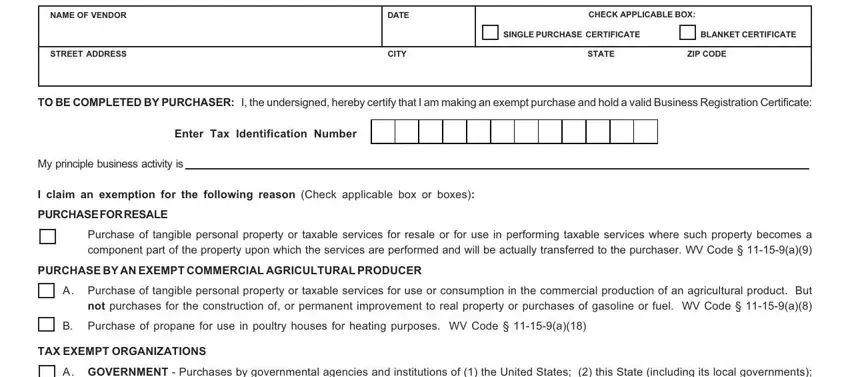

All sales of tangible personal property or taxable services are presumed to be subject to tax unless a properly completed Exemption Certificate or a Direct Pay Permit number is provided. Read instructions on reverse side before completing this certificate.

SINGLE PURCHASE CERTIFICATE

STREET ADDRESS |

CITY |

STATE |

ZIP CODE |

TO BE COMPLETED BY PURCHASER: I, the undersigned, hereby certify that I am making an exempt purchase and hold a valid Business Registration Certificate:

Enter Tax Identification Number

My principle business activity is

I claim an exemption for the following reason (Check applicable box or boxes):

PURCHASEFORRESALE

Purchase of tangible personal property or taxable services for resale or for use in performing taxable services where such property becomes a component part of the property upon which the services are performed and will be actually transferred to the purchaser. WV Code § 11-15-9(a)(9)

PURCHASE BY AN EXEMPT COMMERCIAL AGRICULTURAL PRODUCER

A. Purchase of tangible personal property or taxable services for use or consumption in the commercial production of an agricultural product. But not purchases for the construction of, or permanent improvement to real property or purchases of gasoline or fuel. WV Code § 11-15-9(a)(8)

B. Purchase of propane for use in poultry houses for heating purposes. WV Code § 11-15-9(a)(18)

TAX EXEMPT ORGANIZATIONS

A. GOVERNMENT - Purchases by governmental agencies and institutions of (1) the United States; (2) this State (including its local governments); and (3) any other State (and its local governments) which provides this same exemption to this State. Such purchases by government employees are not exempt unless they are on government business and are billed to and paid for directly by the government. Private persons doing business with government may not claim this exemption. WV Code § 11-15-9(a)(3)

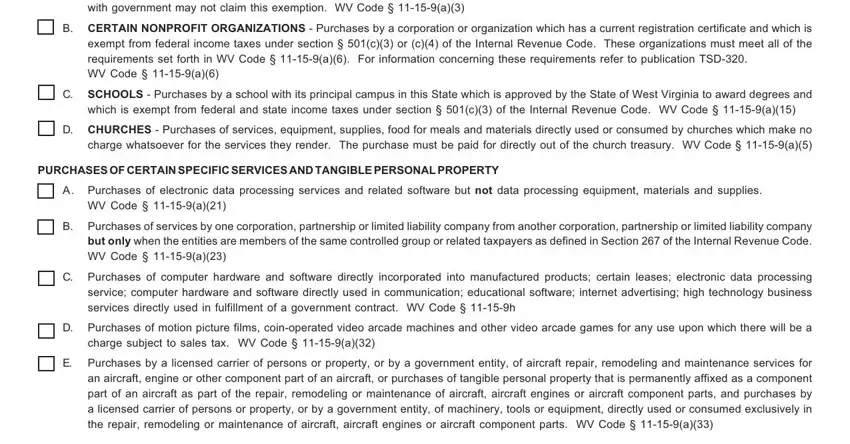

B. CERTAIN NONPROFIT ORGANIZATIONS - Purchases by a corporation or organization which has a current registration certificate and which is exempt from federal income taxes under section § 501(c)(3) or (c)(4) of the Internal Revenue Code. These organizations must meet all of the requirements set forth in WV Code § 11-15-9(a)(6). For information concerning these requirements refer to publication TSD-320.

WV Code § 11-15-9(a)(6)

C. SCHOOLS - Purchases by a school with its principal campus in this State which is approved by the State of West Virginia to award degrees and which is exempt from federal and state income taxes under section § 501(c)(3) of the Internal Revenue Code. WV Code § 11-15-9(a)(15)

D. CHURCHES - Purchases of services, equipment, supplies, food for meals and materials directly used or consumed by churches which make no charge whatsoever for the services they render. The purchase must be paid for directly out of the church treasury. WV Code § 11-15-9(a)(5)

PURCHASES OF CERTAIN SPECIFIC SERVICES AND TANGIBLE PERSONAL PROPERTY

A. Purchases of electronic data processing services and related software but not data processing equipment, materials and supplies. WV Code § 11-15-9(a)(21)

B. Purchases of services by one corporation, partnership or limited liability company from another corporation, partnership or limited liability company but only when the entities are members of the same controlled group or related taxpayers as defined in Section 267 of the Internal Revenue Code. WV Code § 11-15-9(a)(23)

C. Purchases of computer hardware and software directly incorporated into manufactured products; certain leases; electronic data processing service; computer hardware and software directly used in communication; educational software; internet advertising; high technology business services directly used in fulfillment of a government contract. WV Code § 11-15-9h

D. Purchases of motion picture films, coin-operated video arcade machines and other video arcade games for any use upon which there will be a charge subject to sales tax. WV Code § 11-15-9(a)(32)

E. Purchases by a licensed carrier of persons or property, or by a government entity, of aircraft repair, remodeling and maintenance services for an aircraft, engine or other component part of an aircraft, or purchases of tangible personal property that is permanently affixed as a component part of an aircraft as part of the repair, remodeling or maintenance of aircraft, aircraft engines or aircraft component parts, and purchases by a licensed carrier of persons or property, or by a government entity, of machinery, tools or equipment, directly used or consumed exclusively in the repair, remodeling or maintenance of aircraft, aircraft engines or aircraft component parts. WV Code § 11-15-9(a)(33)

REVERSE SIDE OF EXEMPTION CERTIFICATE MUST BE COMPLETED TO BE CONSIDERED VALID

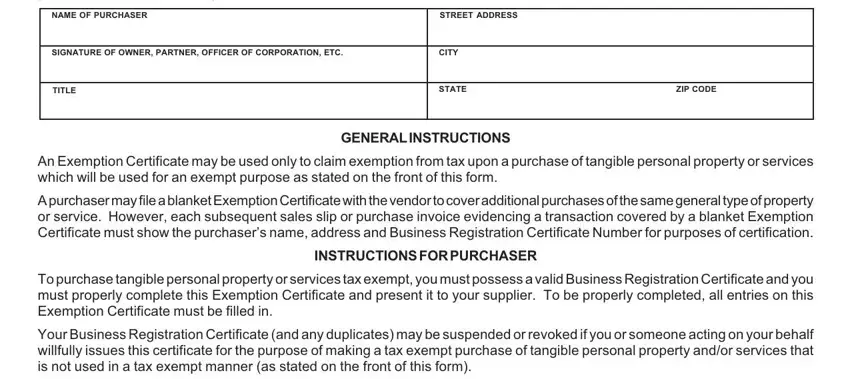

I understand that this certificate may not be used to make tax free purchases of items or services which are not for an exempt purpose and that I will pay the Consumers Sales or Use Tax on tangible personal property or services purchased pursuant to this certificate and subsequently used or consumed in a taxable manner. In addition, I understand that I will be liable for the tax due, plus substantial penalties and interest, for any erroneous or false use of this certificate.

NAME OF PURCHASER |

STREET ADDRESS |

|

|

|

|

SIGNATURE OF OWNER, PARTNER, OFFICER OF CORPORATION, ETC. |

CITY |

|

|

|

|

TITLE |

STATE |

ZIP CODE |

|

|

|

GENERALINSTRUCTIONS

An Exemption Certificate may be used only to claim exemption from tax upon a purchase of tangible personal property or services which will be used for an exempt purpose as stated on the front of this form.

ApurchasermayfileablanketExemptionCertificatewiththevendortocoveradditionalpurchasesofthesamegeneraltypeofproperty or service. However, each subsequent sales slip or purchase invoice evidencing a transaction covered by a blanket Exemption Certificate must show the purchaser’s name, address and Business Registration Certificate Number for purposes of certification.

INSTRUCTIONSFORPURCHASER

To purchase tangible personal property or services tax exempt, you must possess a valid Business Registration Certificate and you must properly complete this Exemption Certificate and present it to your supplier. To be properly completed, all entries on this Exemption Certificate must be filled in.

Your Business Registration Certificate (and any duplicates) may be suspended or revoked if you or someone acting on your behalf willfully issues this certificate for the purpose of making a tax exempt purchase of tangible personal property and/or services that is not used in a tax exempt manner (as stated on the front of this form).

When property or services are purchased tax exempt with an Exemption Certificate, but later used or consumed in a non exempt manner, the purchaser must pay Sales or Use Tax on the purchase price.

The willful issuance of a false or fraudulent Exemption Certificate with the intent to evade Sales or Use Tax is a misdemeanor.

Your misuse of this Certificate with intent to evade the Sales or Use Tax shall also result in your being subject to:

A penalty of fifty percent of the tax that would have been due

had there not been a misuse of such certificate.

This is in addition to any other penalty imposed by the Law.

In the event you make false or fraudulent use of this Certificate with intent to evade the tax, you may be assessed for the tax at any time subsequent to such use.

INSTRUCTIONSFORVENDOR

At the time the property is sold or the service is rendered, you must obtain from your customer this Certificate, properly completed, (or a Direct Pay Permit number issued by the West Virginia Department of Tax and Revenue), or the sale will be deemed a taxable sale, unless the property or service sold is exempt per se from Sales Tax. Your failure to collect tax on such taxable sale will make you personally liable for the tax, plus penalties and interest.

Additionalinformationmayberequiredtosubstantiatethatthesalewasforexemptpurposes. InorderforthisCertificatetobeproperly completed, it must be issued by a purchaser who has a valid Business Registration Certificate and must have all entries completed by the purchaser.

A timely received certificate which contains a material deficiency will be considered satisfactory if such deficiency is subsequently corrected.

You must keep this certificate for at least three years after the due date of the last return to which it relates, or the date when such return was filed, if later.

You must maintain a reasonable method of associating a particular exempt sale to a customer with the Exemption Certificate you have on file for such customer.

INSTRUCTIONSFORVENDORANDPURCHASER

If you, as vendor or as a purchaser, engage in any business activity in West Virginia without possessing a valid Business Registration Certificate (and you do not clearly qualify for an exemption), you shall be subject to a penalty in an amount not exceeding $100 for the first day on which such sales or purchases are made, plus an amount not exceeding $100 for each subsequent day on which such sales or purchases are made.

Please begin using this Certificate immediately.