Arizona Small Estate Affidavit Form

There are specific documents regulating estate relations in every US state, and Arizona is no different. In Arizona, a small estate affidavit operates under Arizona state law. The Arizona Small Estate Affidavit Form is completed when a person (the deceased) passes on without leaving a will.

In situations like this, descendants of the deceased have all rights to claim an inherited property. After receiving the inherited estate, they can handle it whatever way they want. Note that family members are not the only people recognized as descendants. People with rights to the property can also be considered descendants.

If the claimed property does not include real estate, its total value should not exceed $75,000. If there’s real property involved (ground, residence), the total value should not exceed $100,000. Otherwise, the claimants would have to use a different process.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Arizona Laws and Requirements

Estate relations are an essential part of our everyday life. We buy, sell, and rent properties. But are our transactions always secure? Do we think about the safety and validity of everything we do with our estate? Do we have time to think about such things? In most situations, the answer is NO.

The easiest and the fastest way to conduct a secure transaction is signing the legal papers confirmed by Arizona. For each estate issue, there is a specific legal document. If the deceased left no will and the property value is less than $100,000, the descendants should fill out the Arizona Small Estate Affidavit Form. You may download the template using our form-building software.

Legal regulations governing the Arizona Small Estate Affidavit Form are mostly found in the 2019 Arizona Revised Statutes.

The 2019 Arizona Revised Statutes give some requirements on the procedure of handling the inherited property:

- The form is used only if the deceased left no will regarding the disposal of property.

- Without real property, the estate’s value has to be around $75,000. With real estate, the cost should not exceed $100,000. On this condition only, descendants can claim a hereditary property by completing the Affidavit for Collection of all Personal Property.

- If the total sum is more than $100,000, the descendants must fill out two more forms, namely the Affidavit for Transfer of Title to Real Property and Probate Information Cover Sheet.

- The whole process is concluded at least 30 days after the deceased person’s demise.

- No one else but the Superior Courthouse can make decisions on each step of the estate transfer process.

- The descendants must pay $250–$495 for the regulation of the Arizona Small Estate Affidavit Form.

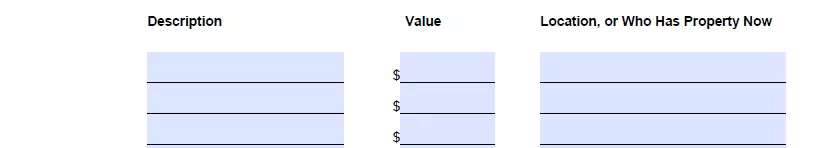

Arizona Small Estate Affidavit Laws Details

| Max. Estate | $75,000 (for personal property) and $100,000 (for real property) |

| Min. Time to Wait After Death | 30 days (for personal property) and 6 months (for real property) |

| Filing Fee | At least $250 |

| State Laws | Arizona Revised Statutes, Sections 14-3971 to 14-3974 |

Looking for more Arizona documents? We offer free forms and simple personalization experience to anyone who wishes for less hassle when confronted with papers.

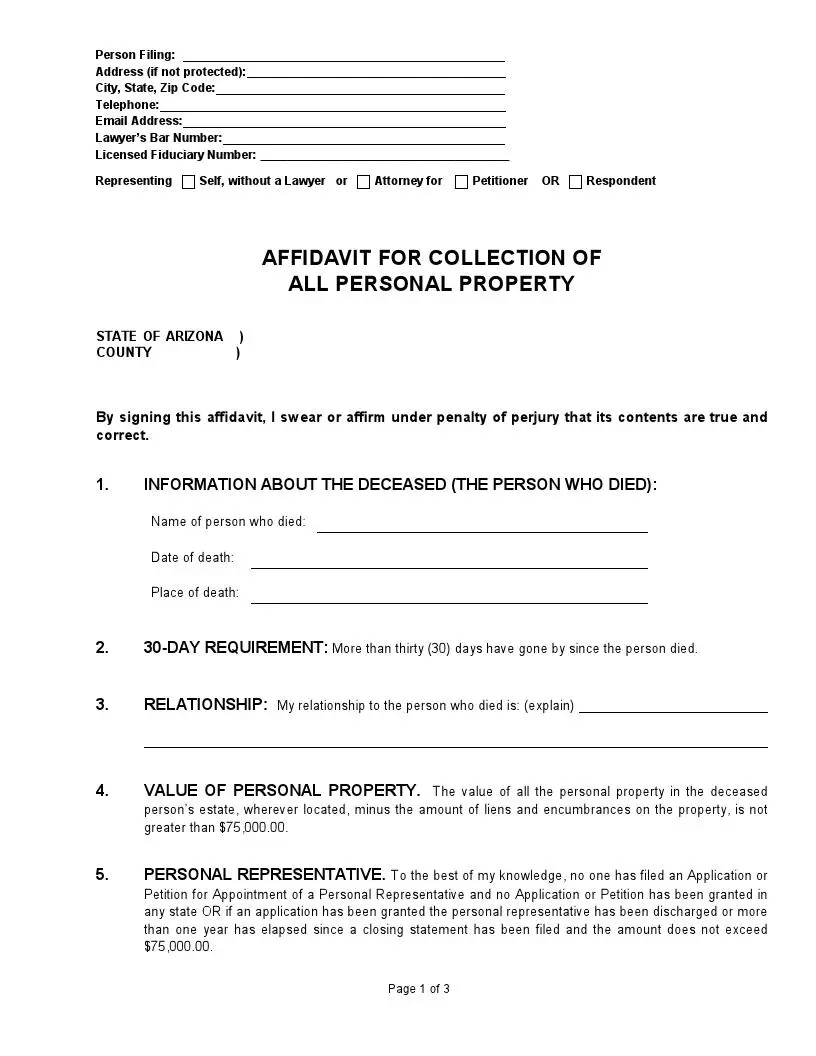

Filling Out the Arizona Small Estate Affidavit Form

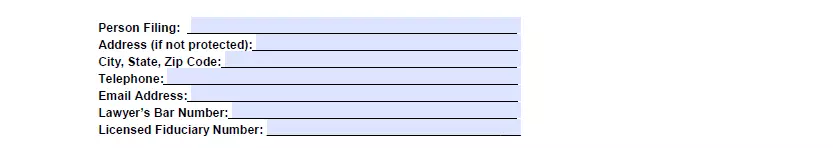

- Write the Descendant’s Personal Information

Write down your name, contact details containing the full address, email, zip code, telephone number, the bar number of your attorney, and the authorized fiduciary number.

Fill in the county where the deceased lived and passed away.

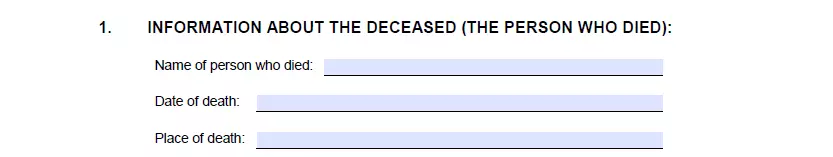

- Present the Deceased’s Information

Enter their full name, place of death, and their date of death.

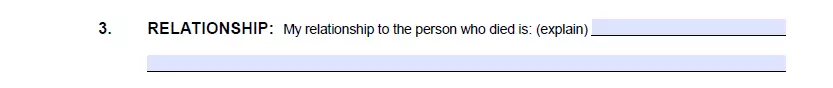

- Proclaim the Status of Your Relationship to the Deceased

Clarify how you are related to the deceased.

- Explain Your Right on the Property

Among all options, choose those that suit you the most—the ones explaining your right on the deceased’s property.

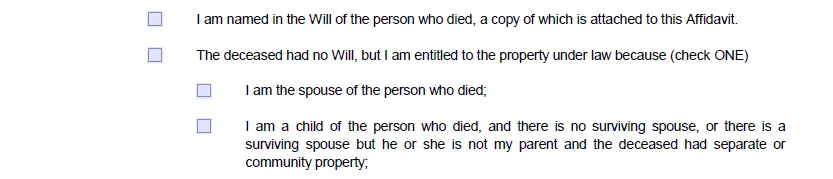

- Enter the Property Details

Write down the full description of the property, including the worth and location.

- State All Debts and Obligations of the Deceased

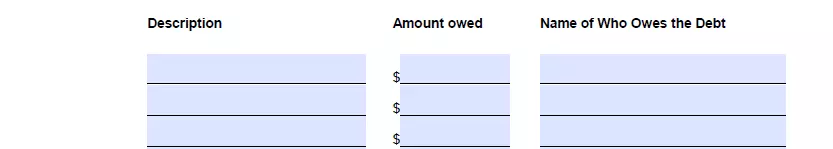

Describe them with as many details as you can. If the deceased left a debt, state the amount and the names of everyone owed.

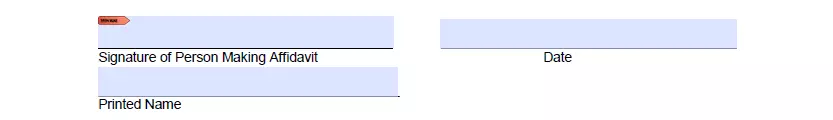

- Sign the Paper

Leave your signature in the company of a notary public. The notary has to seal the document confirming its validity.

- Fill Out the Vehicle’s Form

Complete the Probate Information Cover Sheet and Affidavit for Transfer of Title to Real Property where necessary.

- Go to the Court

Deliver the completed affidavit form to the local Probate Court and pay the fee.