Kansas Small Estate Affidavit Form

Local legal representatives use the Kansas Small Estate Affidavit form to transfer small estate ownership from a deceased person to a successor. This affidavit is only applicable when passing on a property item whose value does not exceed $40,000.The small estate affidavit should be filed in compliance with all state norms and regulations.

Please make sure to check out the state website for the latest versions of official documents. Look for the most recent amendments and supplements before proceeding with the process.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Kansas Laws and Requirements

Small estate succession procedures are regulated by the Kansas Statutes, Probate Code (Article 15, Paragraph 59-1507B). These regulations apply to specific personal property transitions, release and discharge procedures, and affidavit compilation requirements.

When a Kansas resident dies, their personal property should be transferred to the decedent’s successor(s) and heirs at law—this applies to both testate and intestate. If the decedent did not leave behind a will, letters testamentary, or letters of administration, their successor(s) in interest automatically become entitled to a right of succession by an affidavit.

The affidavit only works when the decedent’s estate is not for sale or under investigation and if the decedent had not appointed an executor at death. In this case, the document will save the successor(s) from the complications of probate court paperwork and hearings.

The decedent’s legal representative executes property transfer by affidavit. After a successful transition, no further claim for the subject property will be recognized. The successor(s) will possess the same powers over the decedent’s property as an executor or an administrator would. The affidavit has to comply substantially with the form set forth by the state judicial council. Please do not forget to check for the latest version online.

In turn, the affiant has to be over 18 years old and competent enough to serve an affidavit to inherit the subject property.

Kansas Small Estate Affidavit Laws Details

| Max. Estate | $40,000 |

| Min. Time to Wait After Death | Not specified |

| Filing Fee | $70.50 |

| State Laws | Kansas Statute, Section 59-1507b |

Interested in other Kansas documents? We offer free templates and straightforward customization experience to anybody who prefers less hassle when facing documentation.

Filling Out the Kansas Small Estate Affidavit Form

Before filling out the Kansas Small Affidavit form, you will need to obtain the relevant template. You may ask for legal assistance to complete the form or just use our latest software tools to build and download any form you need.

The successors shall obtain an affidavit to present it to third parties to claim the decedent’s property. There is a separate affidavit form for collecting a vehicle whose value is less than $40,000. If you need it, you can create and download it using our form builder.

Please, follow our step-by-step instructions while filling out the Kansas Small Estate Affidavit form:

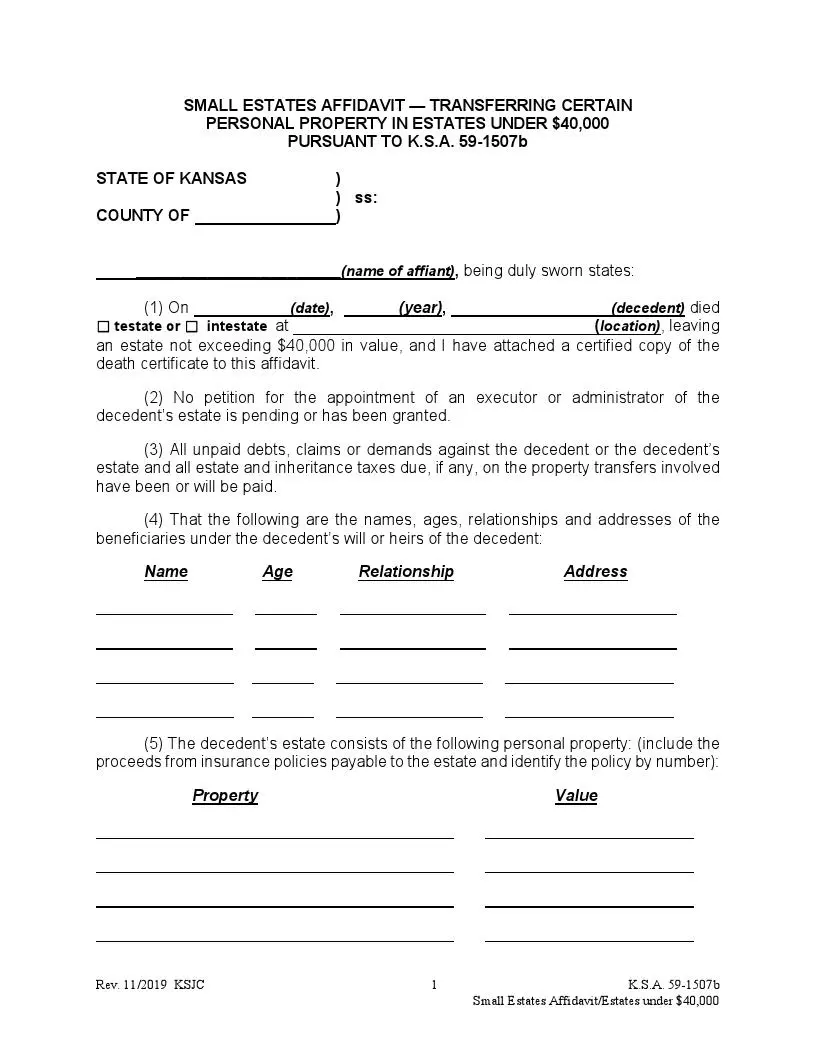

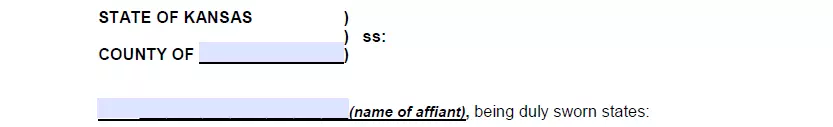

1. Enter the county title of where the decedent last resided and the affiant’s full name.

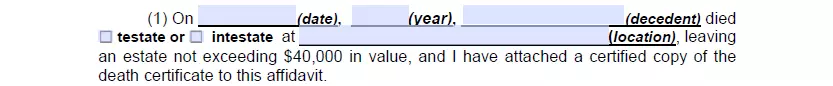

2. Fill in the time and location of death, as well as the decedent’s full name. There will be two options regarding testate availability. Please, check the corresponding box.

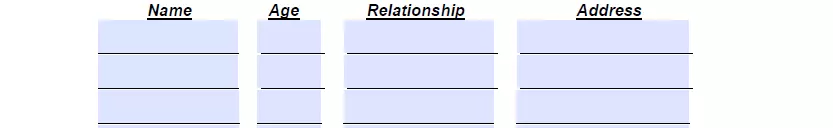

3. In the next section, enter the full names, age, and physical addresses of all beneficiaries or heirs-at-law. Specify how each relates to the deceased person.

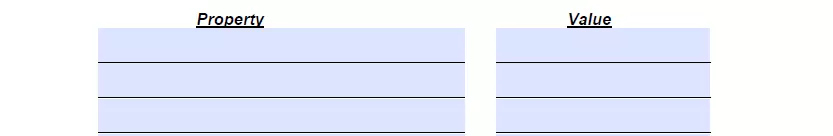

4. Describe the property subject to succession and indicate its total value. Make sure the information provided is accurate.

5. Read the affiant’s declaration carefully and sign the document. Do not forget to write down the document subscription date.

6. An affidavit requires notarization. When all beneficiaries sign the document, a Notary Public agent signs the form and seals it. Upon verification, the successors inherit the decedent’s property.