Massachusetts Small Estate Affidavit Form

The Massachusetts small estate affidavit form is convened upon the death of a person, the inheritance of which the petitioner can claim, and the total value of the deceased person’s estate should not exceed $25,000. This form is used throughout the United States, but the maximum estate value varies from state to state. Also, the conditions for filing and creating a small estate affidavit are different in different states.

The Massachusetts small estate affidavit helps loved ones inherit their personal belongings, making a person’s death a less traumatic experience for family and loved ones. Therefore, filling the Massachusetts small estate affidavit form correctly is an essential part of subdividing a deceased person’s estate.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Below you will find info on the laws governing the inheritance of a personal estate valued at less than $25,000 and a step-by-step guide to filling out the Massachusetts small estate affidavit. You may use our form-building software to get the template.

Massachusetts Laws and Requirements

A responsible approach to studying the laws governing the inheritance act in Massachusetts will help you avoid the confusion associated with the described actions. Therefore, we recommend that you familiarize yourself with the Massachusetts State laws before creating a small estate affidavit form in the state. If you do not understand some of the wording or are not sure that you have studied the laws well enough, seek professional legal advice.

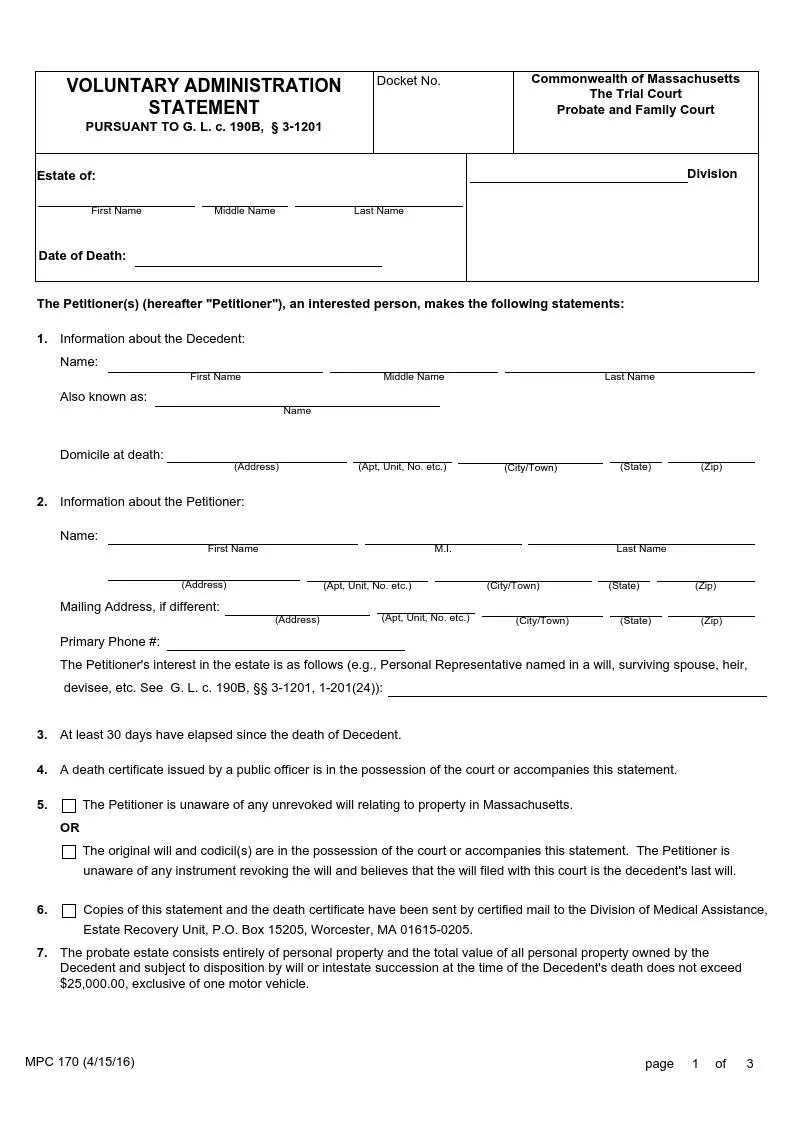

In Massachusetts, inheritance is governed by MGL c. 190B, Section 3-1201 – Collection of a personal estate by affidavit. This section describes all the actions associated with the inheritance of the private estate of the deceased. According to MGL c. 190B, Section 3-1201:

- a personal estate must not exceed 25,000 dollars;

- must not include one vehicle and real estate;

- the Massachusetts small estate affidavit form can only be created and brought to court after 30 days or more from the date of death.

Massachusetts Small Estate Affidavit Laws Details

| Max. Estate | $25,000 |

| Min. Time to Wait After Death | 30 days |

| Filing Fee | $375 |

| State Laws | Massachusetts General Laws, Chapter 190B, Sections 3-1201 to 3-1204 |

Try out our builder to customize any template on our site to your preferences. Here’s a group of other widely-used Massachusetts documents we offer.

Filling Out the Massachusetts Small Estate Affidavit Form

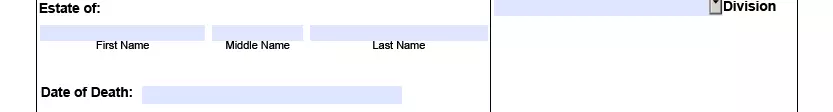

Indicate the Identity of the Deceased and the Date of Death

In the upper left part of the form, you must enter the full legal name of the deceased and the date the death was registered.

Enter Address

After specifying the name of the deceased and the date of decease, you must write the deceased’s address of residence at the time of death.

![]()

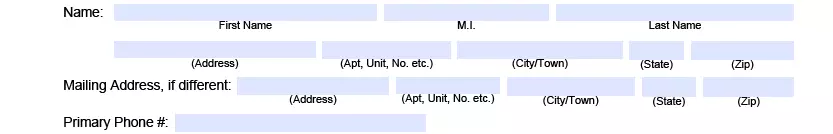

Provide Contact info for the Petitioner

You also need to indicate the identity and contact info of the petitioner. For this, enter the petitioner’s full legal name, telephone number, and address of residence.

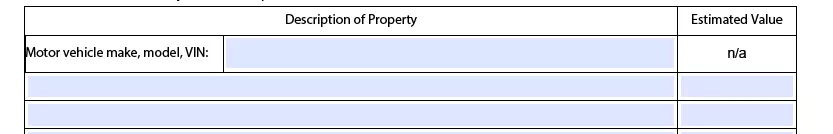

Describe the Inherited Property

On the next page of the form, you need to list all the personal estate of the deceased, indicating the exact or approximate value of this estate. Keep in mind that you need to describe all the vehicles of the deceased, but the cost of one of them may not be taken into account when calculating the total value of the inherited estate.

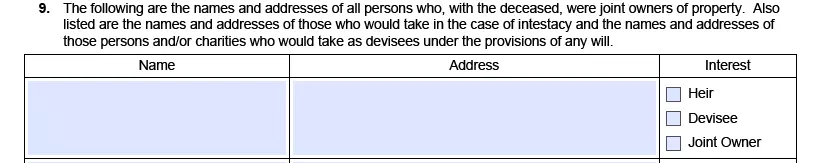

Indicate Who is the Co-owner of the Property

It is important to indicate all co-owners of the property that will be inherited. To do this, write down their names and tell which property they own, respectively.

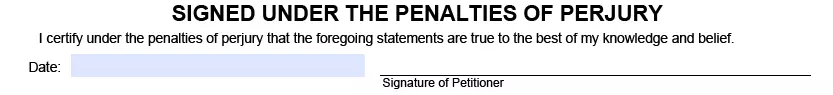

Sign the Form

After filling out the form, you need to put a free signature if you are a petitioner and put the date when the document was created.

Make Copies of the Form

It is important to make several copies of the form and death certificate; one of the copies must be sent to the Division of Medical Assistance Estate Recovery Unit.

Pay the Fee

The amount of the fee in Massachusetts is $115. You must pay this fee