New York Small Estate Affidavit Form

A New York Small Estate Affidavit is also recognized as an Affidavit of Voluntary Administration. It is used when a person expresses a wish to divide and distribute a decedent’s personal properties. The small property includes personal belongings and things worth less than 30,000 USD. This kind of possession does not include real property objects.

Often, a decedent leaves no will, which affects the property that remains within third parties’ temporary possession. The heirs (a spouse or blood-related family members) use a small estate affidavit to obtain their property lawfully.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

New York has initiated a program where an individual can file documents in the Surrogate’s Court in a simplified manner. However, if there is any ambiguity regarding the prior possessor’s death, there will be probate hearings and investigation, so the Surrogate’s Court program cannot proceed.

When you file the New York small estate affidavit petition in the Surrogate’s Court, the judge will qualify the Voluntary Administrator. There are two options:

- if the decedent has left a will, the Executor will be assigned the powers to divide the property;

- if there is no will, the judge will appoint the closest blood-related heir.

The Voluntary Administrator should strictly follow the recommendation given by the court while distributing the property items.

New York Laws and Requirements

In New York, paragraphs 1301-1312 of the Surrogate’s Court Procedure Act regulate the small estate distribution issues between heirs. If an heir decides to apply for the Voluntary Administrator, the bellow listed matters must be provided while filing for the small estate:

- An authorized copy of the decedent’s Death Certificate

- A completed New York Small Estate Affidavit Form

- A copy of the original Will (if applicable)

- If there is no Will, there is a specific priority of who can become a petitioner. The spouse has an advantage over the children. However, if there is no spouse, the children obtain the priority right. The last to apply for the Voluntary Administrator position are other blood-related relatives.

- Relatives with equal heritage rights determine the distributee and the rest members authorize waivers. Signing a waiver does not deprive the heir of their share of the related property.

- Filing tax of 1.00 USD

- Under the Surrogate’s Court program, personal property’s worth must not exceed 50,000 USD.

- At least 30 days should pass since the decedent’s death.

New York Small Estate Affidavit Laws Details

| Max. Estate | $50,000 |

| Min. Time to Wait After Death | No waiting period |

| Filing Fee | $1 |

| State Laws | New York Court Acts, Sections 1301-1312 |

Looking for other New York documents? We provide free templates and straightforward customization experience to anybody who wishes for having fewer to none troubles when coping with paperwork.

Filling Out the New York Small Estate Affidavit

The New York Small Estate Affidavit is a self-sufficient form and doesn’t require much time to complete. However, the template contains inherent information that the involved parties should consider with accuracy.

We encourage you to utilize our latest form-building software to generate and print out the necessary template effortlessly.

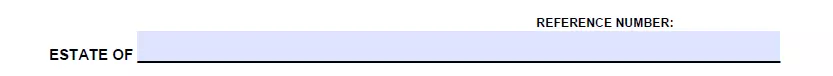

Determine the Decedent Property Owner

The petition opens with a spare line where you should fill in the decedent relative’s legal name.

Complete the Applicable Section

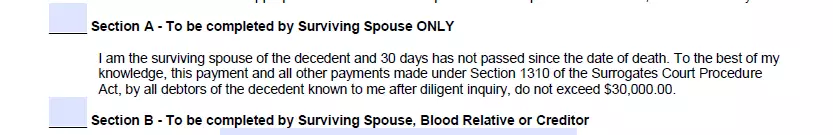

The template introduces three sections. You should choose the relevant one. The spouse can only complete paragraph A within 30 days since the death of the spouse.

B-section is completed by a surviving spouse, blood-related family member, or a creditor after 30 days. You should determine your relation to the decedent on the spare line, identifying your connection.

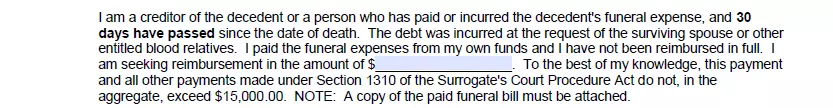

The creditor completes section C. You will find it on the second page of the NY small estate affidavit.

Apply for Reimbursement

If you are a creditor who’s filling out the small estate petition, please include the amount to be reimbursed in USD.

If you are a blood-related relative who has arranged liabilities of the decedent, write down your name on the line “who has incurred expenses of the decedent and is entitled to reimbursement.”

Sign the Affidavit

Fill out the blood-related family member’s name if you are the petitioner. Specify your relation and affix a signature.

Place your signature on the second page, too, and insert the Social Security Number and the current calendar day. The procedure should be held in the presence of a notary.

Notarize the Petition

Following the New York Surrogate’s Court Procedure Act, the small estate affidavit requires compulsory notarization. The notary will verify the identities and affix the seal and signature.