Pennsylvania Small Estate Affidavit Form

The Pennsylvania Small Property form is used in the case of the death of a person whose private estate assets at the moment of death are worth up to $50,000. This amount does not incorporate the expense of the deceased person’s real estate.

Death Certificate and Inheritance Tax (Form REV-1500) should be included and attached when filing the SEA form. There is also a document that lets someone transfer the deceased’s vehicle to themselves, and it’s called the Form MV-53.

The small estate affidavit is filed after a specified duration of time after the demise. In Pennsylvania, it is 60 days. There are two types of inheritance: by will and by law. By will, the property is transferred in accordance with the will of the deceased. If the decedent did not leave a will, then inheritance occurs by law. And by law, only a close family member can do the document. As a rule, this person is a spouse, a child, or a parent.

This way of collecting assets means less time wasted. Thus, the individual will not have to go through the complicated and lengthy process of paperwork and lawful administration of the will. Nevertheless, there is also a caveat. If the property of the deceased is included in any part of the will, then the probate administration cannot be avoided.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Pennsylvania Laws And Requirements

The law (Statute 20 §3102, “Decedents, Estates, and Fiduciaries”) covers the succession of a deceased person’s estate in Pennsylvania.

The law empowers probate courts to deal with private property succession as long as it’s total value does not exceed $50,000. The property must not include real estate.

The court’s powers to decide on the disposition of private property in conformity with this part shall not be limited because the testator holds the real property, regardless of its value. If the government finds that an incorrect assignment order was issued, it will overturn the order and make restitution as per the law.

Filling the Pennsylvania Small Property form is suitable when the inheritors are owed other money that does not pass the highest expense for each segment:

- Wages or Employee Benefits (20 §3101 (a)) $10,000

- Deposit account with a bank or financial institution (20 §3101 (b)) – $10,000

- Personal Care Account (20 §3101 (c)) – $10,000

- Life insurance (20 §3101 (d)) – $11,000

- Unclaimed Property (20 §3101 (e)) – $11,000

Pennsylvania Small Estate Affidavit Laws Details

| Max. Estate | $50,000 |

| Min. Time to Wait After Death | Not specified |

| Filing Fee | Usually $25 |

| State Laws | Pennsylvania Consolidated Statutes, Title 20, Section 3102 |

Here are other Pennsylvania documents filled out by our visitors. Check out our step-by-step builder to customize any of these documents to your needs.

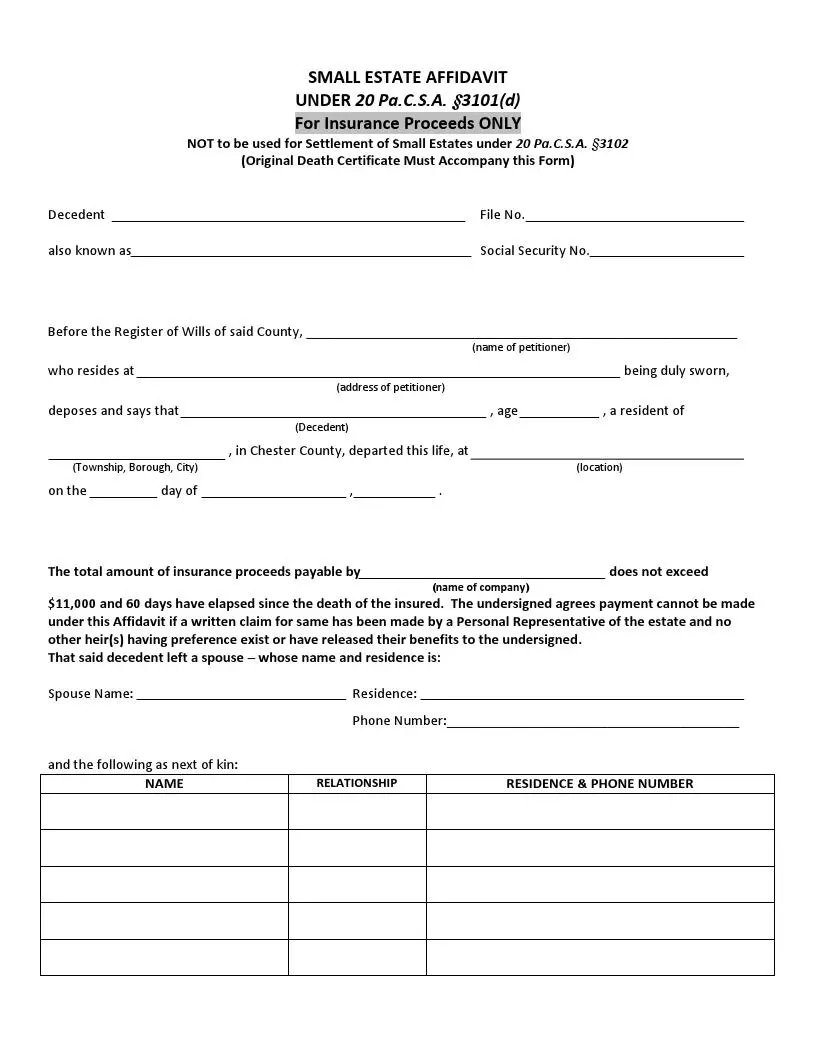

Filling Out the Pennsylvania Small Affidavit Form

This section of the subject will help you to build a fully correct SEA text. Make use of our latest software to generate a template. So, here is an accomplished manual on how to fill out the Small Affidavit Form in Pennsylvania:

1. Download an Affidavit Template

For convenience, the templates for this certificate are prepared in three formats. You just need to select the suitable one and arrange it. This will work as a pattern for testimonies that confirm your ownership of the deceased person’s property.

2. Insert Important Details

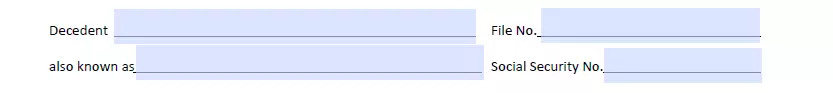

This section of the paper requires you to write the deceased person’s name, the state in which they perished, and the county. Please note that the registered fields must be specified strictly in the order shown.

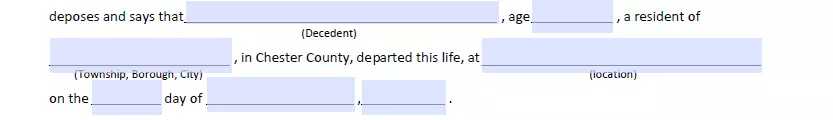

3. Describe the Specifics about the Defunct’s Death

This part has two fields to fill out. In the beginning, you must register the name of the deceased and the exact date of death (day-month-year). In the subsequent paragraph, you want to address the state and county listed on the death certificate.

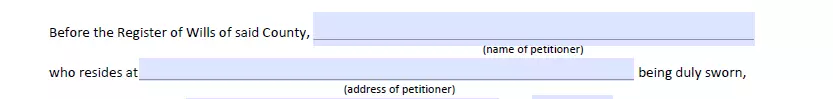

4. Sign the Contract and Identification Segment

The head of this particular statement should be the name of the person filing the Small Estate Application, which must come after the phrase “My name is.” Next, write their full postal address (house number, street name, and apartment number). Then you must name the state of residence of the heir. The latest space should include the number of days elapsed after death as indicated in the certificate.

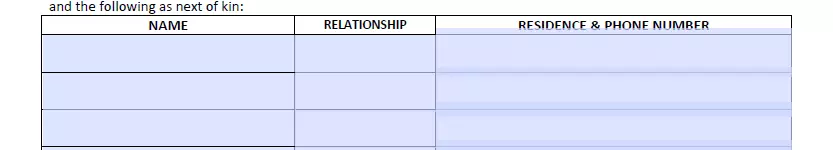

5. List the Heirs

This piece has two columns. In the first one, write down the heir’s full legal name and the degree of relationship with the deceased. In the second one, write down their phone number and address. If there is insufficient space in this part, use “Attachment A” to add the remaining heirs.

6. Register each Testator with Property Bequeathed to them

Each affiant has specific preferences about how much of their acquired inheritance should be transferred to the others. On the 15th line, you must enter each devisee’s name and the piece of the property you would like to share with them. If you don’t have enough space in this sector, use “Attachment D.”

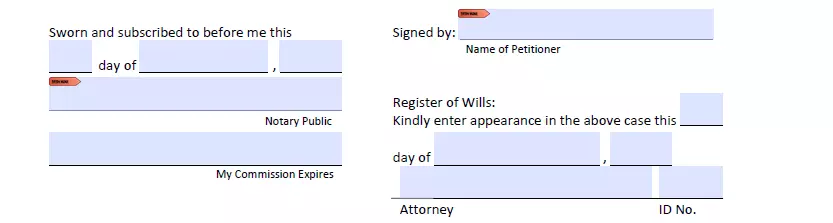

7. Sign and Approve the Certificate

Take this last step in the attendance of a notary. On the corresponding line, you must put the affiant’s signature and name. And later, the notary will verify the date of signing the application, the heir’s identity, and the location where the SEA was signed. Thus, the paper is notarized immediately after signing.