Washington Small Estate Affidavit Form

A Washington Small Estate Affidavit form could be a solution for anyone experiencing difficulties when dealing with the potential inheritance rights to a recently deceased person’s assets. Completing this legal form may be a valid answer on claiming the decedent’s personal property.

The so-called affidavit procedure allows people to gain the right to the property of a person who has passed away without a will. One advantage of this procedure is that it lets the potential heir get the property without the lengthy and costly court process.

The template of a small estate affidavit differs from state to state, though its main aspects remain in common. These are:

- Personal information about the deceased person, including the name and the date of death

- Information about the signatory and the potential successors

- The estimated value of the decedent’s assets and properties

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

Washington Laws and Requirements

In Washington, there are specific regulations and prerequisites regarding the affidavit form one must abide by.

Firstly, the stated time to wait after the date of death is at least 40 days. Only after this period, one is allowed to complete and file the form. The next step will be to

deliver the documents to the decedent’s property holder, whether it is a person or an organization.

Bear in mind that the stated procedure does not apply to real property, such as apartments, houses, or land. In terms of mobile houses, there may be certain discrepancies when acclaiming them a real property. If this is your case, a prior conversation with a lawyer is advised. Furthermore, the affidavit forms for certain testament items, including vehicles, might slightly differ.

According to the law, the notion of the personal property refers mostly to the decedent’s personal items, such as jewelry, bank accounts, any type of vehicle, pieces of art, and so on. It does not entail real estate.

In the state of Washington, to file this form, the maximum sum of the testament assets owned by the decedent should be no more than $100,000. Moreover, if the deceased person was not officially considered a Washington resident, this procedure cannot be applied. It is not applicable either if the proprietor died indebted. All of the person’s liens, charges, fees, and debts should be paid before starting the affidavit procedure.

If the decedent has other potential successors, the written notice should be sent to them by mail or personal service, stating your claim and enumerating the estates you are entitled to.

After sending this notice, there should be a waiting period of not less than ten days when you cannot proceed with further notice. Moreover, there should not be any application delivered to the court for the appointment of a personal representative.

For further rules and recommendations, it is advised to refer to the Revised Code of Washington, Title 11, Chapter 11.62, Section 11.62.010.

Washington Small Estate Affidavit Laws Details

| Max. Estate | $100,000 |

| Min. Time to Wait After Death | 40 days |

| Filing Fee | $20 |

| State Laws | Washington Revised Code, Sections 11.62.005 to 11.62.030 |

We offer a wide range of popular Washington documents to anybody looking for convenience when handling all sorts of agreements, contracts, and other paperwork.

Filling Out the Washington Small Affidavit Form

Filling out the official forms implies several consecutive steps. With the help of our software and easy-to-download templates, this procedure is swift and time-saving:

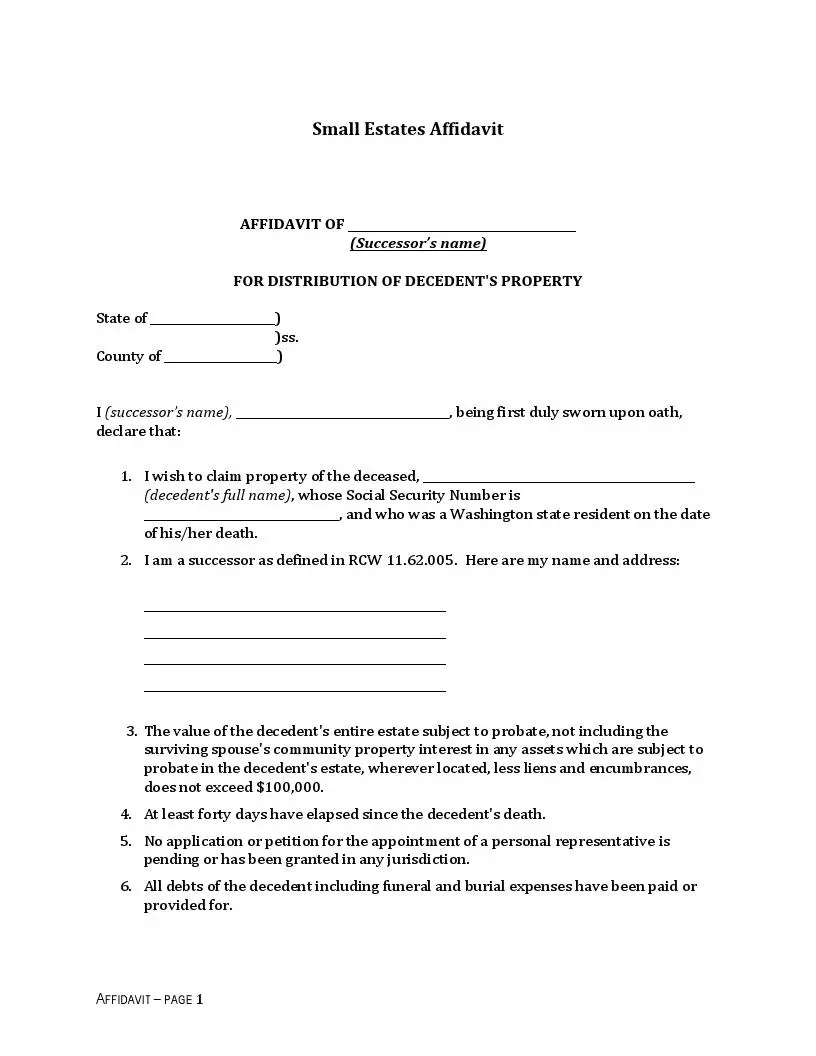

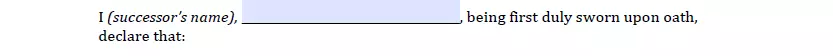

1. Write in your name at the top of the form. This is further considered a successor’s name.

2. Fill in the state and county.

3. Mention your name again.

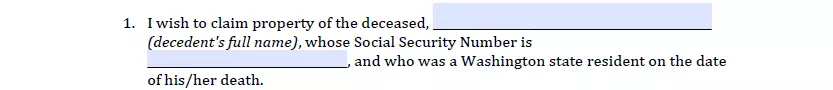

4. Specify the decedent’s name in Section One. Do not forget to mention the decedent’s Social Security number.

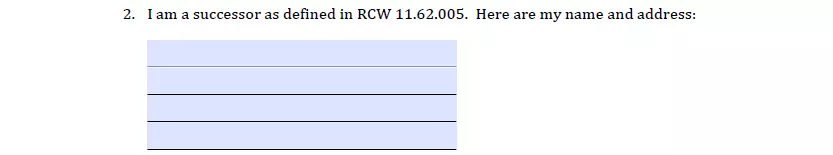

5. Indicate your name again and add your address.

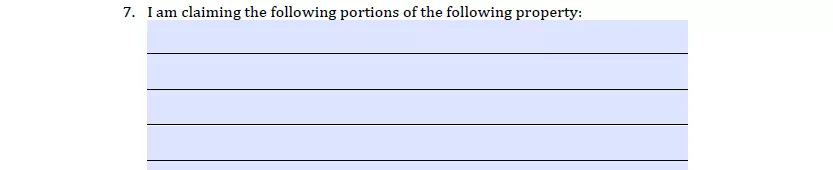

6. In Section Seven, enclose the details on the property you are claiming.

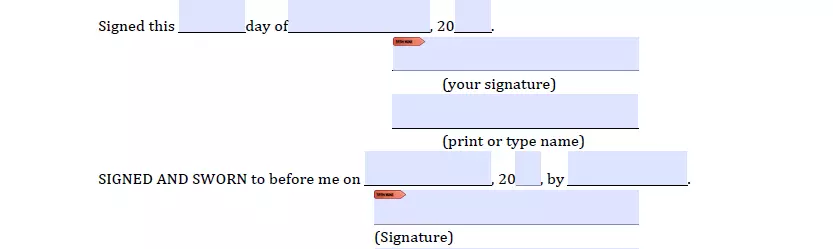

7. Finally, sign and date the form in the presence of the notary.